Wedges and Pennants

By Colin Twiggs

September 2, 2008 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

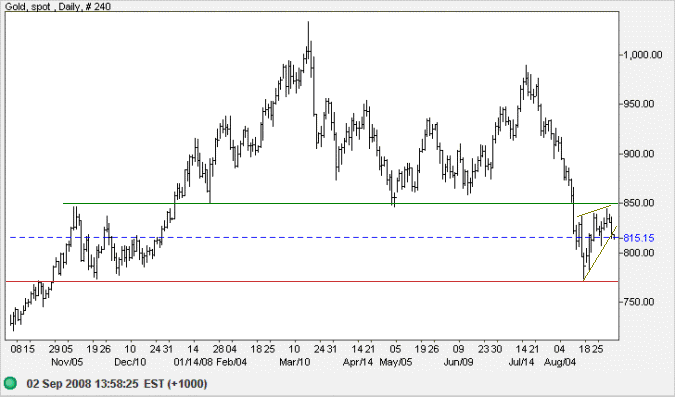

Gold

Spot gold respected the new resistance level at $850 before breaking downwards from its recent pennant. Although the pattern resembles a rising wedge, anything less than 3 weeks duration should be considered a pennant (continuation pattern). Expect another test of primary support at $770.

The long-term target for the primary down-trend is calculated as $700, that is $850 - ($1000 - $850).

Source: Netdania

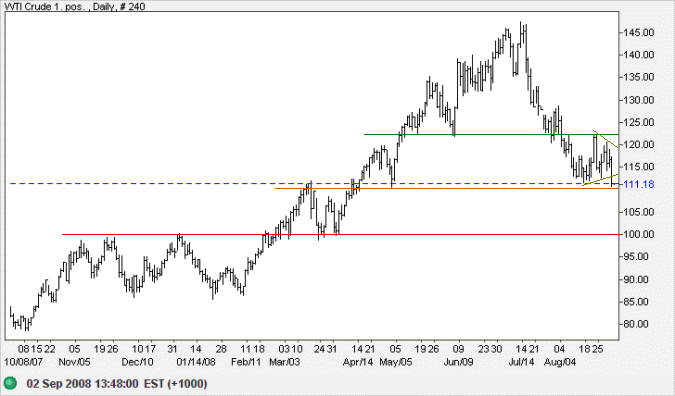

Crude Oil

West Texas Intermediate Crude completed a pennant (again the duration is too short to be a triangle) with a downward breakout, signaling further weakness. Penetration of support at $110 would warn of a primary down-trend — confirmed if the key psychological level of $100 is broken.

The Chinese Purchasing Managers Index (PMI) fell below 50 in August, indicating that activity is contracting. But whether this will translate into a drop in crude oil consumption (and a strong primary down-trend) is too soon to tell.

Source: Netdania

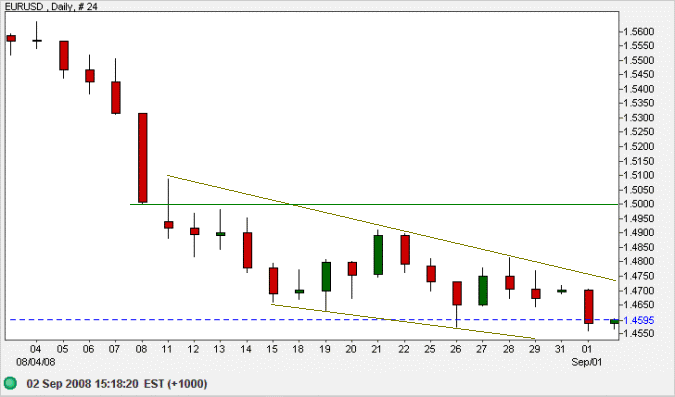

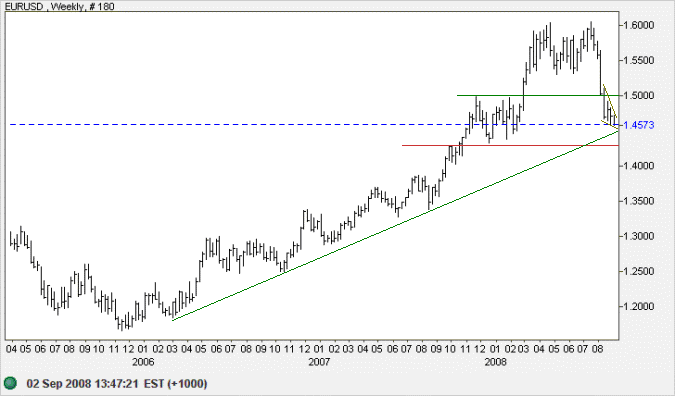

Currencies

The euro displays a falling wedge pattern, signaling retracement to test the new resistance level at $1.50.

Penetration of the long-term rising trendline would warn of a primary trend reversal — confirmed if support at $1.43 is broken.

Source: Netdania

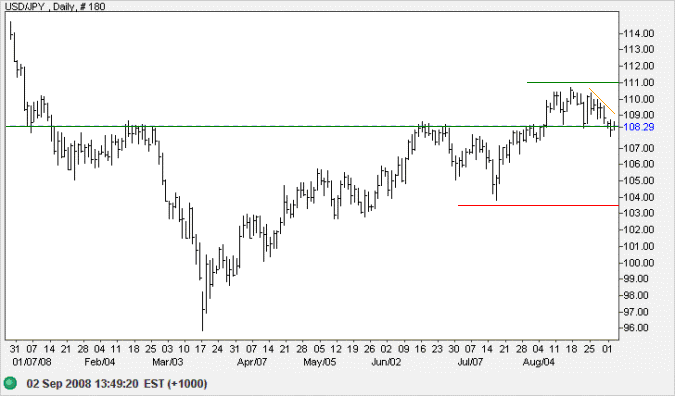

The dollar is again testing support at 108.50 against the yen. Downward breakout would warn of a bull trap — and a test of primary support at 103.50. Recovery above 111.00, on the other hand, would confirm the primary up-trend.

Source: Netdania

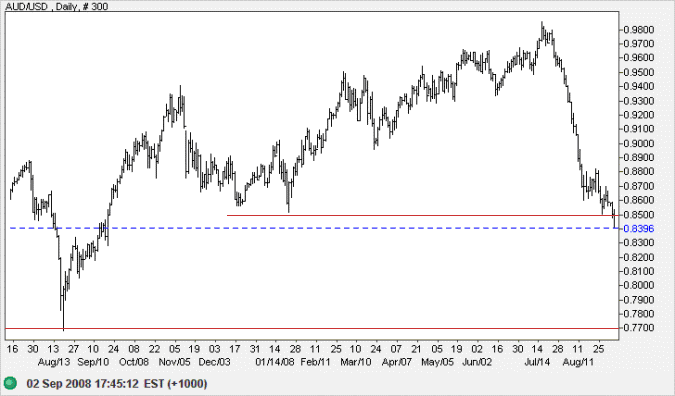

The Australian dollar fell sharply after the RBA announced a 0.25% reduction in the official cash rate, breaking support at $0.85 to signal a test of $0.77. Expect a retracement to test the new resistance level, but recovery above $0.85 is unlikely — and would warn of a bear trap.

Source: Netdania

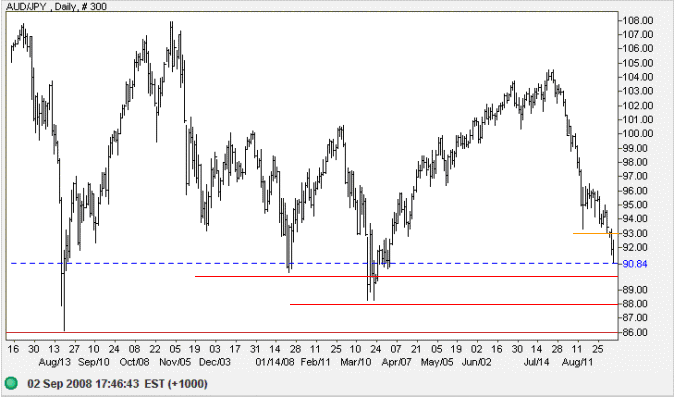

The Aussie broke through short-term support at 93 and is headed for the band of primary support between 88 and 90.

Source: Netdania

The whole history of civilization is strewn with creeds and institutions

which were invaluable at first, and deadly afterwards.

~ Walter Bagehot

To understand my approach, please read About The Trading Diary.