Bear Market Consolidation

By Colin Twiggs

February 16, 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

Moody's Investors Service stripped bond insurer FGIC of its Aaa rating, indicating that other bond insurers are also under review (Bloomberg). Banks who bought CDO protection face further write-downs if bond insurers lose their investment rating. Estimates range from $70 billion (Oppenheimer & Co) to $200 billion (UBS). While this assessment may appear gloomy, we should not under-estimate the domino-effect that a collapsing housing market can have on the broader financial sector.

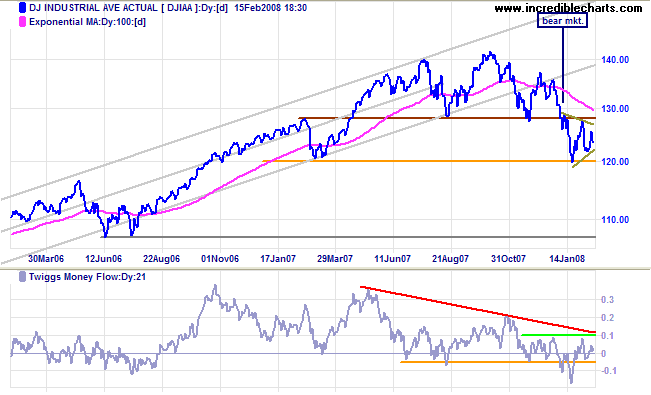

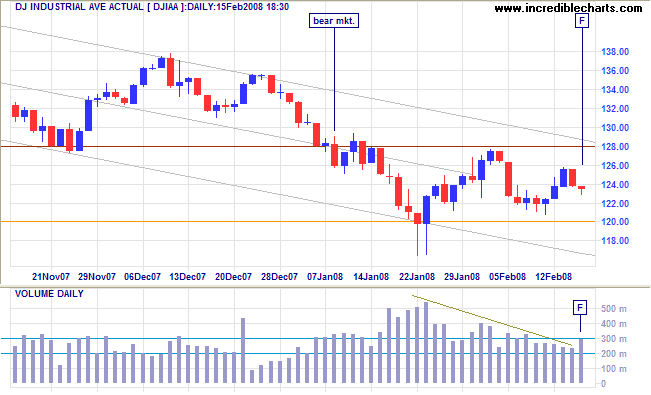

Dow Jones Industrial Average

The Dow is consolidating in a triangle formation between 12000

and 12800 (the former primary support level). Expect a

continuation of the down-trend with a medium-term target of

12000-(12800-12000)=11200.

The long-term target for a "soft landing" would be 11000; while

a "hard landing" would test 10000 (a 30 percent retracement).

If any readers are planning to ride out the down-turn, bear in

mind that depression resulting from a financial sector

melt-down remains a remote possibility — and would cause

at least a 50 percent retracement.

Short Term: Friday's long tail and large volume indicate buying support, but there is no clear indication of medium-term direction until we have a breakout from the consolidation. A close below 12000 remains likely and would indicate the start of another (primary) down-swing; while breakout above 12800 would signal continuation of the market top — rather than a primary advance.

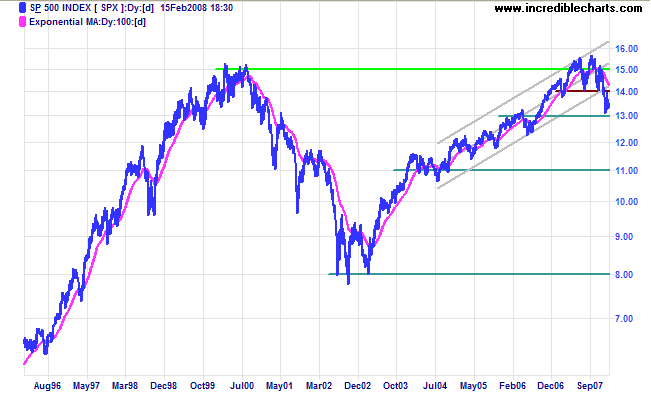

S&P 500

The S&P 500 is consolidating between 1300 and 1400.

Downward breakout is expected and would offer a (medium-term)

target of 1300-(1400-1300)=1200.

The long-term target would be 1300-(1500-1300)=1100 for a "soft

landing"; while a "hard landing" would test the December 2002

low of 800 — a 50 percent retracement.

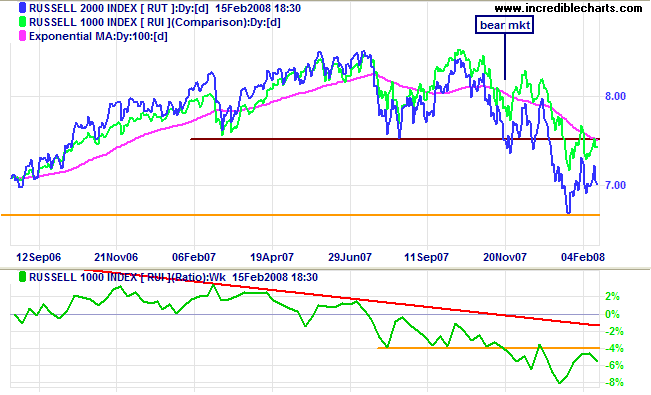

Small Caps

The Russell 2000 is consolidating between 690 and 730. Downward breakout is expected, which would test support at 650. The falling ratio against the Russell 1000 shows migration to the relative safety of large caps.

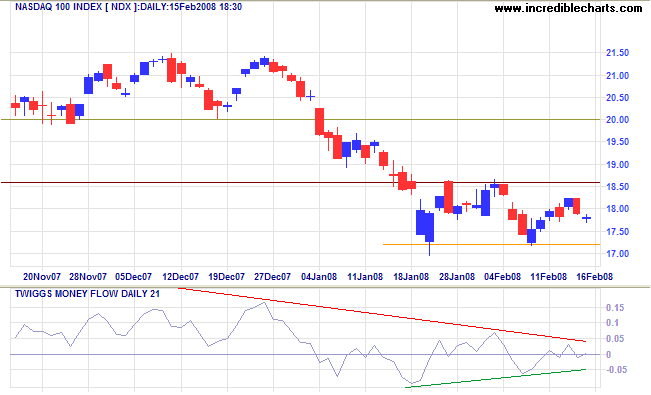

Technology

The Nasdaq 100 is, likewise, consolidating. A fall below 1720 remains likely and would signal another (primary) down-swing; while recovery above 1860 is less likely and would indicate resumption of the market top. Twiggs Money Flow signals short-term accumulation but long-term selling pressure.

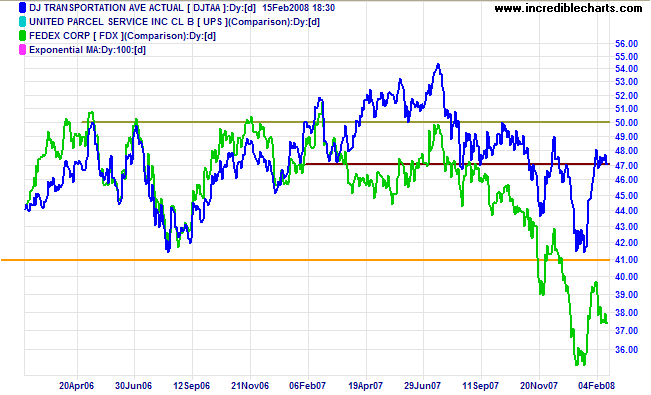

Transport

The Dow Jones Transportation Average remains in a primary down-trend and is likely to follow Fedex lower.

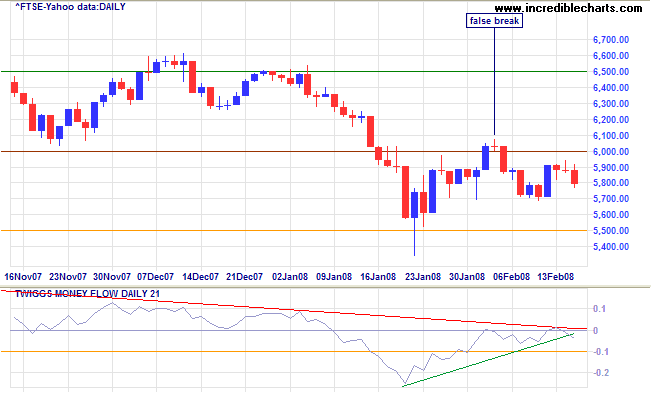

United Kingdom: FTSE

The FTSE 100 shows a similar consolidation to the Dow and S&P 500. Reversal below 5700 would test support at 5500; failure of support would offer a (short/medium-term) target of 5500-(6000-5500)=5000. Twiggs Money Flow signals long-term selling pressure.

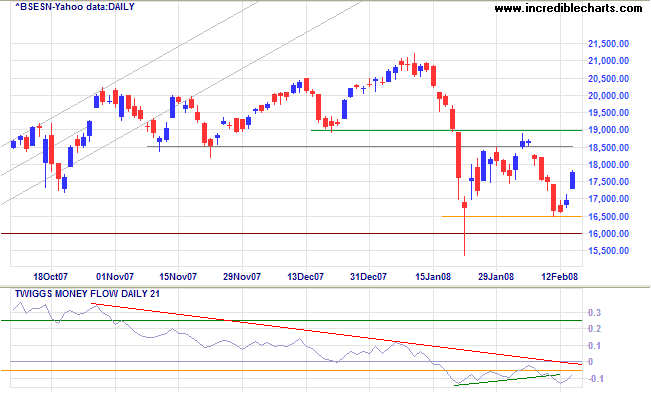

India: Sensex

The Sensex respected support at 16500, before gapping towards another test of resistance at 19000. Breakout above 19000 would signal another test of the high of 21000, but reversal below 16500 remains more likely. Downward breakout would offer a target of 16500-(19000-16500)=14000; though the index may encounter some support at 16000. Twiggs Money Flow signals long-term selling pressure.

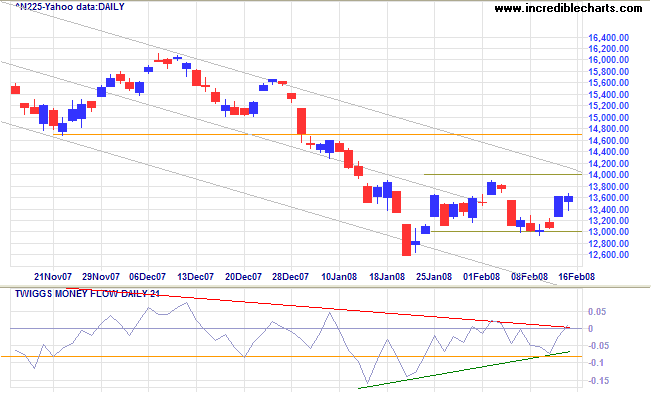

Japan: Nikkei

The Nikkei 225 continues to consolidate between 13000 and 14000. Downward breakout would signal another (primary) down-swing. Recovery above 14000 is less likely and would test resistance at 14700. Twiggs Money Flow signals long-term selling pressure but short-term accumulation.

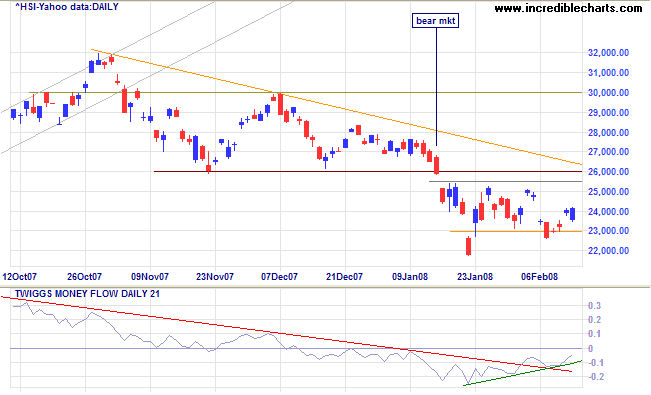

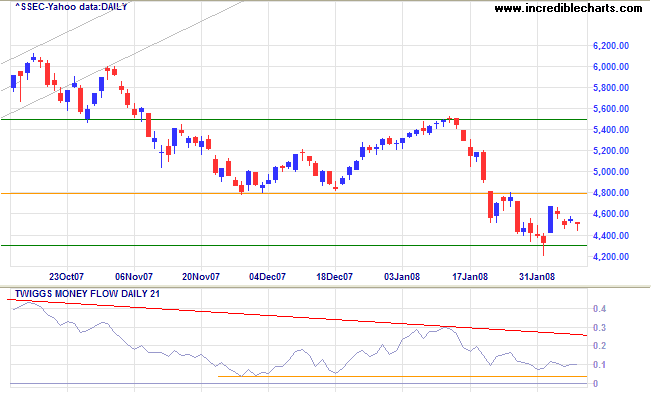

China: Hang Seng & Shanghai

The Hang Seng is, likewise, consolidating. Breakout below 23000 is expected, and would warn of another (primary) down-swing, with a target of 20000 (from August 2007); recovery above 26000 remains unlikely — and would indicate that the primary down-trend is weakening. Twiggs Money Flow signals short-term accumulation but long-term selling pressure (the indicator broke the downward trendline but remains below zero).

The Shanghai Composite is also consolidating. Breakout below 4300 is likely and would warn of another primary down-swing, with a target of 3600 (from July 2007). Recovery above 4800 is not expected and would signal that the bear trend is weakening. Twiggs Money Flow indicates long-term selling pressure; a fall below 0.04 would be a further bear signal.

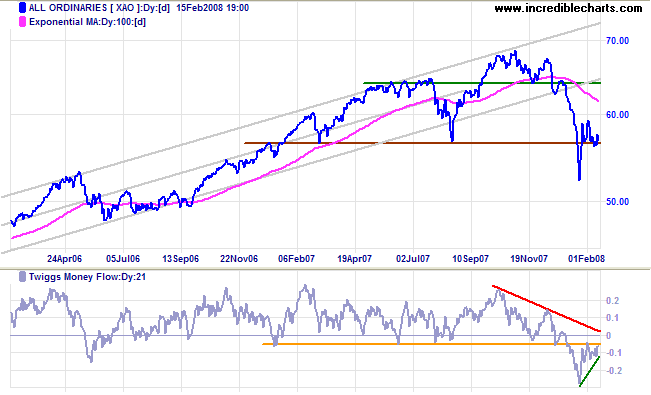

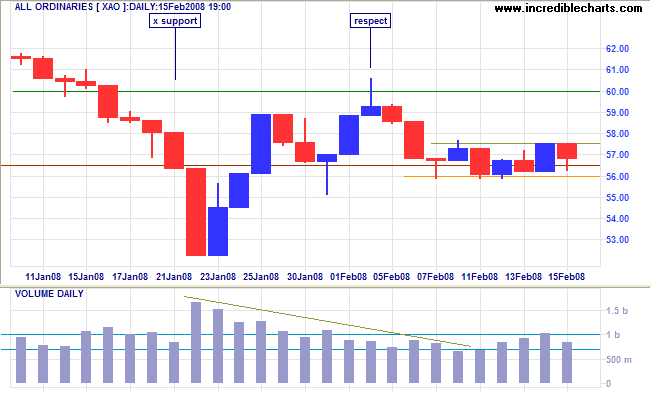

Australia: ASX

The All Ordinaries is consolidating in a narrow band above the former primary support level at 5650. Recovery above 6000 would signal continuation of the market top — rather than a bull market. Reversal below 5600 remains as likely, given the bearish influence of international markets, and would offer a long-term target of 4800 (from June 2006). Twiggs Money Flow signals short-term accumulation but long-term selling pressure.

Short Term: Selling pressure keeps the index pinned in a narrow range between 5600 and 5750. Breakout below 5600 is likely and would offer a short-term target of 5200 (the January low); while recovery above 5750 would indicate another test of 6000.

Without faith in his own judgment no man can go very far in

this game. That is about all I have learned - to study general

conditions, to take a position and stick to it.

~ Jesse Livermore in Edwin Lefevre's

Reminiscences of a Stock Operator

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.