More Trend Reversals

By Colin Twiggs

April 27, 3:30 a.m. ET (5:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Despite positive signs in secondary markets (China, India, Canada and Nasdaq) the majors (Dow, S&P 500, FTSE 100 and Nikkei 225) appear far from recovery. Until we see a recovery in two of the top four, global prospects remain bleak.

USA

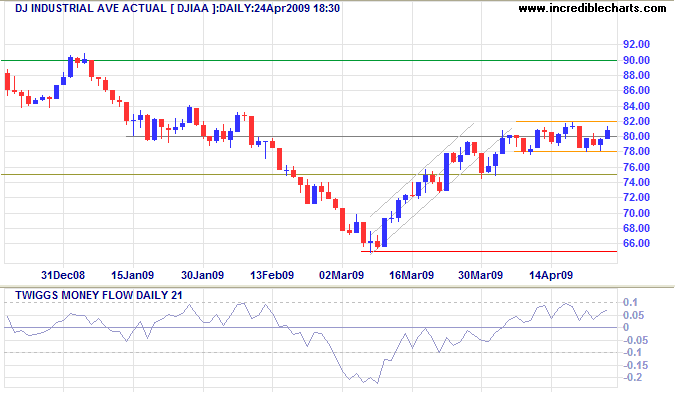

Dow Jones Industrial Average

The Dow is consolidating in a narrow range between 7800 and 8200, favoring continuation of the bear market rally. Upward breakout would signal a test of 9000, while reversal below 7800 would indicate that the rally has ended and a test of 6500. Twiggs Money Flow (21-Day) breakout above 0.1 would signal trend strength, while reversal below zero would warn of a down-swing. In the long term, the primary trend continues downward and test of primary support at 6500 remains likely.

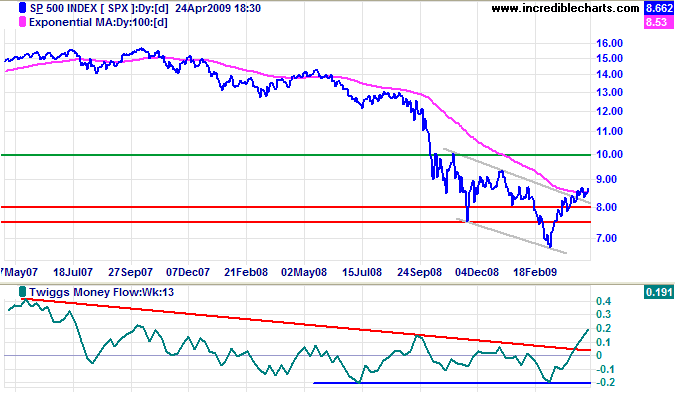

S&P 500

The S&P 500 consolidates (short term) between 830 and 875. Upward breakout would test 940, while downward breakout would test 700. In the long term, the primary trend is down. Twiggs Money Flow (13-Week) bullish divergence shows a weak reversal signal and breakout above 940 would offer confirmation. But it would be prudent to wait for the next correction to complete a higher trough, followed by a new high.

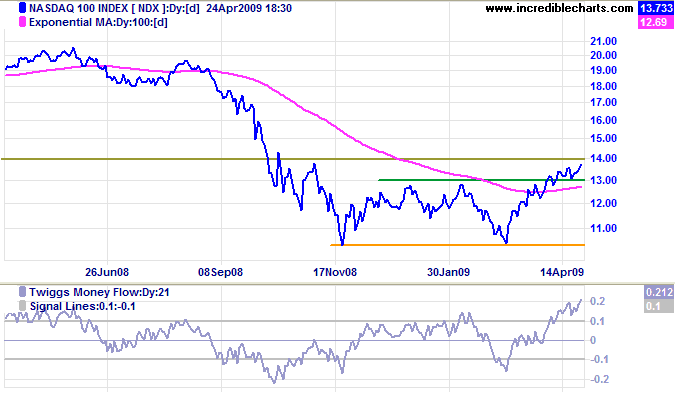

Technology

The Nasdaq 100 wide double bottom reversal offers a target of 1550, calculated as

1300 + [ 1300 - 1050].

Retracement respected the new support level at 1300, and

Twiggs Money Flow (21-Day) broke above 0.1, both indicating a strong up-trend.

The primary trend may be up, but downside risk remains elevated until there is confirmation from the broader market (the Dow or S&P 500)

— or stronger earnings from index leaders like

Microsoft.

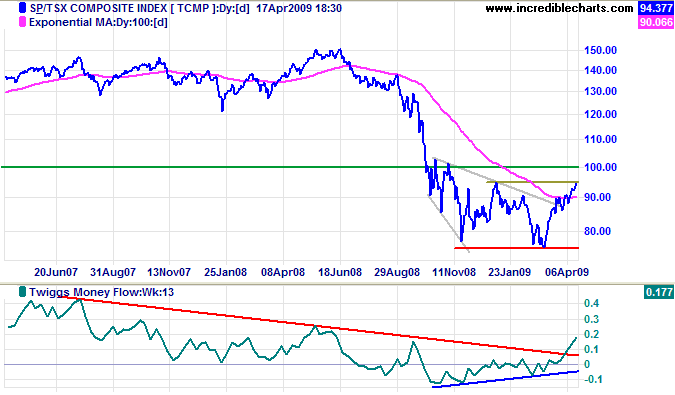

Canada: TSX

The TSX Composite completed a wide double bottom reversal with breakout above 9500 — and confirmation by the TSX 60. The target of 11500 is calculated as 9500 + [ 9500 - 7500 ]. Twiggs Money Flow (13-Week) bullish divergence confirms reversal to a primary up-trend.

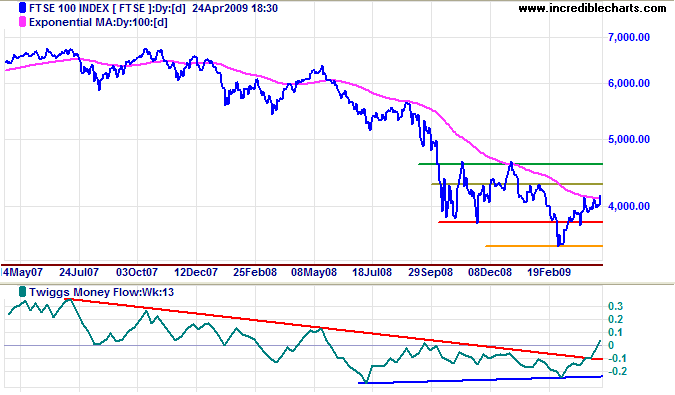

United Kingdom: FTSE

The FTSE 100 is headed for a test of resistance at 4300. Twiggs Money Flow (13-Week) rising above zero completes a weak bullish divergence, indicating primary trend reversal. Long term, the primary trend is down. Reversal below 4000 would signal another test of primary support at 3500, while breakout above resistance at 4650 would offer a weak reversal signal. But it would be prudent to wait for confirmation from a higher secondary trough followed by a new high.

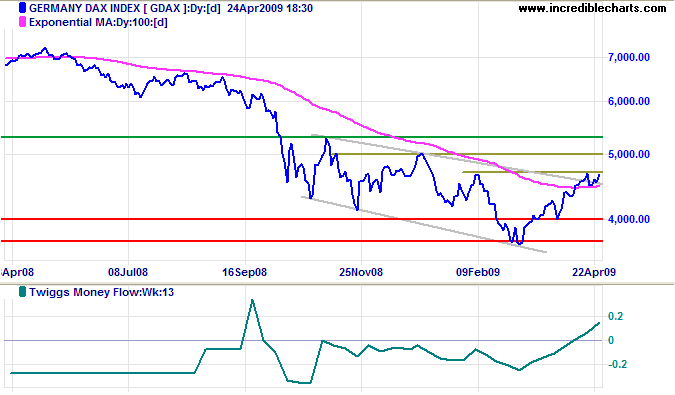

Europe: DAX

The DAX broke out of its downward channel and is testing resistance at 4700. The short retracement indicates buying pressure: expect a test of 5000. Twiggs Money Flow (13-Week) bullish divergence indicates a primary trend reversal. Breakout above 5000 would offer a weak reversal signal. Again, it would be prudent to wait for confirmation from a higher secondary trough followed by a new high.

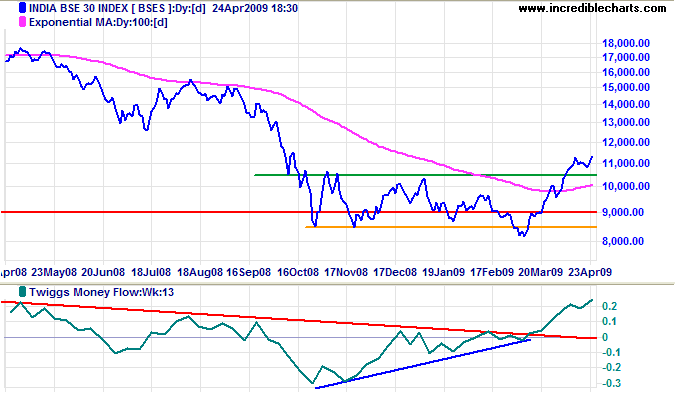

India: Sensex

The Sensex respected the new support level at 10500, confirming a primary up-trend. Twiggs Money Flow (13-Week) rising sharply indicates trend strength. The target for the breakout is 12500, calculated as 10500 + [ 10500 - 8500 ].

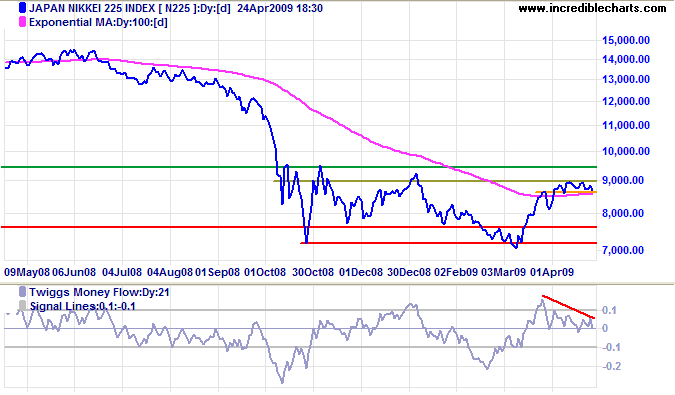

Japan: Nikkei

The Nikkei 225 shows a similar bullish divergence on Twiggs Money Flow (13-Week), but the shorter-term 21-day indicator warns of strong resistance at 9000 — and a dip below zero would warn of a down-swing. Reversal below 8600 would test primary support at 7000. Breakout above resistance is less likely, but would test primary resistance at 9500. Long term, breakout above 9500 would complete a wide double bottom reversal, signaling primary trend reversal and offering a target of 12000 (calculated as 9500 + [ 9500 - 7000 ]). Reversal below 7000 is unlikely, but would offer a target of 5000.

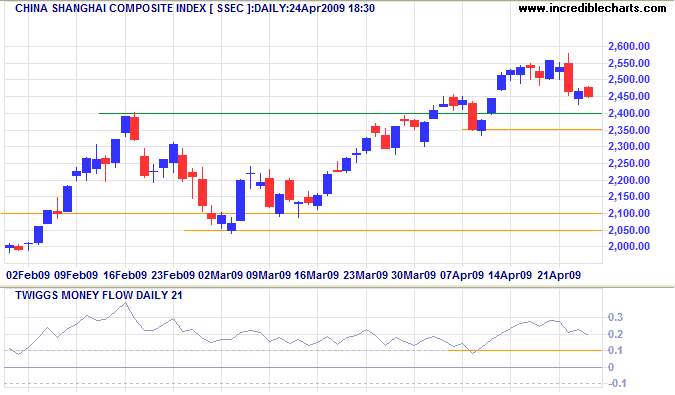

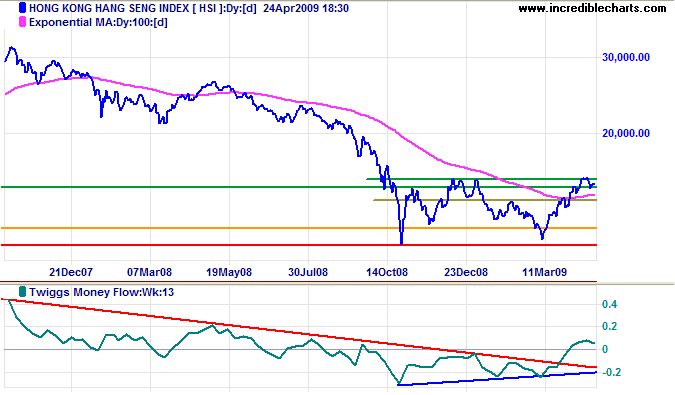

China

The Shanghai Composite is retracing to test the new support level at 2400. Respect of 2350 would confirm a strong primary up-trend. As would Twiggs Money Flow (21-Day) respect of 0.1. The medium term target remains 2750 (calculated as 2400 + [ 2400 - 2050]).

The Hang Seng Index short retracement to 15500 is a bullish sign. Expect another test of resistance at 15800. Breakout would complete a wide double bottom reversal, offering a target of 21000 (calculated as 16000 + [ 16000 - 11000 ]). Reversal below 15000 is unlikely, but would warn of a down-swing to test primary support at 11500. Twiggs Money Flow (13-Week) bullish divergence indicates a primary trend reversal.

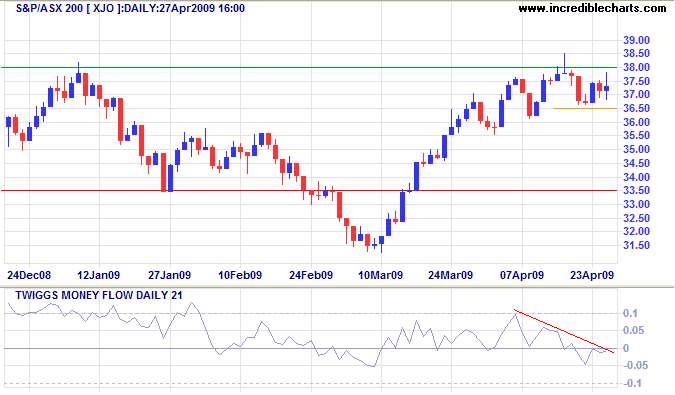

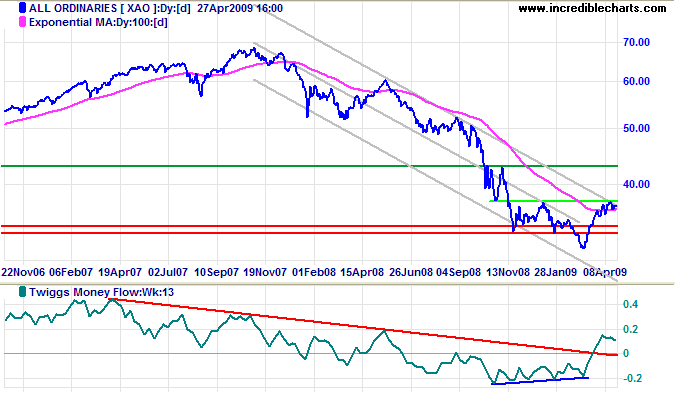

Australia: ASX

Both the ASX 200 and All Ords are consolidating below major resistance, at 3800 and 3750 respectively. Twiggs Money Flow (21-Day) bearish divergence and below zero warns of selling pressure. Reversal below 3650 (XJO) would signal a test of primary support at 3150.

Twiggs Money Flow (13-Week) bullish divergence gives a conflicting signal, but an All Ordinaries breakout below 3600 would signal a down-swing — offering a target of 3100 (XAO). In the long term, breakout below 3100 would offer a target of the 2003 low of 2700. Recovery above 3750, on the other hand, would offer a weak (primary) reversal signal. But it would be prudent to wait for the next correction to confirm the trend change — with a higher trough followed by a new high.

When authority presents itself in the guise of organization,

it develops charms fascinating enough to convert communities of free people into totalitarian states.

~ The Times, quoted by F. A. Hayek in

The Road To Serfdom