Gold Rising Wedge

By Colin Twiggs

February 12, 2008 4:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

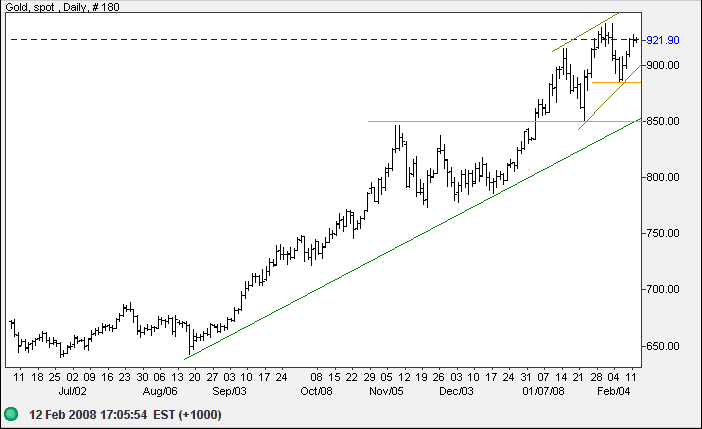

Gold

Spot gold displays a bearish rising wedge pattern, but I would not place much reliance on this — unless the euro or crude showed similar bearish signs. While the formation has a fairly high failure rate, reversal below $900 would warn of a test of long-term support at $850.

Source: Netdania

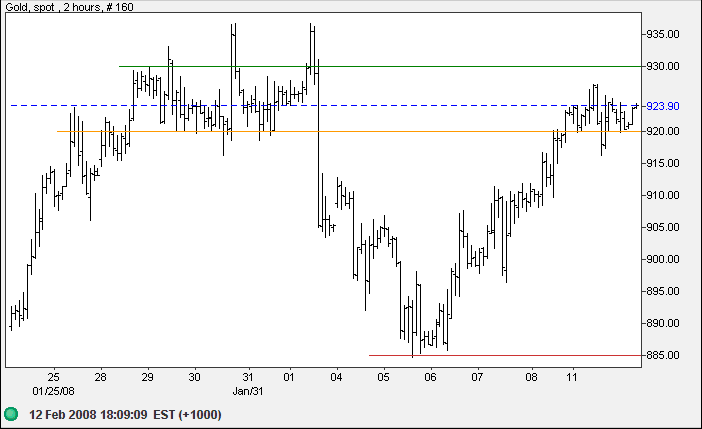

The short-term chart shows gold consolidating in the same band of $920 to $930 as at the end of January. Breakout above $930 would signal a test of the upper wedge border; while reversal below $920/$915 would be bearish.

Source: Netdania

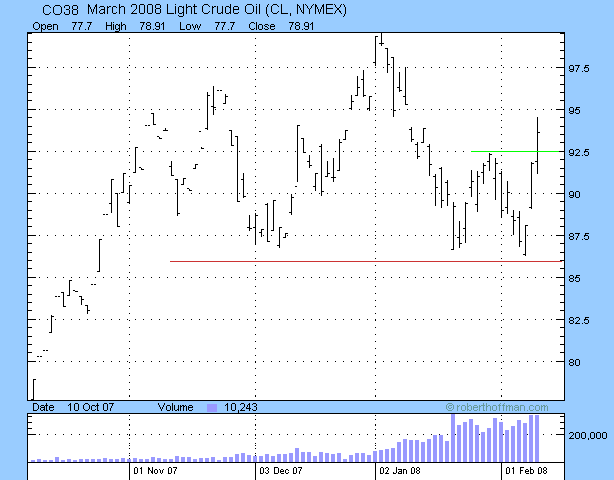

Crude Oil

March 2008 Light Crude respected primary support and is headed for another test of $100 after breaking through $92.50. Failure of support at $86 is unlikely — and would warn that crude has started a primary down-trend.

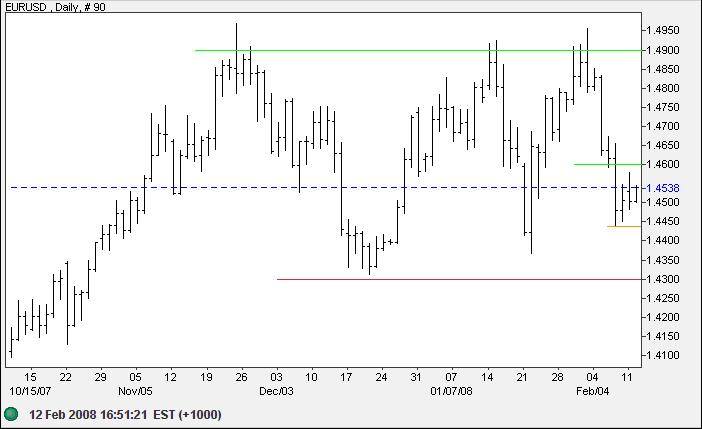

Currencies

The euro is consolidating (short-term) between $1.4450

and $1.4600. Upward breakout would signal another test of

resistance at $1.49, while downward breakout would test primary

support at $1.43.

In the longer term, breakout above $1.49 (and the key

psychogical level of $1.50) would offer a target of

1.50+(1.50-1.43)=$1.57; while reversal below $1.43, though

unlikely in the present circumstances, would signal a primary

down-trend.

Source: Netdania

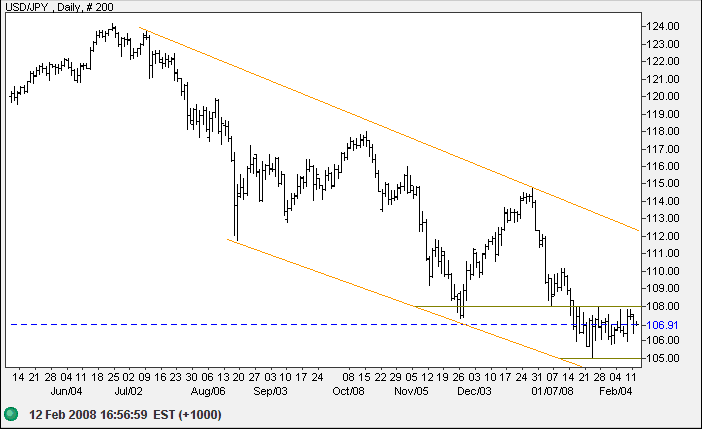

The dollar continues in a downward trend against the yen, with a long term target of 100. Short-term consolidation favors another decline — to test the lower border of the trend channel. Reversal above 108 is not expected, but would signal a test of the upper channel; while a fall below 105 would confirm the down-swing.

Source: Netdania

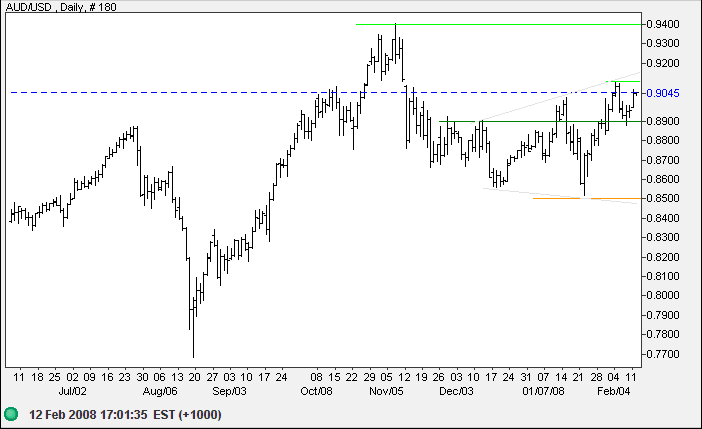

The Australian dollar respected support at $0.89 against the greenback, a strong bull signal for the broadening bottom formation. Breakout above $0.91 would signal a test of $0.94. Reversal below $0.89 is unlikely — and would warn of a test of $0.85.

Source: Netdania

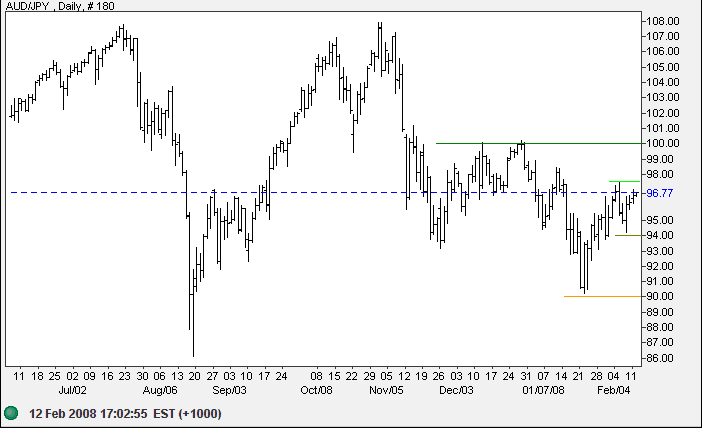

The Aussie continues in a down-trend against the yen and only a break above 100 would signal reversal. In the short-term, a rise above 97.50 would be bullish, while a fall below 94 would warn of another test of 90.

Source: Netdania

Every age in the stock market reinvents the wheel, convinced it

has created something new and quite wonderful while completely

ignoring what happened to the old wheel.

~ Mihir Bose

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.