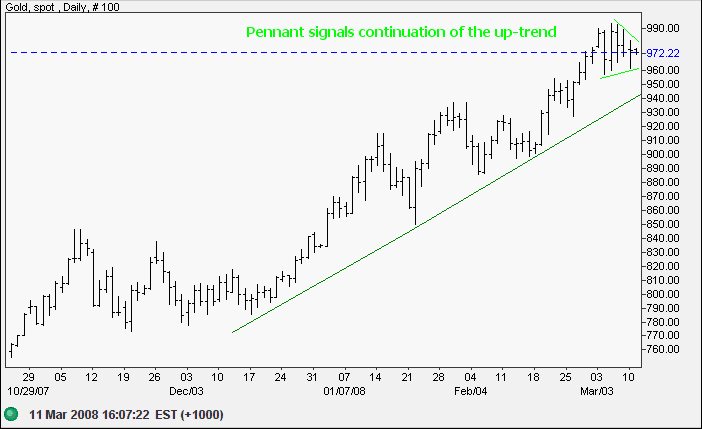

Gold Pennant

By Colin Twiggs

March 11, 2008 3:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Gold

Spot gold formed a small pennant between $960 and $990, signaling continuation of the up-trend. Expect another test of the key psychological level of $1000/ounce. Continued narrow consolidation below the resistance level would be a strong bull signal. Retracement below the rising green trendline, on the other hand, is unlikely — and would warn that the up-trend is weakening.

Source: Netdania

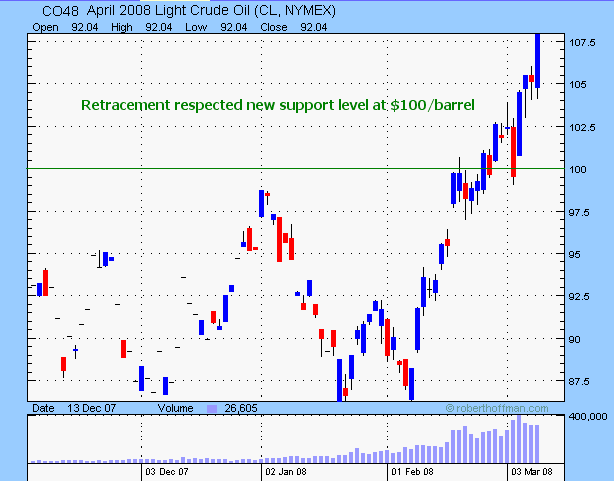

Crude Oil

April 2008 Light Crude respected support at $100 to confirm the up-trend. The medium-term target is 100+(100-86)=$114.00 per barrel.

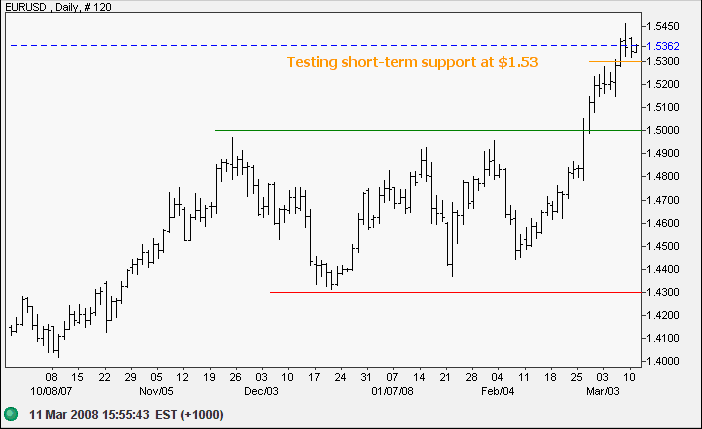

Currencies

The euro is testing short-term support at $1.53.

Penetration would warn of a retracement to test the new support

level at $1.4950/$1.5000 — which would afford traders an

excellent entry point.

Retracements and advances tend to be symmetrical, with price

advance after a breakout roughly equal to the previous

retracement. The medium-term target for the upward breakout is

therefore calculated as 1.50+(1.50-1.43)=$1.57.

Source: Netdania

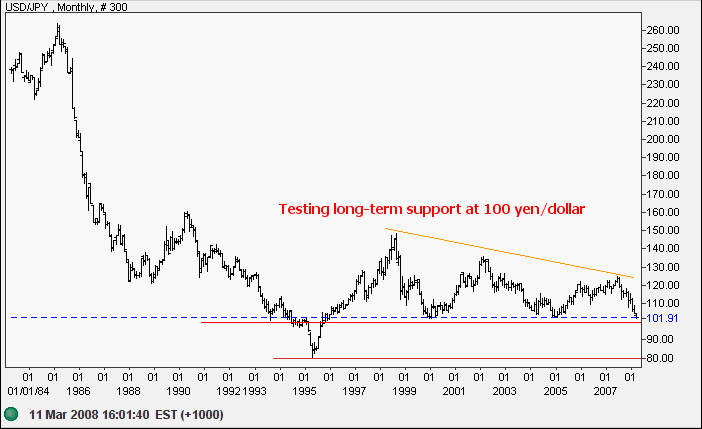

The dollar is headed for a test of long-term support at 100 yen. The descending triangle on the monthly chart warns that support is likely to fail — which would test the all-time low of 80.

Source: Netdania

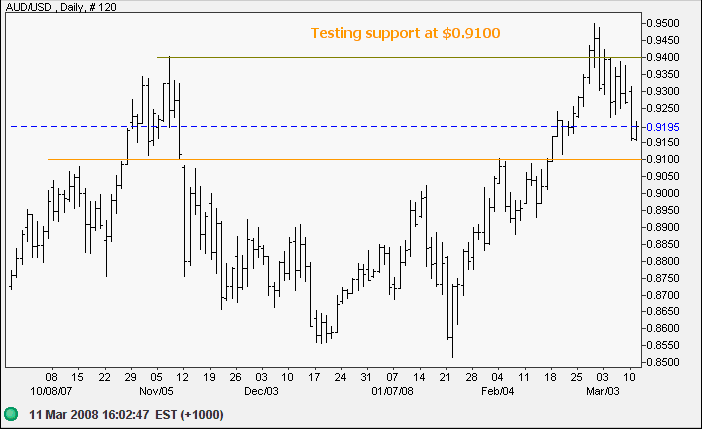

The Australian dollar is headed for a test of medium-term support at $0.91. Failure would warn of a test of primary support at $0.85. Respect of support remains as likely, however, and would signal another test of resistance at $0.94/0.95.

Source: Netdania

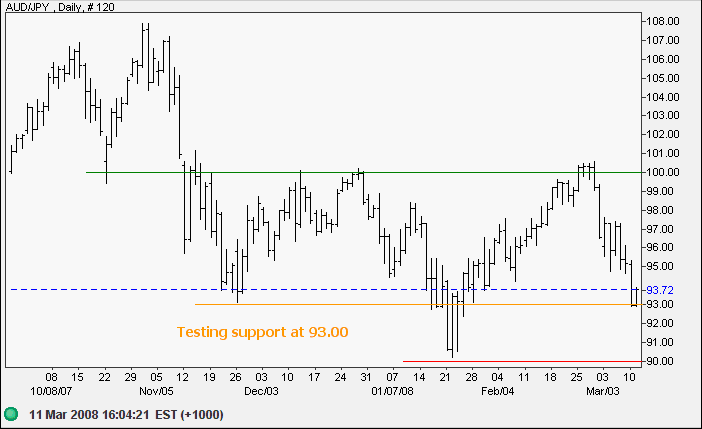

The Aussie is similarly testing medium-term support at 93 against the yen. Failure would mean a test of primary support at 90; while respect of support would indicate retracement to test resistance at 100. The first option (failure) is more likely, because of the prevailing down-trend. In the long-term, a fall below 90 would signal continuation of the down-trend — with a target of 90-(100-90)=80.

Source: Netdania

I remember when I first came to Washington. For the first six

months you wonder how the hell you ever got here. For the next

six months you wonder how the hell the rest of them ever got

here.

~

Harry S Truman.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.