The Biggest Risk Is Doing Nothing

By Colin Twiggs

September 25, 2008 9:00 a.m. ET (11:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Congress is chewing over Henry Paulson's $700 billion bank rescue plan. Everyone is angry that the crisis has occurred and the natural reaction is to seek revenge — to ensure that bankers pay the price for their follies. By vetoing the rescue plan they will succeed in this, but there are further consequences: Main Street will pay a far bigger price than Wall Street.

In 1929 the Fed's attitude was to let the banks fail. Repeated failures, however, caused investors to lose faith in the banking system. Withdrawal of deposits forced banks to withdraw credit from borrowers. Borrowers, forced to liquidate assets, drove down asset prices. This in turn set off another round of bank failures. A downward spiral commenced, with waves of bank failures, collapsing asset prices and rapid contraction of demand and production. The Great Depression lasted almost ten years — and a similar scenario should be avoided at all costs.

The best way to prevent a repeat is to take immediate action to restore confidence in the banking system. While Congress do not want to give Henry Paulson a blank check, he has shown greater leadership than anyone else on this issue. As well as demonstrating a keen interest in protecting taxpayers . In fact we will all be deeply indebted to him if he is able to pull this off.

The $700 billion facility should not be used to buy distressed assets at market value, the prices paid by so-called "vulture funds" in the market place, and not face value or book value. As Warren Buffett pointed out in a recent CNBC interview: buyers in the current market expect to make a 15 to 20 percent return — and Treasury should show a similar profit. Provided that they are given reasonable leeway to negotiate — and are not hobbled with too many restrictions.

Executive compensation is a market-wide issue and not just limited to the financial sector. The real issue is the lack of accountability of senior management, who are able to vote themselves remuneration and incentives which conflict with the interests of shareholders. Bonuses and executive options focus management on short-term profits and the current stock price, rather than long-term survival of the company. Compensation committees and compensation consultants are merely window-dressing — in most cases they are indirectly appointed by management.

Shareholders' interests are not being adequately represented. Directors are supposed to represent shareholders but are often appointed by the Chairman or CEO and feel obliged to support them. We used to joke:

What is the difference between a supermarket trolley and a non-executive director? The one has a mind of its own. The other can hold more food and drink.The board of directors should not be an "old boys club". What is needed is some mechanism whereby non-executive directors are not nominated by the board, but directly by shareholders — and should be accountable to them.

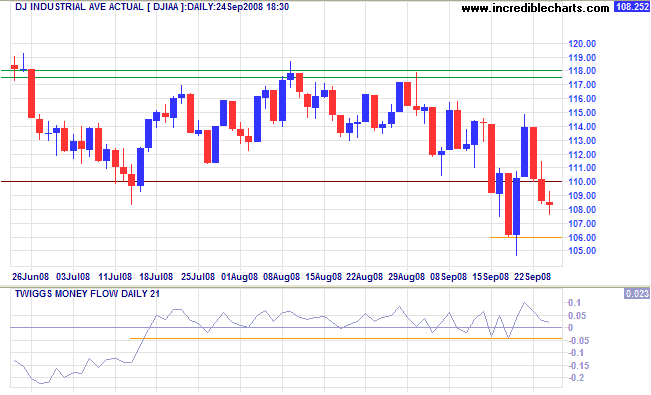

Stocks

The Dow is headed for a test of support at 10600. Expect another relief rally if the rescue package is approved, but the primary trend remains down, with a target of 10000. If the rescue is not approved, or restricted with so many provisions as to make it unworkable — the next major support level is 7500. Twiggs Money Flow (21-day) reversal below recent lows at -0.05 would warn of a test of 10000.

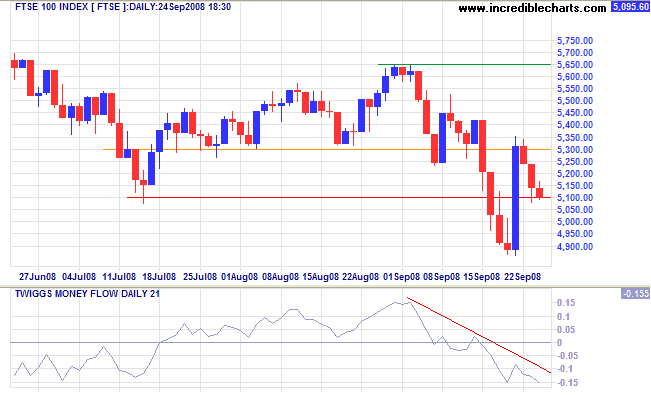

The FTSE 100 shows a similar pattern. Despite a record gain on Friday, the primary trend remains down. Descending Twiggs Money Flow (21-day) reflects strong selling pressure.

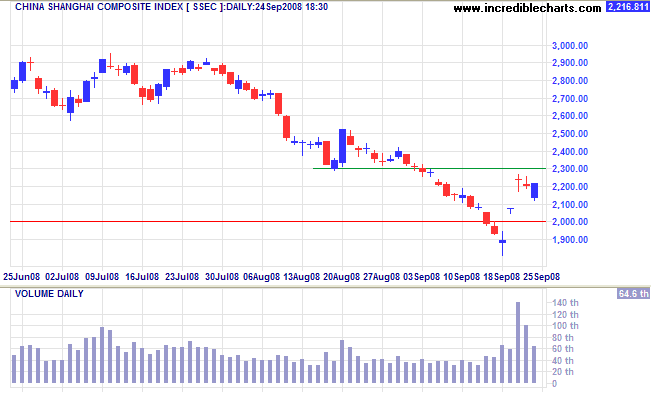

Asian markets have also rallied, but large volumes on the Shanghai Composite index warn of strong resistance at 2300. A successful US rescue package may stimulate a further rally, but the primary trend remains down — this bear market is far from over.

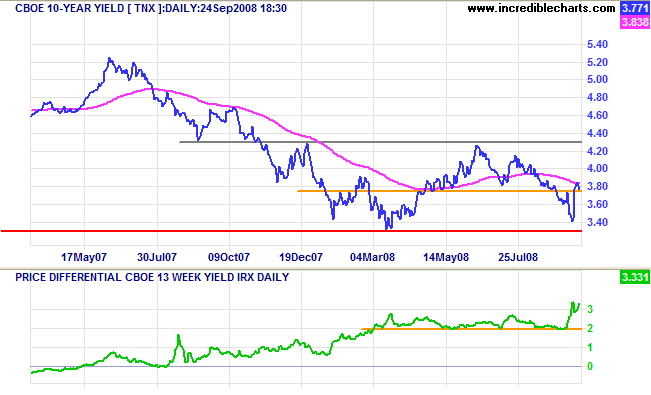

Treasury Yields

Ten-year treasury yields rallied sharply, as money flowed from treasurys to stocks on optimism over the proposed rescue plan. The fall may be short-lived if prompt action is taken to reassure financial markets, but an up-trend (signaled by recovery above 4.30%) appears some way off. Yield differentials remain high, with the yield on 13-week treasury bills reversing below 1.0 percent.

Market Uncertainty

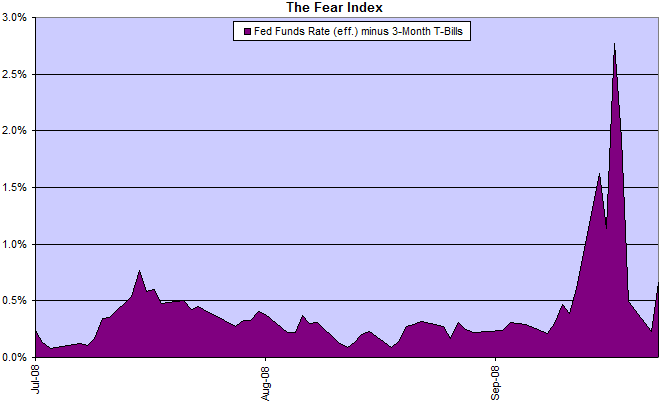

The spread between the fed funds rate and 3-month T-bills retreated sharply, but has again started to climb as Congress delays the proposed rescue package.

LIBOR overnight rates eased from 6.4 percent to below 3.0 percent yesterday, signaling a return to some semblance of normality. Banks remain reluctant to part with their cash, however, with inter-bank lending demanding a 75 basis point premium over the fed funds target rate.

The Shadow Banking System

Professor Nouriel Roubini from RGE Monitors refers to it as the shadow banking system. More than $10 trillion of unregulated markets, with inadequate capital provisions, are now unravelling:

- $2 trillion of commercial paper conduits;

- the $2.5 trillion repo/reverse repo market;

- $4 trillion of brokerage assets, now in the process of de-leveraging to conform with banking regulations; and

- $1.8 trillion of hedge funds.

But these are totally eclipsed by the $65 trillion unregulated credit default swaps market, which threatens to bring down the entire system if one of the major counter-parties defaults — the reason why Treasury/the Fed had no choice but to rescue Bear Stearns and AIG.

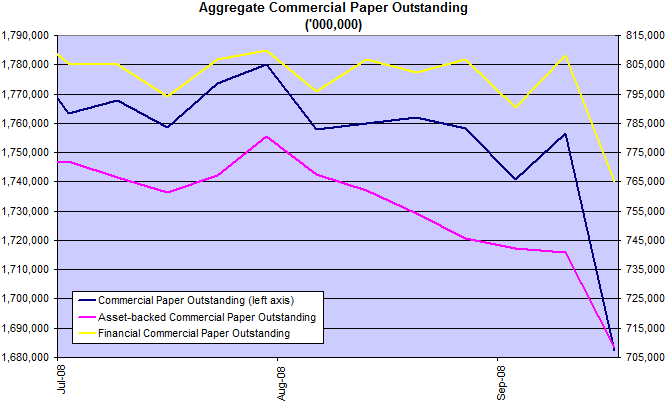

Total commercial paper in issue, one element of this shadow system, has fallen by almost $90 billion since July. A trend that is expected to continue.

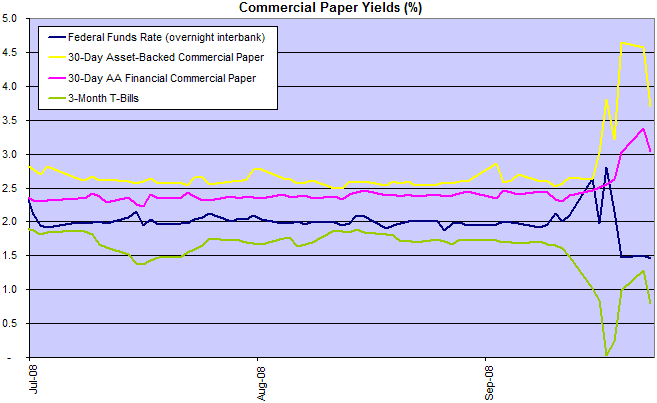

Massive spreads between CP rates and the fed funds target rate of 2 percent make it no longer viable to fund off-balance sheet assets through the wholesale market. The result is an almost total shut down of leasing by large auto manufacturers, further restricting new vehicle sales; and dismal results for GE Leasing, credit card companies, and other consumer financing operations. Contracting credit in the shadow banking system is likely to affect the global economy for the next two to three years. Especially sectors such as housing in the UK and Austalia, which have become overly reliant on wholesale funding in the international market.

Also, the effective fed funds rate has dropped to 1.50 percent, warning of another rate cut at the next FOMC meeting.

Corporate Bonds

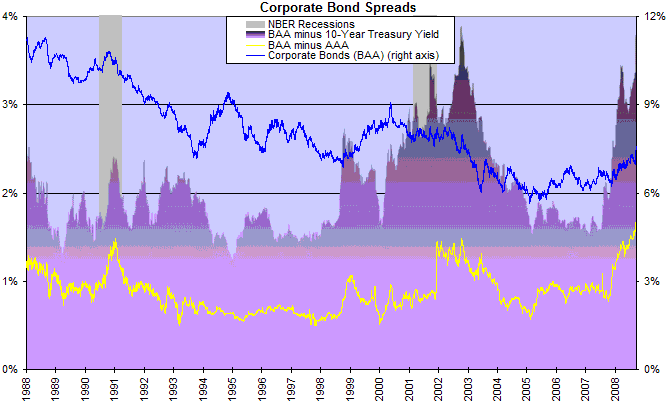

Corporate bond (Baa/Aaa) spreads have climbed to record levels in anticipation of rising defaults.

Housing

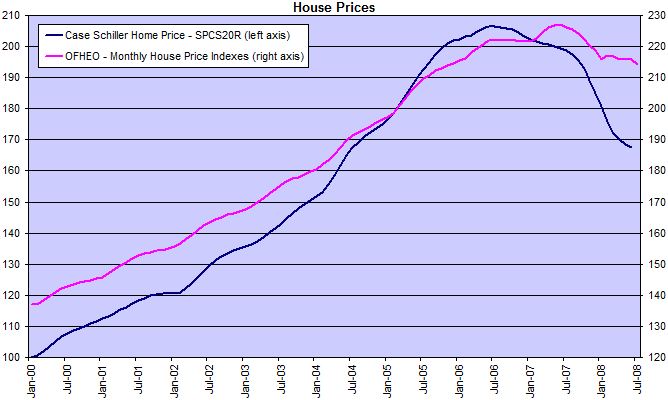

House prices continue to fall. And mortgage applications are declining, according to the latest MBA report.

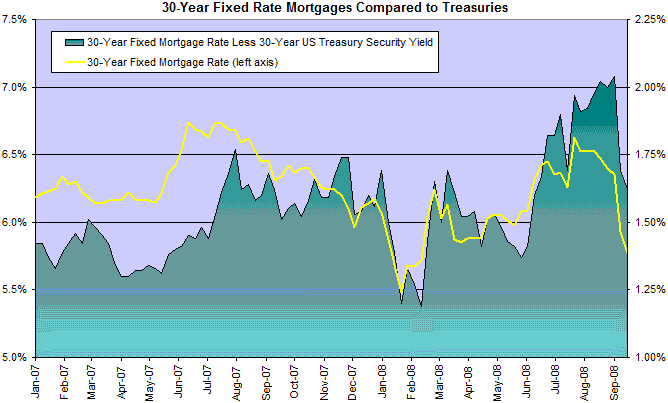

Fixed mortgage rates have started to trend downwards, however, in response to falling treasury yields and the recent GSE rescue — offering some relief to potential home buyers.

Bank Credit

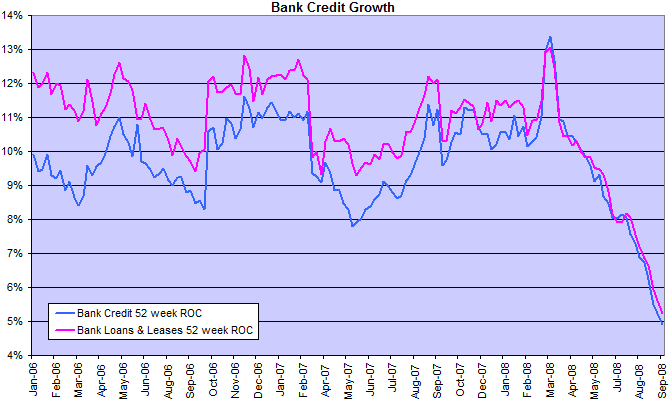

Falling bank credit growth is merely the tip of the iceberg, with the declining shadow banking system restricting consumption and new investment.

Combined Fed and Treasury support for the financial system will total almost $1 trillion if the latest bank rescue package is approved. This dwarfs any previous support and emphasizes the severity of the issues that we face. If we do not show the resolve to fix this properly, and lapse into our old habits, we could eventually do irreparable harm to a system that we all take for granted.

The first step towards getting somewhere is to decide that you are not going to stay where you are.

~

John Pierpont Morgan