Banks Bull Trap

By Colin Twiggs

May 1, 2008 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

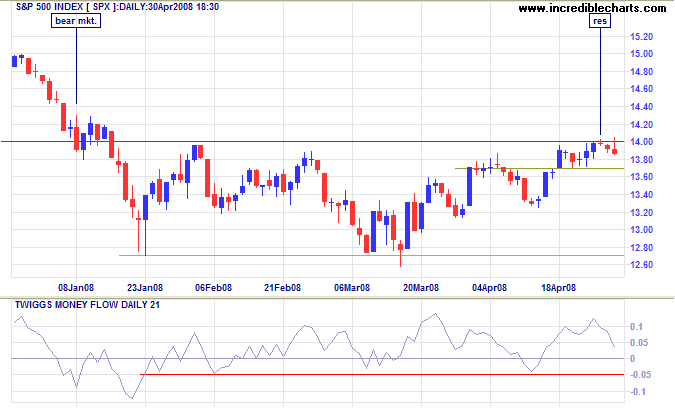

The S&P 500

The S&P 500 has so far failed to confirm the Dow's breakout, encountering strong selling pressure at 1400. Reversal below 1370 would signal that the (medium-term) up-trend is weakening, while a Twiggs Money Flow fall below -0.05 would warn of another primary decline. We need to remind ourselves that:

- this is a bear market;

- there is strong overhead resistance;

- we cannot use low price-earnings ratios to justify current prices: analysts are slow to react to a trend change and earnings tend to halve (from peak to trough) during a recession.

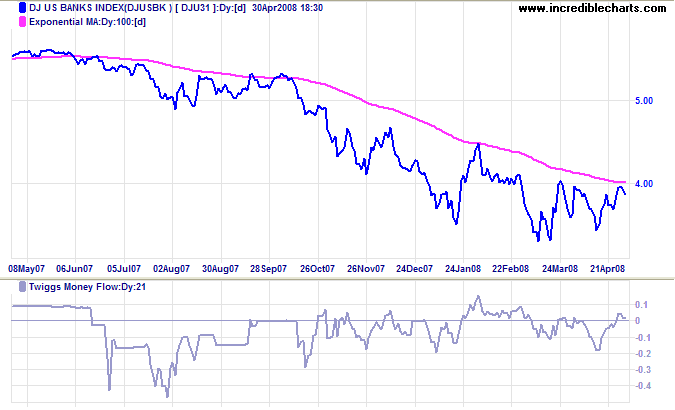

Several readers have mentioned that they believe there are opportunities in banks and investment houses. These may look cheap but are highly leveraged and a collapsing housing market is capable of further eroding their reserves. Twiggs Money Flow holding below the zero line signals continued distribution.

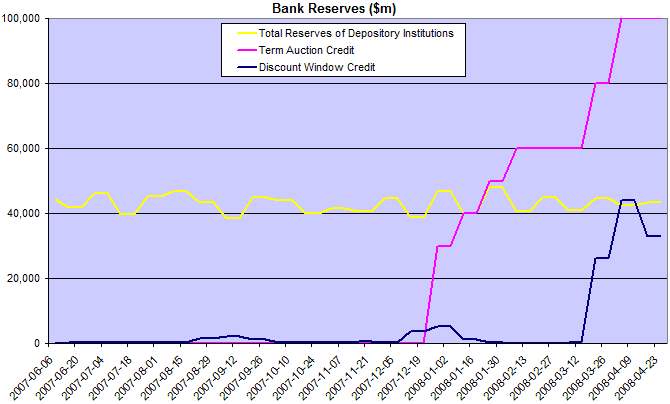

The Fed is currently propping up the banks, with discount window borrowings close to total bank reserves — and a further $100 billion advanced through the Term Auction Facility. Any attempt to reduce support would place upward pressure on interest rates.

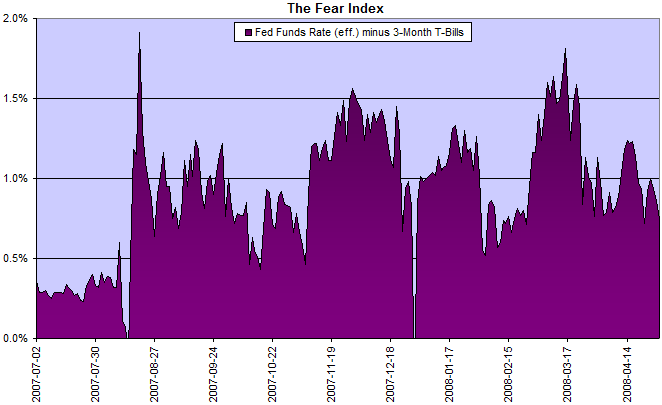

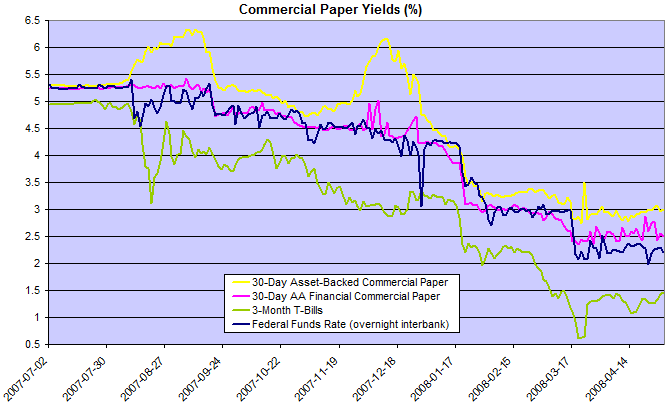

The Fear Index

The spread between the fed funds rate and 3-month T-bills remains in the amber (medium) risk area, between 0.5 and 1 percent. Investors remain wary of inter-bank and commercial paper markets, preferring the safety of treasurys.

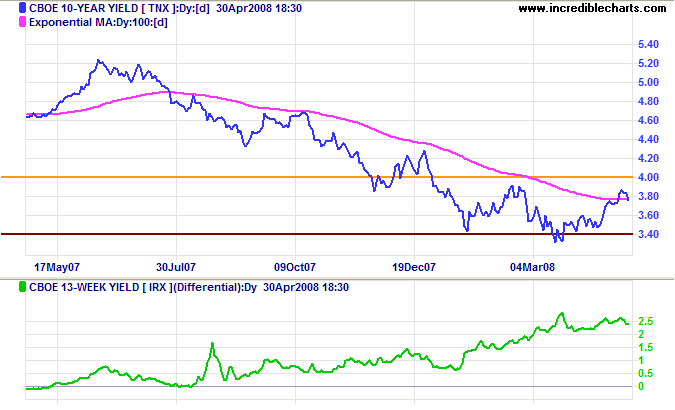

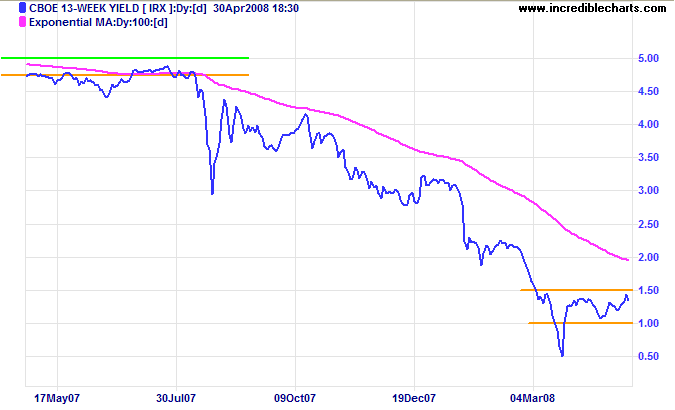

Treasury Yields

Ten-year treasury yields are consolidating between 3.40% and 4.00%. The high yield differential shows that bank margins have recovered, but financial markets will continue to suffer the effects of the 2006/2007 negative yield differential for the rest of 2008 — and probably even longer.

Three-month treasury bill yields are consolidating between 1.00% and 1.50% despite the fed funds rate being cut to 2.0%. Upward breakout would signal recovery, while a fall below 1.00% would warn of further instability.

Financial Markets — Commercial Paper

Asset-backed commercial paper now commands a premium of 100 basis points over the target fed funds rate, while financial paper yields a 50 BP premium, as investors either shun new issues or demand sizable risk premiums.

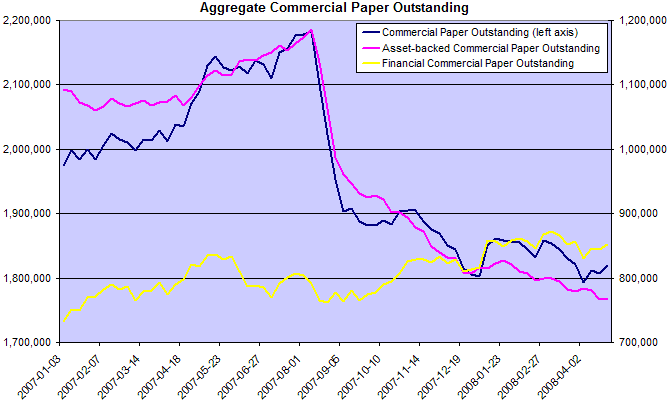

Total asset-backed commercial paper continues to fall, and over time is expected to decline much further — increasing the credit squeeze as corporate clients look to banks for replacement finance.

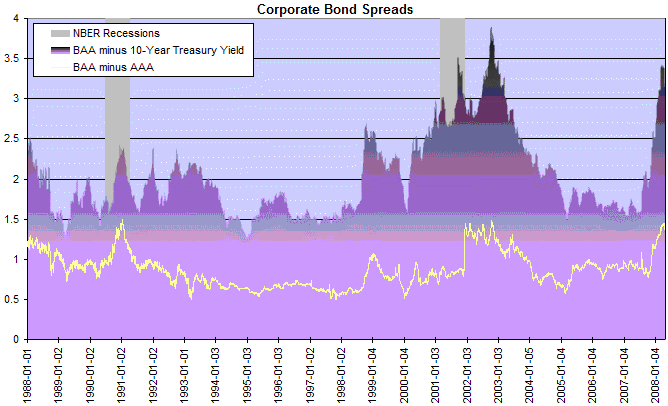

Corporate Bonds

The credit squeeze is further highlighted by rising spreads on corporate bonds, affecting not only earnings, but, more importantly, new investment.

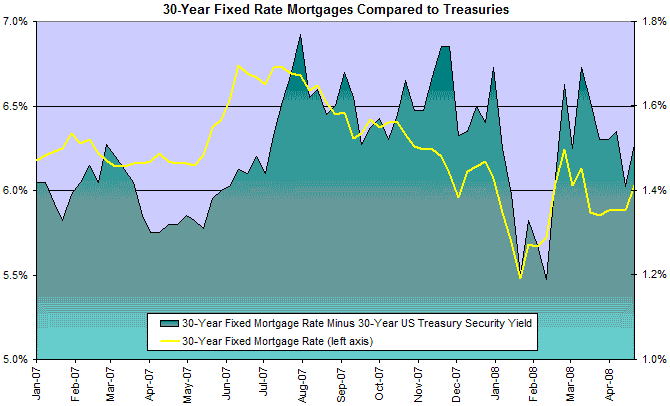

Housing

Thirty-year Fixed Mortgage rates are rising as further losses in the housing market appear likely.

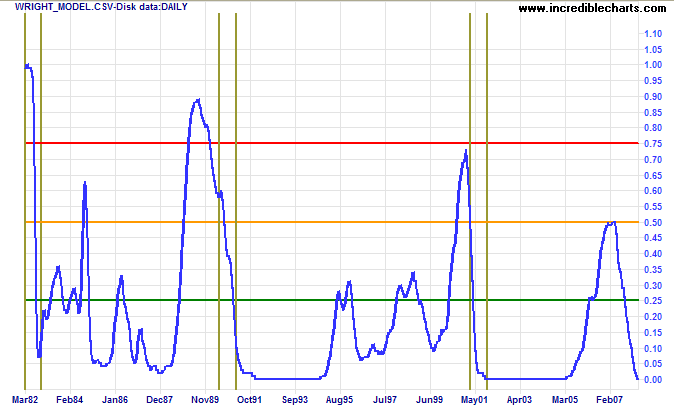

Wright Model

Jonathan Wright's recession prediction model shows that probability of a recession four quarters ahead has fallen to zero. The spike in late 2007 relates to the current crisis, but I believe that it understated the probability of a recession — and should have registered between 80 and 100 percent. The model underestimates the damage a negative yield curve can cause in a low interest rate environment.

No real English gentleman, in his secret soul, was ever sorry for the death of a political economist.

~ Walter Bagehot.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.