Dow Watershed

By Colin Twiggs

January 27, 3:30 a.m. ET (7:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

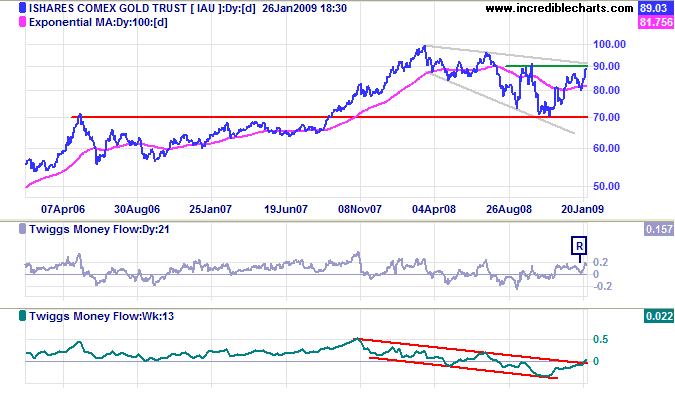

Gold

Spot gold is testing resistance at $900. Twiggs Money Flow (21-Day) respecting the zero line indicates continued buying pressure. Retracement ending in a higher low on the longer-term 13-week indicator would signal another primary up-trend. Upward breakout from the broadening descending wedge formation would offer a long-term target of 1200; calculated 900 + ( 1000 - 700 ). Respect of 900 is less likely — and would indicate another test of $700.

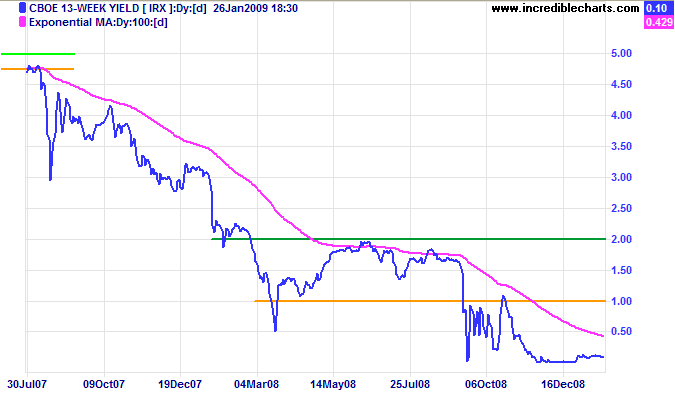

Interbank Lending

Confidence is low, with yields on 3-month Treasury Bills close to zero. Investors remain wary of higher yields offered by banks and commercial paper.

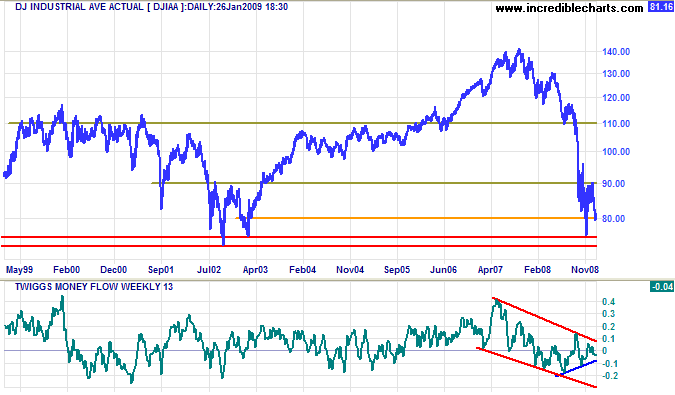

USA

Dow Jones Industrial Average

The Dow is testing support at 8000. Rising volume indicated buying support, but is now declining with no breakout above 8300 in sight. The narrow consolidation between 8000 and 8300 now looks distinctly bearish. Reversal below 8000 would indicate a test of the 2002 low of 7300. Twiggs Money Flow (13-Week) is approaching a watershed: upward breakout from the trend channel would indicate that the primary down-trend is weakening, while reversal below the shorter-term rising trendline would signal another down-swing. In the long term, penetration of the 2002 low of 7300 would offer a long-term target of 6000; calculated as 7500 - ( 9000 - 7500 ).

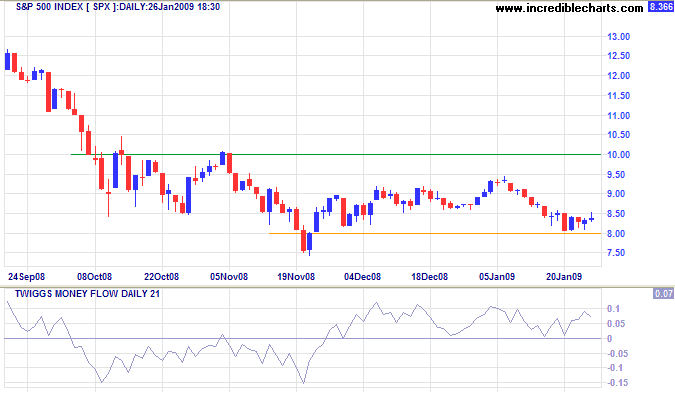

S&P 500

The S&P 500 short-term chart shows a similar consolidation between 800 and 850. Twiggs Money Flow (21-Day), however, is holding above zero, signaling buying pressure and another test of resistance at 950. Poor performance of Citigroup [C] is placing a drag on the Dow. S&P reversal below support at 800, especially if accompanied by TMF breakout below zero, is less likely but would test 750. And break of 750 would offer a target of 550.

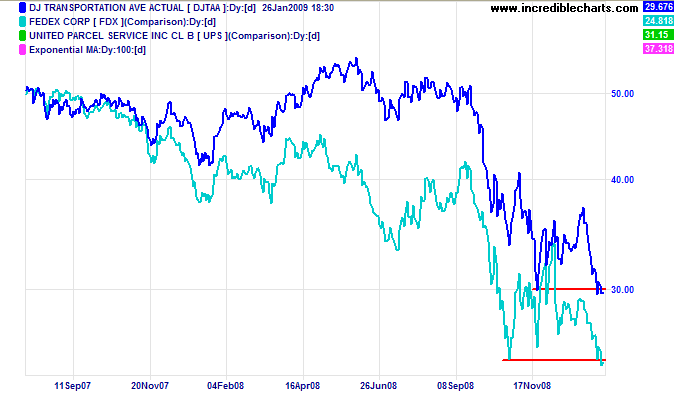

Transport

Fedex and the Dow Transport index broke through primary support, indicating another down-swing — and a further decline in economic activity.

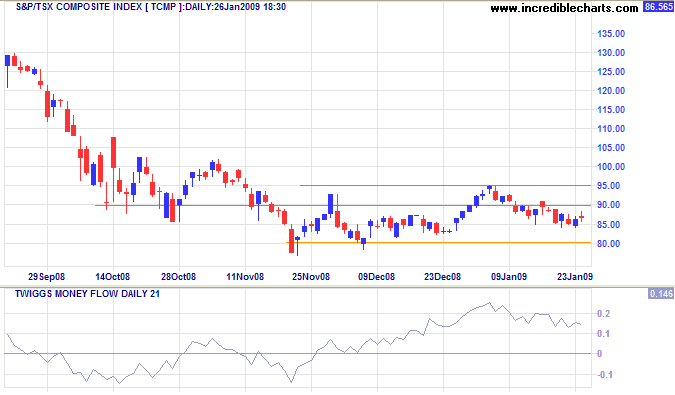

Canada: TSX

The TSX Composite is testing support at 8500. Respect would signal another test of 9500, while failure would test 8000. Twiggs Money Flow (21-Day) has been holding well above zero, indicating medium-term buying pressure. The primary trend is down, however, and reversal below 8000 would offer a target of 6500, calculated as 8000 - (9500 - 8000).

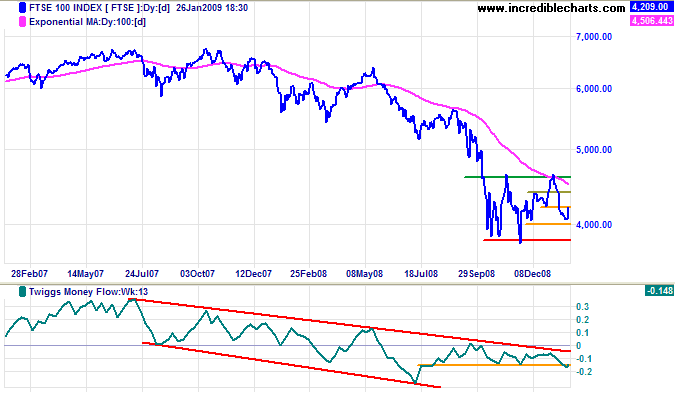

United Kingdom: FTSE

The FTSE 100 continues in a large consolidation between 3800 and 4600. Recovery above 4400 would indicate another test of 4600; reversal below 4000 would suggest another down-swing, with a target of 3000; calculated as 3800 - (4600 - 3800). Twiggs Money Flow (13-Week) ranging at the upper border of the trend chanel signals indecision. The primary trend is down, however, and likely to persist in the medium to long term.

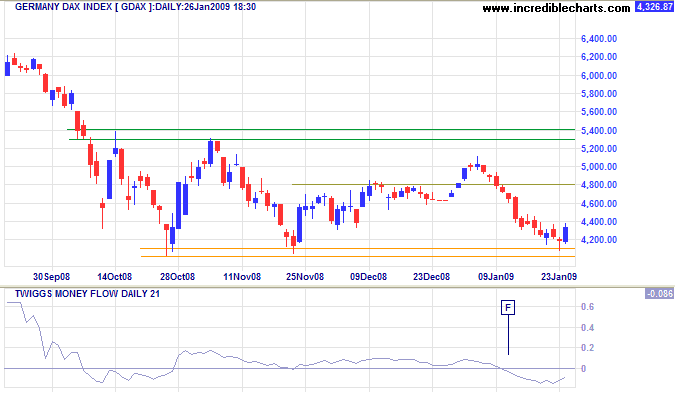

Europe: DAX

The DAX is testing support at 4000. Failure would offer a target of 3000; calculated as 4000 - (5000 - 4000). Twiggs Money Flow (21-day) reversal below zero indicates short-term selling pressure, but recovery above 4400 would negate this.

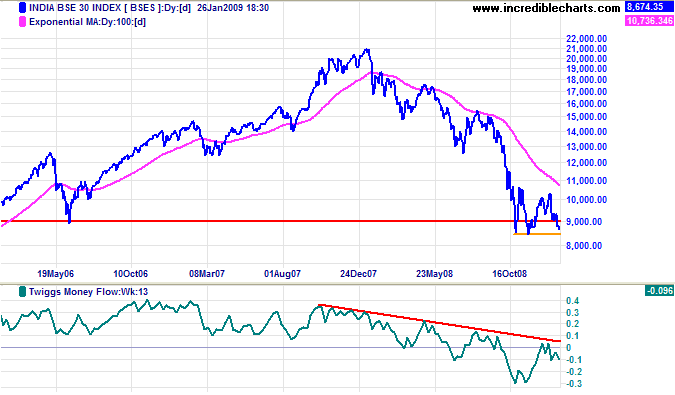

India: Sensex

The Sensex is testing support at 8500 for a third time. Declining Twiggs Money Flow (13-Week) indicates long-term selling pressure. The primary trend is down and breakout below 8500 would offer a target of the 2005 low of 6000; calculated as 8500 - ( 11000 - 8500 ).

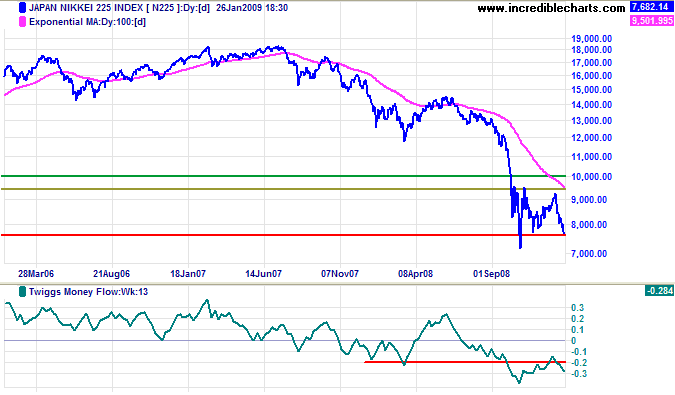

Japan: Nikkei

The Nikkei 225 is likewise testing support: at 7700. Twiggs Money Flow, far below zero and declining, warns of strong selling pressure. Breakout would offer a target of 4500; this is calculated as 7000 - (9500 - 7000).

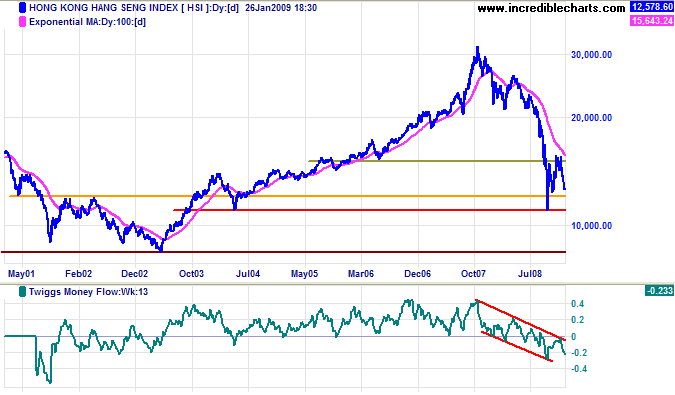

China

The Hang Seng index is headed for a test of support at 12000 [orange]. Twiggs Money Flow (13-week) in a downward trend channel signals selling pressure. Failure of support would suggest a target of 8500, the 2003 low. Confirmed if support at 10000 [red] is penetrated.

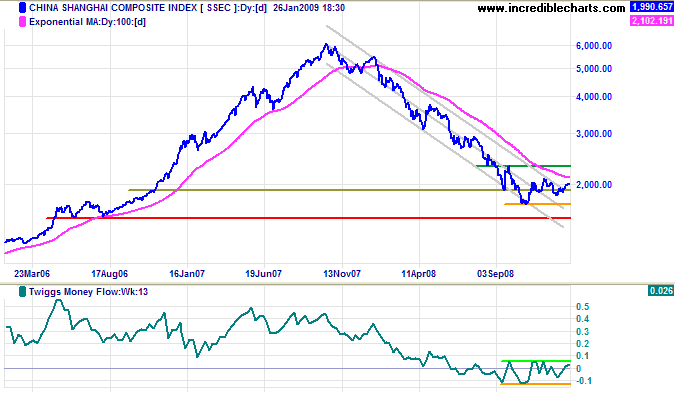

The Shanghai Composite is testing short-term resistance at 2000 after breaking out of the long-term downward trend channel. A close above resistance would test 2100. Twiggs Money Flow (13-week) whipsawing around the zero line signals uncertainty; upward breakout would signal a secondary retracement to test 2300, downward breakout would warn of another primary down-swing — with a target of 1500.

Australia: ASX

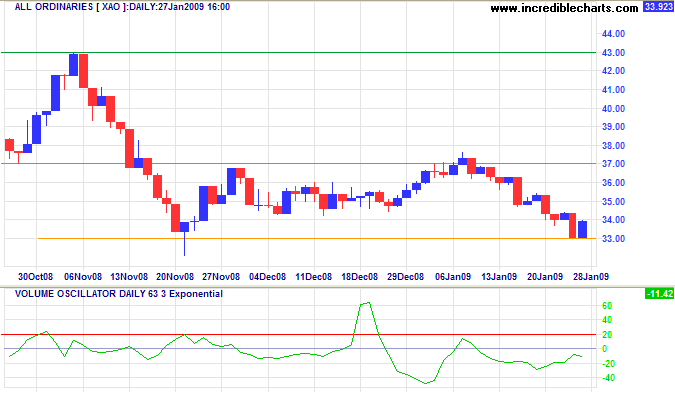

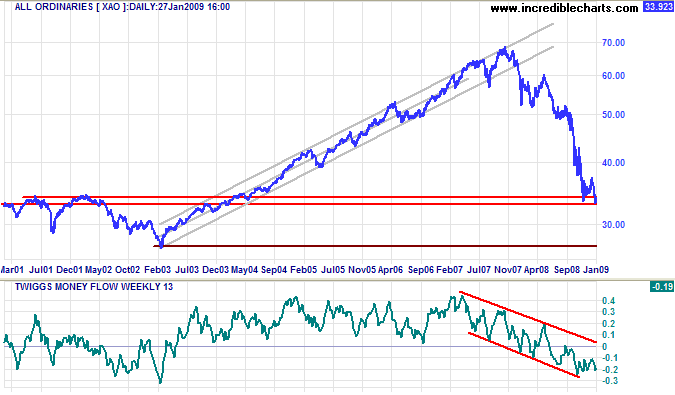

The All Ordinaries has so far respected support at 3300. Weak volume over the past few days warns that support is unlikely to hold.

Long Term: The primary trend is down. Failure of support at 3300 (the lower of the two red support lines) would offer a target of 2700, the 2003 low. Twiggs Money Flow (13-Week) in a downward trend channel signals continued selling pressure.

Much of the social history of the Western world, over the past three decades, has been a history of replacing what worked with what sounded good.

~ Thomas Sowell