Gold Breakout

By Colin Twiggs

February 12, 2009 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

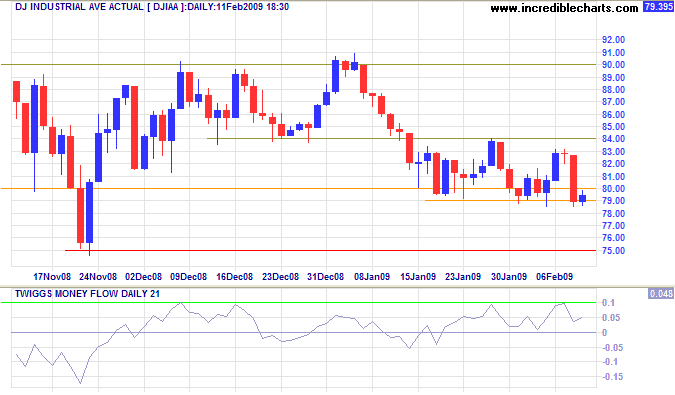

Dow Jones Industrials

The Dow found support at 7900, but volumes are weak and downward breakout from the 7900 to 8400 consolidation remains more likely — targeting the November low of 7500.

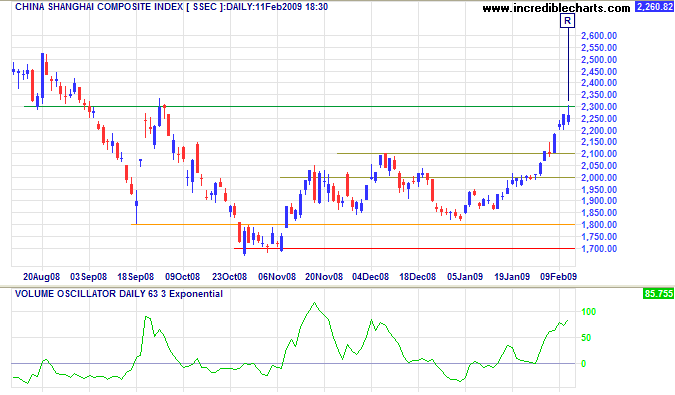

Chinese Recovery

The Shanghai Composite Index encountered resistance at 2300, indicated by a weak close and increased volume. Expect a reaction back to 2100; respect would confirm the primary up-trend.

Whether the market is able to sustain this rally will depend on China's ability to maintain demand in the face of falling exports and rising unemployment. Rising steel production points towards increased infrastructure spending which requires large volumes of steel. But the acid test will be the impact on property prices and consumer spending.

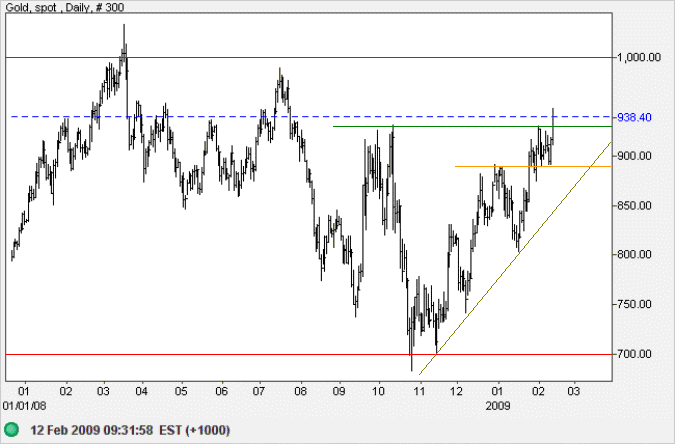

Gold

Spot gold broke through resistance at $930, indicating another test of $1000. Retracement that respects the new support level would strengthen the signal. Reversal below the recent low at $890 is less likely, but would warn of another test of $700. In the longer term, breakout above $1000 would offer a target of $1200; calculated as 900 + ( 1000 - 700 ).

Source: Netdania

The rising gold price also warns that inflation expectations are rising. Bond yields are likely to follow in 6 to 12 months. For a detailed explanation of gold's usefulness as a predictor of inflation and consequently bond yields, see H.C. Wainwright's Nov. 2005 Interest Rate Outlook.

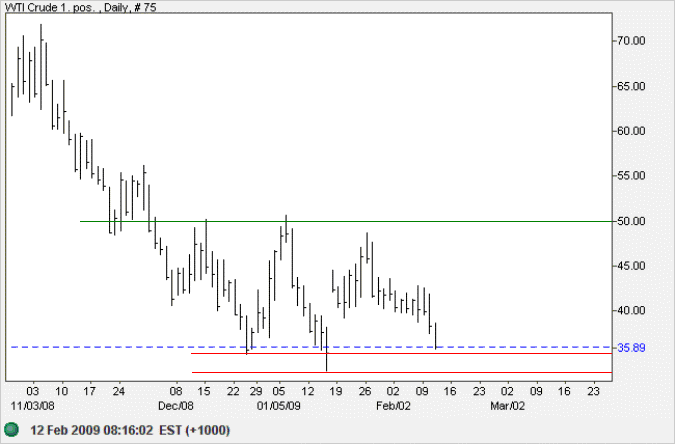

Crude Oil

West Texas Crude is testing the band of support between $33 and $35/barrel. A close below $35 or intra-day break below $33 would warn of a down-swing to test the 2003 low of $20. The target is calculated as 35 - (50 - 35).

Source: Netdania

Economic Stability

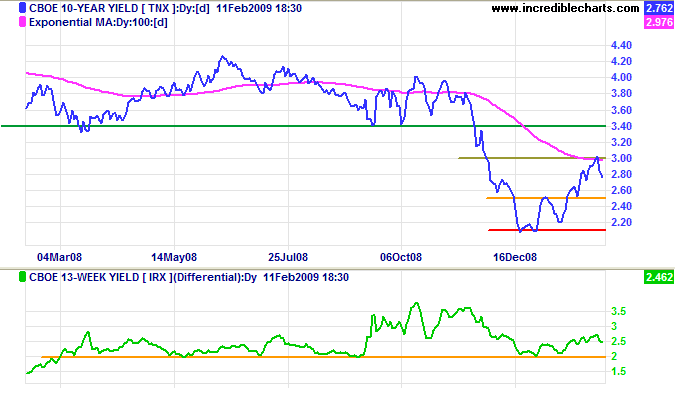

Treasury Yields

Ten-year treasury yields encountered resistance at 3.00 percent and are likely to retrace to test support at 2.50 percent. The yield differential (against 3-month T-bills) remains healthy at above 2 percent, but banks have bigger problems at present.

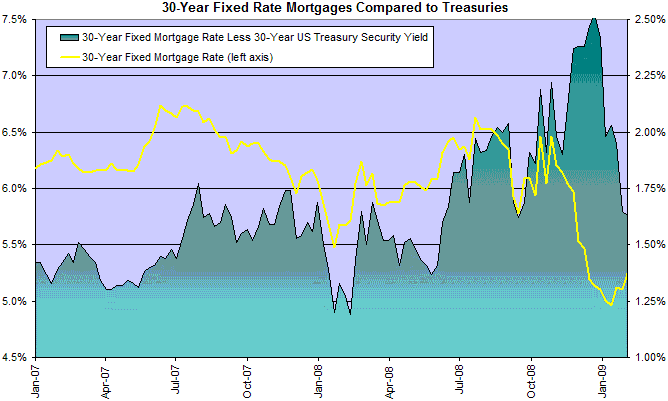

Housing

Fixed rate mortgages are retracing in sympathy with rising treasury yields, but the primary trend remains downward.

Lower rates should ease pressure in the housing market where, according to Fed governor Elizabeth Duke, 25 percent of subprime loans and 13 percent of near-prime loans are more than 90 days past due or in foreclosure. The rate for prime mortgages is below 4 percent, but has almost doubled over the past year. Foreclosures also climbed to 2-1/4 million last year, more than double the 2006 figure.

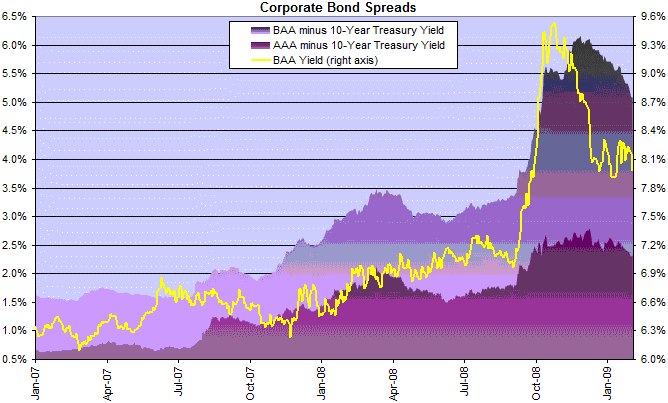

Corporate Bonds

Corporate bond spreads are falling, indicating that default risk is declining. But there is a long way to go to return to 2007 levels.

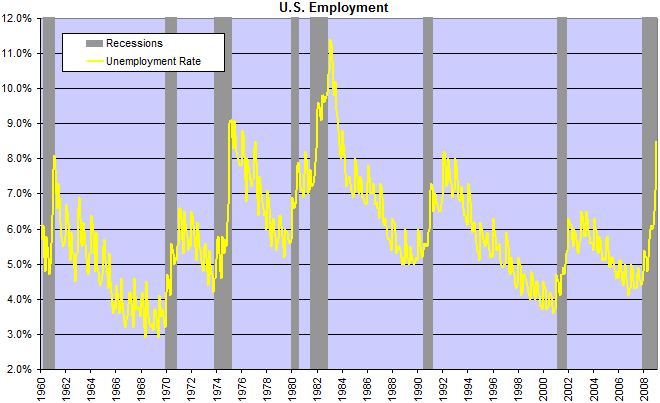

Employment

Unemployment is now higher than the last two recessions. We are entering the realm of the 1970s and 1980s.

Unemployment and consumer confidence go hand-in-hand. Consumers withhold spending when confidence is low, resulting in lower sales and more lay-offs. The risk is that a downward spiral may develop, with rising lay-offs causing a further drop in confidence and contraction in spending.

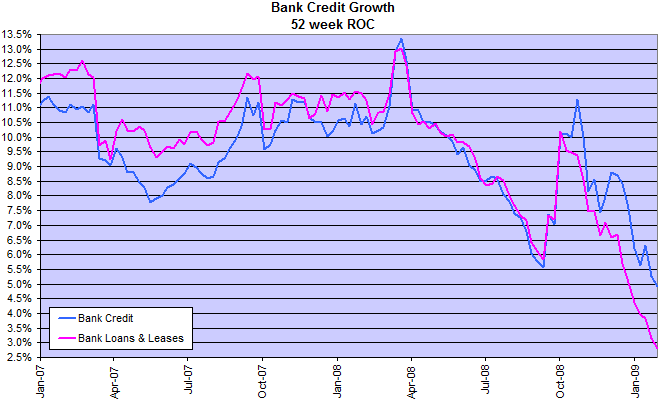

Bank Lending

Bank lending continues to fall, with politicians making noises about forcing banks to resume lending. They miss the point. Demand for credit is falling as consumers and business attempt to reduce their existing debt burden. The only way that banks can increase lending in such a market is to assume greater risk — which would lead to further troubles down the road.

Currencies

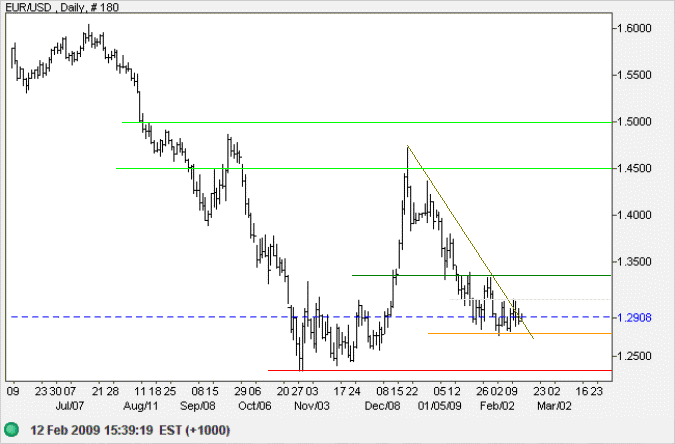

Euro

The euro is consolidating in a narrow range above support at $1.27, indicating that downward breakout and a test of primary support at $1.23 is likely. Recovery above $1.34 is unlikely at present, but would signal another test of $1.45 and increase the probability of a primary trend reversal. In the long term, failure of support at $1.23 would offer a target of $1.00; calculated as 1.25 - ( 1.50 - 1.25 ).

Source: Netdania

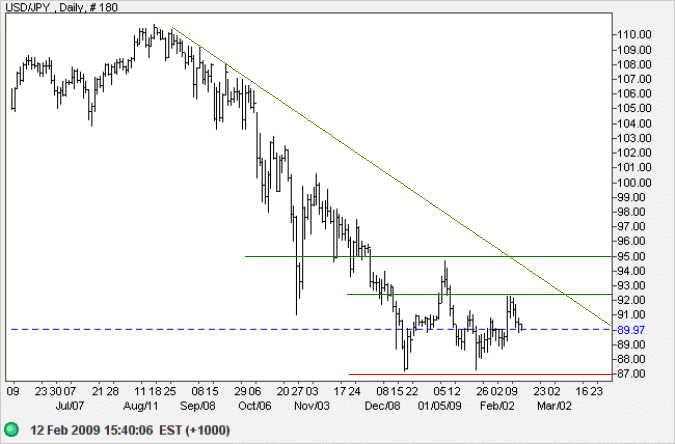

Japanese Yen

The dollar is strengthening (short-term) against the yen. Breakout above 92.50 would test 95. Reversal above 95 would complete a double bottom formation and offer a target of 103; calculated as 95 +( 95 - 87 ). In the long term, the primary trend is down and failure of primary support at 87 would test the 1995 low of 80.

Source: Netdania

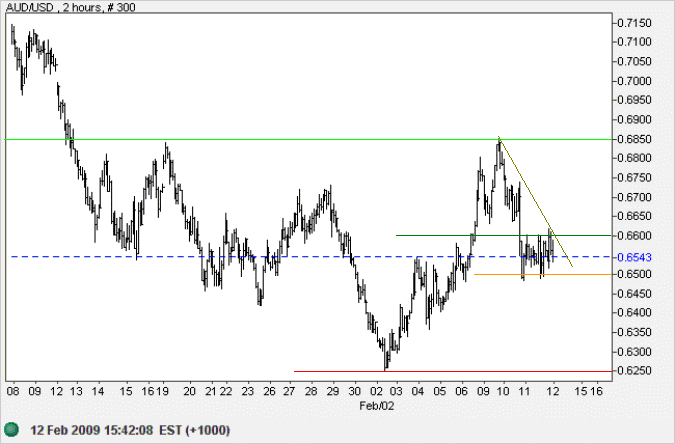

Australian Dollar

The Aussie dollar is consolidating in a narrow band between $0.66 and $0.65 on the intra-day chart, indicating that the down-swing is likely to continue. Breakout below $0.65 would signal a test of $0.6250. Reversal above $0.66 is less likely, but would indicate another test of $0.6850. In the longer term, the primary trend is down and failure of $0.6250 would offer a target of $0.5650; calculated as 0.6250 - ( 0.6850 - 0.6250).

Source: Netdania

All the president is, is a glorified public relations man who spends his time flattering, kissing, and kicking people to get them to do what they are supposed to do anyway.

~ Harry S. Truman