Crude Oil Depends On China

By Colin Twiggs

August 19, 2008 11:00 p.m. ET (1:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

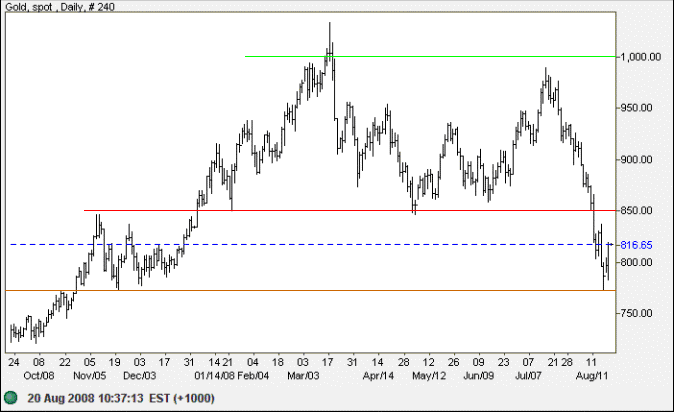

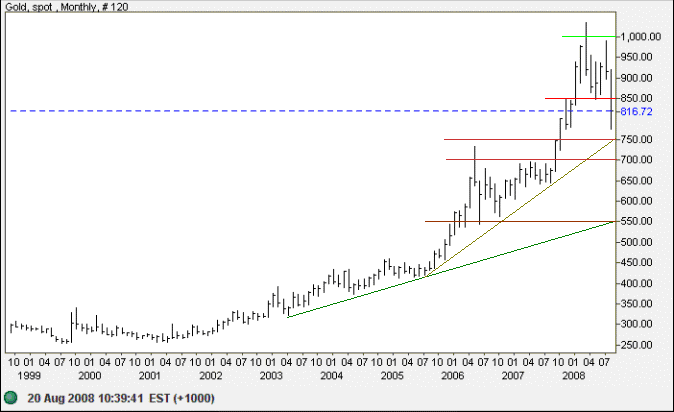

Gold

Spot gold found support at $770, the low of the December 2007 consolidation. Expect a retracement to test the new resistance level at $850.

In the long term, expect a band of support between $700 and $750. The calculated target for the primary down-trend is $700, that is $850 - ($1000 - $850).

Source: Netdania

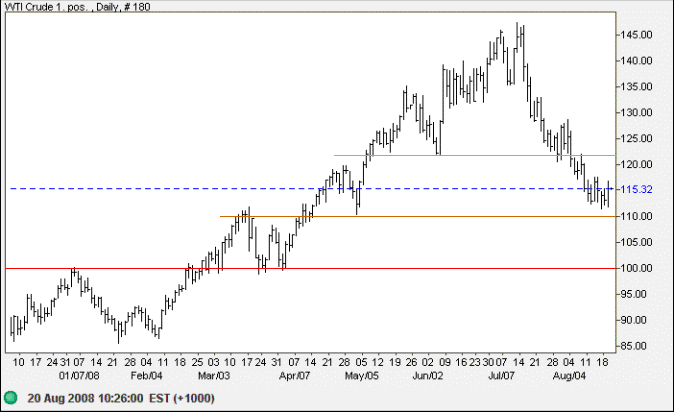

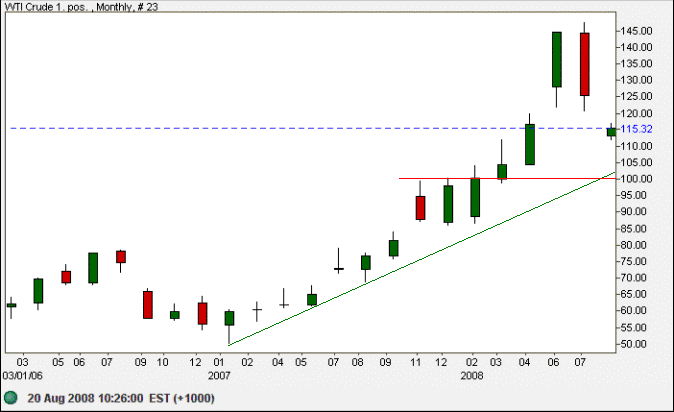

Crude Oil

West Texas Intermediate Crude is edging lower towards medium-term support at $110/barrel. Slowing of the decline indicates support and we are likely to see a retracement to test the new resistance level at $122. Falling demand, however, as the global economy heads for recession, should ensure that the retracement is short-lived.

Source: Netdania

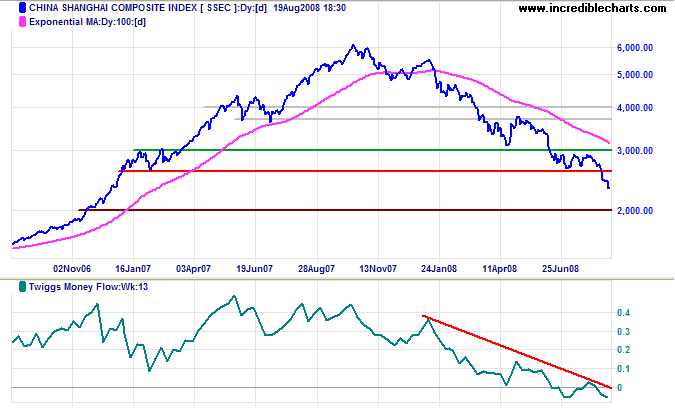

The rise in crude oil demand over the last 5 years, as discussed in last week's newsletter, is largely due to growth in demand from China. So far the Chinese economy has withstood the global slow-down, maintaining GDP growth above 10 percent per year. The Shanghai Composite index, however, has fallen more than 60 percent from its 2007 peak — an indication of what China can expect when the euphoria from the Olympics has faded. Falling crude oil demand from China would threaten long-term support at $100.

The calculated long term target is $122 - ($145 - $122). Failure of support would test the 2007 low of $50/barrel. This remains less than a 50% probability, however. And hope is not a strategy.

Source: Netdania

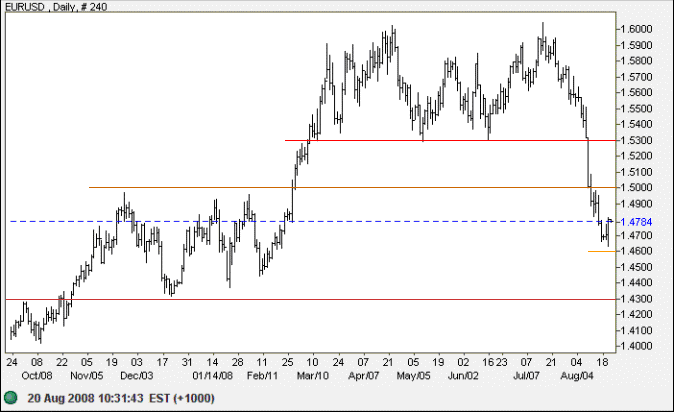

Currencies

The euro found short-term support at $1.46 and is likely to retrace towards $1.50. The calculated target is $1.46, that is $1.53 - ($1.60 - $1.53), but $1.43 remains a more likely long-term support level.

Source: Netdania

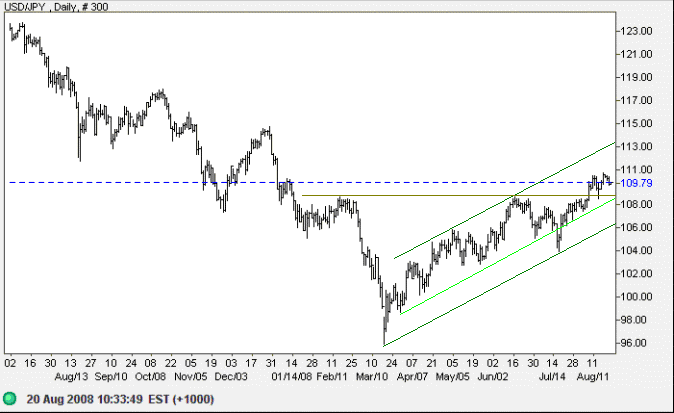

The dollar commenced a primary up-trend against the yen

after breaking through resistance at 108.50/109.00.

Expect retracement to test the new support level at 108.50;

respect would confirm the up-trend.

I have drawn two supporting trendlines:

the lower encapsulates all price activity,

while the upper ignores the two downward spikes.

Future respect of the latter would indicate trend strength.

Source: Netdania

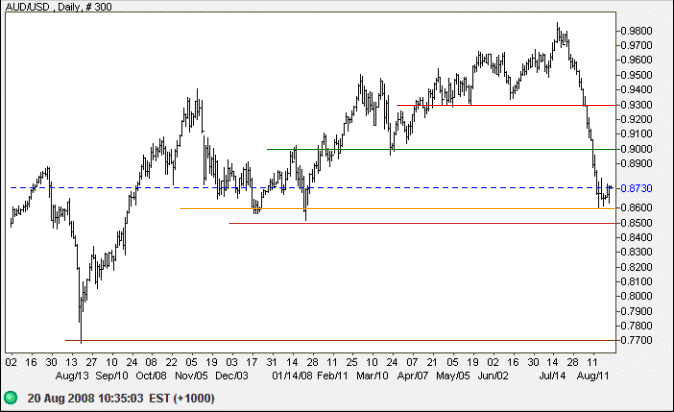

The Australian dollar has performed about as well as our Olympic cycling team: promising much and then crashing badly. It is now consolidating above a band of support between $0.85 and $0.86. Retracement would test $0.90, while failure of support would warn of a test of $0.77.

Source: Netdania

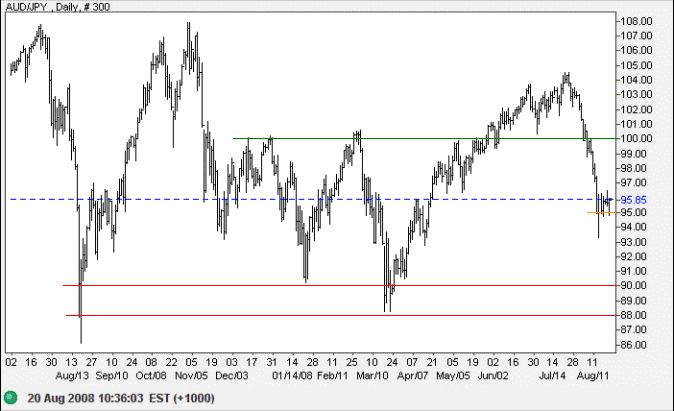

The Aussie found short-term support at 95. Retracement would be unlikely to reach 100, while failure of support would test primary support between 88 and 90.

Source: Netdania

The gold standard has one tremendous virtue: the quantity of the money supply,

under the gold standard, is independent of the policies of governments and political parties.

This is its advantage. It is a form of protection against spendthrift governments.

~

Ludwig von Mises

To understand my approach, please read About The Trading Diary.