Dow Confirms Primary Down-Swing

By Colin Twiggs

March 1, 8:30 p.m. ET (12:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

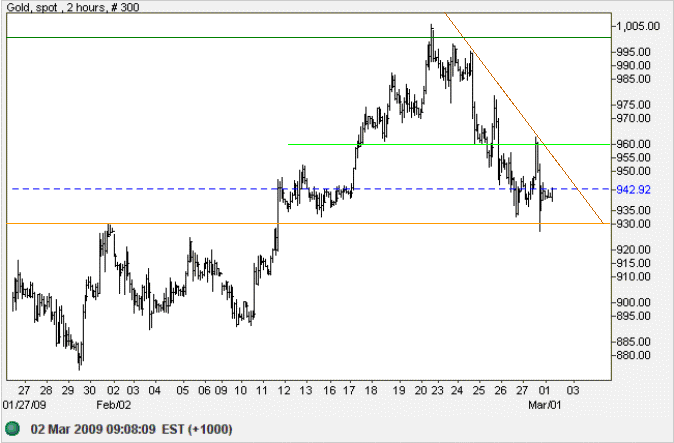

Gold

Spot gold is testing short-term support at $930 on the hourly chart. Respect of support, indicated by recovery above $960, would indicate that the (October to February) up-trend is intact, while breakout below $900 would warn of a down-swing to test primary support at $700. The long term target for breakout above $1000 is $1200, based on the large recent (12-month) descending broadening wedge: 900 + ( 1000 - 700 ).

USA

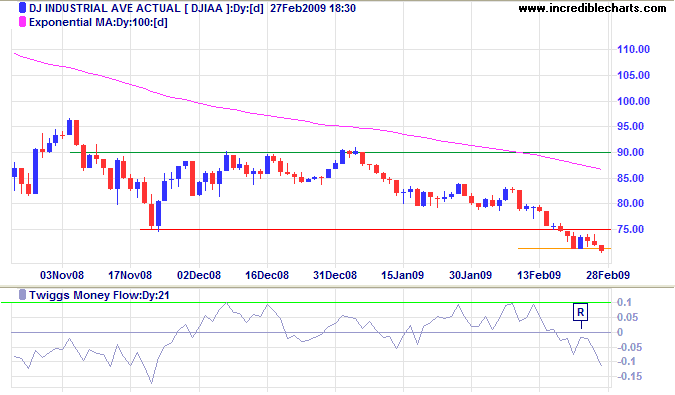

Dow Jones Industrial Average

The Dow broke through short-term support at 7100, respecting the new resistance level at 7500 and confirming the primary down-swing with a target of 6000; calculated as 7500 - ( 9000 - 7500 ). Twiggs Money Flow (21-Day) respecting the zero line from below [R] confirms selling pressure.

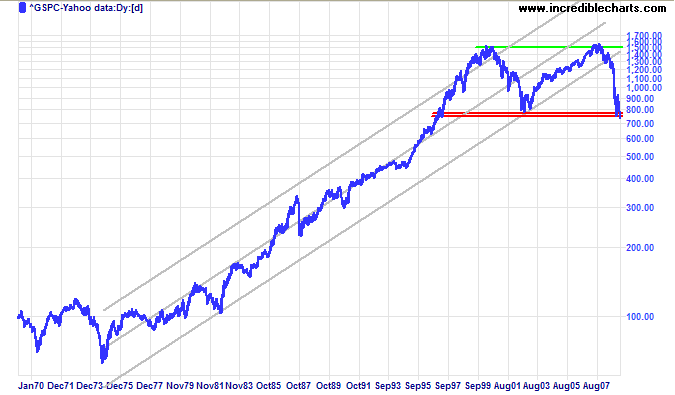

S&P 500

The S&P 500 also broke through short-term support, confirming the Dow signal. The medium-term target is 600; calculated as 750 - ( 900 - 750 ). Breakout from the 30-year rising trend channel should dispel any argument that this is a normal recession. There are two viable options from here: a volatile ranging (long-term) market as in the 1960s and 70s; or a downward trend channel as in the 1930s. I favor the first option, with the Fed using the printing press to counter the contraction in consumer spending, but cannot rule out the second.

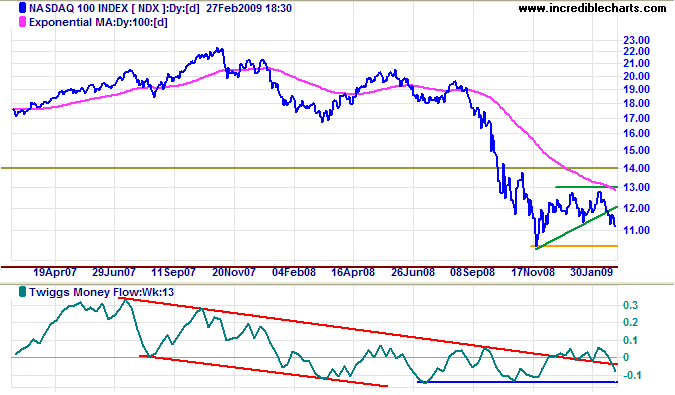

Technology

The Nasdaq 100 broke medium-term support at 1140 and is headed for a test of primary support at 1040. Breakout below 1040 would offer a target of 800; calculated as 1050 - ( 1300 - 1050 ). Twiggs Money Flow (13-week) below -0.15 would warn of another down-swing.

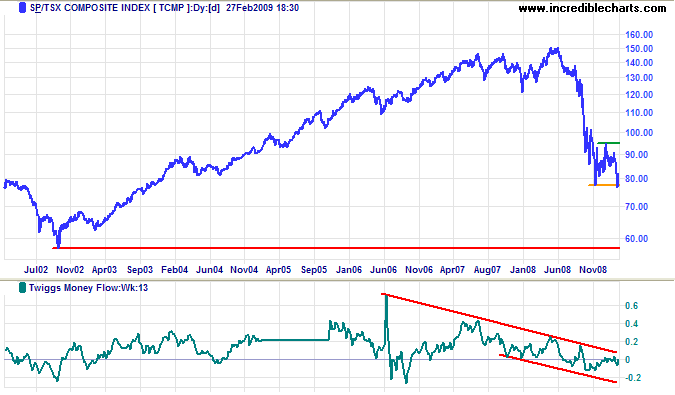

Canada: TSX

The TSX Composite is testing primary support at 7700. Negative sentiment in US and European markets make failure highly likely. The calculated target for a breakout is 5900, 7700 - ( 9500 - 7700), but the down-swing would be likely to test the nearby October 2002 low of 5700.

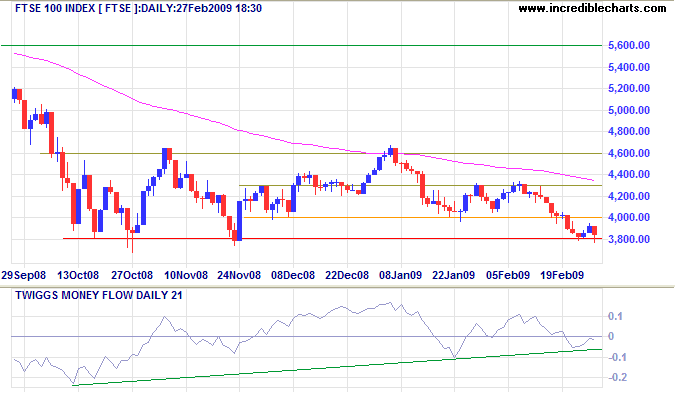

United Kingdom: FTSE

The FTSE 100 is testing primary support at 3800. Twiggs Money Flow (21-Day) below the zero line indicates selling pressure. Breakout is likely, given negative sentiment in the US and Europe, and would offer a target of 3000; calculated as 3800 - (4600 - 3800).

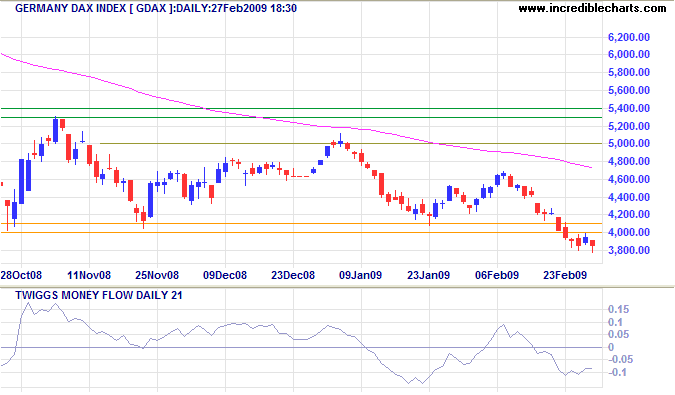

Europe: DAX

The DAX respected the new resistance level at 4000, confirming the primary down-swing. Expect a target of 3000; calculated as 4000 - (5000 - 4000).

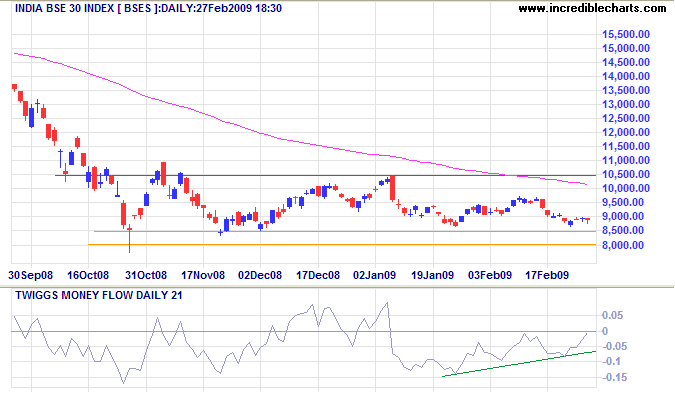

India: Sensex

The Sensex continues in a long, narrow consolidation — testing support at 8500. Rising Twiggs Money Flow (21-Day) indicates short-term buying pressure, but whether this is sufficient to overcome negative sentiment in international markets is questionable. The primary trend is down and breakout below 8500 would offer a target of 6500; calculated as 8500 - ( 10500 - 8500 ).

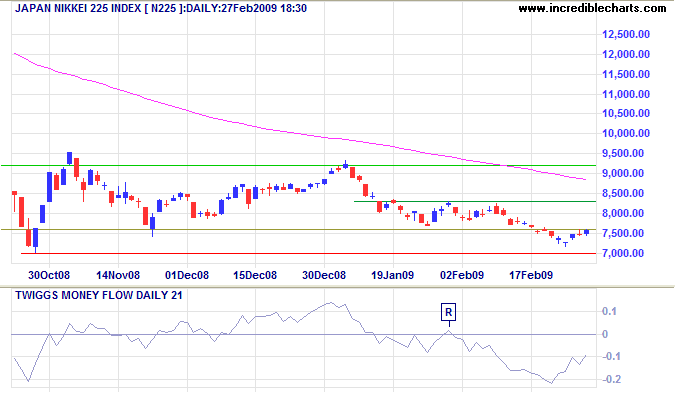

Japan: Nikkei

The Nikkei 225 respected primary support at 7000, but Twiggs Money Flow (21-Day) continues to show weakness. Breakout below 7000 would signal a primary down-swing with a target of 5000; calculated as 7000 - (9000 - 7000).

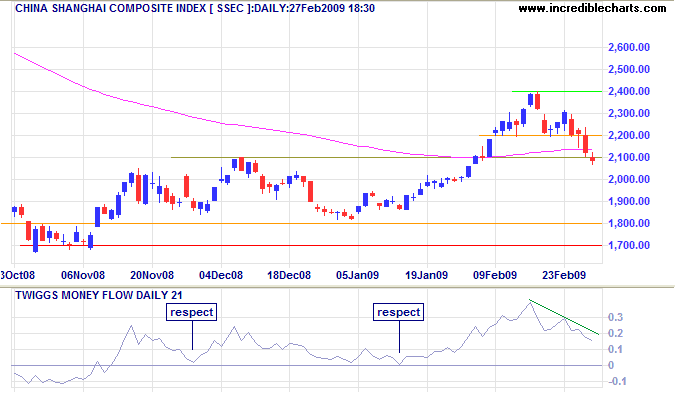

China

There appears little relief ahead for commodity exporters like Australia, with Luo Bingsheng, vice-chairman of the China Iron and Steel Association, emphasizing his industry's reliance on exports. January increases in steel production were most likely temporary.

The Shanghai Composite retreated below interim support at 2100, indicating a test of primary support at 1800. While not expected, quick reversal above 2200 would signal trend strength. In the long term, respect of 1800 would indicate that the primary up-trend is intact, while failure would signal reversal.

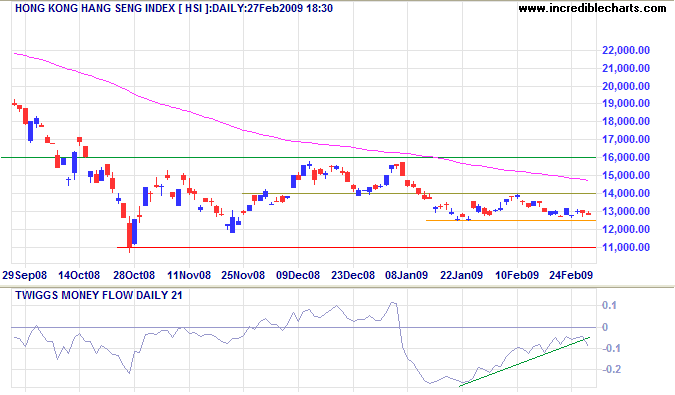

The Hang Seng index consolidating in a narrow band above short-term support at 12500 warns of a downward breakout to test primary support at 11000. Twiggs Money Flow (21-Day) break of the rising trendline confirms selling pressure. In the longer term, the primary trend is down and breakout below 11000 would offer a target of 8500, the April 2003 low.

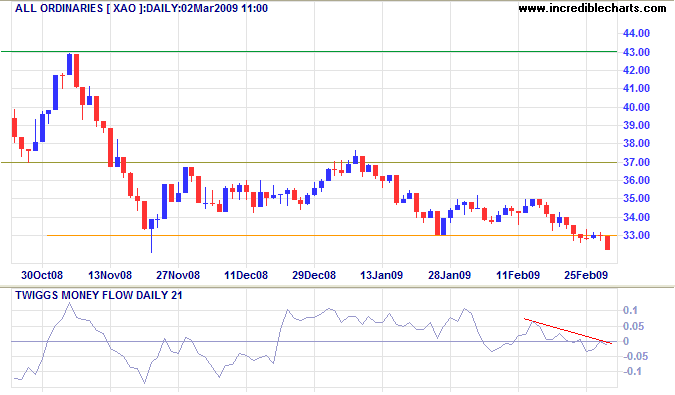

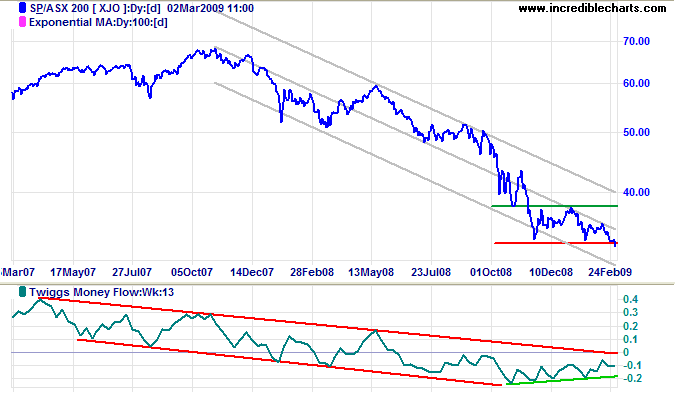

Australia: ASX

The All Ordinaries respected the new resistance level at 3300, confirming the primary down-swing with a target of 2700, the March 2003 low. Twiggs Money Flow (21-Day) settling below zero indicates selling pressure.

The ASX 200 index added further confirmation, respecting resistance at 3350. The target is identical: the 2003 low of 2700. Twiggs Money Flow (13-Week) respect of the upper trend channel would add further weight.

The most violent revolutions in an individuals beliefs leave most of his old order standing.........

New truth is always a go-between, a smoother-over of transitions.

It marries old opinion to new fact so as ever to show a minimum of jolt, a maximum of continuity.

~ William James (1906)