Dollar Breaks 100 Yen

By Colin Twiggs

April 9, 2009 1:00 a.m. ET (3:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

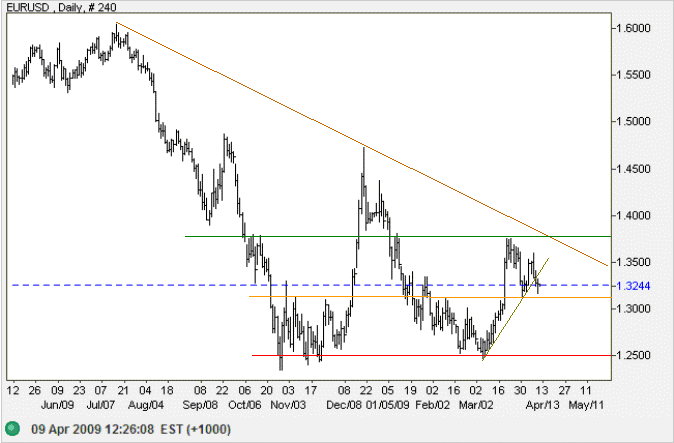

Euro

The euro failed to test resistance at $1.37 and is now headed for short-term support at $1.31. Breakout would test primary support at $1.25. In the long term, failure of the band of support at $1.25 would offer a target of $1.00 (calculated as 1.25 - [ 1.50 - 1.25 ]). Recovery above $1.47 is unlikely, but would signal a primary trend change — and test previous highs at $1.60.

Source: Netdania

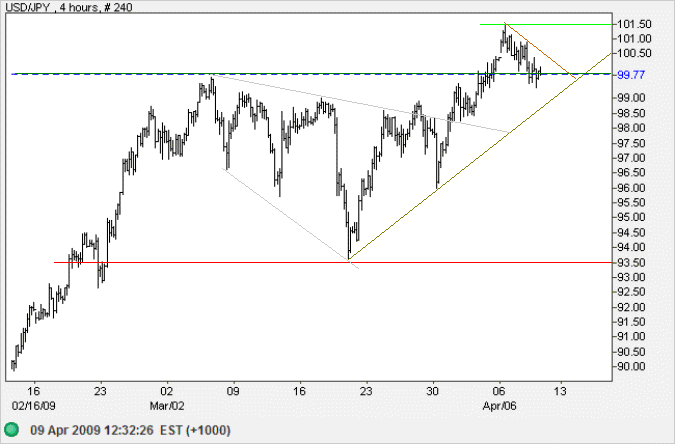

Japanese Yen

The dollar penetrated resistance at ¥100, providing confirmation of the recent breakout from a descending broadening wedge, then retraced to test the new support level. Respect of support would confirm the up-trend, with a target of ¥105 (calculated as 99 + [ 100 - 94 ]). Reversal below the rising trendline is unlikely, but would warn of a bull trap. In the long term, failure of primary support at ¥87 is also unlikely, and breakout above ¥100 offers a target of ¥110 (the August 2008 high).

Source: Netdania

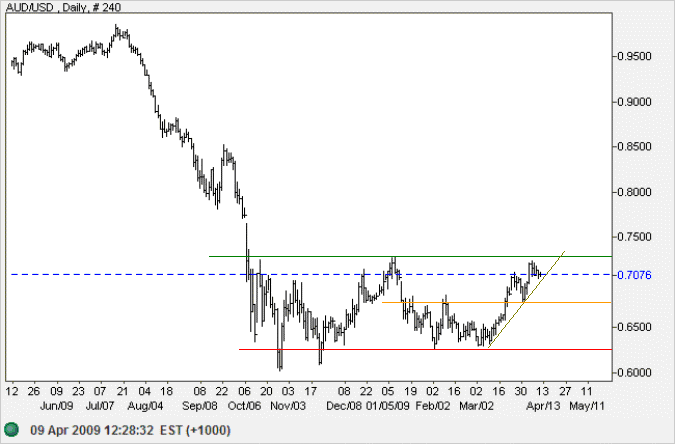

Australian Dollar

The quarter percent rate cut by the RBA did not disturb the up-trend

of the Australian dollar against the greenback.

Respect of the rising trendline is likely, followed by a test of resistance at $0.7300.

Breakout above $0.7300 would offer a target of the September high of $0.8500

(calculated as

0.7250 + [ 0.7250 - 0.6000 ]).

Failure of $0.60 now appears unlikely, but would target the 2001 lows between $0.48 and $0.50.

Source: Netdania

To be content with what we possess is the greatest and most secure of riches.

~ Marcus Tullius Cicero