Throwing The Baby Out With The Bathwater

By Colin Twiggs

November 4, 2008 7:00 a.m. ET (11:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Who Has Failed Us

Obviously the banks, investment houses, GSEs and their lobbyists are to blame for participating in an orgy of greed and short-sighted ignorance. With inevitable results, they pursued their own self-interest and multi-million dollar bonuses with a single-minded dedication that would have made Ayn Rand proud. But who was supposed to be looking after the taxpayer's interests?

The Fed failed to adequately regulate banks and restrict off-balance sheet assets, going so far as to lobby the FASB to relax accounting rules introduced after the collapse of Enron. They maintained interest rates at artificially low levels, failing to recognize the threat of a rapidly expanding credit bubble and rising house prices. They ignored the risk that rapid expansion of the money supply could flow through to asset prices, while leaving consumer prices relatively unscathed. Their suspension of M3 money supply publication was a crude attempt to hide this threat from public view. They confused inflation with CPI, I believe deliberately, in an attempt to draw attention away from debasement of the currency and the expanding housing bubble.

The SEC failed to adequately regulate investment banks, reducing capital requirements for broker-dealers and allowing them to expand leverage ratios to more than 30 times capital. They were also instrumental in lobbying the FASB to amend and delay accounting changes for off-balance sheet assets.

The FASB succumbed to pressure from banks, the SEC and the Fed, relaxing accounting rules for off-balance sheet assets instituted after the collapse of Enron. Again in 2008, under intense pressure from banks and the SEC, they agreed to postpone introduction of fair value accounting until November next year.

Treasury ignored the risk posed by a massive current account deficit. They also joined Alan Greenspan and the SEC in opposing attempts by the Commodity Futures Trading Commission to regulate over-the counter derivatives.

Congress most of all. For not doing their job in overseeing the Federal Reserve. For failing to address the ballooning unfunded Medicare and Social Security liabilities of the Federal government, recently estimated at $99 trillion. For allowing the world's wealthiest nation to shrink to the world's biggest debtor. For preventing the regulation of over-the-counter derivatives in 2000; credit default swaps subsequently ballooned from $600 billion to more than $60 trillion. For repeatedly blocking attempts to curb the massive leverage of GSEs Fannie Mae and Freddie Mac. For dithering over introduction of TARP when the whole ugly mess exploded in October 2008 — panicking the entire global financial market. And for attemppting to intefere with fair value accounting of bank assets in the recent Emergency Economic Stabilization Act.

The Act confirms the SEC right to place a moratorium on mark-to-market accounting if deemed "necessary or appropriate in the public interest." And also requires an SEC review by January 2009 as to the role played by mark-to-market accounting in recent bank failures. What they do not seem to have grasped is that the crisis of confidence was brought about by a lack of disclosure. The absence of information caused all banks, good and bad, to be tarred with the same brush, resulting in a complete breakdown of inter-bank lending. Only when fair value disclosure is enforced, or voluntarily provided by banks, will confidence be restored. In the case of voluntary compliance, insolvent banks would be obvious by their non-disclosure.

New Deal Infrastructure Spending - The Great Leap Backwards

The instinctive response of most governments faced with a severe recession is to promote infrastructure projects along the lines of FDR's New Deal program of the 1930s. While projects such as the Tenessee Valley Authority and Boulder Dam may be close to some readers hearts, and should be respected for the sheer scale of the endeavor, they are a lite version of socialism — and incredibly wasteful in their use of taxpayers funds. In effect, prolonging the recession.

I came across this analysis of the TVA by Ronald Reagan (1964) that some of you may appreciate:

This program started as a flood control project; the Tennessee Valley was periodically ravaged by destructive floods. The Army Engineers set out to solve this problem. They said that it was possible that once in 500 years there could be a total capacity flood that would inundate some 600,000 acres (2,400 km²). Well, the engineers fixed that. They made a permanent lake which inundated a million acres (4,000 km²). This solved the problem of floods, but the annual interest on the TVA debt is five times as great as the annual flood damage they sought to correct. Of course, you will point out that TVA gets electric power from the impounded waters, and this is true, but today 85 percent of TVA's electricity is generated in coal burning steam plants. Now perhaps you'll charge that I'm overlooking the navigable waterway that was created, providing cheap barge traffic, but the bulk of the freight barged on that waterway is coal being shipped to the TVA steam plants, and the cost of maintaining that channel each year would pay for shipping all of the coal by rail, and there would be money left over.

Another achievement of FDR's New Deal was the creation of GSE Fannie Mae in 1938, to fund mortgages insured by the Federal Housing Authority. We all know how that ended.

Don't Throw The Baby Out With The Bathwater

Greater Regulation

We need much greater regulation of financial markets and strict enforcement of conservative capital-asset ratios. To curb the excesses of individuals pursuing their own interests. But don't mistake this for a failure of the free market. The underlying cause of these excesses was market intervention: creating artificial situations that could be exploited by self-interested individuals. The exact opposite of a free market.

Less Market Intervention

The Federal Reserve should allow the market to set its own equilibrium interest rate. Keynesian style intervention, creating a mis-match between savings and investment, has continually failed us for half a century and yet central banks persist in trying to improve on the market's ability to restore balance — with disastrous results. The market is dynamic. Central banks can only react to out-of-date economic data, ensuring that they are inevitably wrong. Like driving a car while looking out the rear window to see where you are going.

Clear The Temple

The role of Congress is to act as a watchdog over the nation's purse and to balance the power exercised by other arms of the legislature. Banks and other special interest groups have demonstrated their ability to subvert government to their own ends, using Congress to block attempts to curb their activities. If you own a watchdog that will allow anyone free access to your property provided they toss him a bone, is he worth keeping?

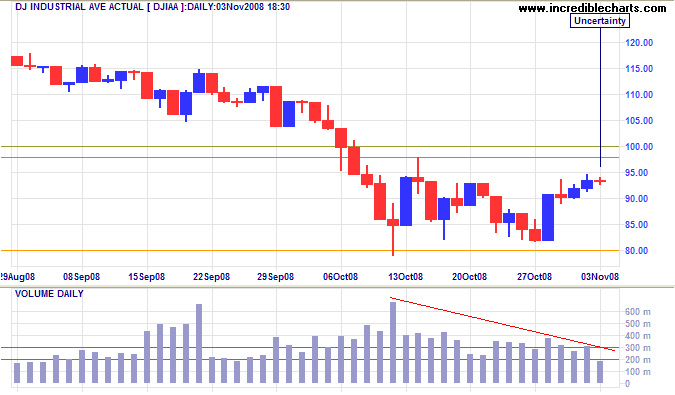

Election Rally

The market is unlikely to do much until the election result is announced. The small doji and low volume on the Dow indicate uncertainty. Expect a relief rally for several days after the election, no matter which candidate wins. The relief is similar to that of a drowning man who finds a piece of timber to cling to — before the realization dawns that he is adrift in the middle of the ocean, far from the nearest land.

Gold

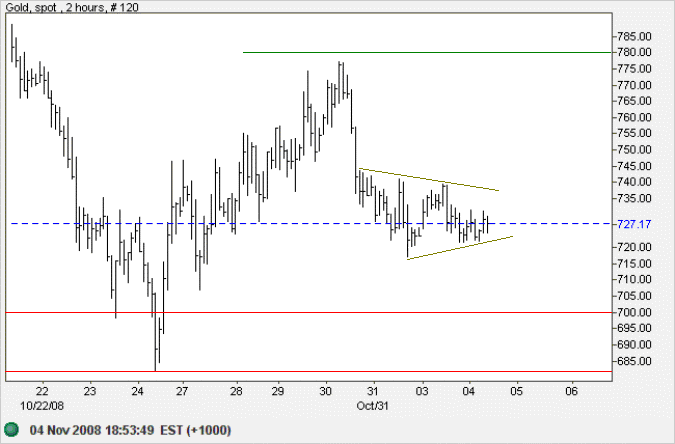

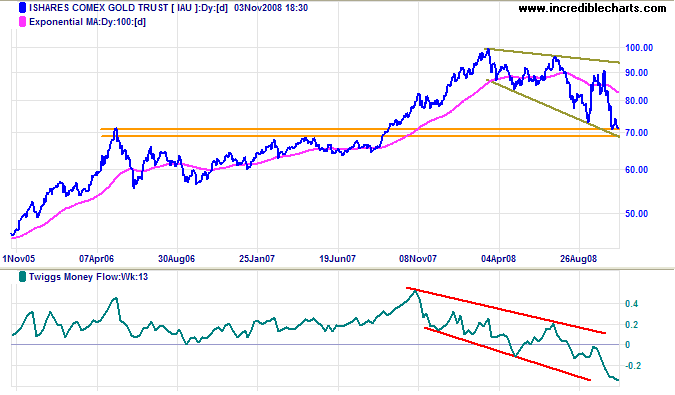

Spot gold found resistance at $780 before reversing below support at $750. The pennant continuation pattern warns of another test of the band of support between $700 and $680. Upward breakout is unlikely, but would signal a test of $780.

In the long term, the broadening descending wedge displays a failed up-swing, indicating that downward breakout is likely. The primary trend remains down and reversal below $680 would warn of a down-swing to the June 2006 low of $550. The downward trend channel on Twiggs Money Flow (13-Week) confirms strong selling pressure.

Source: Netdania

Crude Oil

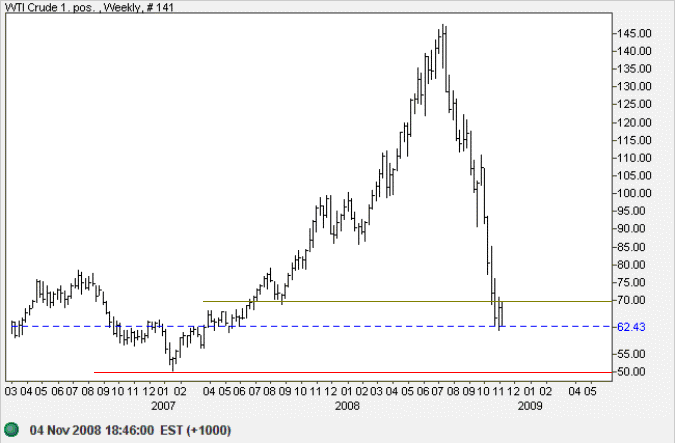

West Texas Intermediate Crude respected resistance at $70 and is once again testing support at $60. Failure would offer a target of $50 per barrel. The primary trend is down, driven by expectations of a global recession. OPEC production cuts have had no effect so far and further cuts may be necessary to support prices.

Source: Netdania

Currencies

Euro

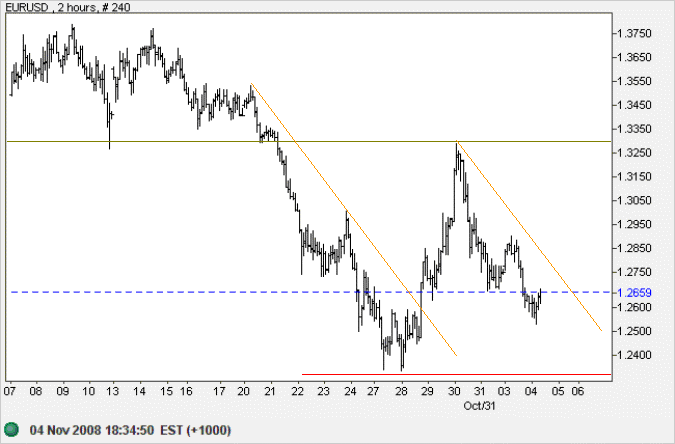

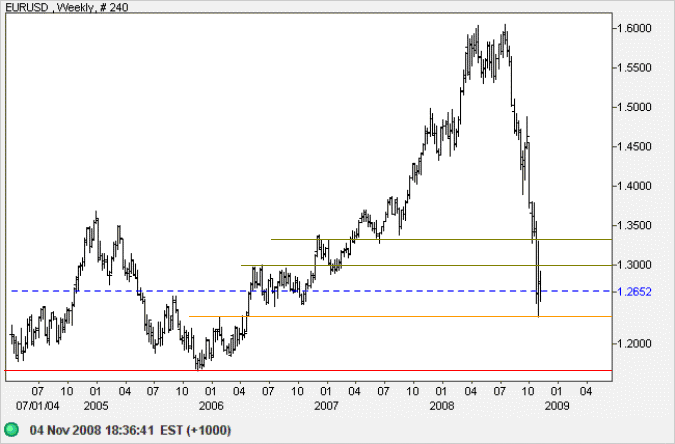

The euro respected resistance at $1.3300 and is now headed for a test of support at $1.2350. Breakout above the descending trendline before then would be a bullish sign.

The primary trend is down, however, and failure of support would offer a target of $1.16, the 2005 low.

Source: Netdania

Japanese Yen

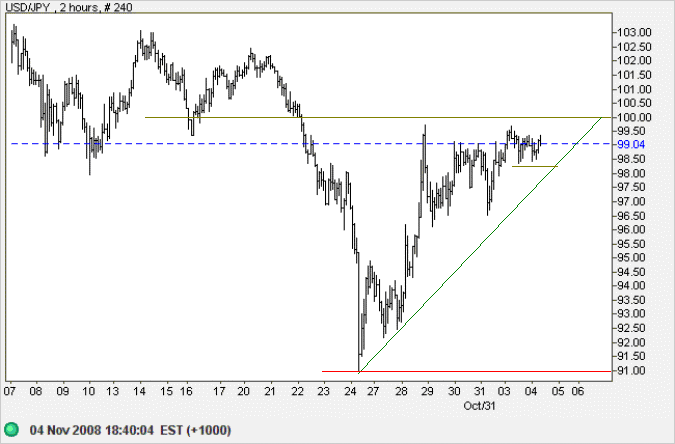

The dollar found support at 91 against the yen, before retracing to test 100. The narrow consolidation below 100 indicates that upward breakout is likely, testing 103, while reversal below the rising trendline would warn of another test of 91. In the longer term, failure of 91 would test 80 yen, while breakout above 103 would warn of a possible trend reversal.

Source: Netdania

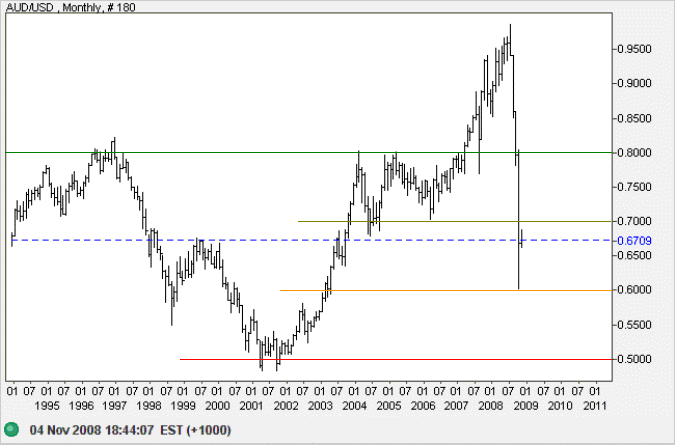

Australian Dollar

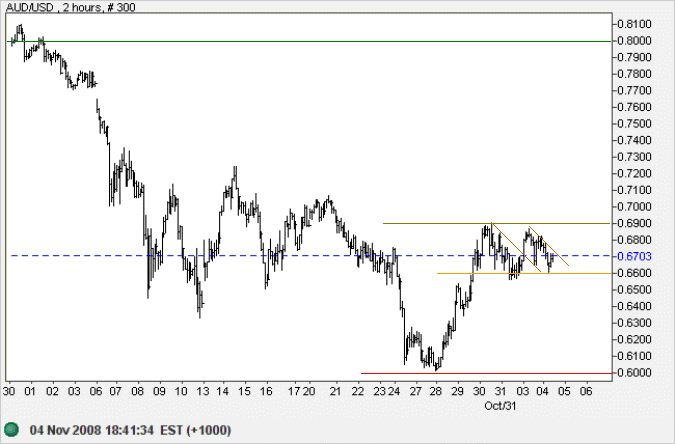

The Australian dollar is consolidating between $0.66 and $0.69 against the greenback, a continuation signal. Downward breakout would test $0.60, while upward breakout would test $0.80.

The primary trend remains down. Breakout below $0.60 is more likely and would test the band of support between $0.4800 and $0.5000, the 2001 lows.

Source: Netdania

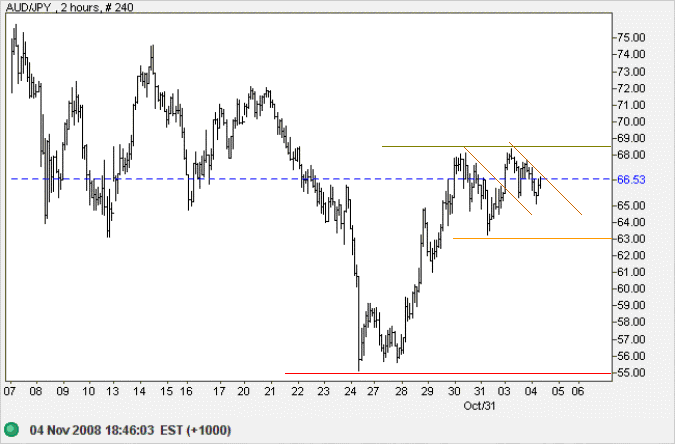

The Aussie respected support at 55 against the yen and is now consolidating between 63 and 68.50 against the yen. Downward breakout would test 55, while upward breakout would offer a target of 80.

Source: Netdania

Political campaigns are designedly made into emotional orgies which endeavor to distract attention

from the real issues involved, and they actually paralyze what slight powers of cerebration man can normally muster.

~ James Harvey Robinson (1937)