Bear Market Rally

By Colin Twiggs

March 23, 2009 8:30 p.m. ET (11:30 a.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

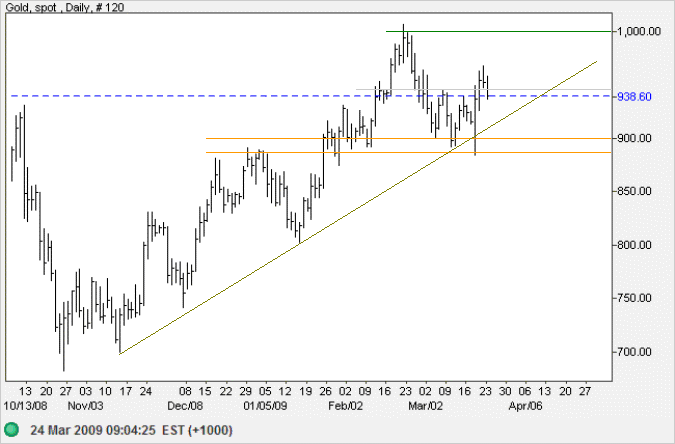

Gold

Spot gold made a sharp upward spike four days ago, in response to Fed plans to expand the money supply. After testing the band of support between $890 and $900, the market rallied on the same day to a high of $940. The strong reversal signals another rally to test $1000. A short retracement that respects the rising trendline would confirm. Failure of support (between $890 and $900) is unlikely, but would warn of a down-swing to test $700.

Source: Netdania

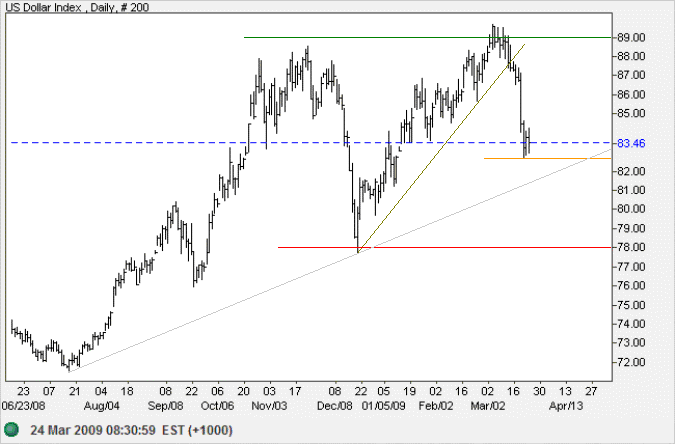

The recent bull trap on the US Dollar Index, with marginal break above 89 followed by a sharp drop, warns of a primary trend reversal. Failure of support at 78 would confirm. A weakening dollar would drive the gold price higher.

Source: Netdania

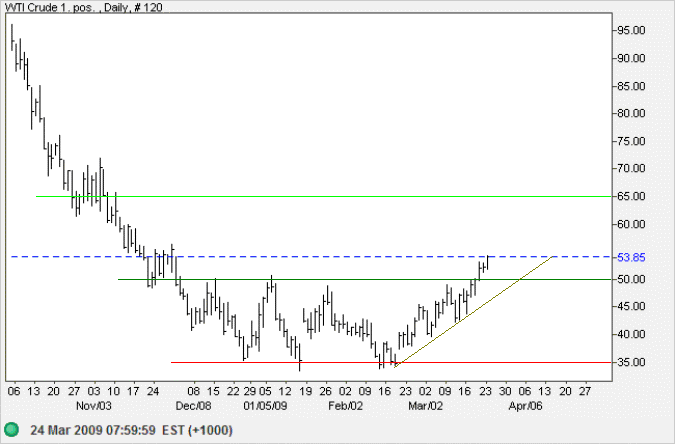

Crude Oil

West Texas Crude broke through resistance at $50 per barrel, completing a triple bottom reversal. While the primary trend has not reversed, expect a bear market rally with a target of $65. Reversal below $50 is unlikely, but would signal a bull trap — warning of another test of support between $33 and $35 per barrel.

Source: Netdania

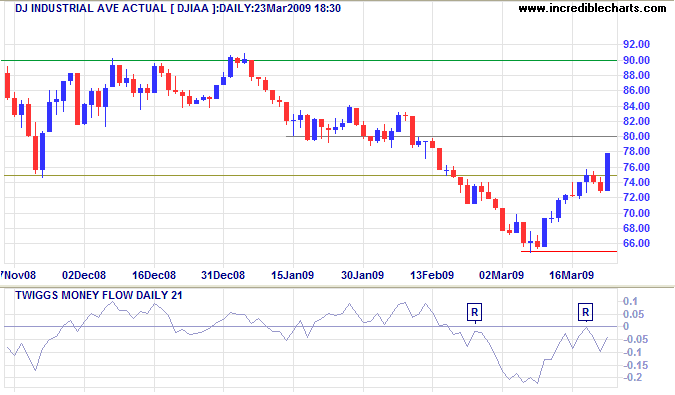

Dow Jones Industrial Average

Dow futures climbed by 190 points before the opening, with the Dow staging an optimistic recovery to break resistance at 7500 — in anticipation of Treasury plans to remove toxic assets from financial sector balance sheets. Sharp rallies are typical of a bear market. Expect a test of 8000, with a possible rally to 9000, but the primary trend is unlikely to change. The primary target remains at 6000; calculated as 7500 - ( 9000 - 7500 ).

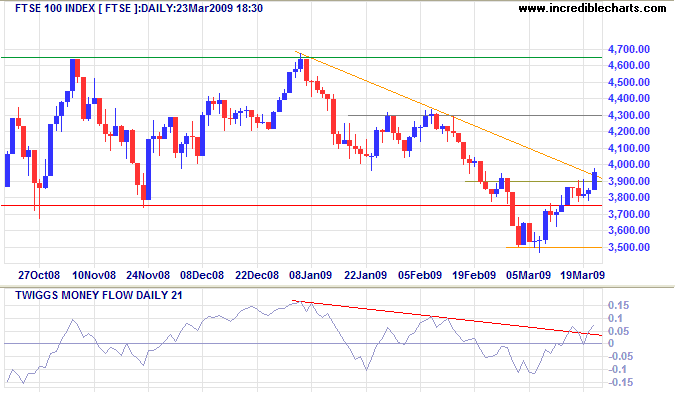

United Kingdom: FTSE

The FTSE 100 broke through 3900 and is likely to test 4300. The primary target, however, remains at 3000; calculated as 3800 - (4600 - 3800).

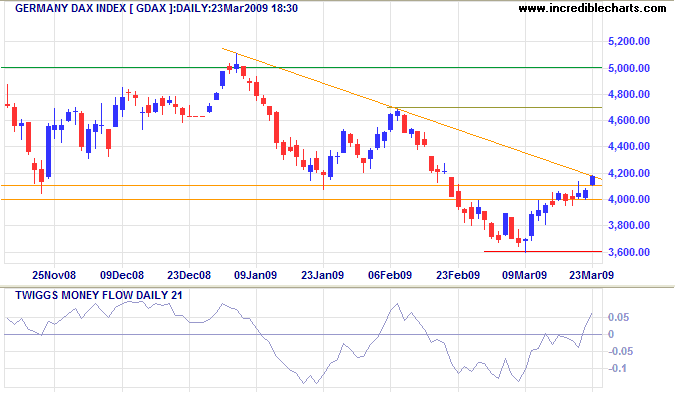

Germany: Dax

The Dax gapped through resistance at 4100 and is likely to test 4700. The primary target, however, remains at 3000; calculated as 4000 - ( 5000 - 4000 ).

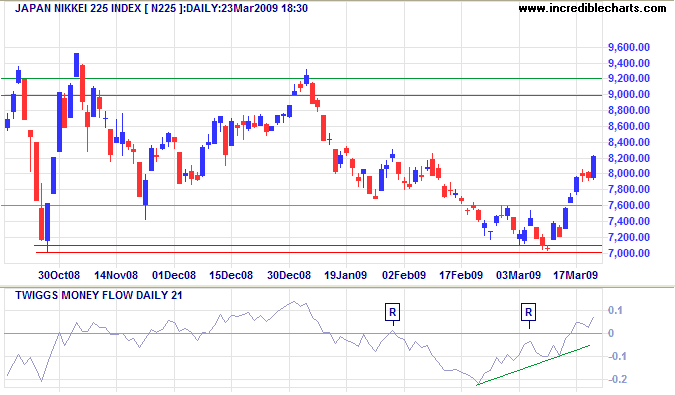

Japan: Nikkei

The Nikkei 225 broke through 8000 and is expected to test the next band of resistance, between 9000 and 9200. Breakout above that level would signal a primary trend reversal.

In the end, it is earnings — profit and profit potential that moves stock,

not emotions, like hope and greed.

~ Jesse Livermore: How To Trade In Stocks