Drawing A Line In The Sand

By Colin Twiggs

September 18, 2008 11:00 p.m. ET (1:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

In 1907 the failure of the Knickerbocker Trust Company of New York unleashed a perfect storm on financial markets. Complex cross-holdings between banks and inadequate safety margins threatened to bring down the entire financial system. The collapse of two brokerage houses involved in the failed corner of United Copper stock precipitated the crisis. Rumors that Knickerbocker was embroiled in the scheme started a run against the famed trust company, with lines of investors demanding the return of their money. Knickerbocker was forced to close its doors and its president, Charles T. Barney, resigned. He committed suicide shortly afterwards. The panic spread to other banks and trust companies, with depositors queueing to withdraw their savings and banks wary of supporting each other in case of further failures.

The market was saved by the leadership of J.P. Morgan, unofficial head of the New York banking community. There was no Federal Reserve in those days: the panic of 1907 would lead to its formation. Trust companies were particularly vulnerable to a run because they did not enjoy the support of a central clearing house. Morgan conducted a speedy review of the most vulnerable trust companies; his young assistant, Benjamin Strong, at times standing in their vaults counting boxes of securities. They identified which of the trust companies were capable of rescue and those who were beyond redemption. Drawing a line in the sand, Morgan browbeat his fellow bankers into providing a pool of funds to support the Trust Company of America — locking them in his library until they had all agreed to participate. The trust company was saved and the panic abated.

Benjamin Strong later became chairman of the Federal Reserve. If not for his untimely death in October 1928, leaving the Fed without strong leadership, I believe that the worst of the post 1929 banking collapse would have been avoided. More than 10,000 large and small banks eventually failed, precipitating the Great Depression.

What we can learn from 1907 is the need for prompt action to identify the extent of the damage, the courage to make tough "triage" decisions about who should fail and who should be rescued, and strong leadership to force this through. Panic feeds on uncertainty. What the public and banking community need is a clear view of bank exposure to off-balance sheet SIVs — and of exposure to counter-party risk in the multi-trillion dollar credit default swaps market. Attempts to sweep this under the carpet are likely to lead to further panics — and unnecessary failures. What we do not need is prevarication from Congress and attempts to postpone any action until after the November election. By then it could be too late.

Immediate steps should include restrictions on short-selling; banning SIVs; forcing banks to sell bad assets at a steep discount into a controlled entity similar to the Resolution Trust Corp.(used to clear up the S&L mess); and forcing all credit default swaps through a central exchange.

Readers interested in learning more should read The Panic Of 1907: Lessons Learned From The Market's Perfect Storm, by Robert Bruner and Sean Carr.

Coping with Market Pressure

If you find yourself scouring the press for the latest news, glued to financial news channels waiting for the next bombshell, and watching your screen for hours at a time — you may be losing your objectivity. It is difficult to make clear decisions when you are continually bombarded with new stimuli, leaving you with no time to reflect. The best method I have found is to distance yourself as far as possible from market "noise". Select a few key sources of information and exclude all the rest. Turn off the TV and only look at your charts when you have to make a decision.

And if you find you are not sleeping well at night; in the words of Jesse Livermore: "sell down to the sleeping point". Reduce your exposure to the point that you can regain your objectivity.

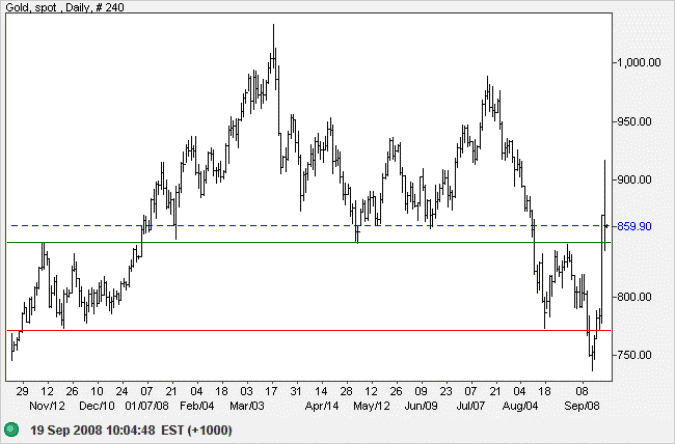

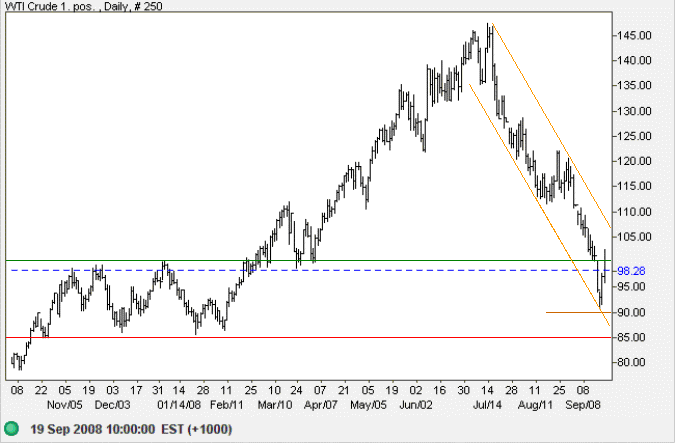

Gold & Crude Oil

Spot gold rallied sharply above the earlier high of $850, completing a large correction. The market is exceedingly volatile and is likely to overshoot support and resistance in either direction. While some analysts view a large correction as signaling a primary trend reversal, the results can be treacherous — especially in times of high volatility. A more conservative approach is to wait for clear formation of a higher low before recognizing the change to a primary up-trend.

Crude oil found support at $90 and is rallying to test resistance at the upper trend channel. Increased volatility may cause rapid swings between the upper and lower trend channel. The primary trend continues downward. Expect medium-term support between $85 and $90 per barrel. Failure could lead to crude falling as far as the 2007 low of $50/barrel.

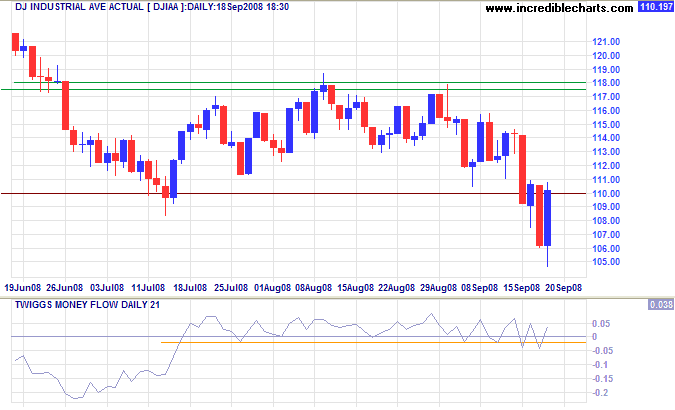

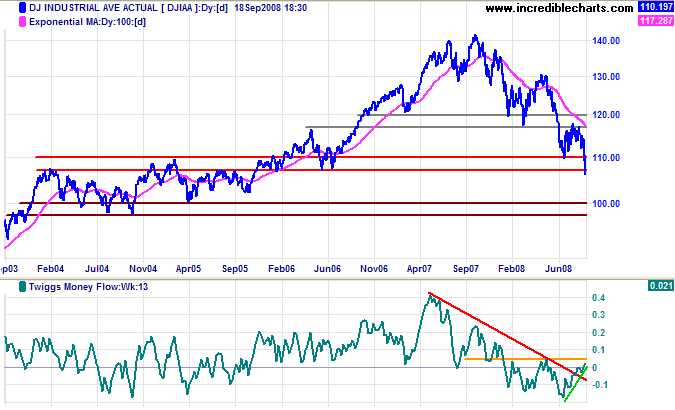

Stocks

The Dow broke through primary support at 11000, warning of a down-swing with a target of 10000. Retracement to test the new resistance level does not alter the original signal — unless the recovery breaks short-term resistance at 11450. Twiggs Money Flow whipsawing around the zero line indicates uncertainty; reversal below recent lows would confirm the down-trend.

The long-term chart highlights bands of support at 11000/10700 and at 10000/9700. Reversal below the current band would confirm the down-swing. Twiggs Money Flow (13-week) continues to reflect a bear market.

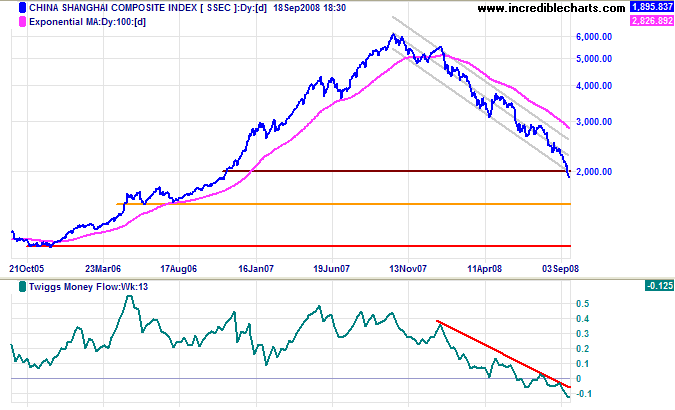

Asian markets are not immune from the crisis, with the Shanghai Composite index breaking through 2000 — having lost more than two-thirds of its value in the last year. Expect support at 1500 (orange). If that fails, the next major support level is 1000 (red).

Falls in both China and G7 markets should precipitate weakness in commodities and commodity-related stocks.

Treasury Yields

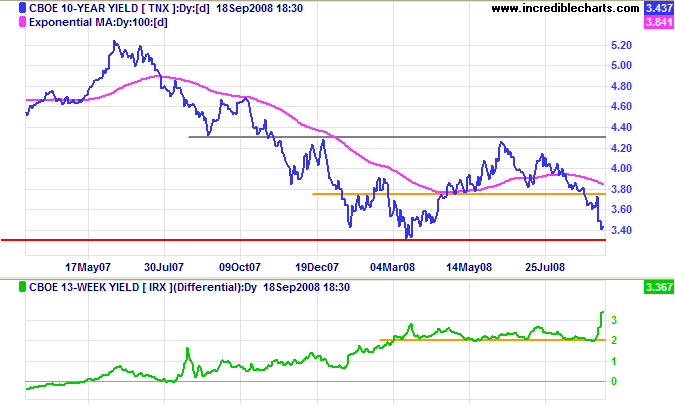

Ten-year treasury yields fell sharply, heading for a test of support at 3.30 percent as investors flee to the safety of treasurys. The fall may be short-lived if prompt action is taken to reassure financial markets, but an up-trend (signaled by recovery above 4.30%) appears some way off. Yield differentials climbed steeply, with the yield on 13-week treasury bills falling to practically zero.

Market Uncertainty

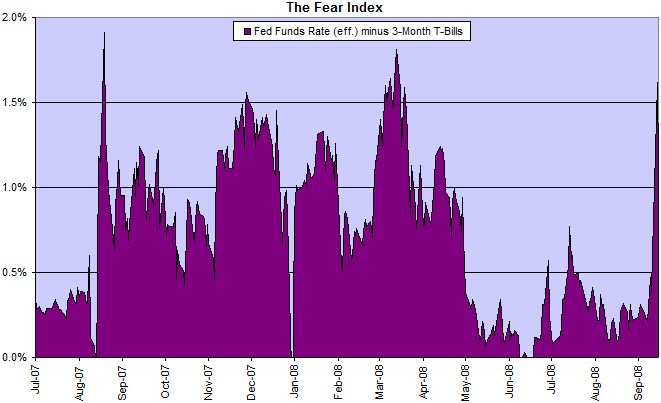

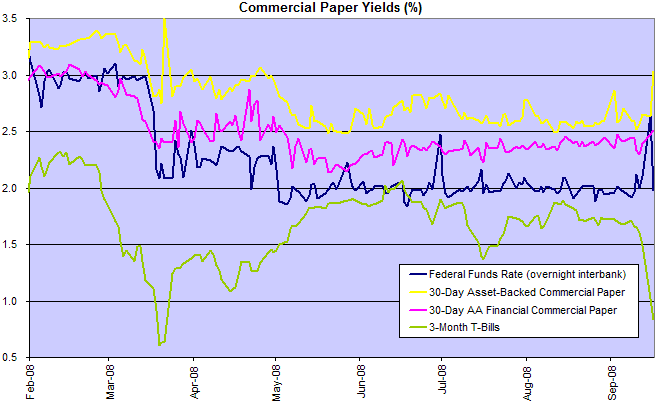

The spread between the fed funds rate and 3-month T-bills sky-rocketed as the latest wave of uncertainty rocked the markets.

LIBOR rates reflect a total break-down in inter-bank confidence, with overnight rates jumping from 2.1 percent to 6.4 percent in less than a week, before easing slightly to 5.0 percent yesterday.

Inflation

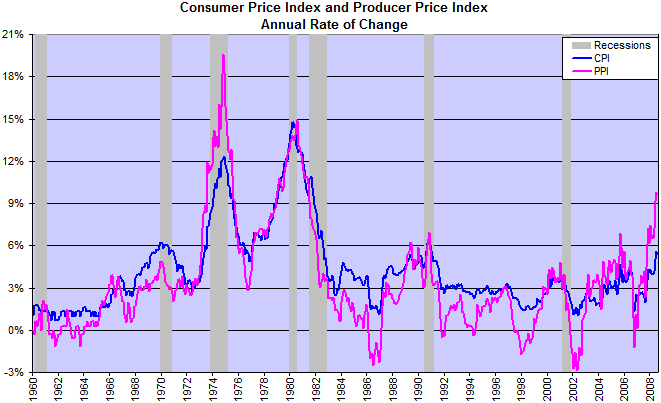

The consumer price index is following the producer price index higher, though falling demand and lower oil prices are expected to exert downward pressure.

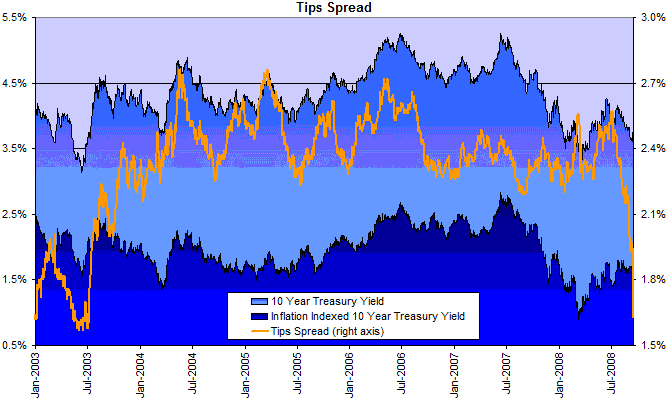

The TIPS spread no longer reflects inflation expectations as the flight to safety distorts treasury yields.

Financial Markets — Commercial Paper

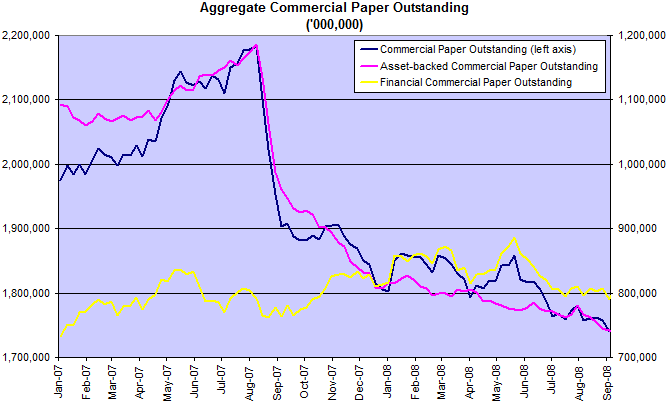

Commercial paper is the equivalent of short-term IOUs between large corporations and financial institutions. The rising spread between CP rates and the fed funds target rate (2 percent) reflect pressure on the financial sector to unwind off-balance sheet SIVs and reduce their reliance on wholesale funding.

Total commercial paper in issue continues to decline.

Corporate Bonds

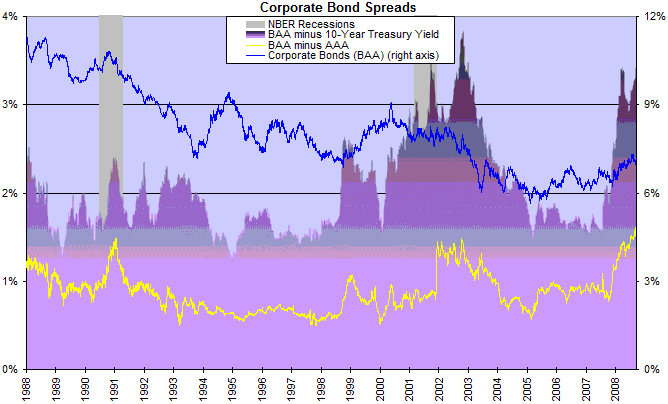

Corporate bond spreads are rising in anticipation of rising defaults, with Baa/Aaa spreads at the highest level since 1991.

Housing

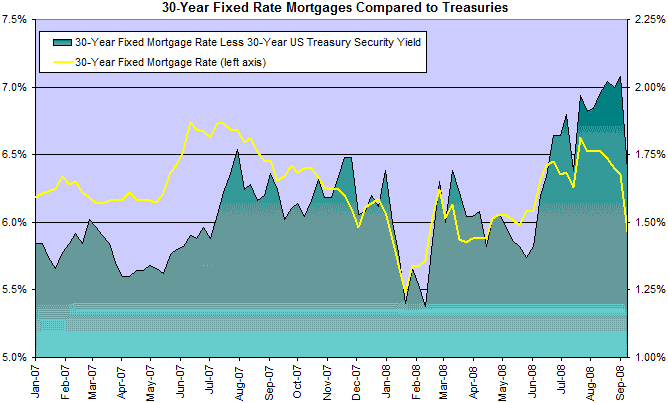

An encouraging sign for the housing market is the fall in fixed mortgage rate spread in response to the Treasury takeover of GSEs. Thirty-year fixed mortgages below 6.0 percent signal that the up-trend has weakened.

Bank Credit

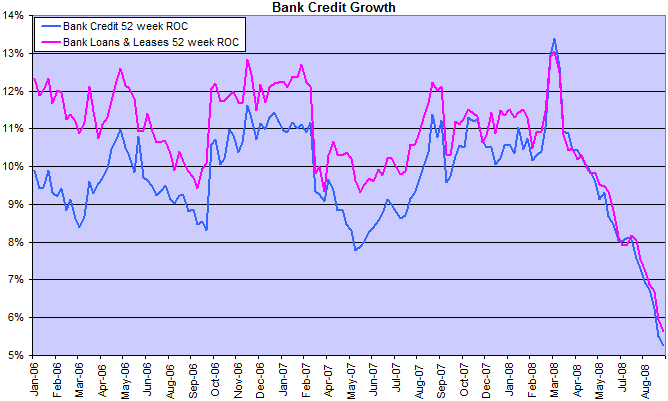

Falling bank credit growth is merely the tip of the iceberg, with declining off-balance sheet funding further restricting consumption and new investment.

The Fed this week announced an increase in Term Security Lending Facilities from $175 to $200 billion and relaxation in eligible collateral to include all investment-grade debt securities. Collateral eligible for the Primary Dealer Credit Facility has been widened to "closely match the types of collateral that can be pledged in the tri-party repo systems of the two major clearing banks". If I understand this correctly it means that the Fed, for the first time ever, is prepared to accept equity as collateral. This gives us a glimpse into the exceptional circumstances they face.

Software Progress

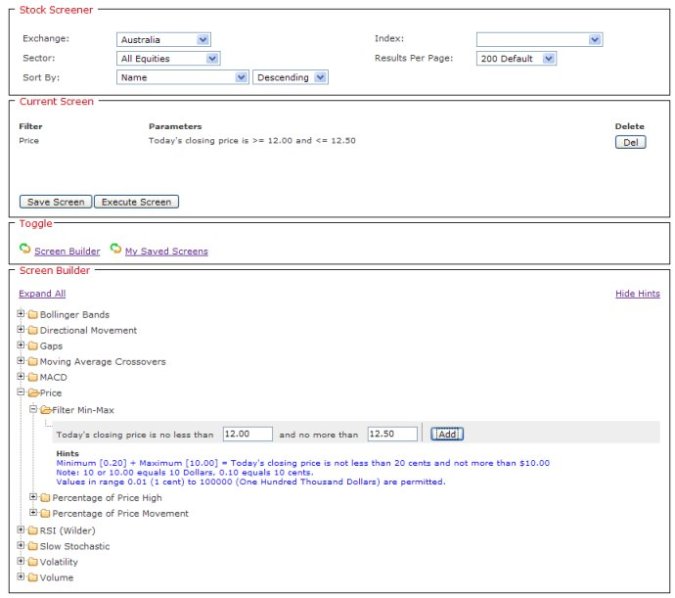

We have expanded our development team and are making good progress on the new stock screener. We hope to announce the first beta version in the next two weeks.

No problem can be solved until it is reduced to some simple form.

The changing of a vague difficulty into a specific, concrete form is a very essential element in thinking.

~

John Pierpont Morgan