It's All About Jobs

By Colin Twiggs

April 8, 2009 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

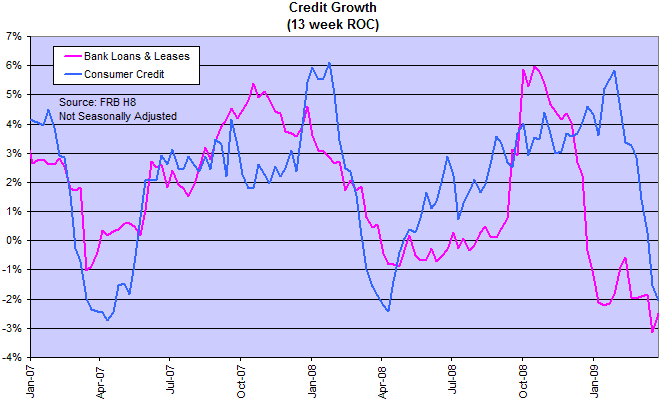

We will closely monitor credit growth over the next year to look for signs that central bank money creation has caused an upsurge in private sector debt. An upsurge would warn of rising inflation — and lead to rising gold prices, rising interest rates and falling bond prices. Bank loans and leases are contracting at the quarterly rate of 3 percent compared to the normal seasonal contraction of 1 percent, while consumer credit is still within the normal seasonal range. Falls below -3 percent would warn of further deterioration in the economy.

Confidence Levels

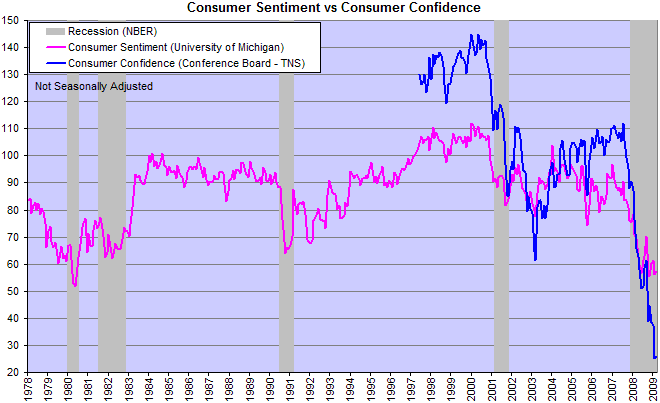

Consumer confidence as measured by the Conference Board is at an all-time low since the start of the series in 1997. Consumer sentiment is approaching its 1980 low of 50. This illustrates how deeply the financial crisis has shaken consumer faith in the economy and how difficult it will be to regain that trust. Unfortunately this unleashes a self-reinforcing cycle, with low confidence levels leading to increased savings and debt reduction — which in turn leads to lower consumer spending and further job losses.

Retail Sales

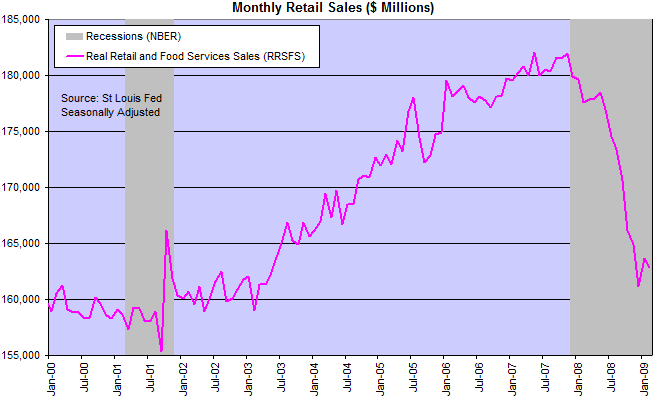

The $20 billion drop in monthly retail sales is far more severe than recent recessions (since 1980). Resultant layoffs feed the negative cycle, making the economy unresponsive to stimulus attempts.

Job Losses

Job losses are the core of the problem. Contracting incomes translate into declining consumer spending, but the heightened uncertainty affects all consumers, prompting them to pay off debt and increase savings — and magnify the fall in consumer spending and employment.

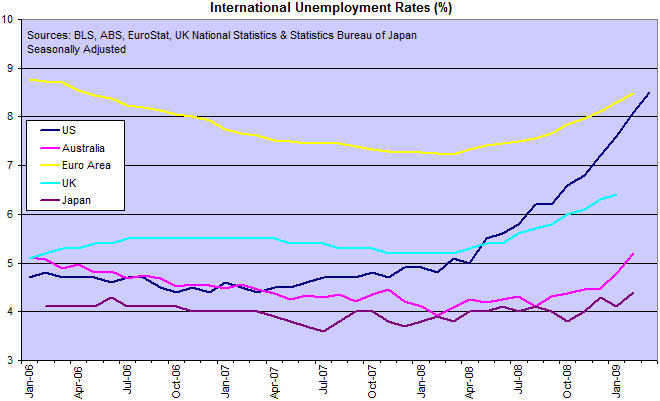

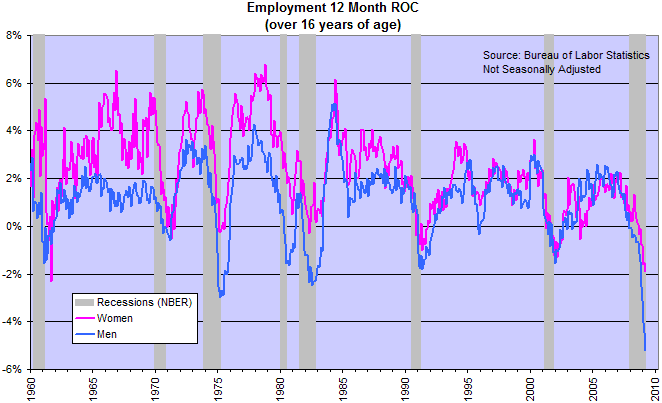

Official unemployment is close to 9.0 percent, and likely to get worse before it improves. But unemployment figures understate the magnitude of the problem because they exclude those not actively seeking work. If we look at actual job losses, the contraction in employment is the highest in 50 years, far exceeding the troughs of 1975 and 1982.

The stock market normally recovers ahead of employment, with employers only hiring when spare capacity is taken up and they are certain that the recovery is sustainable. In 2001, however, employment started rising ahead of the Dow recovery. So, while it normally provides confirmation of an up-turn, employment occasionally serves as a lead indicator.

What beat me was not having brains enough to stick to my own game — that is, to play the market only when I was satisfied that precedents favoured my play.

There is the plain fool, who does the wrong thing at all times everywhere, but there is also the Wall Street fool, who thinks he must trade all the time.

~ Jesse Livermore in Edwin Lefevre's Reminiscences of a Stock Operator