European Bank Tremors Fuel Gold

By Colin Twiggs

February 19, 2009 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Concerns over European bank exposure to emerging markets in Eastern Europe and South America are placing downward pressure on the euro and upward pressure on gold. Failure of the European banking system would threaten not only the EU but would engulf the global economy. It is vital that world leaders head off this threat. They should be reminded that the 1931 failure of Kreditanstalt, Austria's foremost bank, sent shock waves throughout Europe — and precipitated the collapse of the gold standard. The resulting panic overwhelmed Herbert Hoover's efforts to rescue the US economy from recession.

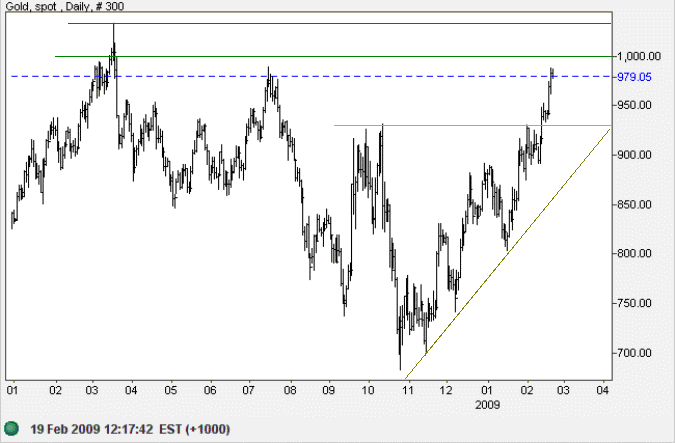

Gold

Spot gold is headed for a test of $1000. Profit-taking would normally cause retracement towards $930. Failure to retrace would indicate panic buying and an accelerating up-trend. Reversal below the rising trendline remains unlikely, but would warn of another test of $700. In the longer term, breakout above $1000 would offer a target of $1200; calculated as 900 + ( 1000 - 700 ).

Source: Netdania

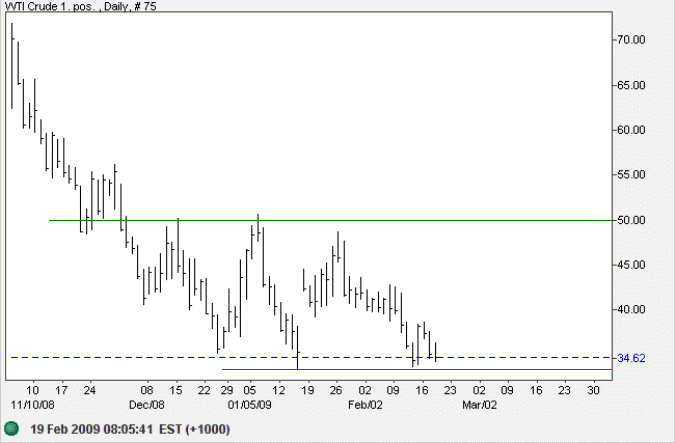

Crude Oil

West Texas Crude is testing support at $33 after a brief rally. Expect further weakness as global economies contract. Breakout below $33 would warn of a down-swing to test the 2003 low of $20. The target is calculated as 35 - (50 - 35).

Source: Netdania

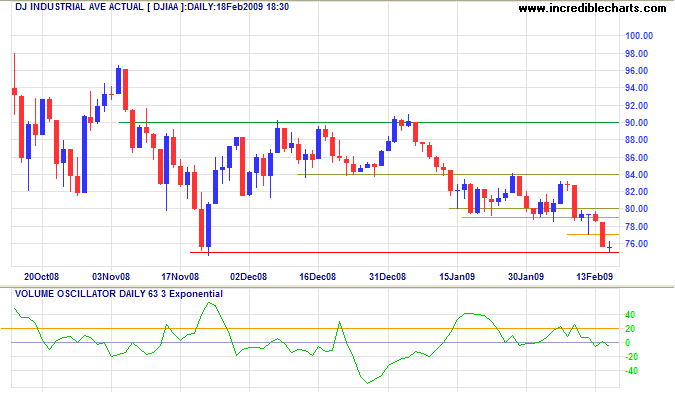

Dow Jones Industrials

The Dow is testing the November low of 7500. Low volume indicates a lack of buying support. Failure of support is likely and would offer a target of 6000; calculated as 7500 - ( 9000 - 7500 ).

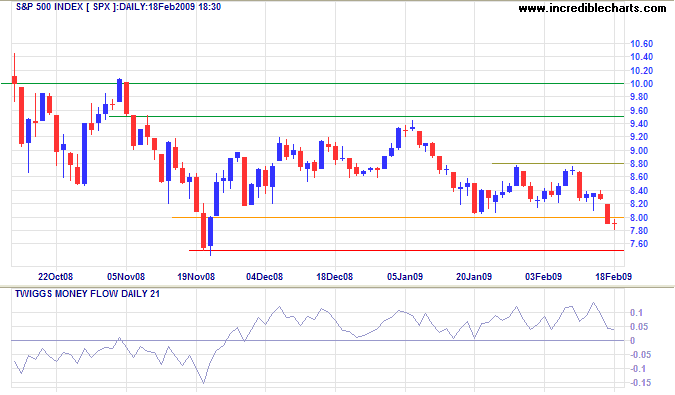

The S&P 500 also shows signs of weakness, breaking through 800. Twiggs Money Flow respect of the zero line, however, would warn of a bear trap. In the longer term, breakout below 750 would confirm the Dow and offer a similar target of 600; calculated as 750 - ( 900 - 750).

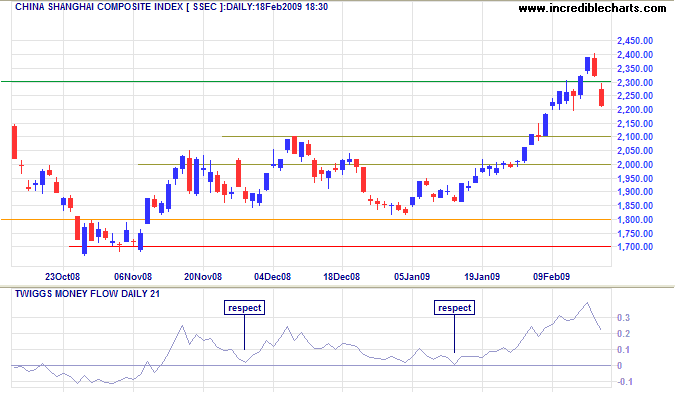

Chinese Recovery

The Shanghai Composite Index formed an island reversal, gapping below 2300. Respect of 2100 would be a positive sign, while failure of 1800 would signal continuation of the down-trend.

Chinese exports fell by 17.5 percent from January 2008, but the real concern for bulk commodity exporters such as Australia is that imports plunged 43 percent. While some of this fall can be explained by lower oil prices, it warns of further contraction in Chinese exports in the months ahead.

Economic Stability

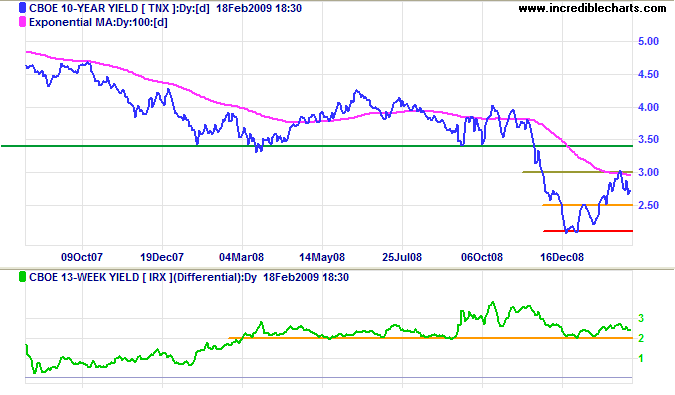

Treasury Yields

Ten-year treasury yields are retracing to test support at 2.50 percent. Fears of inflation, indicated by rising gold prices, are expected to drive yields upward. The yield differential (against 3-month T-bills) remains healthy at above 2 percent, ensuring banks enjoy strong interest margins.

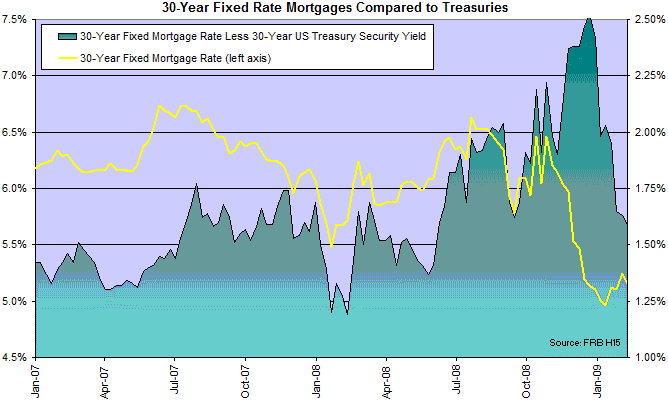

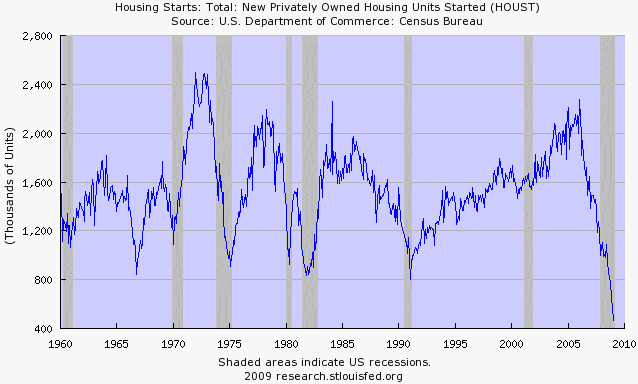

Housing

Fixed rate mortgages are retracing in sympathy with rising treasury yields, but the primary trend remains downward — driven by Treasury purchases of mortgage backed securities.

New housing starts at a 50 year low warn that demand is shrinking despite low mortgage rates.

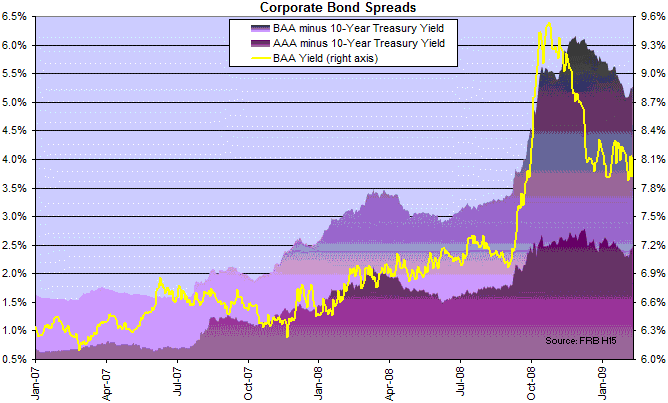

Corporate Bonds

Corporate bond yields have fallen from their peak in late 2008, but spreads recently ticked up, reviving concerns over defaults.

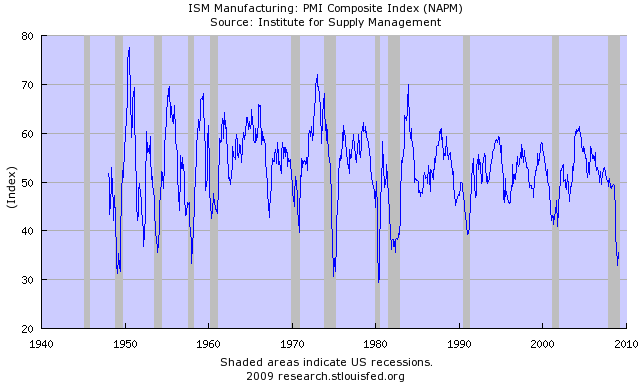

Employment

The PMI manufacturing index is approaching the lows of 1981 and 1949. Expect unemployment to rise.

Unemployment and consumer confidence go hand-in-hand. Consumers withhold spending when confidence is low, resulting in lower sales and more lay-offs. The risk is that a downward spiral may develop — rising lay-offs causing a further drop in confidence and contraction in spending.

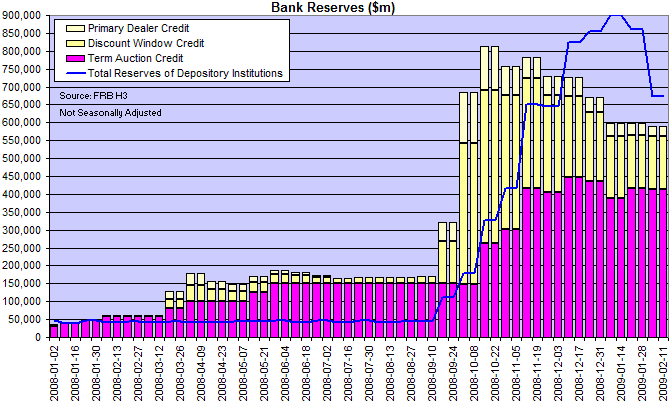

Bank Lending

Fed support for the banking sector, in excess of $600 billion including the Bear Stearns SIV, remains uncomfortably high.

Currencies

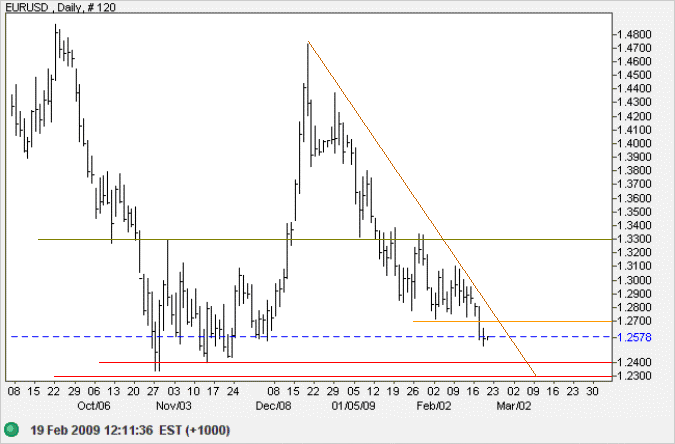

Euro

The euro broke through support at $1.27 and is headed for a test of $1.23. In the long term, failure of support at $1.23 would offer a target of $1.00; calculated as 1.25 - ( 1.50 - 1.25 ).

Source: Netdania

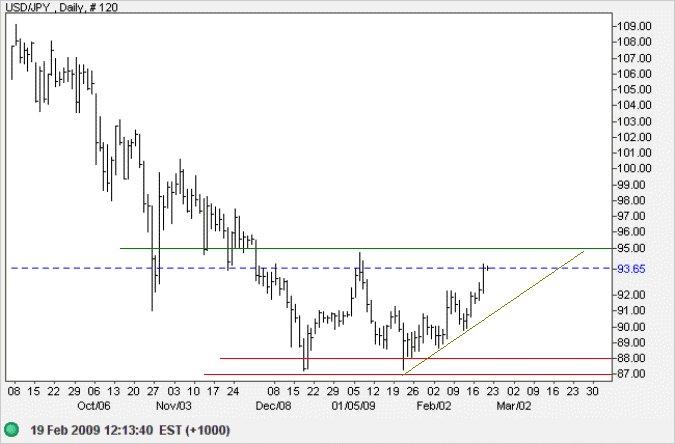

Japanese Yen

The dollar is headed for a test of resistance at 95 against the yen. Breakout would complete a double bottom formation, offering a target of 103; calculated as 95 +( 95 - 87 ). The primary trend is down, however, and respect of 95 would test support at 87. In the long term, failure of 87 would target the 1995 low of 80.

Source: Netdania

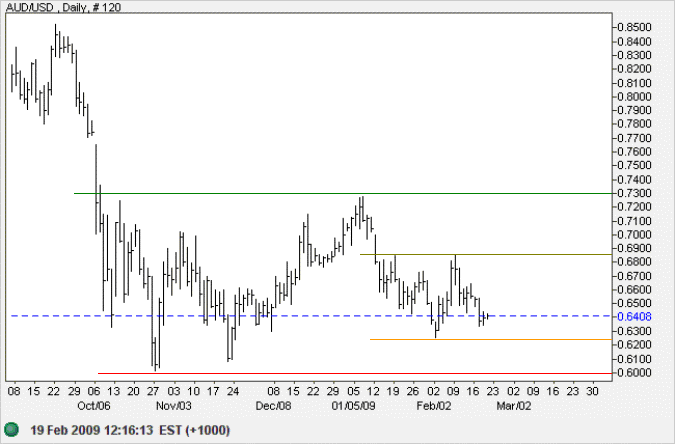

Australian Dollar

The Aussie dollar is headed for a test of support at $0.6250. Failure would test $0.60. Respect of support, while less likely, would indicate a rally to $0.6850. In the long term, the primary trend is down and failure of $0.60 would offer a target of $0.50; calculated as 0.60 - ( 0.70 - 0.60).

Source: Netdania

Economic depression cannot be cured by legislative action or executive pronouncement.

Economic wounds must be healed by the action of the cells of the economic body — the producers and consumers themselves.

~ Herbert Hoover