S&P 500 and All Ords Break Primary Support

By Colin Twiggs

July 3, 2008 8:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Stocks

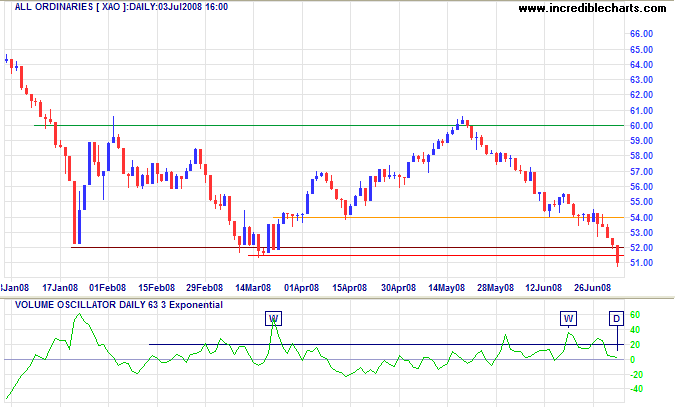

The Australian All Ordinaries broke through support at 5150 to signal another primary down-swing. Declining volume displays a lack of interest from buyers. Expect medium-term support at 4800, the June 2006 low, but the calculated target is 5200-(6000-5200)=4400.

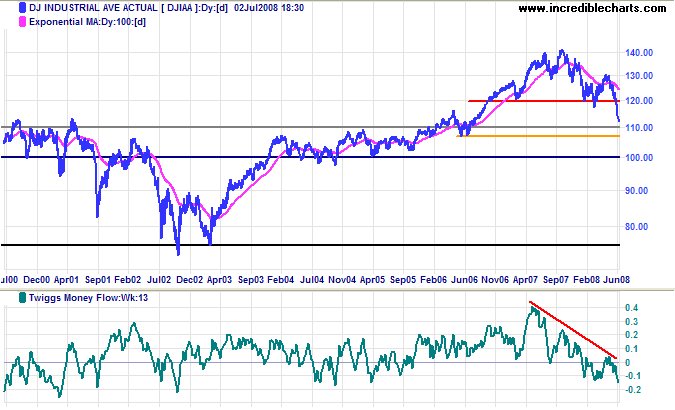

The Dow is likely to encounter support between 11000 and 10700 (the June 2006 low), but falling Twiggs Money Flow shows no sign of selling pressure easing.

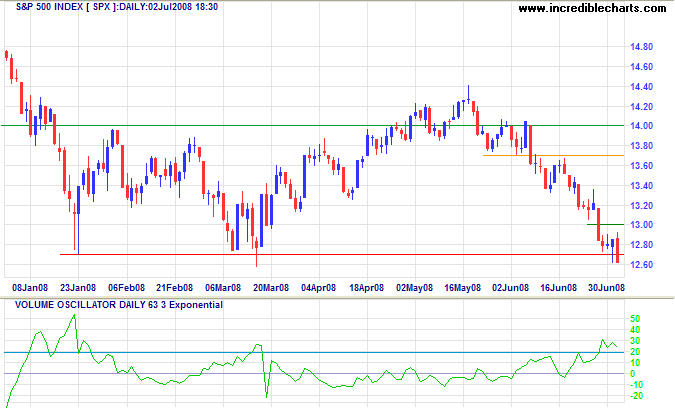

The S&P 500 overcame strong buying, indicated by rising volume, to break through primary support at 1270. The target is 1280-(1420-1280)=1140.

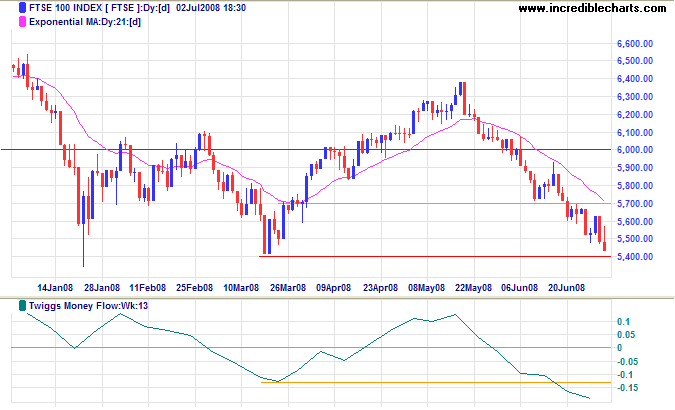

The FTSE 100 is testing primary support at 5400. Twiggs Money Flow below its March 2008 low warns that support is unlikely to hold — offering a target of 5400-(6400-5400)=4400.

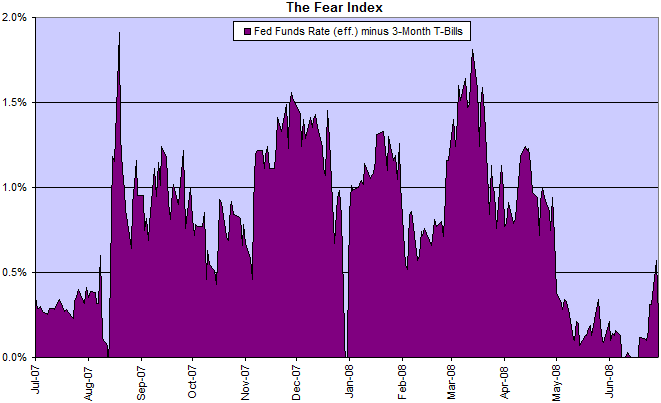

The Fear Index

The spread between the fed funds rate and 3-month T-bills gave a brief warning that all may not be right in financial markets, briefly spiking above 0.5 percent before returning to the green zone. The gap widens when institutional investors become concerned about the credit-worthiness of banks and resort to the safety of treasury-bills.

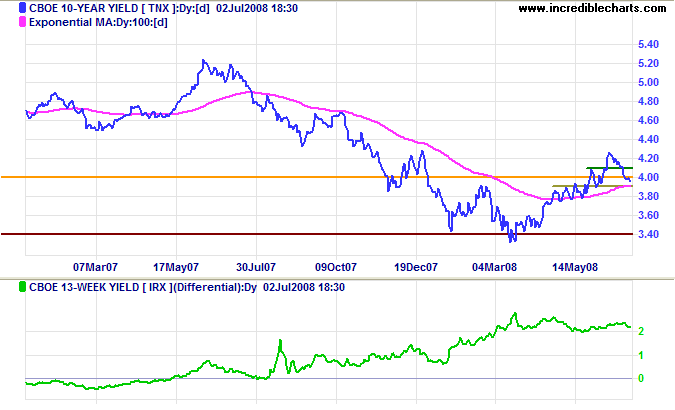

Treasury Yields

Ten-year treasury yields retraced to test support at 3.90 percent. Failure would warn of another test of primary support at 3.40 percent. The yield differential above 2.0 percent shows bank margins are relatively healthy (their troubles lie elsewhere: rising default rates and falling collateral values).

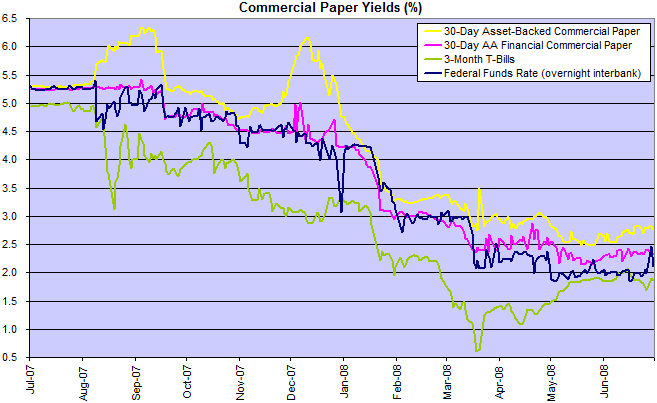

Financial Markets — Commercial Paper

The effective fed funds rate spiked above its 2 percent target while the short-term treasury bill rate dipped — reflecting investors concerns about financial markets. Commercial paper yields continue to rise, pressuring banks to reduce off-balance sheet funding and weakening institutions reliant on wholesale funding.

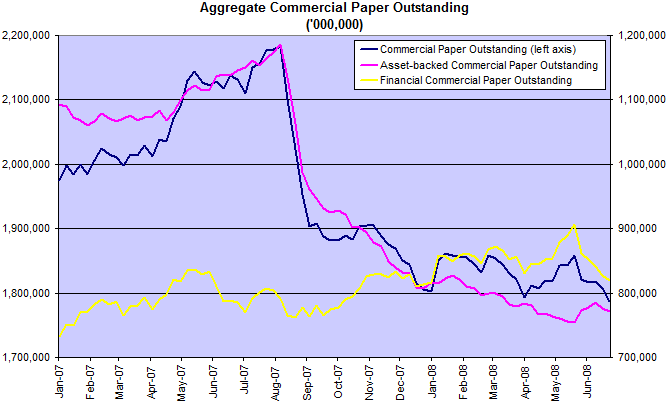

Total commercial paper in issue continues to decline, dipping below $1.8 trillion.

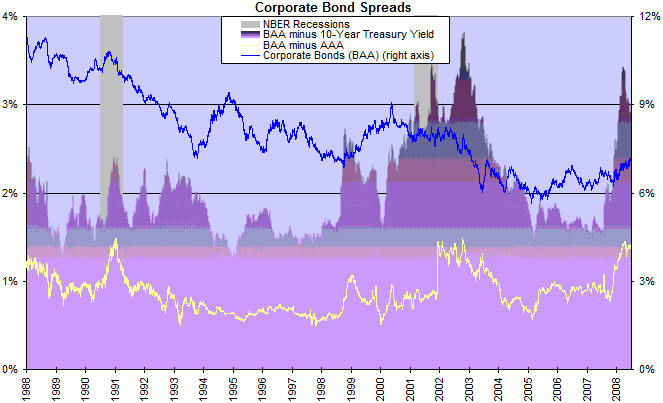

Corporate Bonds

Corporate bond yields are rising, slowing new investment.

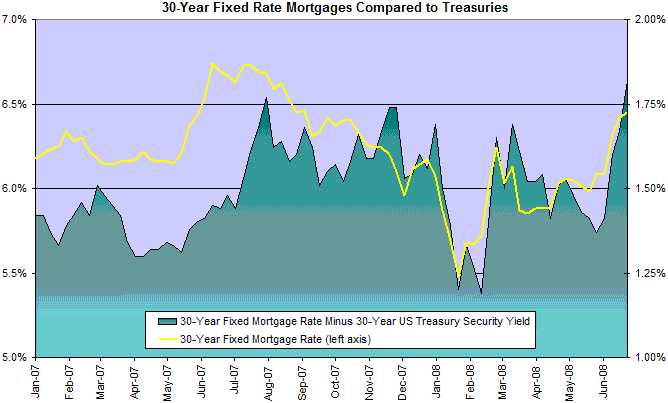

Housing

Fixed mortgage rates continue their rise, placing downward pressure on the housing market.

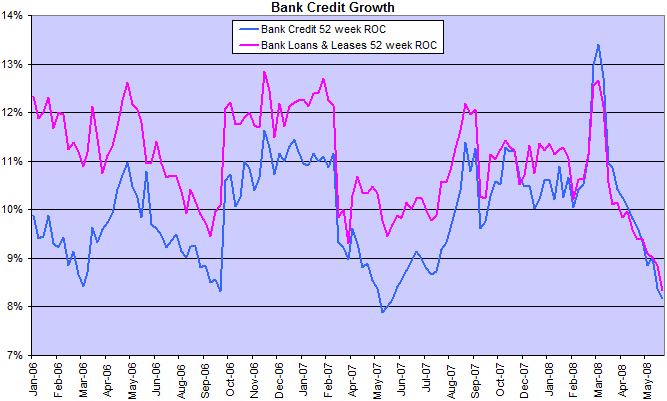

Bank Credit

Credit growth is falling as banks shore up their balance sheets. This will in turn affect consumption and new investment, slowing the economy.

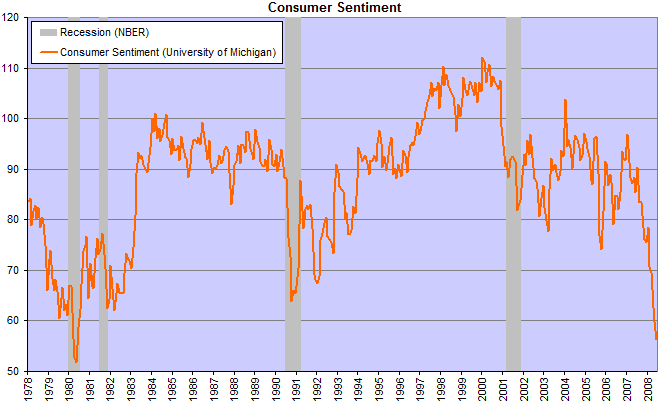

Consumers

Consumer sentiment is at its lowest level since 1980 and is bound to suppress spending, further slowing the economy.

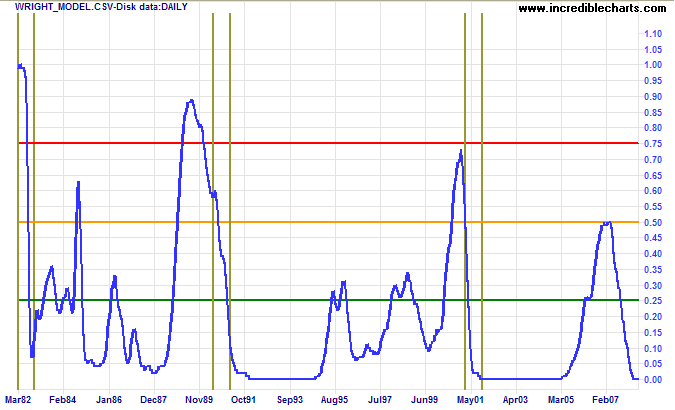

Wright Model

Jonathan Wright's recession prediction model remains at zero. The model looks four quarters ahead and does not reflect that we are currently in (or about to enter) a recession.

The greater the disaster, the simpler its cause (Lund's Law).

~ Henning Boetius: The Phoenix

(The root cause of the present turmoil is uncontrolled credit expansion over the past three decades.

And we face increasing instability if central banks continue to ignore this. — Colin)

To understand my approach, please read About The Trading Diary.