Crude At $100

By Colin Twiggs

February 26, 2008 3:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

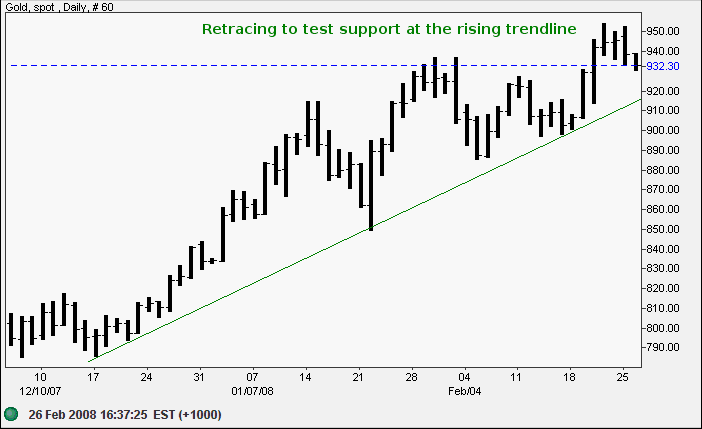

Gold

Spot gold is retracing to test the rising trendline, after encountering resistance at $950. Failure of the trendline would warn that the up-trend is slowing; respect would indicate another test of $950.

Source: Netdania

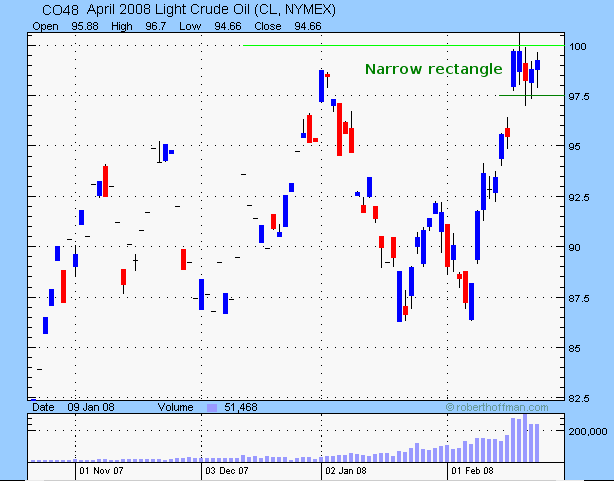

Crude Oil

April 2008 Light Crude is forming a narrow consolidation below resistance at $100/ barrel. This is a bullish formation, signaling accumulation. Reversal below $97, however, would indicate that the pattern has failed and primary support at $86 is to face another test.

Currencies

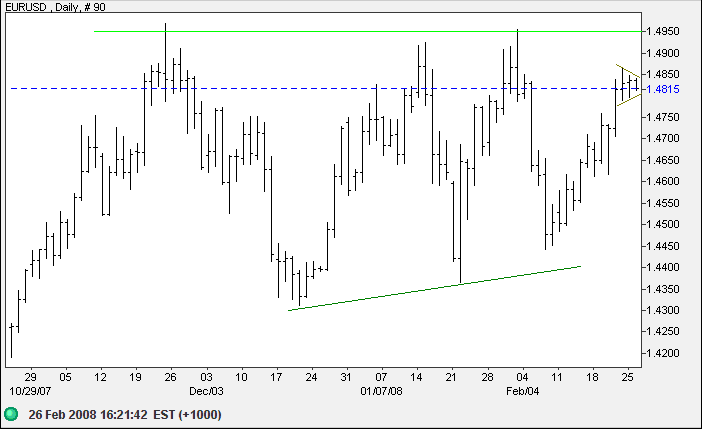

The euro formed a small

pennant above $1.4800, likely to resolve in a test of

resistance at $1.4950. Downward breakout, however, would test

support at $1.4450.

In the long term, broad consolidation below the key psychogical

level of $1.50 indicates extensive profit-taking and the

outcome remains unclear. Upward breakout would offer a target

of 1.50+(1.50-1.43)=$1.57; while reversal below $1.43, though

less likely at present, would reverse the primary up-trend.

Source: Netdania

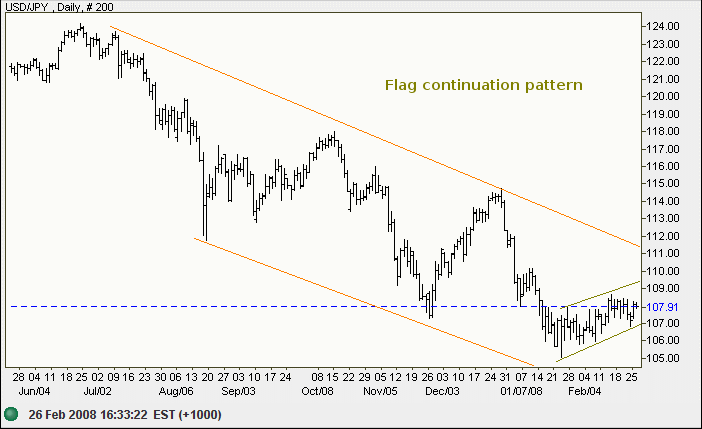

The dollar continues in a long down-trend against the yen, with a target of 100. In the short-term, the flag formation is likely to resolve in continuation of the down-trend.

Source: Netdania

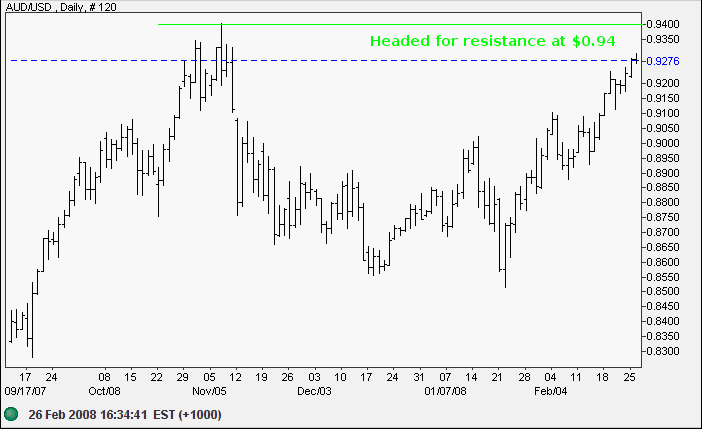

The Australian dollar is headed for a test of $0.94, after breaking through $0.91. In the long-term, breakout above $0.94 would offer a target of parity; while reversal would indicate a test of $0.85.

Source: Netdania

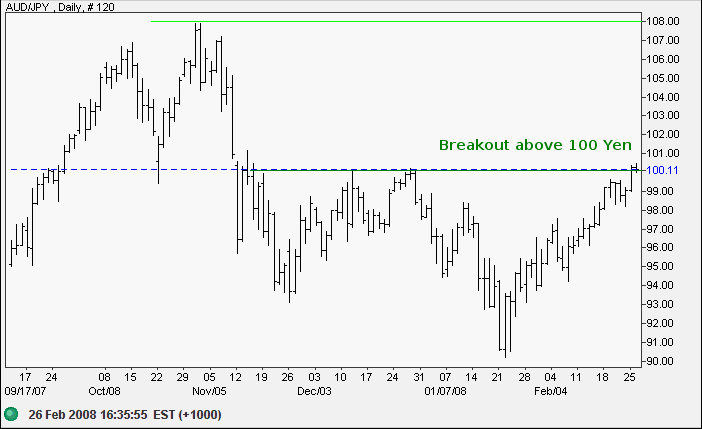

The Aussie broke through resistance at 100 against the yen, indicating a test of 108. Resistance when broken becomes support — expect a (short-term) retracement to test the new support level.

Source: Netdania

I was twenty when I made my first ten thousand, and I lost

that. But I knew how and why – because I traded out of

season all the time; because when I couldn’t play

according to my system, which was based on study and

experience, I went in and gambled. I hoped to win, instead of

knowing that I ought to win on form.

~ Jesse Livermore in Edwin Lefevre's

Reminiscences Of A Stock Operator

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.