2009 Outlook

By Colin Twiggs

January 14, 6:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Just a short note to let you know I have not gone missing in darkest Africa and will be back at my desk next Thursday. Here is a short update in the mean time.

We are experiencing a balance-sheet recession as described by Richard Koo: where banks and private corporations place a high priority on liquidity and continue to reduce balance sheet debt despite low interest rates intended to stimulate borrowing. Deleveraging exerts downward pressure on both stocks and real estate prices. Falling asset prices are likely to continue for most of 2009 and act as a further deterrent against borrowing.

Non-bank financial markets are on life support, with the Fed and other central banks stepping in to replace the outflow of private investors from commercial paper and money markets. Commercial banks remain reliant on taxpayer funding while they hold securitized assets of doubtful value, preventing them from raising private capital.

The Fed is attempting to reduce borrowing costs through purchases of commercial paper and mortgage-backed securities. The purchases inject more money into the financial system and threaten further inflation in the long term. This is more than offset in the short/medium term, however, by continued deleveraging: a three decade long credit bubble does not quietly disappear overnight.

Deficit spending is the order of the day. Fiscal stimulus packages on their own are unlikely to pull the global economy out of recession. Tax refunds have a limited short-term effect that soon passes. Capital spending projects require lengthy planning and cannot be fast-tracked without compromising the decision-making process — resulting in poor (bridge to nowhere) project choices.

The engine of the economy, and the source of eventual recovery, is private investment. Corporations and investors have entered a new era of conservatism, with greater emphasis on long-term survival and reduced emphasis on short-term profits. They need to meet two criteria to justify new expansion: a secure financial system with stable borrowing costs; and stable consumption patterns — as opposed to cyclical fluctuations caused by artificial manipulation of interest rates. The first requires increased regulation of both bank and non-bank, global financial markets. And stricter enforcement of capital requirements. The second needs a close examination of the role that central bank intervention played in causing the current crisis — and realization that often the cure causes more damage than the original affliction.

Summary

Expect a period of falling asset prices lasting from one to five years, depending on the success of monetary and fiscal policy. The deflationary impact of deleveraging will overwhelm the inflationary effect of monetary and fiscal policy for one to two years. Thereafter we run the risk of stagflation: high inflation accompanied by low economic growth — and stagnant asset prices. Financial markets will continue on life support until supervision is improved and banks make full disclosure of their investment in high-risk assets. Financial assets such as government-backed mortgage securities and quality corporate bonds will appeal to investors during the deflationary period, but run the risk of capital losses when interest rates eventually rise. Rising inflation will later increase the appeal of gold and defensive stocks. Traders, on the other hand, will benefit from increased volatility of stocks and forex throughout this entire period.

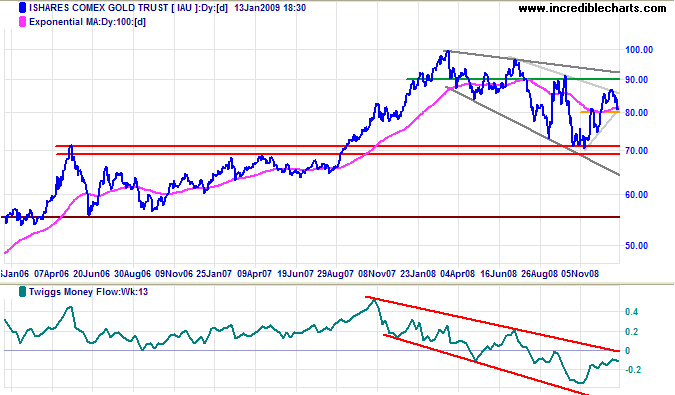

Gold

Spot gold is headed for a test of $900. Respect of $800 would confirm this. Failure to penetrate $900 would indicate another test of support at $700, while breakout would signal a test of $1000. The long-term downward broadening wedge is losing its shape, with too many failed swings. Continued fluctuation between $700 and $900 remains most likely.

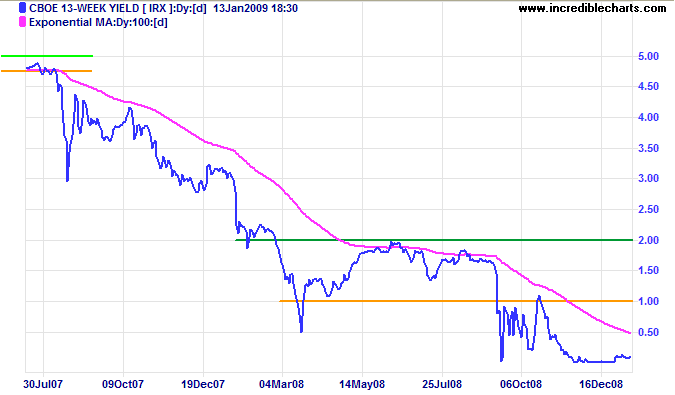

Yields

Short-term yields close to zero confirm investors lack of trust in financial markets.

USA

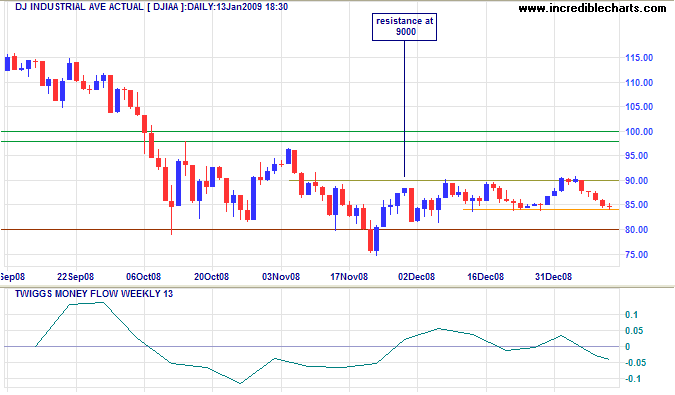

Dow Jones Industrial Average

The Dow is consolidating in a narrow range between 8400 and 9000, with Twiggs Money Flow whipsawing around the zero line, signaling uncertainty. Expect an "Obama rally" at the start of the new President's term and introduction of a new stimulus package. Breakout above 9000 would test 10000 — possibly even higher. But the primary down-trend is unlikely to reverse and the subsequent retracement, when the "honeymoon" is over, will offer a clearer indication of long-term direction.

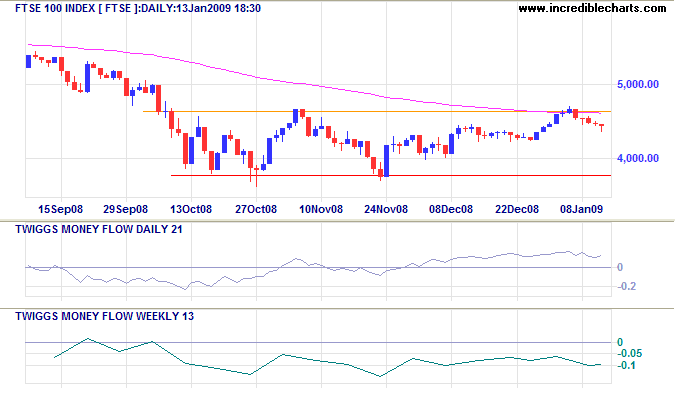

United Kingdom: FTSE

The FTSE 100 is testing resistance at 4600. Twiggs Money Flow (21-day) signals medium term buying pressure and upward breakout is likely. The primary trend remains down, however, as confirmed by Weekly Twiggs Money Flow holding below zero. Only a successful retracement that confirms the new support level would provide convincing evidence of a trend change.

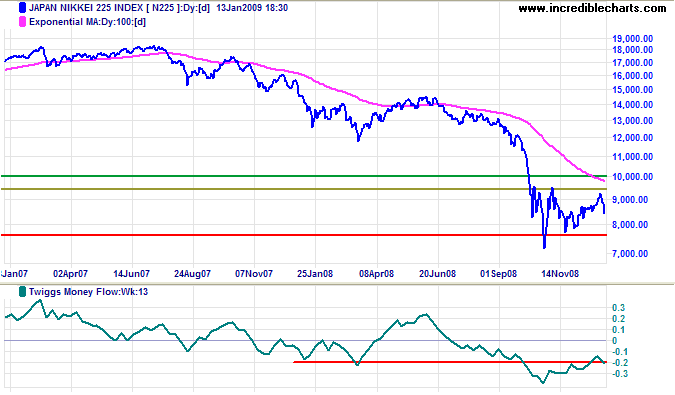

Japan: Nikkei

The Nikkei 225 respected resistance at 9500 and is retreating to test support at 7600. Failure of support would offer a target of 5500, calculated as 7500 - ( 9500 - 7500 ). Twiggs Money Flow (13-week) well below zero confirms long-term selling pressure.

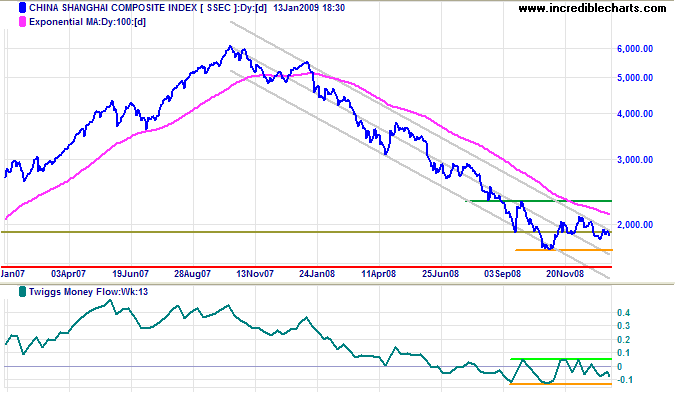

China

The Shanghai Composite failed to test resistance at 2300, signaling weakness, and is now headed for a test of support at 1700. The primary trend remains down. Breakout below 1700 would test the lower trend channel.

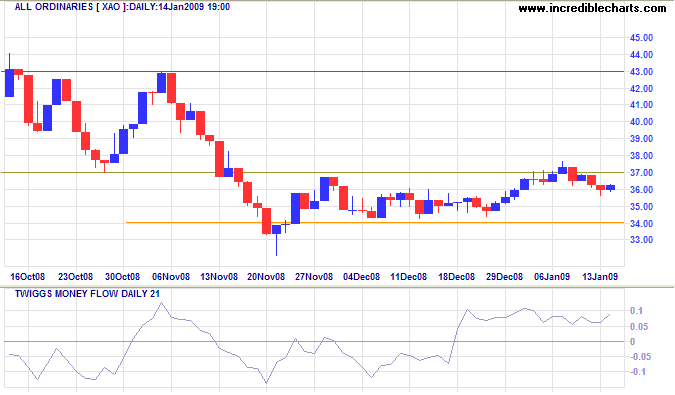

Australia: ASX

The All Ordinaries appears to be readying for a breakout above 3700, with a narrow consolidation and Twiggs Money Flow (21-day) holding above zero. Success would signal a test of 4300, but no change in the primary down-trend.

We should be careful to get out of an experience only the wisdom that is in it — and stop there;

lest we be like the cat that sits down on a hot stove-lid.

She will never sit down on a hot stove-lid again, and that is well;

but also she will never sit down on a cold one anymore.

~ Samuel Clemens