Crude Finds Support

By Colin Twiggs

July 29, 2008 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

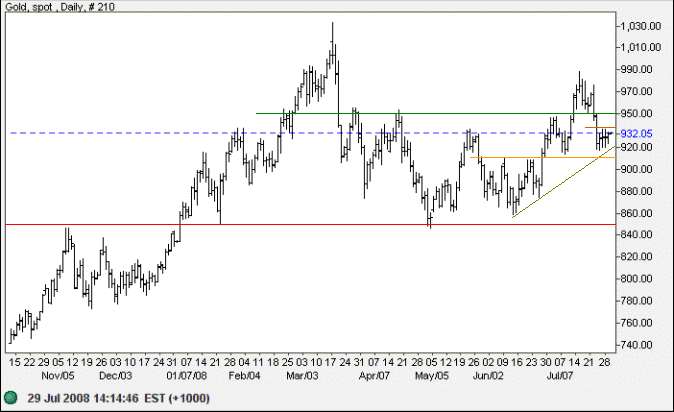

Gold

Spot gold reversed below $950 and is consolidating between $910 and $935. Failure of $910 would signal a test of primary support at $850, while reversal above $935 would indicate another attempt at $1000. Expect strong profit-taking at this important psychological barrier.

Source: Netdania

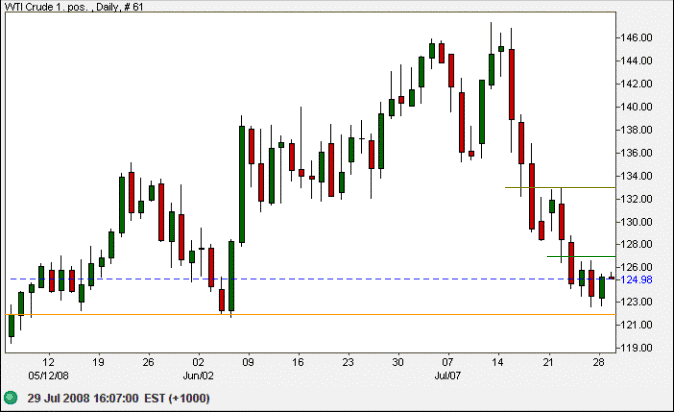

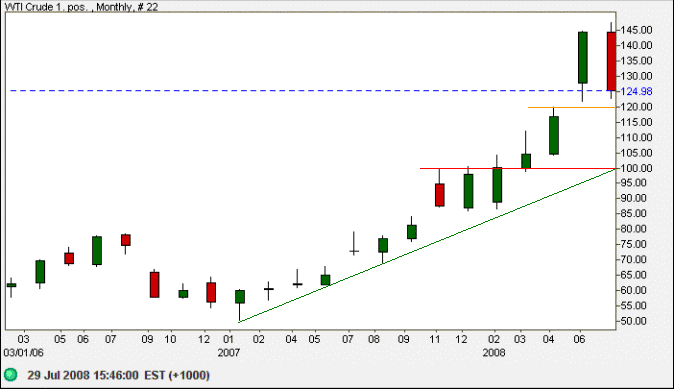

Crude Oil

West Texas Intermediate Crude is consolidating above medium-term support at $122/barrel. Continued narrow consolidation above the support level would be a bearish sign, threatening a test of primary support at $100. Recovery above $133 is less likely and would signal the end of the correction.

Penetration of primary support at $100/barrel, and the long-term trendline, remain unlikely.

Source: Netdania

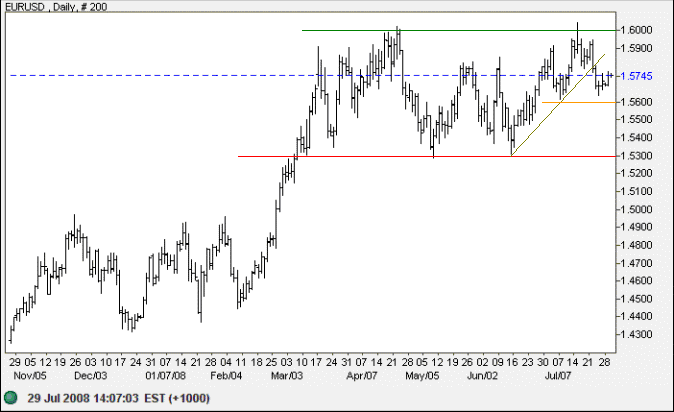

Currencies

The euro shows similar medium-term behavior to gold, retreating from a failed breakout above $1.60 to test medium-term support at $1.56. Failure of $1.56 would warn of a test of primary support at $1.53.

Source: Netdania

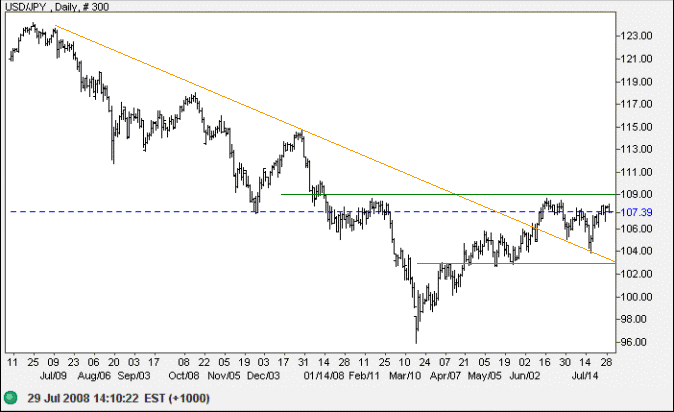

The dollar remains above the long-term descending trendline against the yen. Respect of support at 103 is a bullish sign — and breakout above 109 would signal a primary up-trend. Reversal below 103 is now unlikely and would warn of a test of 96 yen.

Source: Netdania

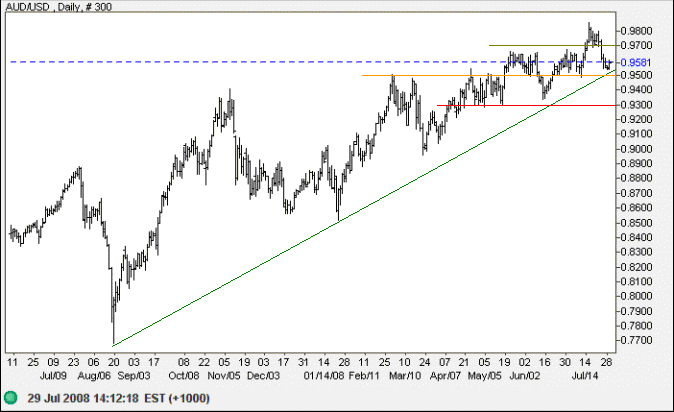

The Australian dollar reversed below $0.9700 and is testing medium-term support at $0.9500. Recovery above $0.9700 would indicate another attempt at parity, while failure of support would warn that the up-trend is weakening. A fall below $0.9300 remains unlikely — and would signal a primary trend change.

Source: Netdania

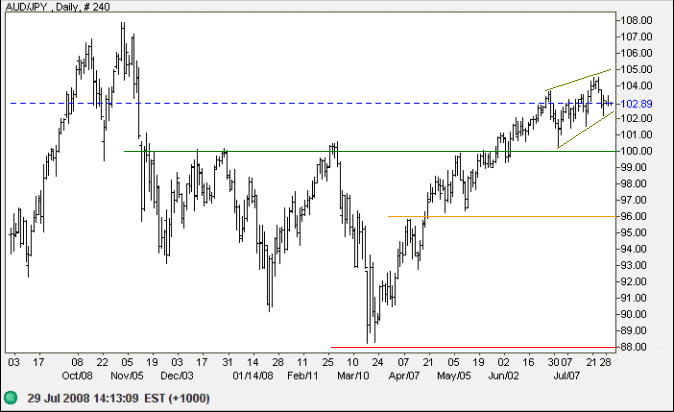

The Aussie formed a bearish rising wedge formation against the yen. Reversal below 102 would offer a target of 96, but this may not be achieved given strong support at 100. In the long term, the target for the broadening wedge pattern remains at 108 — with primary support at 88.

Source: Netdania

I sincerely believe that banking establishments are more dangerous than standing armies,

and that the principle of spending money to be paid by posterity, under the name of funding,

is but swindling futurity on a large scale.

~

Thomas Jefferson

To understand my approach, please read About The Trading Diary.