Sharing A Lifeboat With An Elephant

By Colin Twiggs

September 23, 2008 7:00 a.m. ET (9:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Charles De Gaulle once equated being an ally of the United States to sharing a lifeboat with an elephant. Participants in the global economy would share that sentiment: when the elephant shifts position there is a mad scramble to save the lifeboat from capsizing. At present the elephant is suffering from a bad case of indigestion, after gorging itself on credit for the last three decades, so be prepared for a turbulent ride.

There is bound to be a relief (bear) rally if Congress manage to cobble together a rescue package for the financial sector. This time, however, do not expect a typical sharp surge — as there are no longer any shorts who need to cover their positions. Creation of an entity like Resolution Trust Corp. to buy up bad assets will help to restore market confidence, but this is just one step in the process. We still need formalization of the credit default swaps market — and banks to reveal their true exposure to bad assets. Banning SIVs and forcing banks to carry all their assets on their balance sheet would be a start. But expect strong resistance. Banks have become overly reliant on securitization: taking all your profits up-front, instead of over the life of the loan, does wonders for the bottom-line — and annual bonuses.

Merrill Lynch economist David Rosenberg sums up the present situation with the following reminder: "keep in mind, for all the bottom pickers out there, that the RTC was established in 1989, but it still took a year for the stock market to bottom, two years for the economy to bottom, and three years for the housing market to bottom" (WSJ).

And it may be inconvenient at times sharing the lifeboat with an elephant, but always remember that the alternative is a large bear who may not display the same nicety of manners — and remember not to eat his fellow passengers.

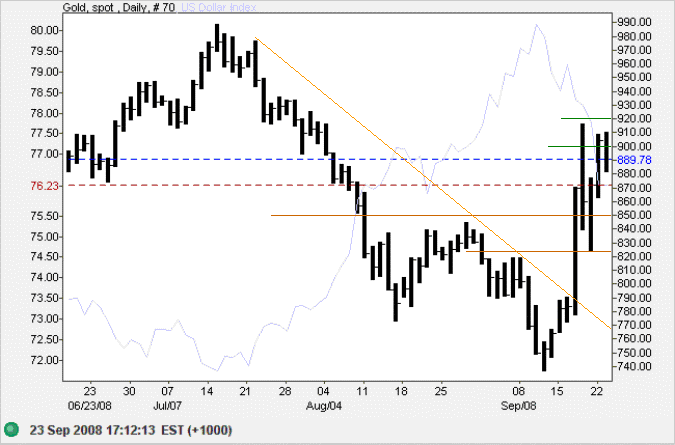

Gold

Spot gold is testing the band of resistance between $900 and $920. Breakout would confirm the primary up-trend, while reversal below $825 would signal a test of primary support at $735. As the (pale blue) plot of the US dollar index shows, the gold price is being dictated by the strength (or weakness) of the dollar. Be prepared for a turbulent ride, but the dollar is expected to weaken in the long term — and gold to strengthen.

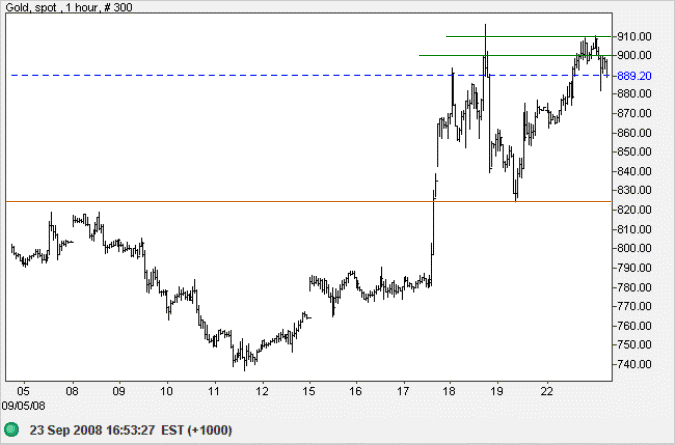

The hourly chart shows gold has made three failed breaks above $900, only to retreat each time. Further false breaks are likely. Look for a rally that then retraces to respect the new support level (at $900). A fall below $880, on the other hand, would signal a test of support at $825.

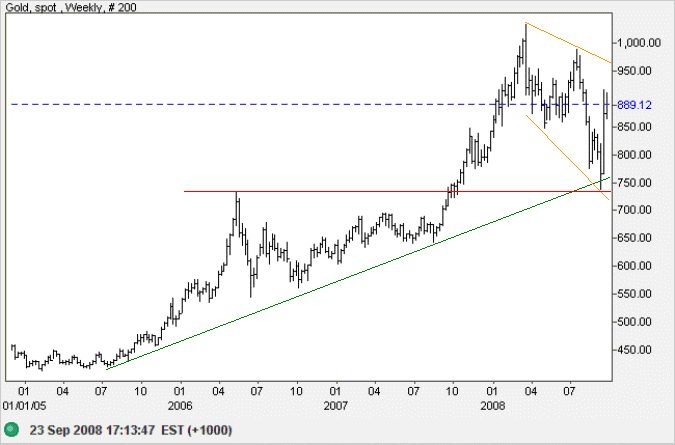

The weekly chart reveals a broadening descending wedge: a bullish sign. Breakout above the upper border would offer a target of roughly $1200, calculated as 950 + ( 1000 - 750 ). A partial swing, that reverses before the opposite border, would also indicate future direction.

Source: Netdania

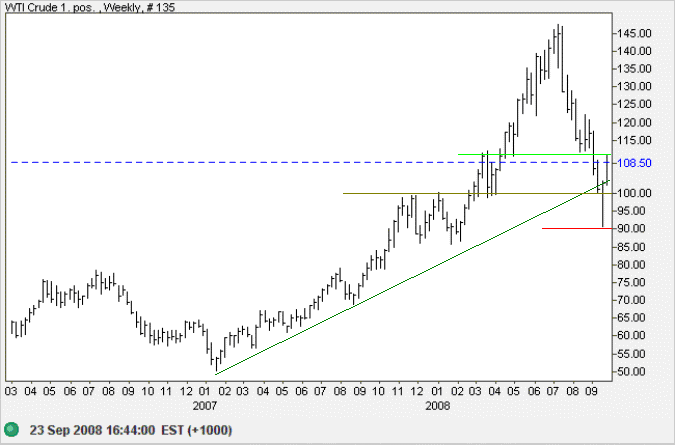

Crude Oil

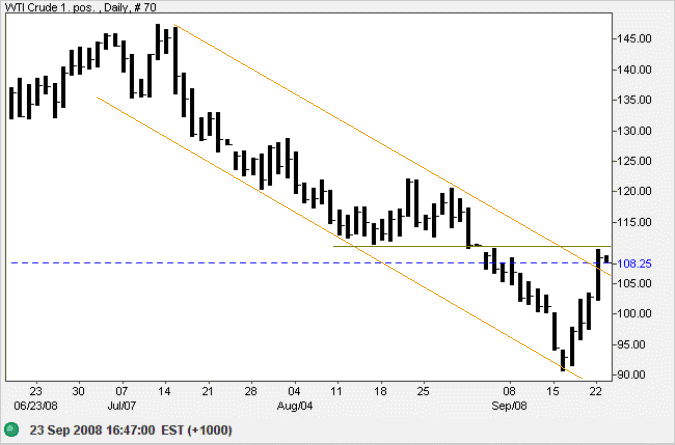

West Texas Intermediate Crude is testing resistance at $110 — and the upper trend channel. A short retracement followed by breakout above $110 would signal reversal to an up-trend. Shorts appear to have been squeezed, however, by the dramatic turn of events in financial markets over the weekend. If so, the current rally should be short-lived, reversal below $100 warning of another down-swing.

In the long-term, prices are expected to fall further as major economies slide into recession. Failure of support at $90 would see support at $70 tested. Even $50 per barrel is not out of the question.

Source: Netdania

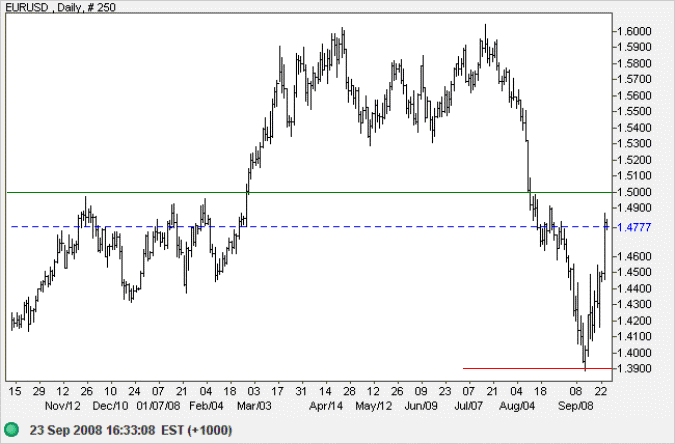

Currencies

The euro is headed for a test of resistance at $1.50 as the dollar weakens. V-bottom reversals are notoriously unreliable: expect another retracement to test the band of support between $1.43 and $1.39 before a serious attempt is made at a breakout.

Source: Netdania

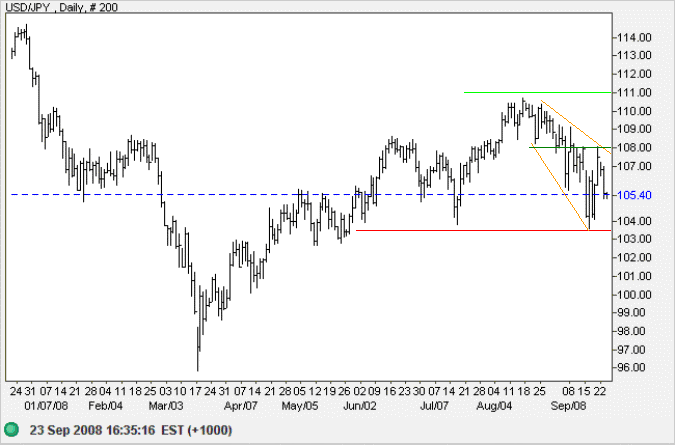

The dollar shows a bullish descending broadening wedge against the yen. Expect support at 103.50 to hold, followed by breakout above 108 to confirm the up-trend. Failure of 103.50, while less likely, would signal a primary down-trend.

Source: Netdania

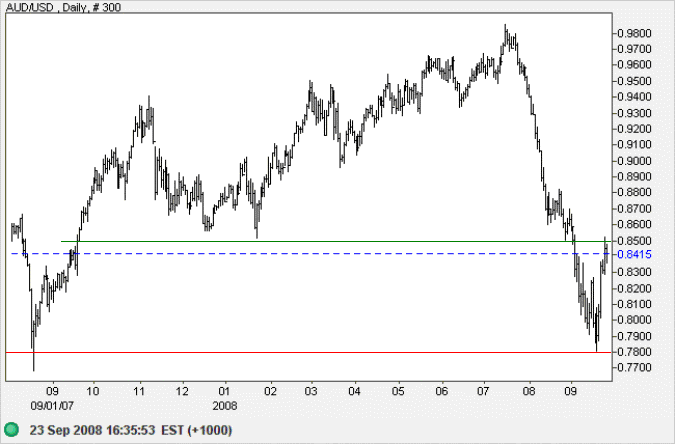

The Australian dollar is testing the band of resistance between $0.85 and $0.86 against the greenback. Again, V-bottoms are unreliable. Expect a retracement to test primary support at $0.78.

Source: Netdania

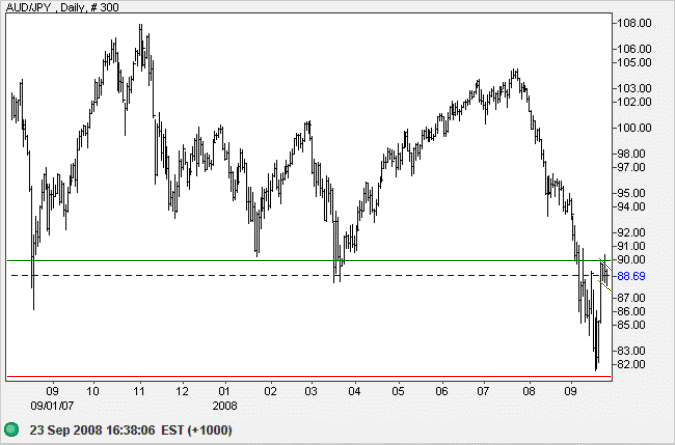

The Aussie is testing resistance at 90 against the yen. The small flag is a short-term bull signal, indicating that a breakout is likely. Again, however, V-bottoms are unreliable and we should expect retracement to test primary support at 80 yen.

Source: Netdania

If a loose monetary policy and rapid asset price inflation were the route to economic prosperity,

Argentina would be the richest country in the world by now.

~ Albert Edwards, Societe Generale

(quoted in SafeHaven)