Current Account Weakness

By Colin Twiggs

November 18, 2008 4:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Imprudent Investors

President Bush and the Group of 20 blame the global recession on imprudent investors who "sought higher yields without an adequate appreciation of the risks" (Bloomberg). That is an interesting statement considering who suppressed interest rates to artificially low levels — forcing investors to assume greater risk in order to earn an adequate return on their investments. Was it not the major central banks, at the urging of their governments? The attempt to engineer a soft landing in 2002/2003 caused far more pain than it saved. The cure almost killed the patient. Political leaders are not prepared to admit that we are currently reaping the results of their past intervention. And they fail to realize that further intervention to prevent falling prices is likely to cause more trouble in the future — prolonging the current recession.

Another Rate Cut

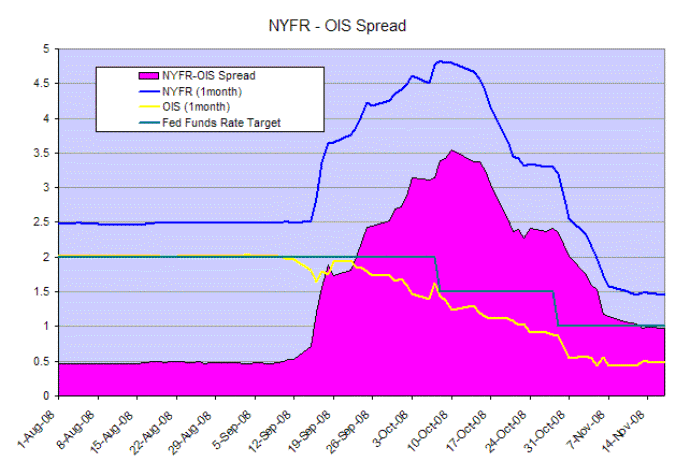

The spread between the New York Funds Rate (1-month) and the fed funds target rate returned to 50 basis points, typical of normal market conditions. The Overnight Index Swap Rate (OIS), reflecting traders best estimates of the effective fed funds rate, is significantly below the target rate of 1.0 percent — signaling another 0.50 percent rate cut. Confidence is not yet restored, however. Financial markets remain on life support with massive injections of liquidity by the Fed.

Gold

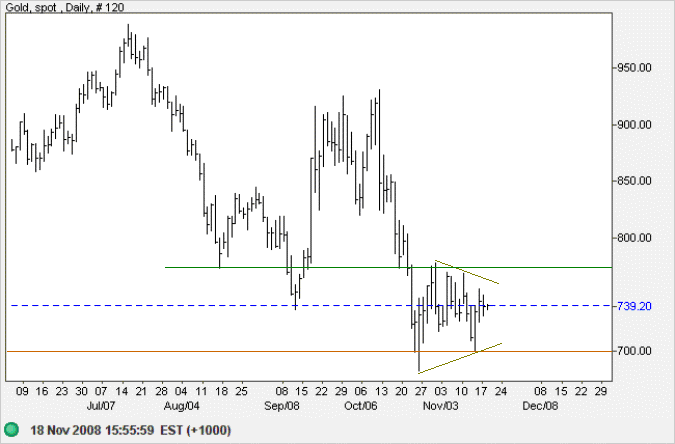

Spot gold continues to consolidate between $700 and $770. Breakout above $770 would offer a target of $840, calculated as $770 + ( 770 - 700 ). Reversal below $700 remains more likely, as gold is in a primary down-trend, and would offer a target of the June 2006 low of $550.

Source: Netdania

Crude Oil

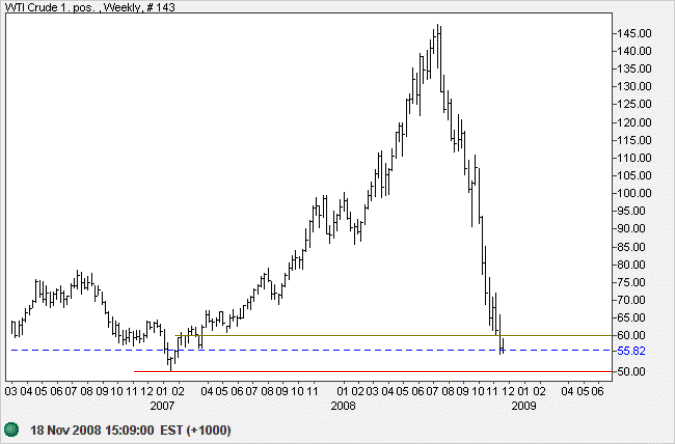

West Texas Intermediate Crude broke through $60 and is headed for support at the 2007 low of $50 per barrel. Expect retracement to confirm resistance at $60. Failure of support remains likely in the medium term, however, and would offer a target of $40 per barrel.

Source: Netdania

Currencies

Repatriation of funds by US and Japanese investors and creditors is primarily responsible for the strength of the dollar and the yen. In the long run, the current account surplus or deficit should determine a currency's strength or weakness. Here are a few of the strongest and weakest as forecast by the IMF for 2008.

| Country | Current Account 2008 ($Bn) |

| China | 385 |

| Japan | 193 |

| Germany | 190 |

| Saudi Arabia | 145 |

| Russia | 98 |

| Norway | 91 |

| Switzerland | 72 |

| Australia | -65 |

| France | -66 |

| UK | -137 |

| Spain | -170 |

| USA | -614 |

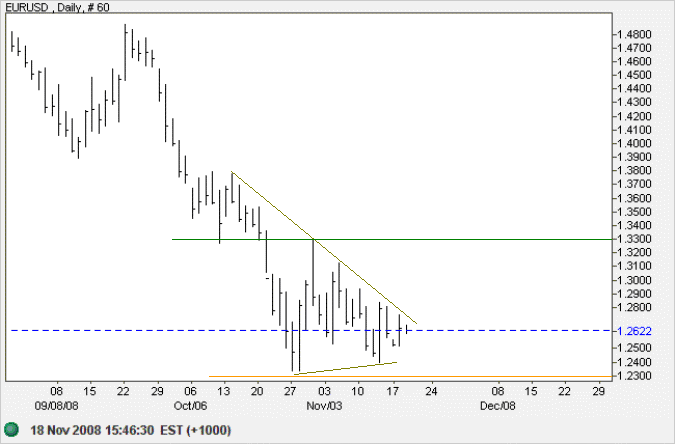

Euro

The euro is headed for a test of support at $1.23. Downward breakout would offer a target of $1.16, the 2005 low. Recovery above the falling trendline would signal a test of $1.33 and, while unlikely, upward breakout would offer a target of $1.43.

Source: Netdania

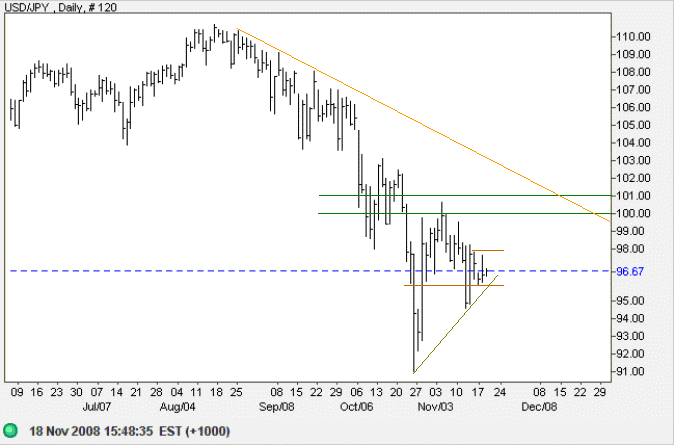

Japanese Yen

The dollar consolidated between 96 and 98 against the yen, over the last few days. Breakout above 98 would signal a test of 100, while reversal below 96 would break the rising trendline and warn of another test of 91, the October low.

Source: Netdania

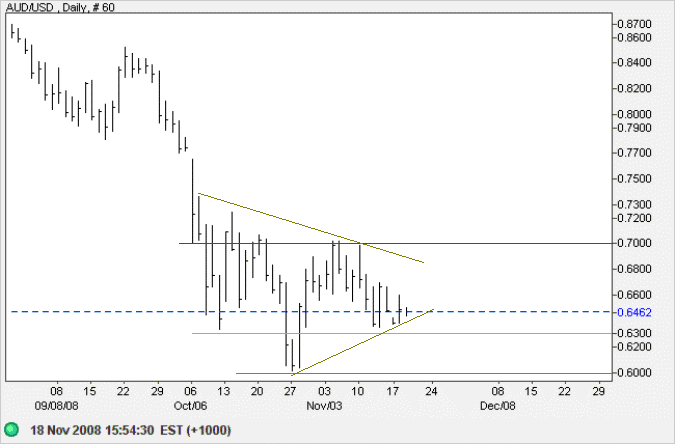

Australian Dollar

The Australian dollar is testing support at $0.63 against the greenback. Downward breakout would reach $0.60, while respect would mean a test of $0.70. In the longer term, the primary trend is down and failure of $0.60 would offer a target of $0.50.

Source: Netdania

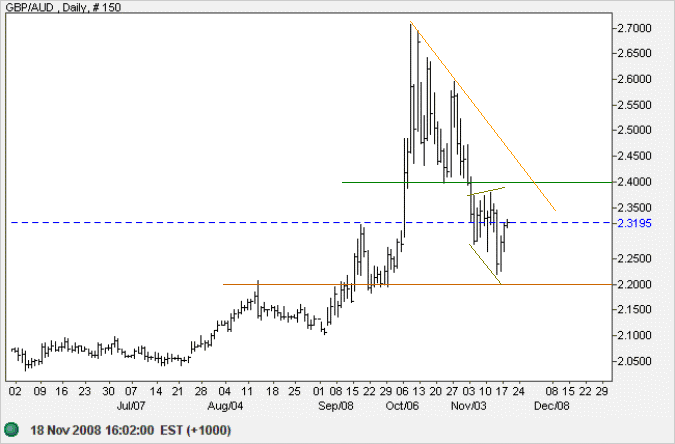

The UK Pound is weakening faster than the Australian Dollar, falling as low as $2.20 before retracing to confirm resistance at $2.40. Breakout above $2.40 is unlikely and we can expect another test of $2.20. In the longer term, the primary trend is down and failure of support would offer a target of $2.00.

Source: Netdania

The idea that you can merchandise candidates for high office like breakfast cereal —

that you can gather votes like box tops — is the ultimate indignity to the democratic process.

~ Adlai Stevenson (1956)