Gold Pennant While Markets Fall

By Colin Twiggs

March 9, 3:30 a.m. ET (6:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

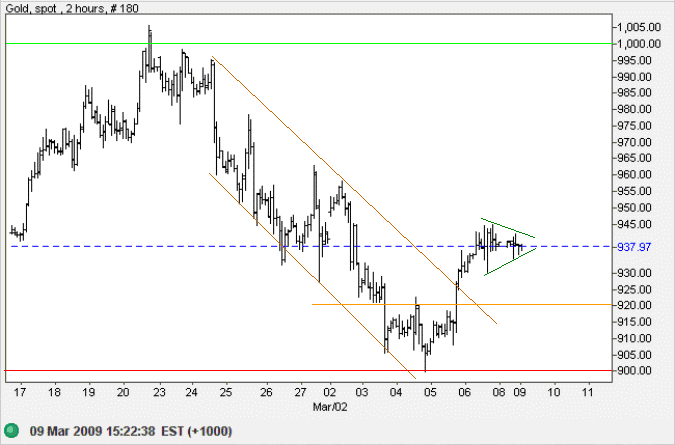

Gold

Spot gold formed a short-term pennant formation between $930 and $945 on the hourly chart, indicating continuation of the recent rally towards $1000. Reversal below $930, while unlikely, would warn of another test of support at $900. In the long term, breakout above $1000 would offer a target of $1200, based on the large (12-month) descending broadening wedge: 900 + ( 1000 - 700 ).

USA

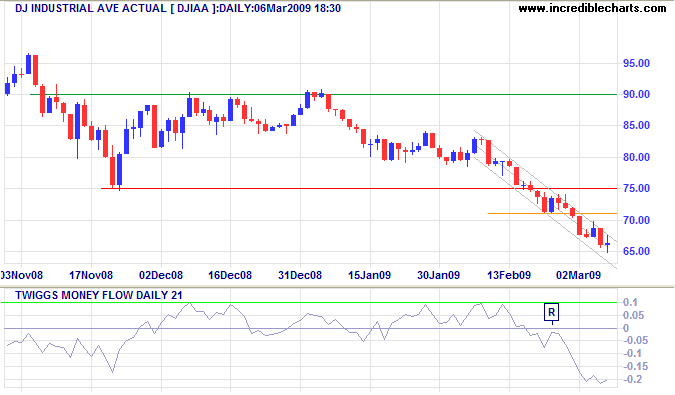

Dow Jones Industrial Average

The Dow's narrow trend channel and sharp fall in Twiggs Money Flow (21-Day) confirm selling pressure. The primary down-swing offers a target of 6000; calculated as 7500 - ( 9000 - 7500 ).

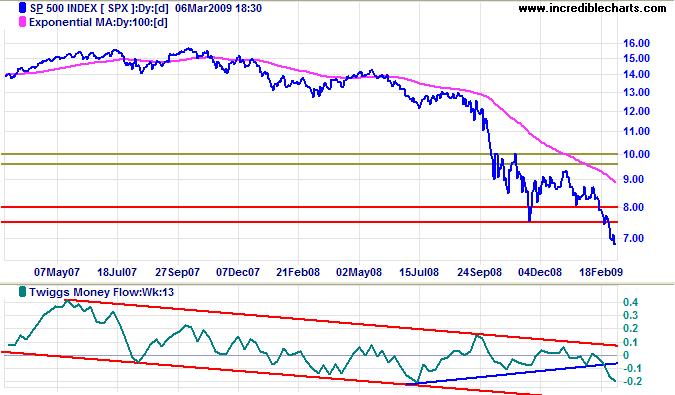

S&P 500

The S&P 500 primary down-swing offers a target of 600; calculated as 750 - ( 900 - 750 ). Twiggs Money Flow (13-Week) confirms long-term selling pressure with a swing towards the lower trend channel.

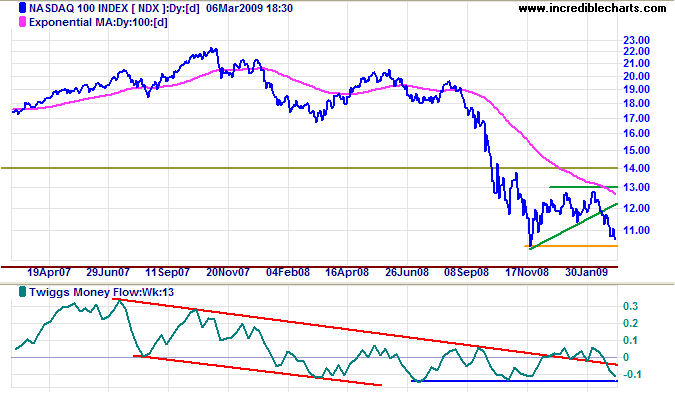

Technology

The Nasdaq 100 is headed for a test of primary support at 1040. Failure would offer a target of 800; calculated as 1050 - ( 1300 - 1050 ). Twiggs Money Flow (13-week) below -0.15 would warn of a primary down-swing.

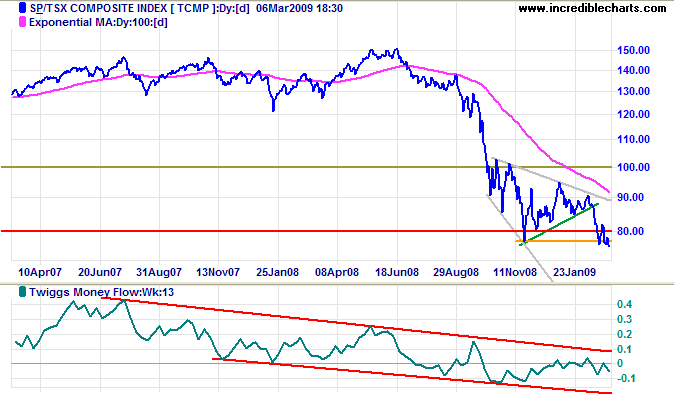

Canada: TSX

The TSX Composite broke primary support at 7700, offering a target of 5900, but support may form at the nearby October 2002 low of 5700. The target calculation is 7700 - ( 9500 - 7700).

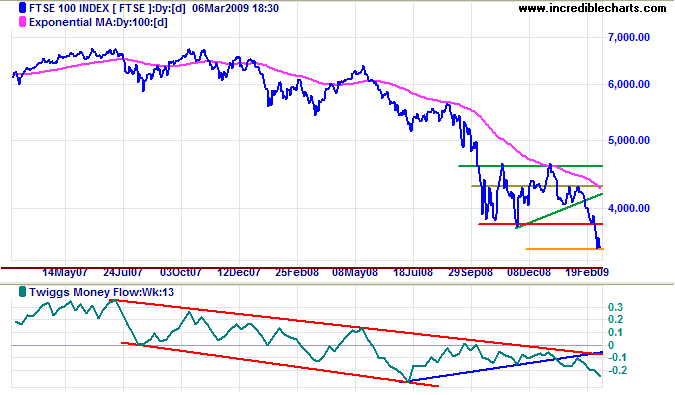

United Kingdom: FTSE

The FTSE 100 broke through primary support at 3800, while Twiggs Money Flow (13-Week) commenced a swing towards the lower trend channel. The short-term consolidation between 3500 and 3650 signals continuation. Expect a primary down-swing with a target of 3000; calculated as 3800 - (4600 - 3800).

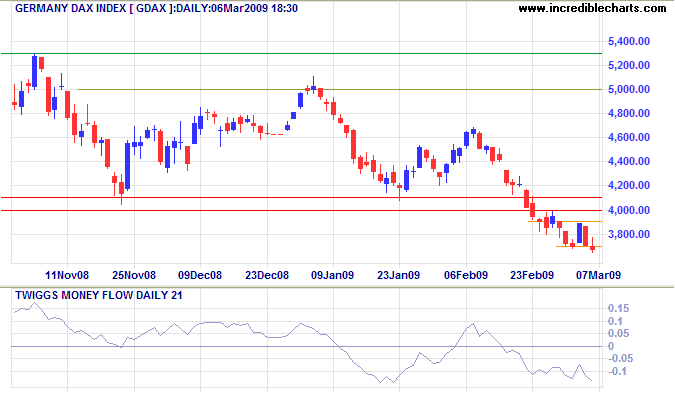

Europe: DAX

The DAX short retracement (1 day) to 3900 indicates a strong down-trend. As does Twiggs Money Flow (21-Day) holding below zero. Expect a primary down-swing with a target of 3000; calculated as 4000 - (5000 - 4000).

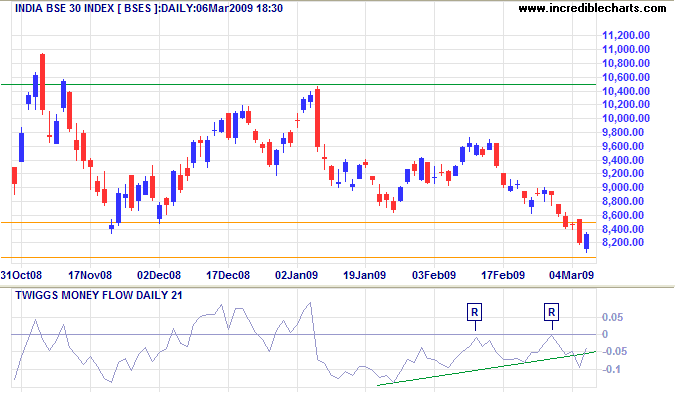

India: Sensex

The Sensex broke through primary support at 8500 and is now retracing to confirm the new support level. Twiggs Money Flow (21-Day) respecting the zero line from below indicates selling pressure. Expect a primary down-swing with a target of 6500; calculated as 8500 - ( 10500 - 8500 ).

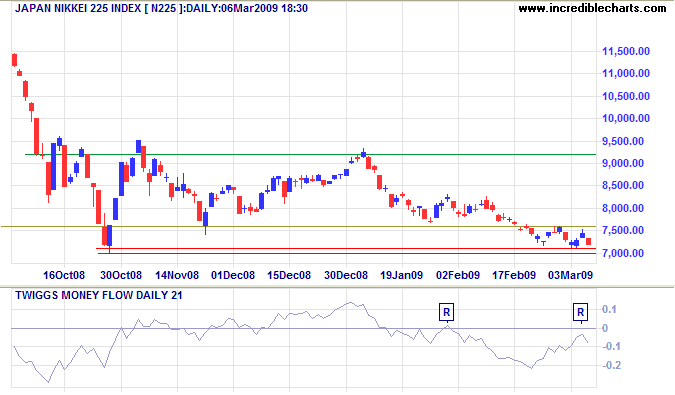

Japan: Nikkei

The Nikkei 225 is consolidating in a narrow range above primary support at 7000, warning of a downward breakout. Twiggs Money Flow (21-Day) respecting the zero line from below confirms selling pressure. Breakout below 7000 would signal a primary down-swing with a target of 5000; calculated as 7000 - (9000 - 7000).

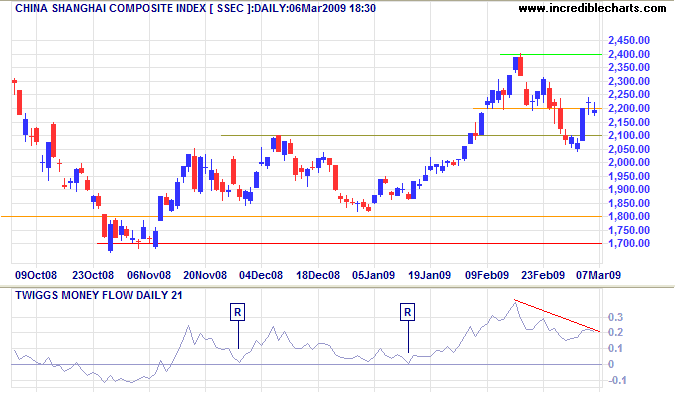

China

The Shanghai Composite retraced after briefly penetrating interim support at 2100, but the retracement encountered strong interim resistance at 2200. Reversal below 2050 would warn of primary trend weakness, while follow-through above 2250 would test 2400. In the long term, breakout above 2400 would indicate primary (up) trend strength, while a fall below 1800 would signal reversal.

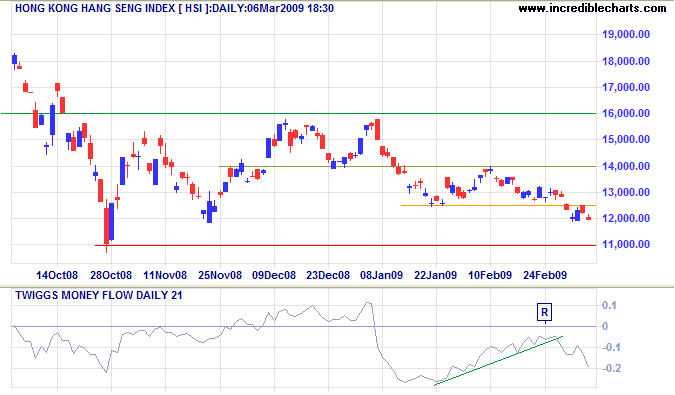

The Hang Seng index broke through short-term support at 12500, warning of a test of primary support at 11000. The subsequent short retracement and Twiggs Money Flow (21-Day) respect of the zero line confirm selling pressure. In the longer term, the primary trend is down and breakout below 11000 would offer a target of 8500, the April 2003 low.

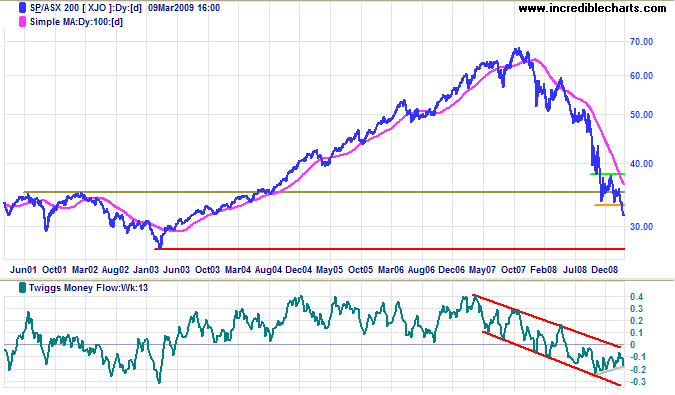

Australia: ASX

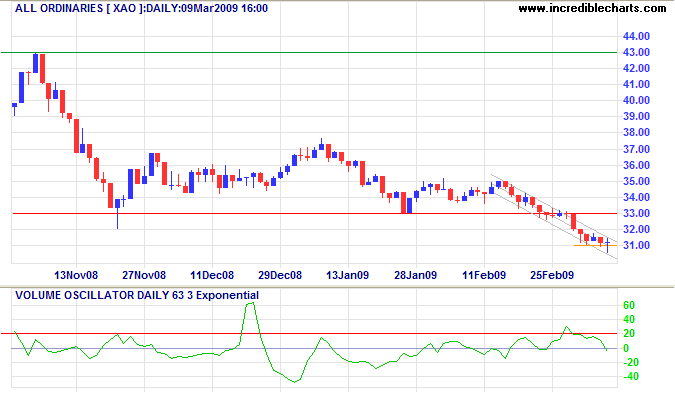

The All Ordinaries is testing short-term support at 3100, low volume indicating that this level is unlikely to hold. In the long term, breakout below 3300 indicates a primary down-swing with a target of 2700, the March 2003 low.

The ASX 200 is likewise headed for a target of 2700: its 2003 low. Twiggs Money Flow (13-Week) respect of the upper trend channel would add further confirmation.

Coming from, first, Europe

and, second, from a former communist country.......

I almost don't believe my eyes to see how much here you believe in government

and how much you don't believe in the market.

This is for me a shocking experience and I have to say that very loudly.......

It seems to me that the fight for freedom — for free markets

— is still the task of the day.....

I don't think that the current problem in the world — in this country

— is the example of a market failure.

I think it is the example of government failure.

I am absolutely sure that the current crisis is the "just" price

we all of us have to pay for the attempts of politicians to "play" with the markets.

I am not one to say: blame the markets.

No. Blame the politicians.

~ Vaclav Klaus, President of the Czech Republic and former economics professor,

at the

Wall Street Journal's Economics Conference.