Solvency Issues & PE Ratios

By Colin Twiggs

October 23, 2008 8:00 a.m. ET (11:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

I will be away on the weekend; so this is my last newsletter for the week.

Economy

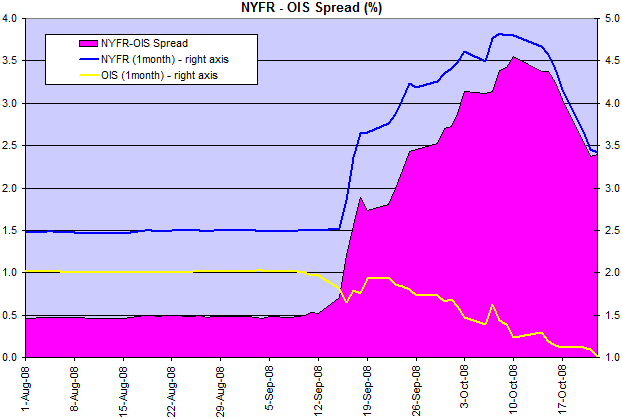

The ICAP 1-month New York Funding Rate (an alternative to LIBOR that is less open to manipulation) spread over the overnight index swap rate eased by more than 100 basis points (1.0%), but remains alarmingly high. A spread of 2.50 percent is unsustainable in the long term.

The Fed may be able to provide liquidity but cannot allay fears regarding bank solvency. An underlying cause is the failure of accounting standards to accurately reflect bank solvency. And many banks are hiding behind current standards because marking assets to market value would reveal that they are insolvent.

The only way to restore stability is to either sell toxic assets to an independent buyer, such as the US taxpayer, or write them down to zero. If liabilities then exceed assets, the taxpayer will again be needed. This time to restore solvency through preferred share funding. Pricing of the rescue is critical to its success. Price the funding too cheap and it will be abused. Some banks have already made noises about funding acquisitions. Pricing of preferred shares should also include participation or conversion options to reward the taxpayer for the risks being assumed. This is not a hand-out and any banks that are not viable should be merged with their stronger compatriots or broken up and sold off piece-meal. With creditors picking up the tab. Not the taxpayer.

Credit Default Swaps

Another reason for current hesitation is the shadow cast by the $65 trillion credit default swaps market. This requires regulation and creation of a formal exchange that can trade a standardised product. Not something that is likely to occur until after the election.

Election 2008

The coming election adds further uncertainty. Expect a post-election rally, but this is unlikely to signal the end of the bear market. The real task at hand is to restore the world's biggest debtor to solvency. Raising taxes in order to balance the books appears the only short-term solution. And cutting back on spending programs in the medium term.

The long-term solution is to stimulate investment. Lowering interest rates is a blunt instrument that actually does more harm than good. The accompanying rise in inflation channels funds away from real investment to speculation in rising asset prices, that inevitably lead to higher interest rates. The consequent slow-down heralds the downfall of any corporations deceived into poor long-term investment decisions by artificially low interest rates and the temporary inflationary spike in consumption. Increased tax incentives for new investment lead to similar distortion, with many investments bound to fail when the artificial stimulus is removed.

What business really needs is stability. Stable demand, sustained by limiting intervention in interest rate markets and tight control over credit expansion. And stable low interest rates, brought about by stimulating savings rather than consumption. Consumption spending may produce a short-term "sugar rush" but only investment in productive assets delivers long-term gains.

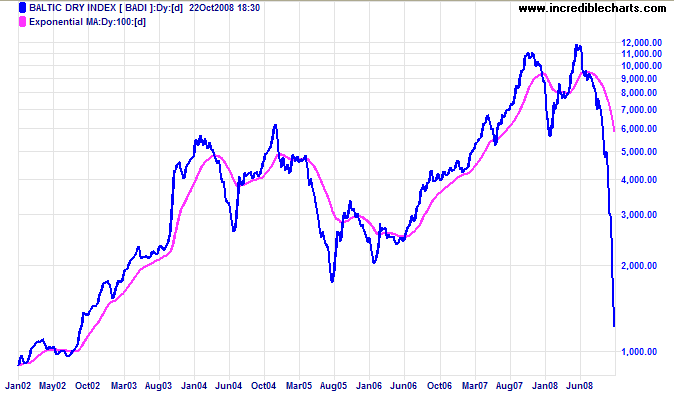

Shipping and China

The Baltic Dry Index had a spectacular fall in recent weeks. The index is dominated by large bulk carriers of coal and iron ore, reflecting the fall-off in shipments between major producers, particularly Australia and Brazil, and China, the largest global consumer. This warns of substantial falls in revenue for both producers and consumers.

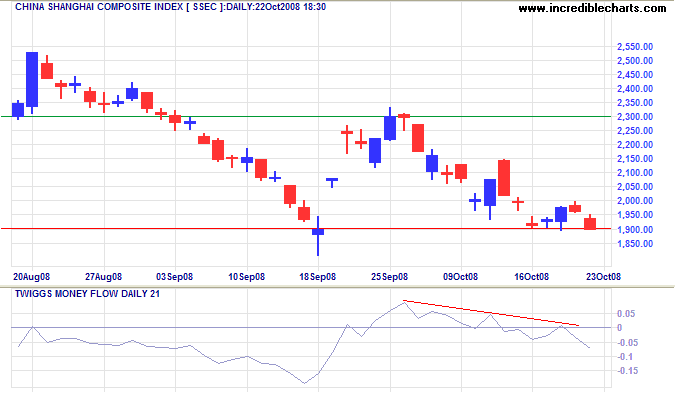

China's export-led economy looks increasingly likely to join the global recession. And Australia would inevitably follow. A fall below 1900 on the Shanghai Composite Index would offer a target of 1500, calculated as 1900 - ( 2300 - 1900 ).

Gold & Oil

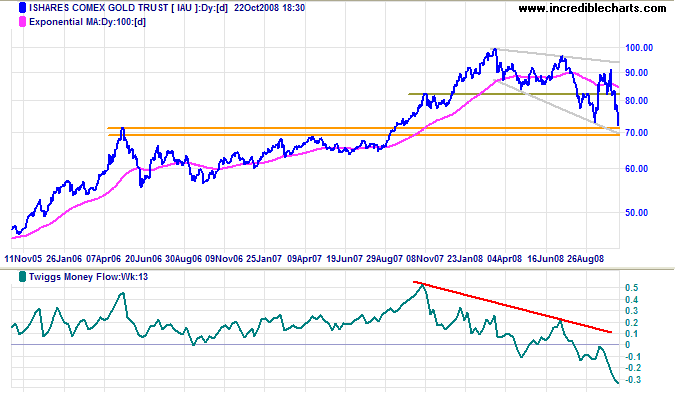

Gold is headed for a test of the band of support around $700 after a bearish failed swing in a long-term descending broadening wedge formation. Failure would offer a target of $560, calculated as 740 - ( 920 - 740 ), the June 2006 low.

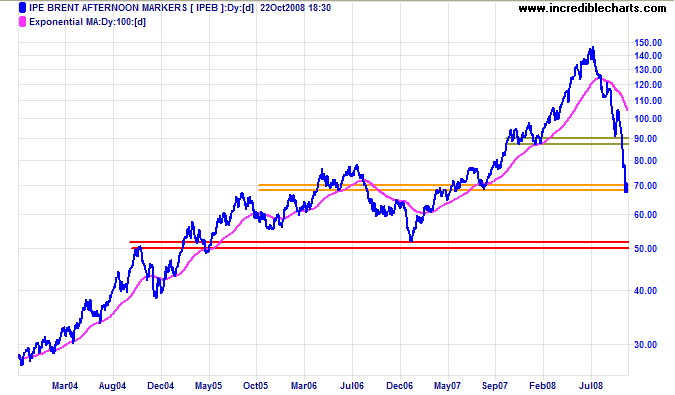

Brent crude broke through the band of support at $70. OPEC production cuts would increase support, but presently appear unlikely to prevent a test of the 2007 low of $50.

Stocks

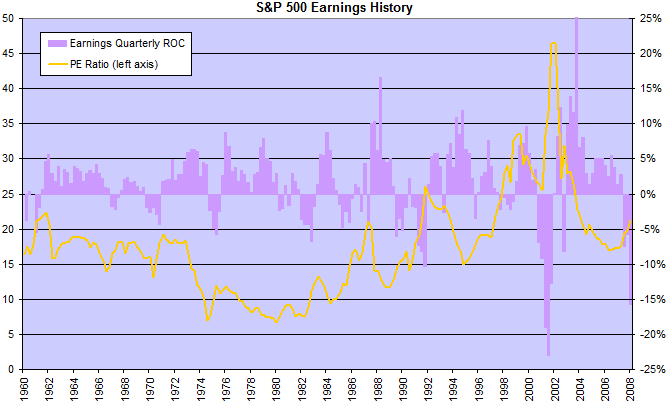

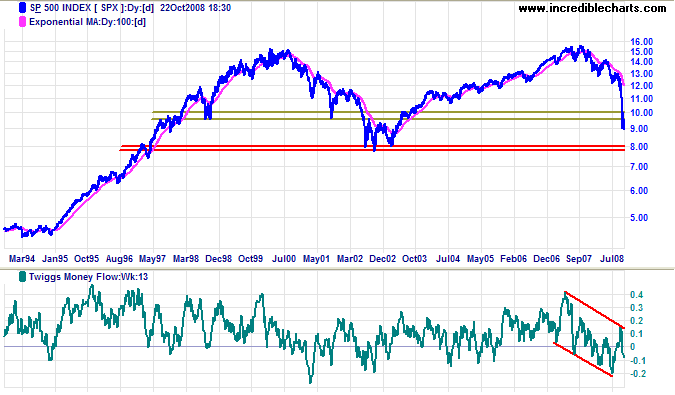

The S&P 500 is approaching the 50% retracement level of 800 and there is talk that stocks now represent exceptional value. Price Earnings (PE) ratios are relatively low at 16.5, based on 2008 forward estimates of 54.5 cents/share. Estimates for 2009 are 48.5 cents — a 40 percent fall from the 2006 peak of 81 cents. Index earnings fell roughly 50% in the 2001 recession.

This raises two questions. First, is 48.5 cents the bottom of the current earnings cycle? The chart below shows how the earnings volatility has increased in recent business cycles. An earnings fall to 40 cents/share would not be unreasonable. Expect further shocks as employment falls, consumption slows and the economy slides into recession. That includes more bank write-downs.

Second, what are future PEs likely to be? Expect an extended period of stagflation, with low growth accompanied by high inflation. In the last such period, from the late 1960s to the early 1980s, PE ratios declined to as low as 7. While I am not suggesting a repeat, history shows that when inflation is high PE ratios fall.

If earnings had to fall to 40 cents/share and PE ratios to a fairly optimistic 15, that would offer a projected target of 600 — 33 percent below the current level of 900.

Long term support at 800 appears vulnerable.

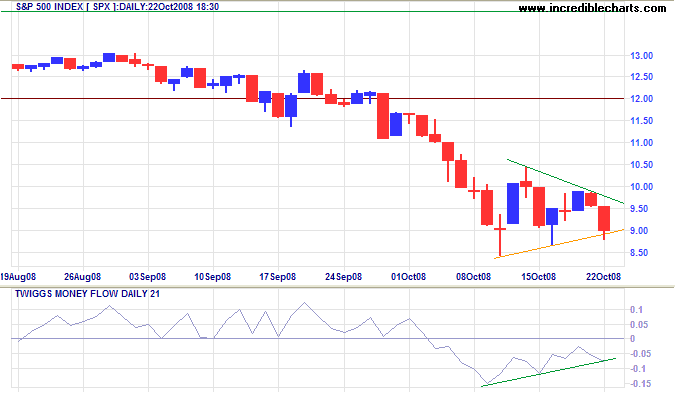

The S&P 500 index is again testing support at 900. The ban on short selling had an unexpected side effect. With no short sellers jumping to cover their positions, the market failed to rally, exhibiting a dead cat bounce. The short-term pennant warns of continuation of the down-trend. Failure of support would offer a short-term target of 800, from the 2002/2003 lows.

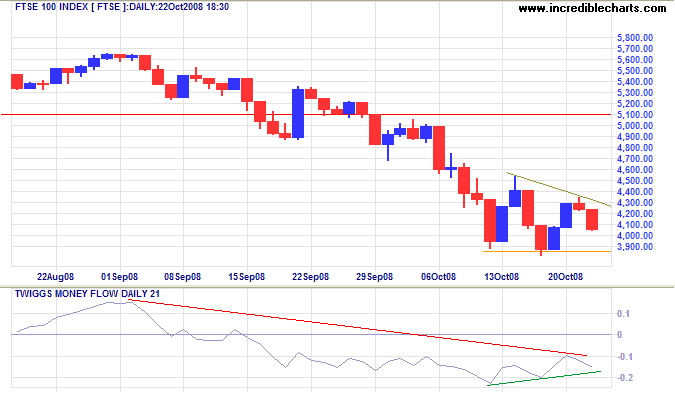

The FTSE 100 formed a similar pennant above 3900. Breakout would test the 2003 low of 3300.

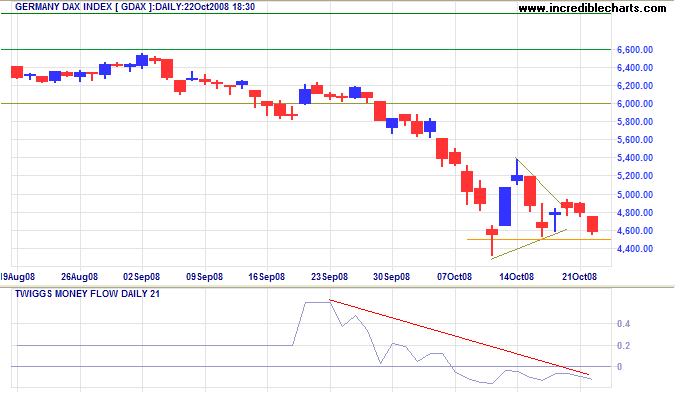

The German DAX is similarly testing 4500. Downward breakout would offer a target of 3600, the August 2004 low.

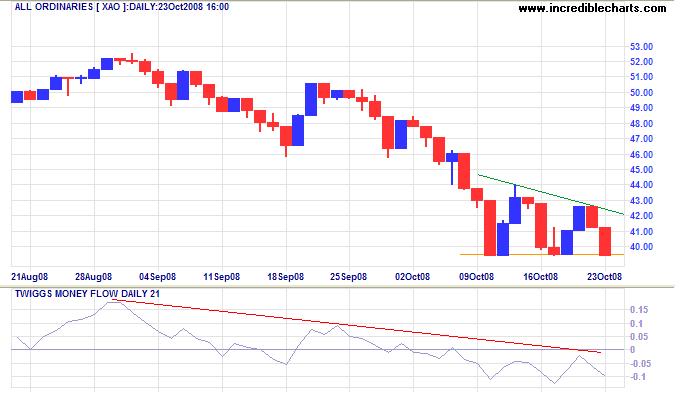

The Australian All Ordinaries is likewise testing short-term support at 3950. Failure will offer a target of 3400: the 2001 to 2002 high (and 50 percent retracement level from 6800).

Treasury Yields

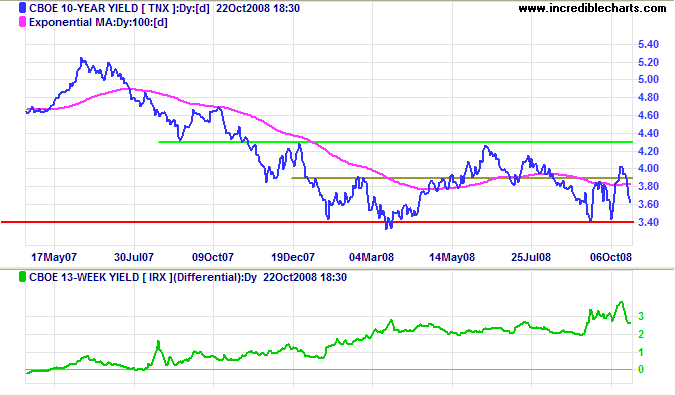

Ten-year treasury yields are headed for another test of support at 3.40 percent, anticipating further rate cuts. Yield differentials are high, reflecting healthy bank margins.

The Shadow Banking System

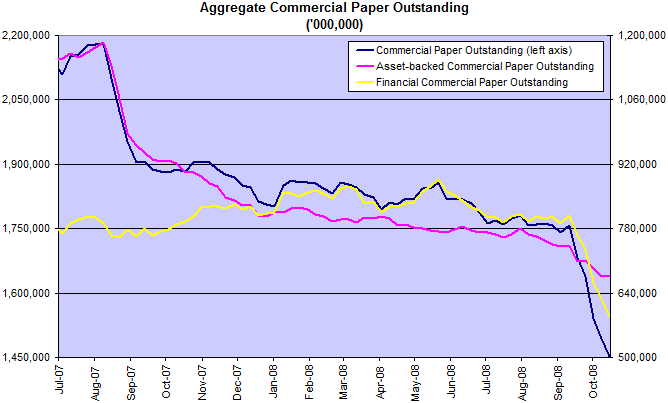

The $10 trillion shadow banking system continues to unravel. Total commercial paper in issue is falling rapidly despite the Fed purchasing commercial paper to maintain liquidity. Contracting credit in the shadow banking system is likely to affect the global economy for at least two to three years.

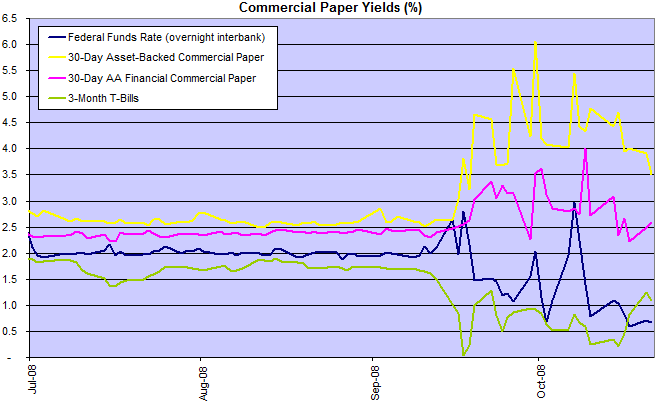

Declining commercial paper yields reflect Fed intervention. Short-term treasury yields are also expected to stabilize, due to the introduction of interest payments on bank reserves deposited with the Fed. The effective fed funds rate has declined well below its 1.50 percent target — warning of further rate cuts.

Corporate Bonds

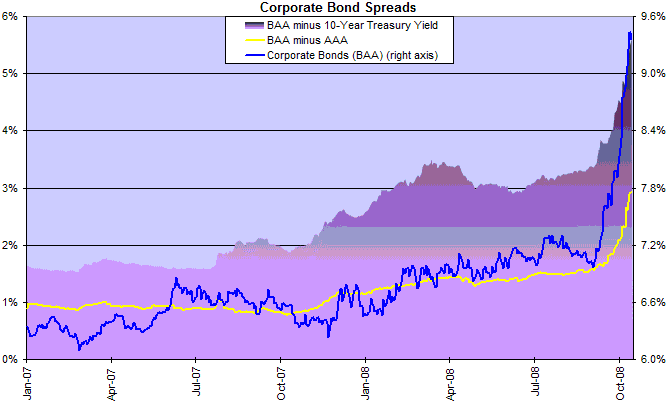

Corporate (Baa/Aaa) bond spreads have spiked upwards in anticipation of record defaults.

Housing

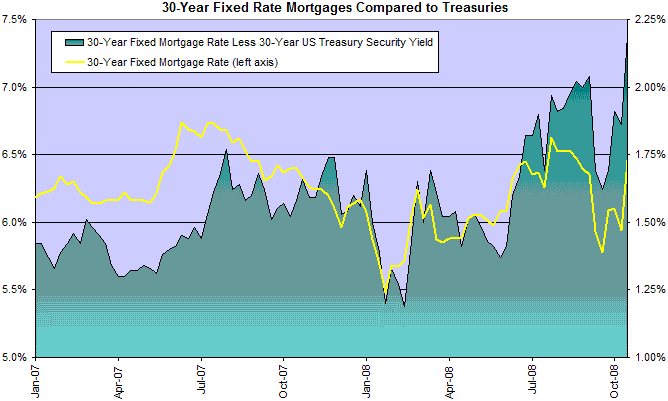

Treasury yields may be falling but this is more than offset by the upward spike in mortgage spreads. An up-trend in fixed mortgage rates would warn of further weakness in the housing market.

Banks

The Fed and Treasury are pouring massive amounts of money into the financial system in order to avoid a complete melt-down. Unfortunately this is not just a liquidity crisis. It is firstly a solvency crisis, with lenders wary of defaults in the interbank market. Too many toxic assets remain undisclosed, leading to uncertainty, and a reluctance to lend. Tough measures are needed to restore confidence. And if there are a few more casualties, so be it.

The ideas of economists and

political philosophers, both when they are right and when

they are wrong, are more powerful than is commonly

understood. Indeed, the world is ruled by little else.

~ John Maynard Keynes