Dollar Dominates

By Colin Twiggs

September 9, 2008 6:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

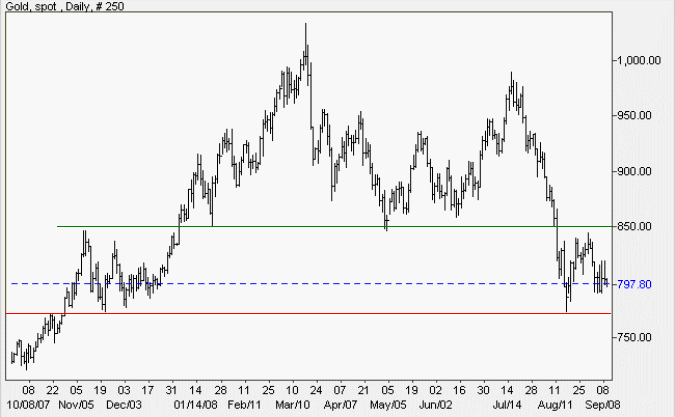

Gold

Spot gold is headed for another test of primary support at $770. Failure would offer a target of $700, calculated as $770 - ($850 - $770). Respect of support, on the other hand, would indicate further consolidation — and another test of $850.

Source: Netdania

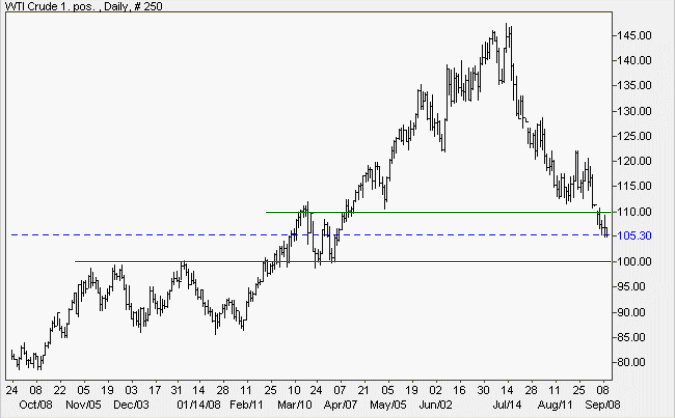

Crude Oil

West Texas Intermediate Crude broke through support at $110, warning of a primary down-trend. This would be confirmed if the key psychological level of $100 is broken. Global crude oil consumption is expected to slow as major economies edge into recession — driving prices lower.

Source: Netdania

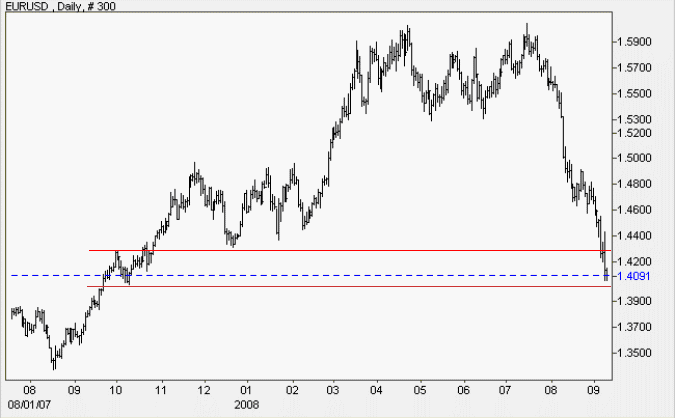

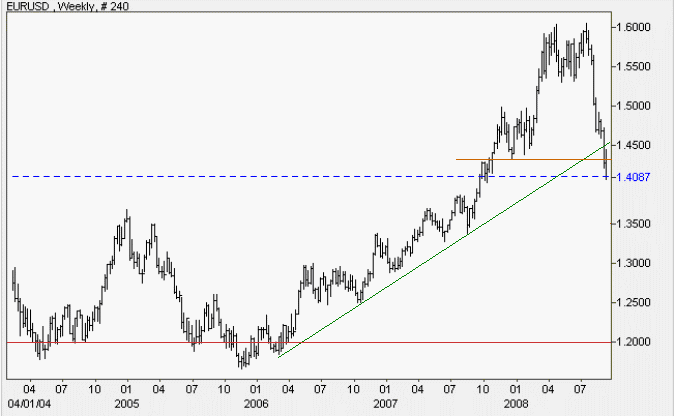

Currencies

The euro is in a strong down-trend, having broken support at $1.43.

Penetration of the long-term rising trendline also warns of a further decline. The calculated target is $1.26, that is $1.43 - ( 1.60 - 1.43 ), but long-term support at $1.20 appears a more likely candidate.

Source: Netdania

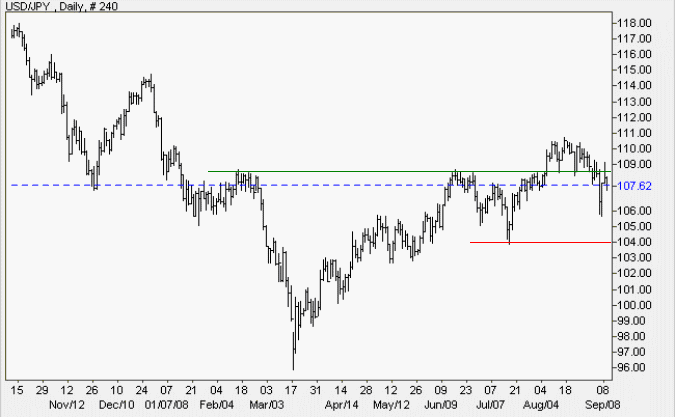

The dollar retraced to test the new resistance level after falling sharply through support at 108.50 against the yen. Respect of resistance is likely and would warn of a test of primary support at 103.50. Recovery above 111.00 is not expected, but would confirm the primary up-trend.

Source: Netdania

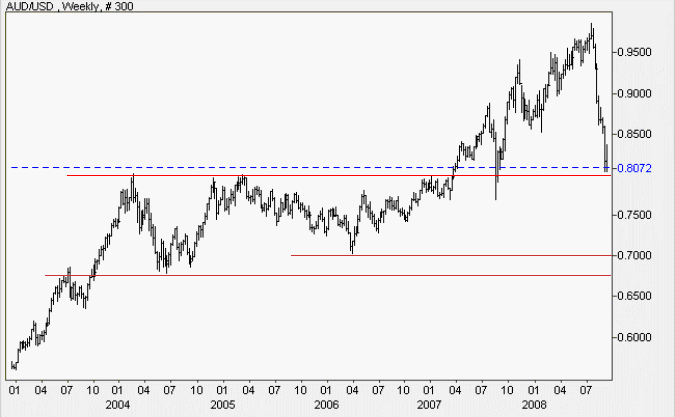

The Australian dollar is testing support at $0.80 against the greenback. Failure would test long-term support at $0.70.

Source: Netdania

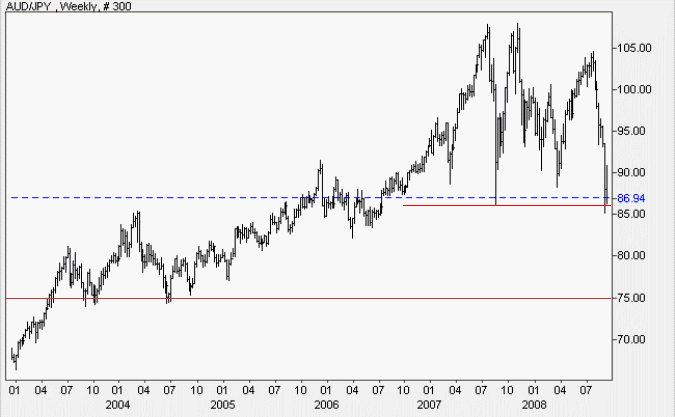

The Aussie is testing long-term support at 86 against the yen. Failure of support is likely — and would offer a target of 75.

Source: Netdania

Every day you spend drifting away from your goals is a waste not only

of that day, but also of the additional day it takes to regain lost

ground.

~ Ralph Marston

To understand my approach, please read About The Trading Diary.