Another Rate Cut?

By Colin Twiggs

October 7, 2008 2:00 a.m. ET (4:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The Fed

The Fed will begin paying interest on balances held at reserve banks, effective Thursday, October 9. Banks will be paid interest at two separate rates: 0.1 percent below the fed funds target rate on balances held to meet their reserve requirements; and a lower rate of 0.75 percent below the target rate for balances in excess of requirements. The latter is only likely to used by banks in times of crisis when they are wary of lending in the inter-bank market. The Fed will then act as intermediary between banks, preventing the financial system from choking up as it has in recent weeks.

The new facility may enable the Fed to avoid another rate cut that, only last week, appeared inevitable.

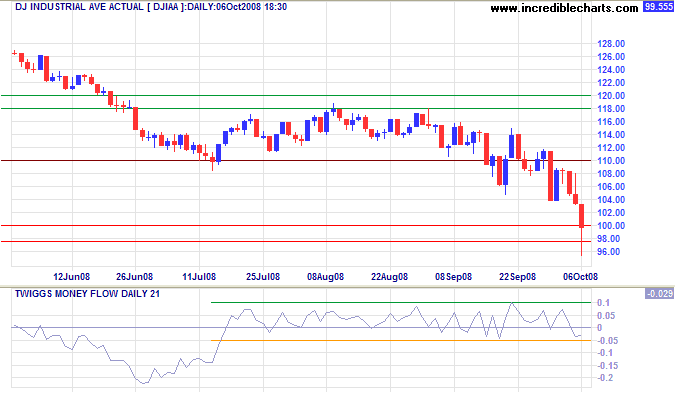

The Dow

The Dow Jones Industrial Average fell sharply on news that the contagion has spread to European banks. Monday's long tail and strong volume, however, indicate a committed band of support between 10000 and 9750. Twiggs Money Flow, likewise, continues to oscillate in a narrow band around the zero line, signaling uncertainty. Expect retracement to test the new resistance level at 11000, but we remain in a down-trend and there are bound to be further tests of primary support at 9750. Failure of support would offer a target of 9000.

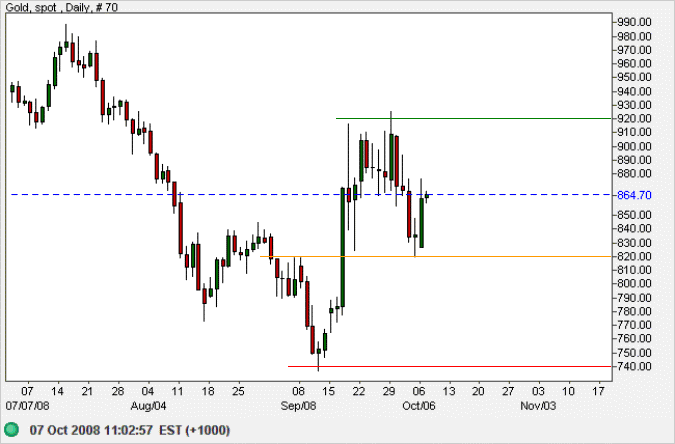

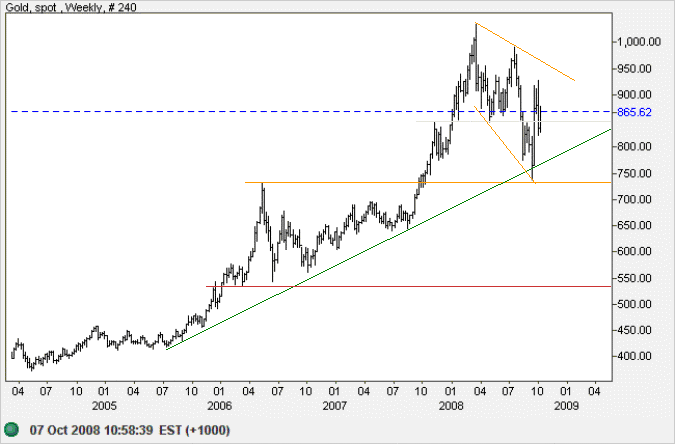

Gold

Spot gold is testing support at $820. Failure would signal a test of $740, while breakout above $920 would offer a target of $1000.

In the long term, uncertainty in financial markets is likely to increase demand for gold. The broadening descending wedge over the last 6 months is a bullish sign. Upward breakout would offer a target of 1200, calculated as 950 + ( 1000 - 750 ).

Source: Netdania

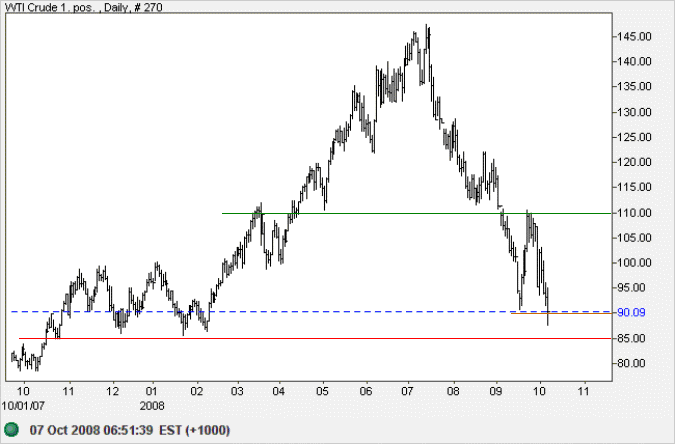

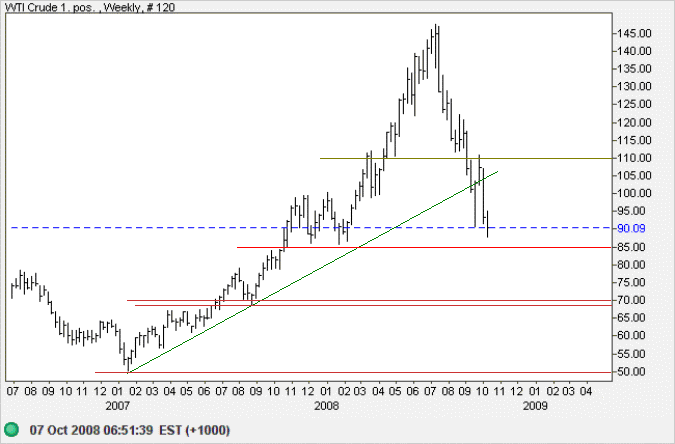

Crude Oil

West Texas Intermediate Crude broke through support at $90 and is now retracing to test the new resistance level. Breakout offers a target of $70, calculated as $90 - ( $110 - $90 ), but expect further support at $85.

In the long-term, crude prices are expected to fall as the global economy slides into recession. Failure of support at $70 would test $50 per barrel.

Source: Netdania

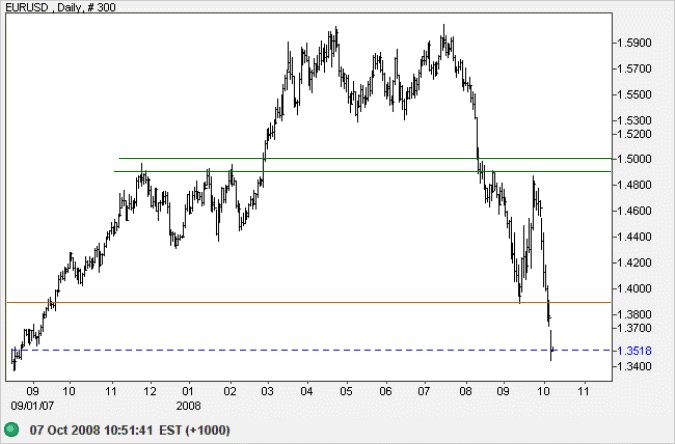

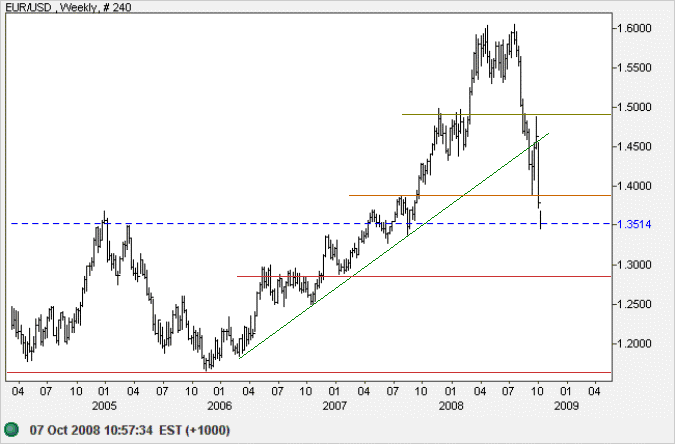

Currencies

The euro broke through support at $1.39, offering a target of $1.29, calculated as $1.39 - ( $1.49 - $1.39 ). But first expect a retracement to test the new resistance level.

In the long term, failure of support at $1.29 would test the 2005 low of $1.16. Respect of $1.29, on the other hand, would see a base form between $1.29 and $1.39.

Source: Netdania

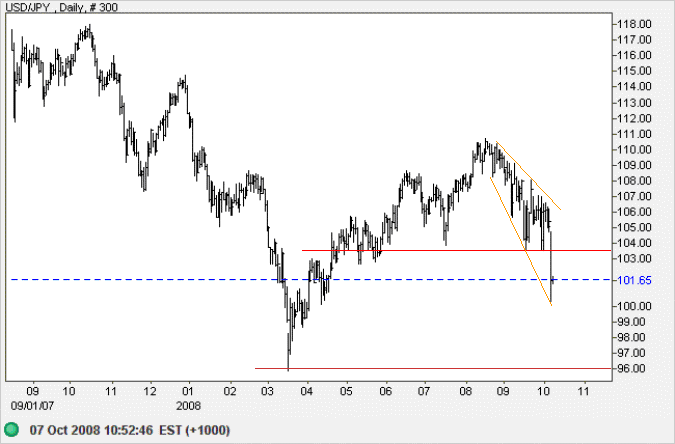

The dollar broke through primary support at 103.50 against the yen, warning of a test of 96. The descending broadening wedge is normally a bullish sign, however, so wait for a retracement to confirm the new resistance level at 103.50.

Source: Netdania

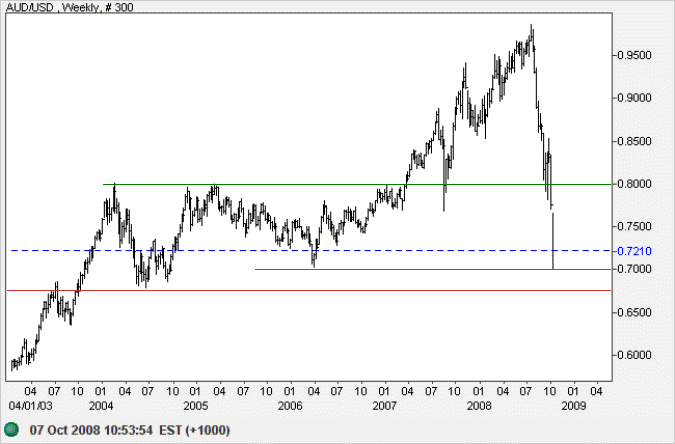

The Australian dollar found support at $0.70 after a sharp fall against the greenback. The Reserve Bank of Australia subsequently announced a full 1 percent interest rate cut to 6 percent, at 2:00 p.m. AET today, in an attempt to shield the Australian economy from the global credit crisis.

Expectations of further interest rate cuts, falling commodity prices and unwinding carry trades have eroded support for the Aussie. Expect a retracement to confirm resistance at $0.80, but the primary trend is down and we can expect further tests of the band of support between $0.68 and $0.70.

Source: Netdania

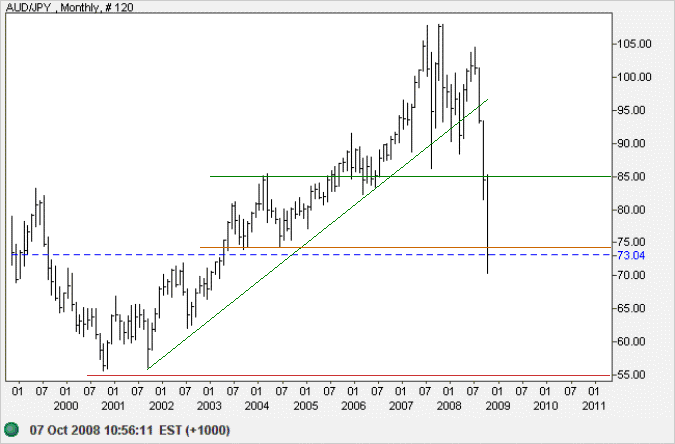

The Aussie broke through support at 74 against the yen and is now retracing to test the new resistance level. If resistance at 74/75 holds, expect further sharp falls to test the 2001 low of 55. Recovery above 75 remains as likely, however, and would indicate another test of resistance at 85.

Source: Netdania

So we beat on, boats against the current, borne back ceaselessly into the past.

~ F. Scott Fitzgerald,

The Great Gatsby (1925)