Tax Grab Ahead

By Colin Twiggs

April 22, 2009 11:00 p.m. ET (1:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

U.K. Chancellor of the Exchequer Alistair Darling, delivering the annual budget statement, forecast a rise in net borrowing to £175 billion in the current financial year and an increase to £606 billion by 2013. He also announced a series of tax increases on higher income earners to help rein in the deficit. (WSJ) That is a mistake. Whether you tax the rich or the poor, the result is the same. Raising taxes reduces consumption. And falling consumption causes further job losses — reinforcing the downward spiral.

Australian Prime Minister Kevin Rudd appears to be following a similar path, attempting to spend his way out of a recession. (WSJ) Having inherited a clean balance sheet from its predecessor, his government is fast running up debt in order to fund new stimulus programs. Despite stimulus spending amongst the highest (as a percentage of GDP) in the G20, according to the IMF the economy will shrink 1.4 percent in 2009 — faster than the global average. Government revenues are already 63 per cent below estimates from last May's budget and expected to worsen further. (SMH) The trap is when tax revenues shrink and the budget deficit starts to balloon, it becomes difficult to resist increasing taxes. The same mistake that Alistair Darling is making — and the Obama administration is likely to follow. Raising tax rates needs to be avoided at all costs.

Another alternative would be to increase the tax grab on what's left of your retirement savings. Australians' massive superannuation fund investments are an easy target. That would save jobs, but is likely to prove highly unpopular with voters.

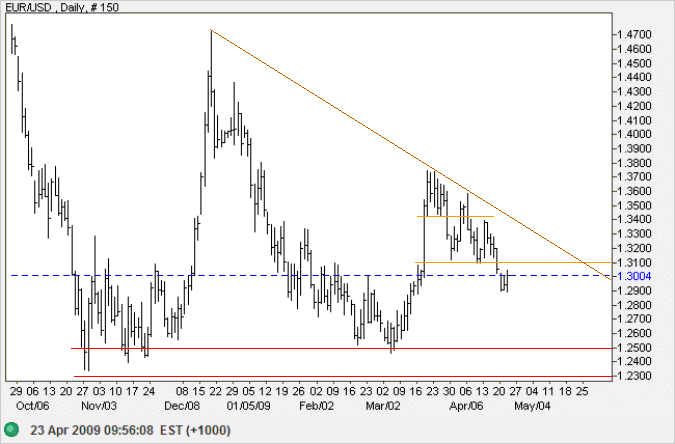

Euro

The euro broke through support at $1.31 and is headed for a test of primary support at $1.25. In the long term, failure of support at $1.25 would offer a target of parity (calculated as 1.25 - [ 1.50 - 1.25 ]). Recovery above the descending trendline is unlikely, but would warn of a test of $1.47.

Source: Netdania

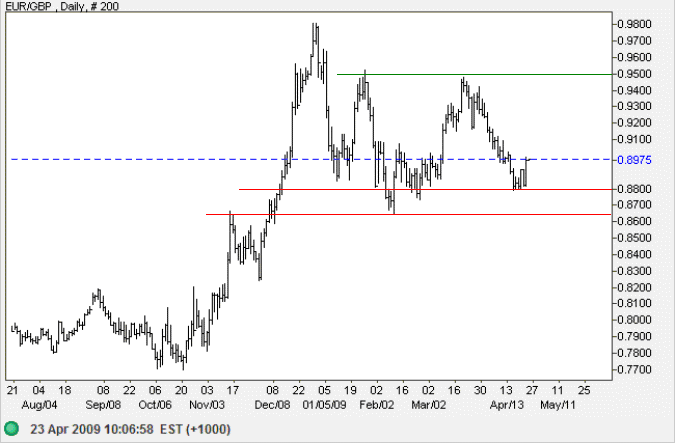

Pound Sterling

The euro's two lower highs at £0.95 are a bearish formation, but the currency respected support at £0.88. Expect another rally to test £0.95. In the long term, breakout below £0.8650 would confirm reversal to a primary down-trend — offering a target of the October 2008 lows at £0.77.

Source: Netdania

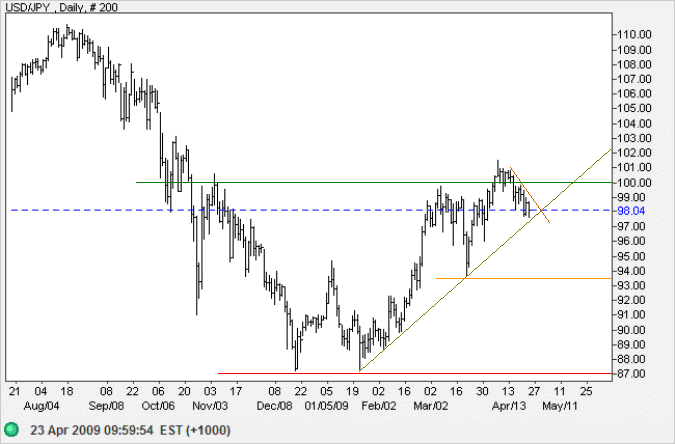

Japanese Yen

The dollar threatens to complete a bull trap with penetration of the rising trendline. Breakout would indicate a test of ¥87. Until then, reversal above ¥100 remains equally likely — confirming the up-trend and offering a long-term target of ¥110 (the August 2008 high).

Source: Netdania

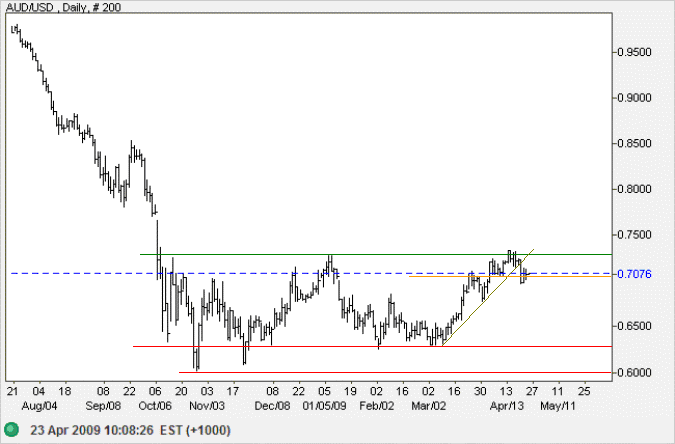

Australian Dollar

After a false break above resistance at $0.7300 against the greenback, the Australian dollar retreated below the rising trendline. Breakout below $0.7000 confirmed the down-trend, but the Aussie now appears headed for another test of $0.7300. Reversal below $0.7000 would again confirm, offering a target of primary support at $0.6300. Recovery above $0.7300 and a primary up-trend are unlikely, but would offer a target of the September high at $0.8500.

Source: Netdania

Our years of living beyond our means, of buying everything on credit and on money printed out of thin air, are over.

Sure, our government will carry on with its nonsensical policy of curing indebtedness with more indebtedness,

inflation with more inflation, but the game is up.

It's not going to work.

~ Congressman Ron Paul in the foreword to Meltdown

by Thomas E. Woods Jr.