Banks Face Further Pressure

By Colin Twiggs

April 17, 2008 3:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

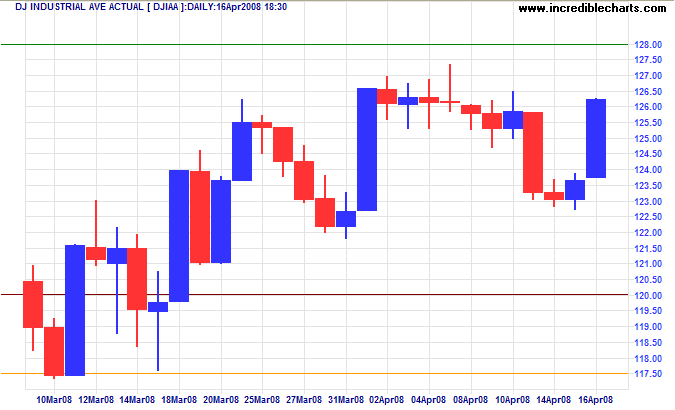

The Dow

The Dow Jones Industrial Average closed more than 2 percent higher, rallying on news that JPMorgan had exceeded earnings expectations. The response is strange as the New York-based bank reported earnings of $2.37 billion — a fall of 50 percent. And the situation would have been far worse but for a $1.5 billion pretax gain from the sale of its share in the recently listed Visa Inc. (Associated Press). We need to remind ourselves that:

- this is a bear market;

- there is strong overhead resistance at the former primary support level of 12800;

- sharp rises are typical of a bear market rally — while in a bull market retracements are sharp and prices tend to advance at a more measured pace.

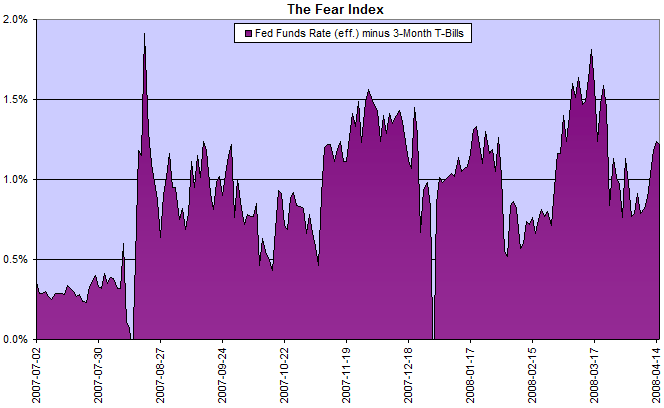

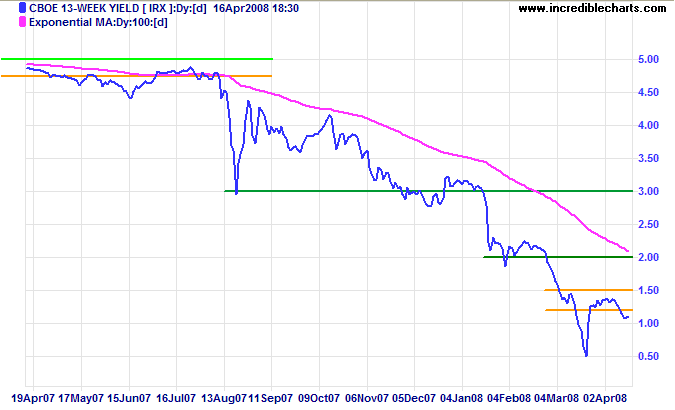

The Fear Index

The spread between the fed funds rate and 3-month T-bills reversed back into the danger area above 1 percent. The shift from long-term to short-term maturities contributed to falling T-bill yields, but the widening spread demonstrates that investors continue to shun inter-bank and commercial paper markets, preferring the safety of treasuries.

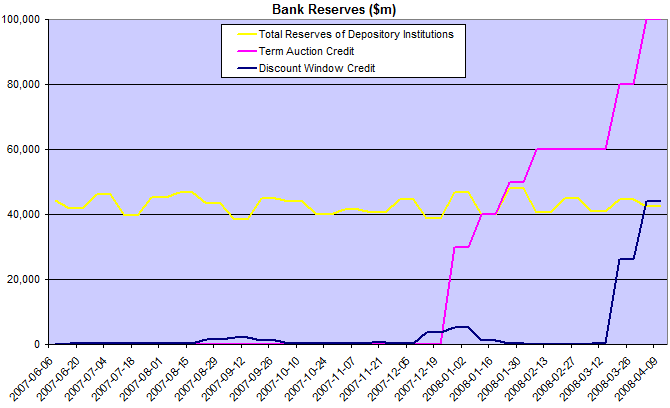

The Fed faces the worst financial crisis since the 1930s, with banks forced to raise new capital, in order to maintain their capital ratios, at the worst possible time. The cost of capital is at its highest in a bear market. Banks have also borrowed record amounts from the Fed. Discount window borrowings now exceed total bank reserves — with a further $100 billion advanced through the Term Auction Facility. Available data goes back to 1960 and the previously recorded high for borrowed reserves was 32% (of total reserves) in 1984.

Pronouncements that the crisis is close to an end appear premature.

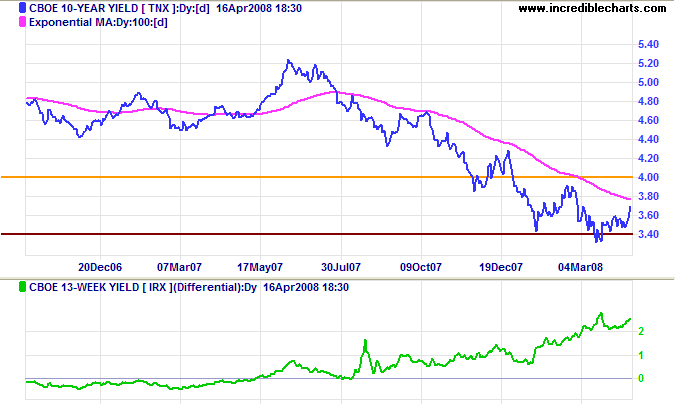

Treasury Yields

Ten-year treasury yields found support at 3.40%, rallying sharply as inflation expectations start to rise (Bloomberg). The primary trend remains down, but we are likely to see further consolidation between 3.40% and 4.00%. The high yield differential shows that bank margins have recovered, but financial markets will continue to suffer the after-effects of the 2006/2007 negative yield differential for the rest of 2008. And there is growing support for the view that the slow-down in consumer spending may extend as far as 2010.

Three-month treasury bill yields are headed for another test of 0.50%, warning of further instability in financial markets.

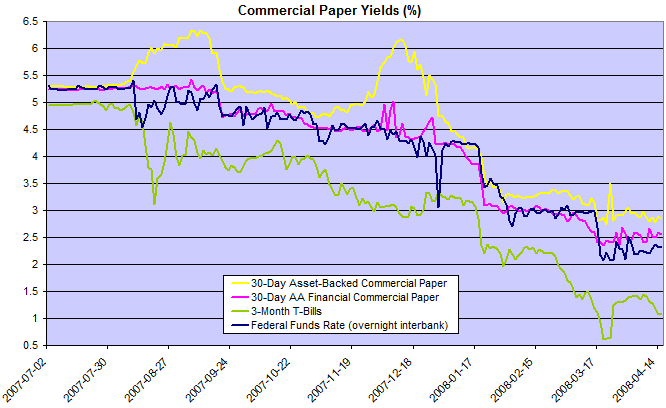

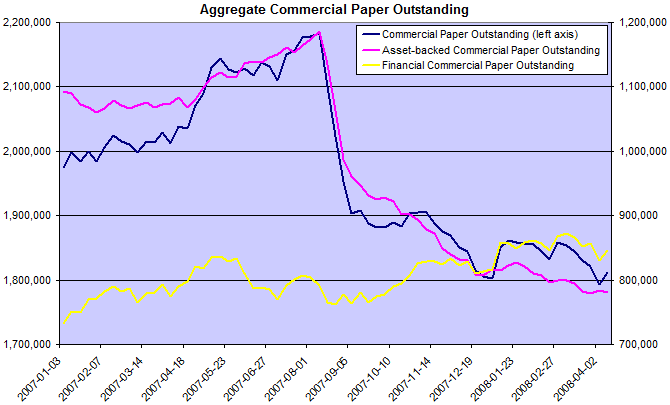

Financial Markets — Commercial Paper

Asset-backed and financial commercial paper yields are noticably higher than the fed funds rate — a risk premium not normally seen in stable conditions.

Total asset-backed commercial paper is falling, further exacerbating the credit squeeze as corporate clients look for replacement finance.

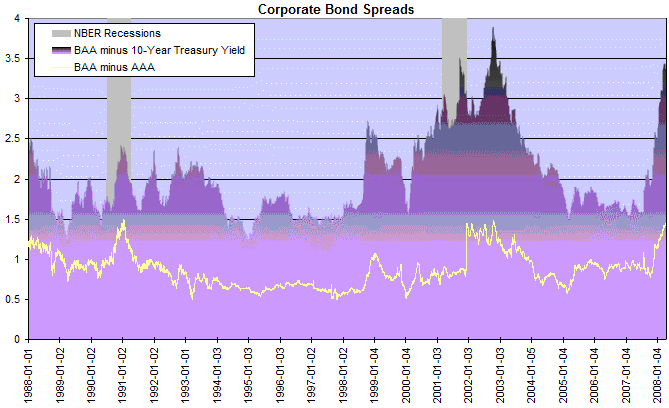

Corporate Bonds

Rising corporate bond spreads will impact on current earnings and curtail new investment.

Housing

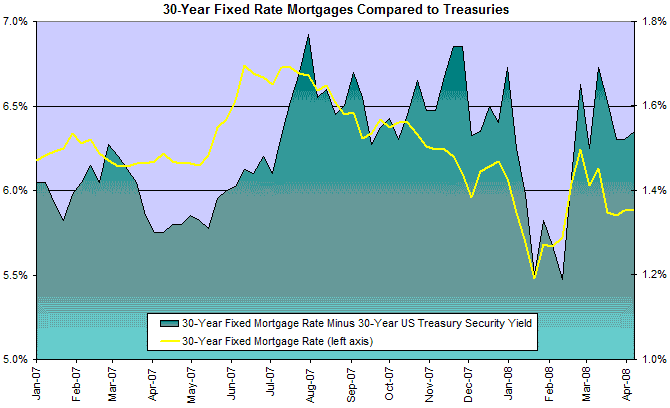

The 30-Year Fixed Mortgage Rate spread with 30-Year Treasury Bonds indicates continued aversion to lending in the housing market.

Bank Credit

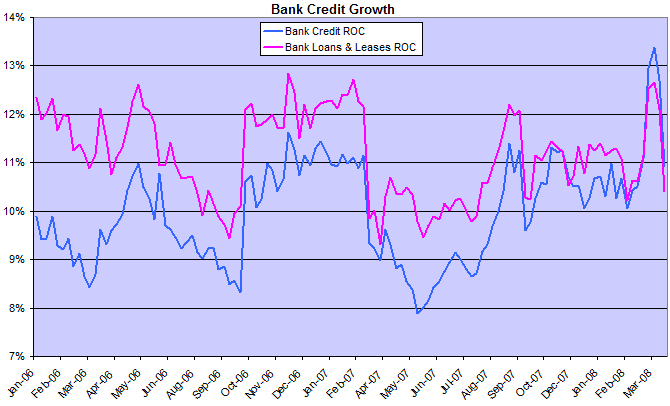

Bank credit growth is falling, but does not show the full picture, with sharp falls in off-balance sheet funding.

Consumers

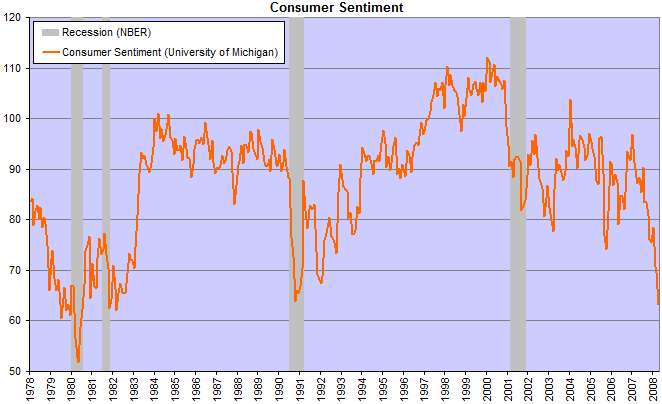

Consumer sentiment has fallen to levels last seen in 1991, warning of a recession.

Employment

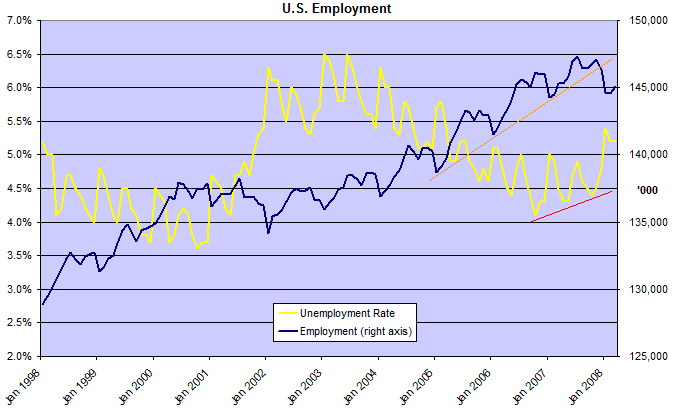

Unemployment is trending upwards after breaking above 5%. Employment is likely to consolidate, as in recent recessions, rather than trend downwards — which would warn of a depression.

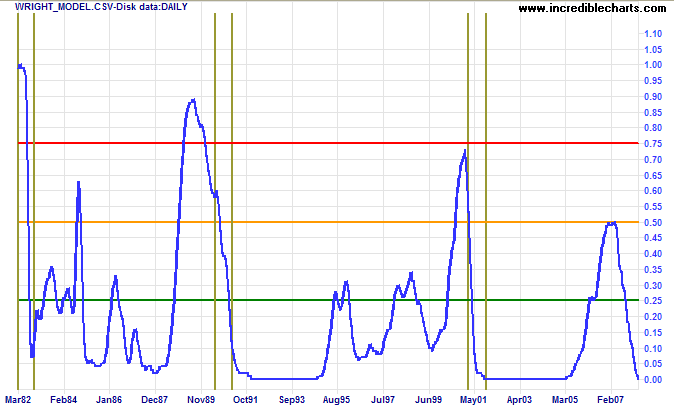

Wright Model

Jonathan Wright's recession prediction model shows that probability of a recession four quarters ahead has fallen to zero. There appears to be some confusion about the model: the spike in late 2007 relates to the current crisis, but I believe that it understated the probability of a recession — and should have registered between 80 and 100 percent. The model underestimates the damage a negative yield curve can cause in a low interest rate environment.

Some readers have requested that I continue to publish the chart as they find it useful.

I have always wished for my computer to be as easy to use as my telephone;

my wish has come true because I can no longer figure out how to use my telephone.

~ Bjarne Stroustrup.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.