Killing Two Birds With One Stone

By Colin Twiggs

November 6, 2008 6:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

A Triumph Over Racism

The latest election result has been heralded as a triumph over racism, but, in reality, this is merely another step in a long struggle. Racism is unlikely to ever be entirely eliminated, but it may be relegated to a secondary rather than primary role in future elections. It was evident, observing election rallies on television (not always the most reliable source I concede), that a number of supporters of both candidates were racially motivated. Hopefully over time this percentage can be reduced to the point that they are irrelevant.

Some years ago I was involved with an affirmative action program in a large corporation. What became clear is that promoting an employee over their level of competence was counter-productive. It is essential to advance candidates who are highly competent — in order that they leave a positive stereotype for their successors. I believe that the new president has demonstrated from his election campaign that he is an exceedingly competent individual. It is now equally important that he succeed. That would be the real victory.

Fiscal Stimulus

The task of the new government will be to restore confidence in the financial system, in the business community, and amongst consumers. A significant obstacle that needs to be overcome is the inordinate influence that well-funded special interest lobbies exercise over Congress: big banks, big oil, drug companies and the health care sector, to name but a few.

Restoring confidence in the financial system will require strong regulation of financial markets and enforcement of conservative capital-asset ratios. Re-capitalizing banks is already making a difference, with a substantial drop in the price of credit default swaps. Establishing a formal market for the more than $62 trillion in credit default swaps would provide additional comfort.

The business community desperately needs two things: a stable interest rate so that they can accurately determine their cost of capital when evaluating new investment projects; and stable consumption patterns so that they rely on continued demand for new products. Unfortunately stimulatory monetary policy distorts both interest rates and consumption patterns, causing a rash of failures when interest rates are later raised and consumption falls — the foundation for the next recession. Government spending programs may have a similar affect: reducing new private (business) investment in productive assets by shrinking the surplus of income over consumption; and artificially stimulating consumption — which leaves a hole when expenditure is later discontinued.

Consumers need to have confidence in a fair and stable tax regime, confidence that their jobs are secure, and confidence in a stable financial system. The government has direct influence over the tax regime and indirect influence over the latter two. If they refrain from stimulatory monetary policy and are careful in their choice of stimulus measures they should be able to achieve a stable business and financial environment.

Taxation

Taxation is a politically sensitive instrument and creating a level-playing field is critical. It encourages a "we are all in this together" attitude. A two-tier system, with tax cuts for the poor and increased taxes for the rich will not necessarily raise more taxes. It encourages avoidance. The very wealthy can afford good tax advice and the higher you raise their taxes the more likely they are to opt out of the system, paying little or no tax at all.

It is also important that the new government be exceptionally frugal with tax dollars collected. If you want to be trusted, you need to be even more careful when spending other peoples money than you would when spending your own.

Rate Cuts

Fed rate cuts not only cause long term pain, but deliver little short-term gain. The corporate and banking sector, now highly risk averse, are de-leveraging. They will liquidate assets in order to remove debt from their balance sheets, thereby forcing prices even lower. In the present climate, lower interest rates are unlikely to entice them to resume borrowing.

Infrastructure Spending — Tuesday

My newsletter earlier this week may not have been clear, judging from readers responses. I support infrastructure spending. Without a strong infrastructure, economic growth would be stifled. And not all infrastructure projects are suited to private sector investment.

What I am against is spending programs where the primary aim is to create jobs, not productive capacity. And a centrally planned economy — that is the road to socialism. While central planning offers the appeal of efficient allocation of resources, results over the last century prove otherwise. The most effective mechanism for allocating resources is a free market, despite its decentralized nature.

Killing Two Birds With One Stone

It is fine for me to say that the government should stimulate investment, not consumption, but how can this be achieved when demand is falling? If the manufacturer cannot sell his goods, he is unlikely to invest in new plant and equipment, no matter how good the incentives.

At the same time the government is under intense pressure to reduce dependence on oil imports and reduce carbon emmissions. This is commonly opposed by dirty industries, arguing that greater penalties or restrictions would cause job losses.

Giving money to manufacturers to develop new energy efficient products would also be likely to lead to excessive waste of taxpayer money. I am sure that projects like the East German Trabant seemed like a good idea at the time.

Offering rebates to consumers, however, would ensure that funds are allocated efficiently through the market. Rebates for electric or alternative energy vehicles, rebates for solar panels and wind-powered electricity generators, rebates for more effective home insulation and appliances, and rebates for use of public transport systems — all would stimulate demand while encouraging lower carbon emissions. And increased demand would lead to investment in new technologies, creating jobs in supply, manufacturing and support services. A win-win outcome.

Who Has Failed Us — Tuesday

Thank you to Shane and Jan for pointing out that I had omitted rating agencies from my list of offendors. These agencies were instrumental in spreading the contagion. Blinded by fat fees, they failed to adequately assess the risk of a major correction in the housing market. I like Richard Koo's suggestion that all rating agencies be required to display the following disclaimer on all announcements:

Warning: Subprime crisis has proven that ratings produced by this agency are sometimes worthless. Investors are therefore advised not to rely entirely on ratings produced by this agency in making investment decisions.

Another industry caught up in the orgy of greed and ignorance were mortgage insurers, raking in fees without adequately assessing the attached risks. Audit firms, however, were only indirectly responsible where they lobbied the FASB, on behalf of their clients, to relax standards.

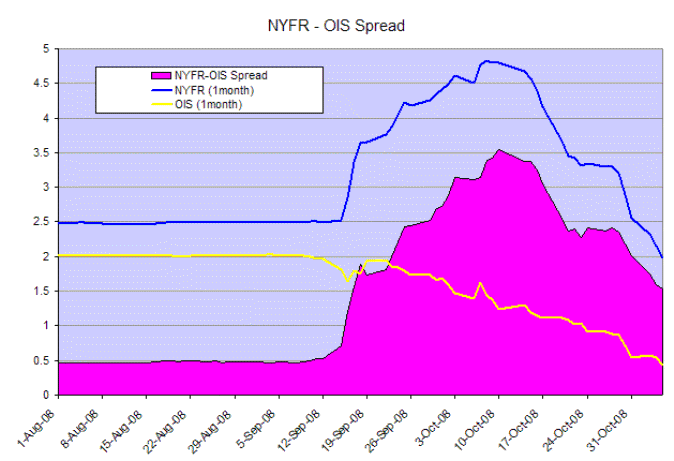

Interbank Lending

The 1-month NYFR-OIS spread has declined to 150 basis points. While this is encouraging, the spread reflects continuing concern over defaults in the inter-bank market. The ICAP New York Funding Rate is an alternative to LIBOR that is less open to manipulation and indicates the rate at which banks are prepared to lend to each other in the open market. The Overnight Index swap rate reflects traders' best estimates of the effective fed funds rate.

The Fed announced that the rate payable on excess reserves held with Federal Reserve Banks will increase: the discount of 0.35 percent below the target rate being reduced to zero. This means that the Fed will now act as intermediary in short-term interbank lending without any compensation for default risk — indicating the level of desperation to restore credit flows in interbank markets.

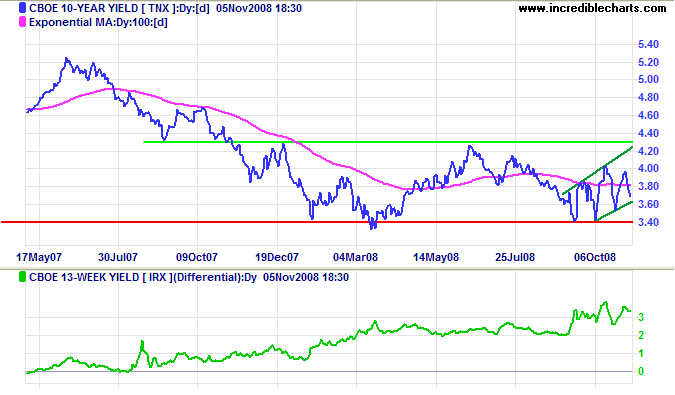

Treasury Yields

Ten-year treasury yields encountered resistance at 4.00 percent. A failed up-swing in the bearish ascending broadening wedge warns of a downward breakout — offering a target of 3.00 percent. Rising yield differentials will boost bank margins; a healthy long term sign for the banking sector.

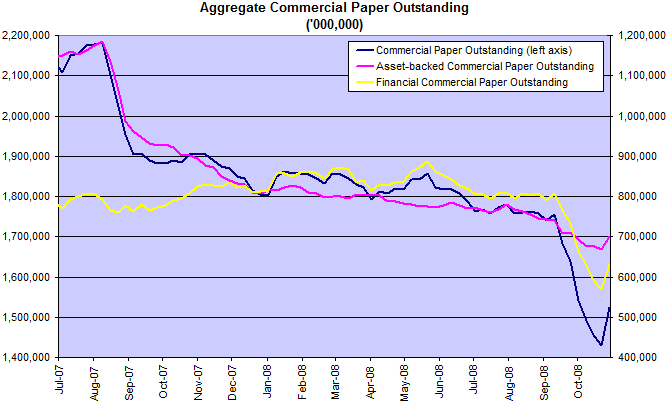

The Shadow Banking System

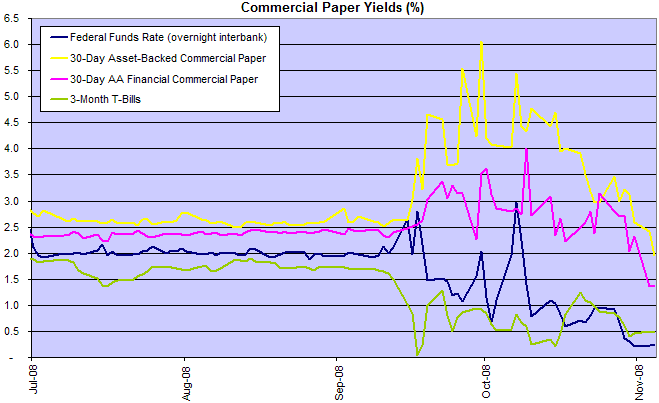

The $10 trillion shadow banking system is unraveling. The commercial paper market has contracted by almost $800 billion in the last year. This is somewhat disguised by recent Fed purchases of $122 billion of commercial paper to support short term funding requirements of large corporates. Investors are now risk averse and liquidating investments in money market funds, hedge funds and other high-yield investments.

The effective fed funds rate fall below 0.50 percent warns of further rate cuts.

Housing

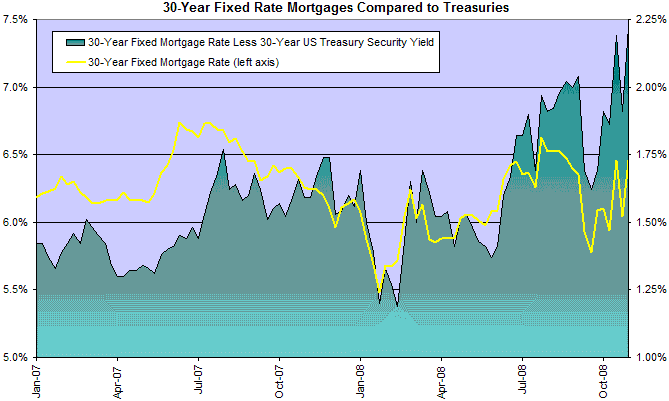

The spread between 30-year fixed rate mortgages and the equivalent treasury yield is rising, indicating increased concerns over mortgage defaults. Rising mortgage rates are likely to translate into lower home prices.

Banks

Domestically chartered banks hold $3.75 trillion of real estate loans and more than $2.8 trillion in securitized assets, mainly real estate loans and mortgage securities. Offering the potential for further write-offs if house prices continue to fall.

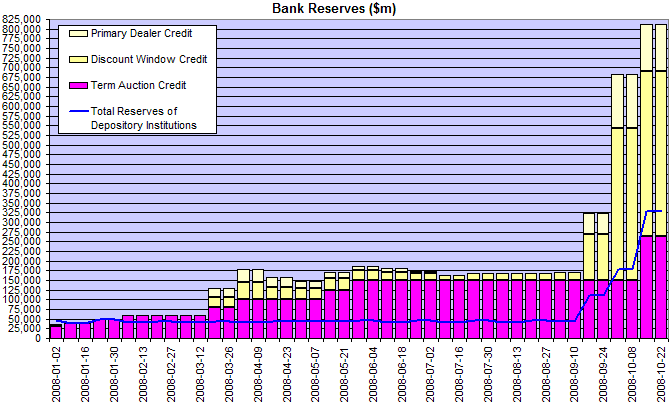

Fed support of financial markets is at an unprecedented $800 billion. This excludes the $29 billion net holdings in the Bear Stearns bailout and Treasury support for GSEs, AIG and money market funds. The system remains on life support.

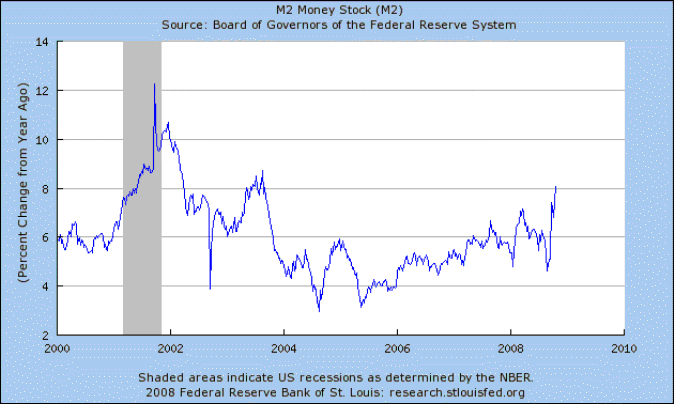

M2 money stock is rising, threatening a repeat of the 2001 blowout that caused the current crisis.

A more instructive analogy is between inflation and alcoholism.

When the alcoholic starts drinking, the good effects come first;

the bad effects only come the next morning when he wakes up with a hangover

— and often cannot resist easing the hangover by taking "the hair of the dog that bit him".

~ Milton Friedman: Free To Choose