Gold Pennant

By Colin Twiggs

October 21, 2008 5:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

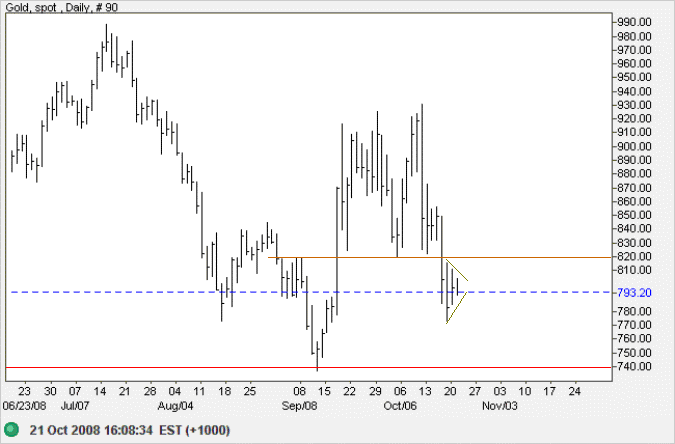

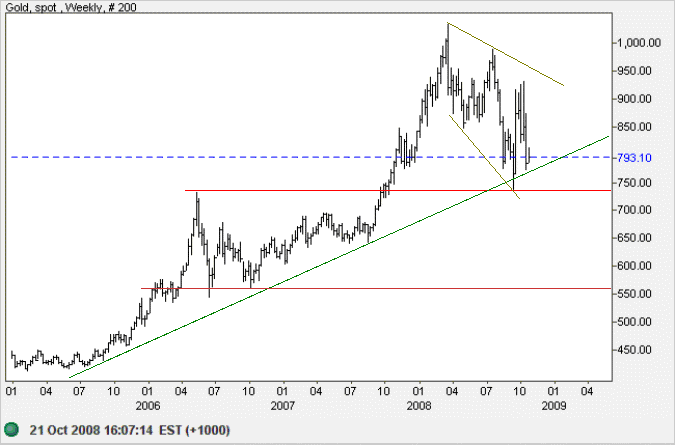

Gold

Since breaking through support at $820, spot gold has consolidated in a small pennant, signaling continuation. Expect a test of $740. Failure would offer a target of $560, calculated as 740 - ( 920 - 740 ). Respect of support is less likely because of the down-trend; and would signal another test of $920.

In the long term, the broadening descending wedge is normally a bullish sign, but the recent failed up-swing warns of a downward breakout.

Source: Netdania

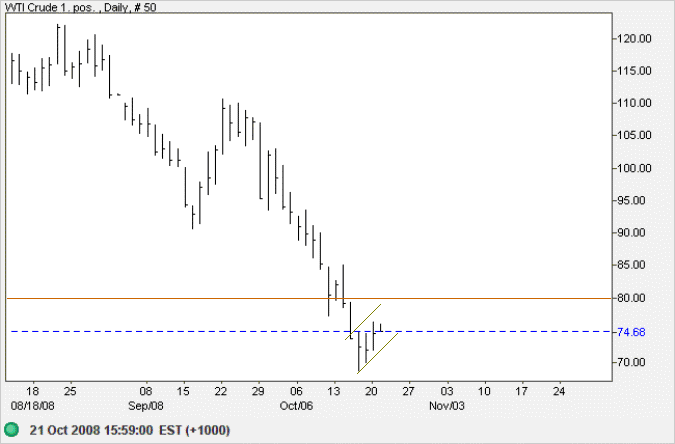

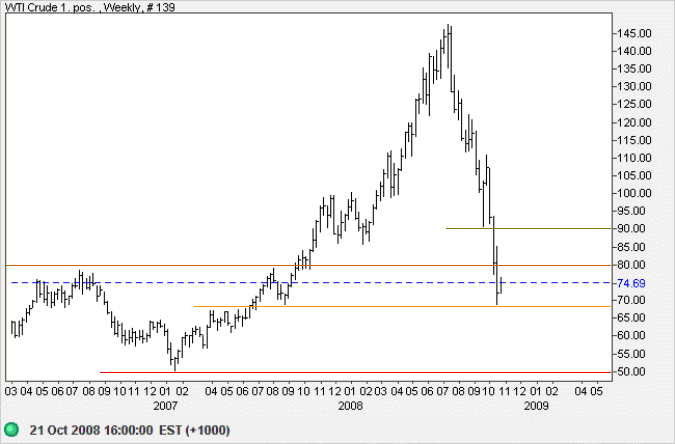

Crude Oil

West Texas Intermediate Crude is retracing to test the new resistance level at $80. Downward breakout from the small flag is likely, signaling another down-swing with a target of $60.

In the long term, breakout below $70 per barrel would be likely to test $50. The wild card could be OPEC cuts in production, which would strengthen support. Member states have already experienced a substantial drop in revenues, however, and there is some doubt whether they would all comply with any agreed cuts — voluntarily suffering a further drop in revenue.

Source: Netdania

Currencies

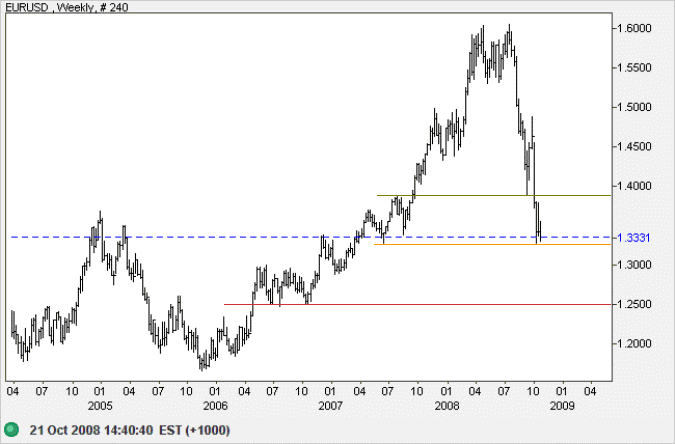

The euro respected the band of resistance between $1.3900 and $1.4000 in recent weeks and is again testing support at $1.3250. Expect support to fail, offering a target of $1.25; calculated as 1.3250 - ( 1.4000 - 1.3250 ).

Source: Netdania

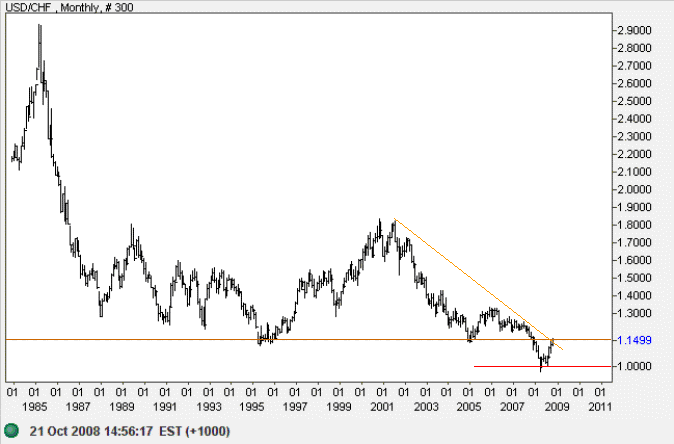

The dollar retraced to test the new resistance level at 1.15 against the swiss franc. Respect would signal another test of parity, while breakout would not indicate a trend reversal unless support at 1.15 is later respected.

Source: Netdania

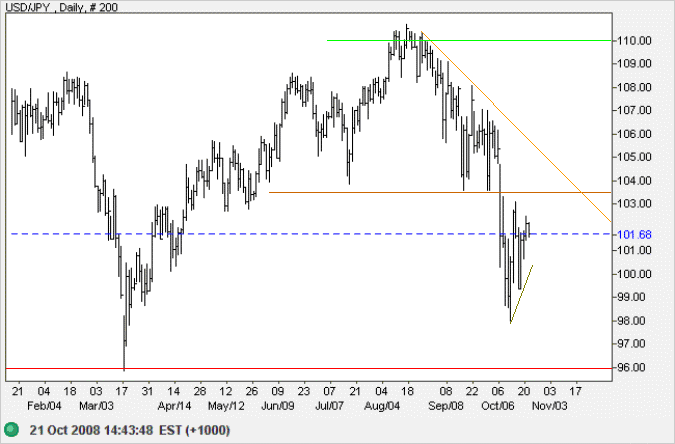

The dollar is headed for another test of the new resistance level of 103.50 against the yen. Breakout would not necessarily indicate a trend reversal unless the new support level is later respected. Reversal below the rising short-term trendline (at 99) would warn of another test of 96.

Source: Netdania

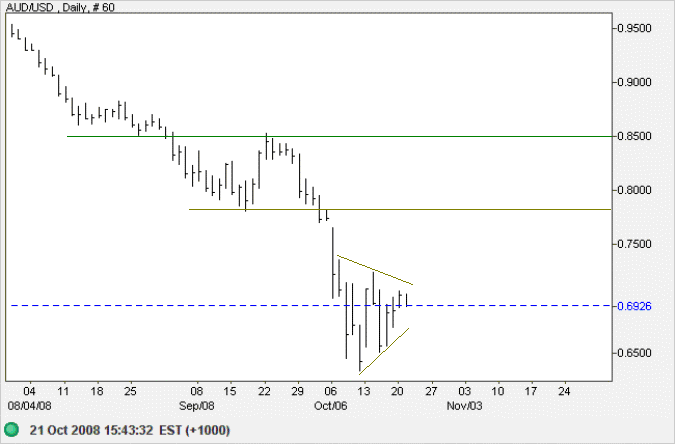

The Australian dollar formed a pennant against the greenback, warning of continuation of the down-trend. Downward breakout would offer a target of $0.5000, calculated as 0.65 - ( 0.78 - 0.63 ). Upward breakout is less likely and would test $0.8500 — with some resistance at $0.7800.

Source: Netdania

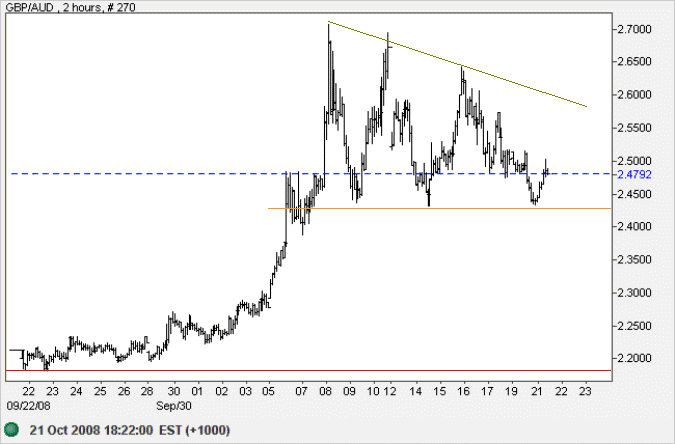

The pound also strengthened markedly against the Aussie dollar, but has now formed a bearish descending triangle on the short-term chart. Failure of support at 2.43 would offer a target of 2.20, calculated roughly as 2.45 - ( 2.70 - 2.45 ).

Source: Netdania

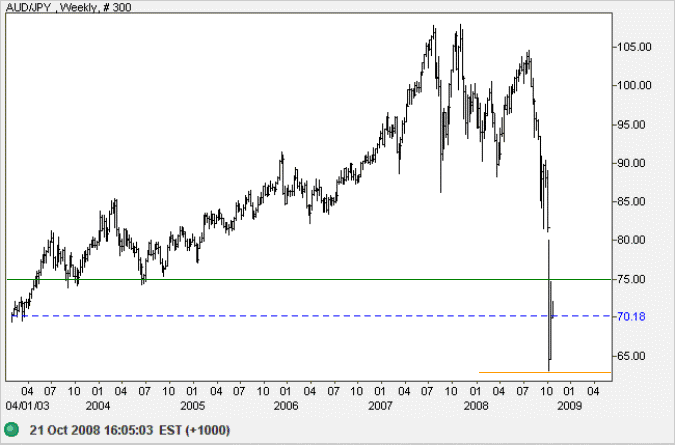

If we look at the weekly chart, the Aussie is consolidating between 63 and 75 against the yen. Upward breakout remains less likely because of the down-trend, but at this stage there is no further indication. Failure of support at 63 would offer a target of 55, calculated as 65 - ( 75 - 65 ).

Source: Netdania

Of all tyrannies, a tyranny exercised for the good of its victims may be the most oppressive.

It may be better to live under robber barons than under omnipotent moral busybodies.

The robber baron's cruelty may sometimes sleep, his cupidity may at some point be satiated;

but those who torment us for our own good will torment us without end,

for they do so with the approval of their own conscience.

~ C.S. Lewis