Bear Feint

By Colin Twiggs

January 26, 1:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

If you see an express train coming, step off the tracks. Extending Jesse Livermore's analogy: it is also important not to step back on the tracks until the last coach has passed. Bear market rallies are typically steep and accompanied by large volume. High volumes warn that existing stockholders are taking the opportunity to sell down their remaining positions. Stocks are transferred from strong hands to weak, and the market is likely to fall sharply at the first setback.

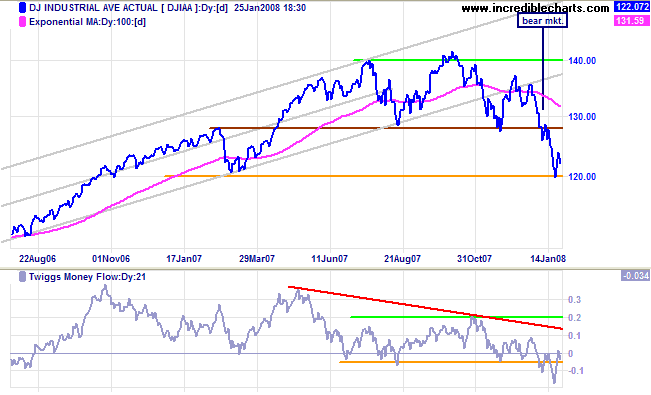

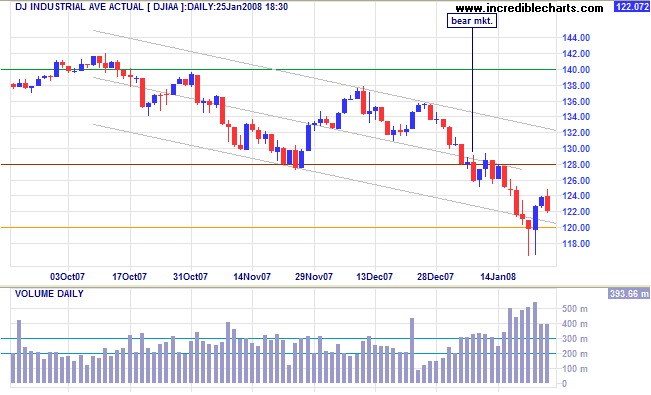

Dow Jones Industrial Average

The Dow found support at 12000, completing the first leg of a bear market. There are signs of a bear market rally which could carry as high as 12800/13000, where it is likely to encounter stiff resistance.

Short Term: A close below 12000, or intra-day fall below 11650, would signal the start of a second downward leg.

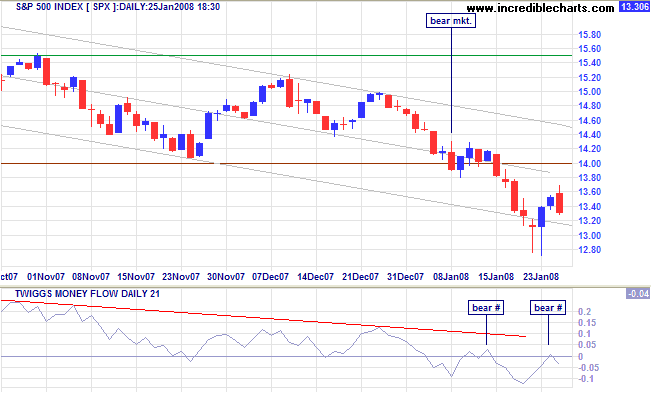

S&P 500

Friday's weak close on the S&P 500 and the Dow warns that the bear rally may already be fading. A fall below 1280 would signal the start of another decline. Twiggs Money Flow shows two bear signals where the indicator has peaked at the zero line.

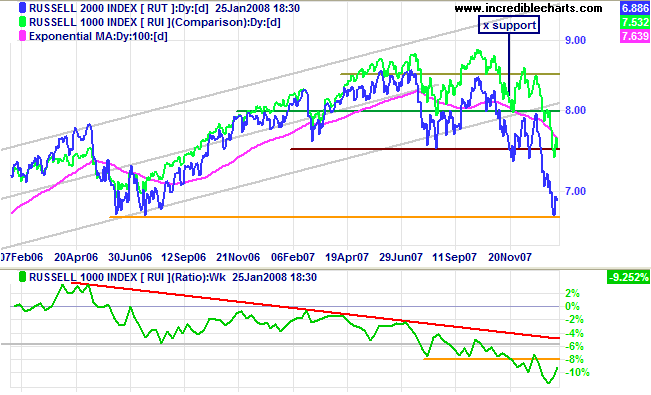

Small Caps

The Russell 2000 found support at 650. Penetration of this level would warn of another down-swing.

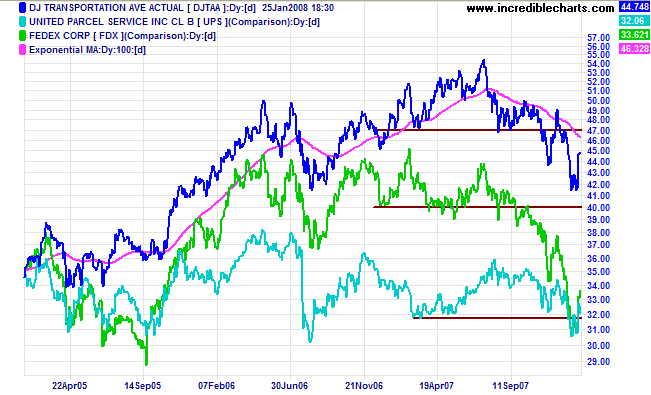

Transport

The Dow Jones Transportation Average and lead indicators Fedex & UPS have all rallied, but continue in primary down-trends, signaling a broad economic down-turn.

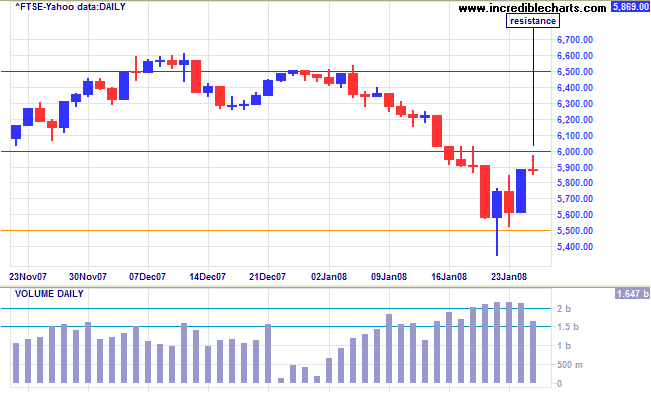

United Kingdom: FTSE

The FTSE 100 is finding resistance at the former primary support level of 6000. Another decline is likely, signaled by a close below 5500 or an intra-day fall below 5350.

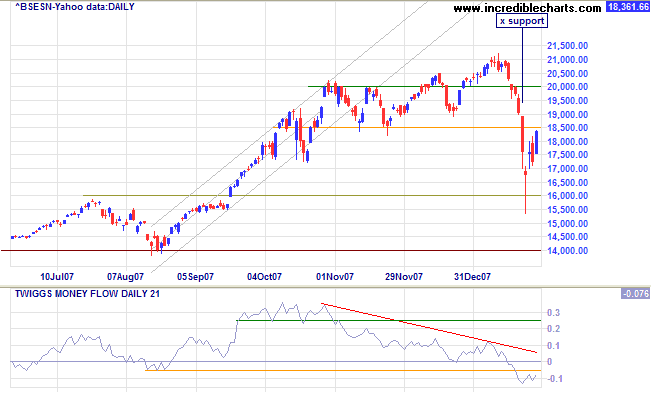

India: Sensex

The Sensex found support at 16000, before rallying to

test resistance at 18500. I consider the index to be in a

primary down-trend, though it could be argued that 18500 does

not qualify as primary support in terms of classic Dow theory:

retracement is less than a third of the previous up-swing and

the pattern is rather loose to fit the definition of a

line.

Expect resistance at 18500 to hold and another test of support

at 16000 to follow. Twiggs Money Flow signals strong

distribution, holding below its August 2007 low.

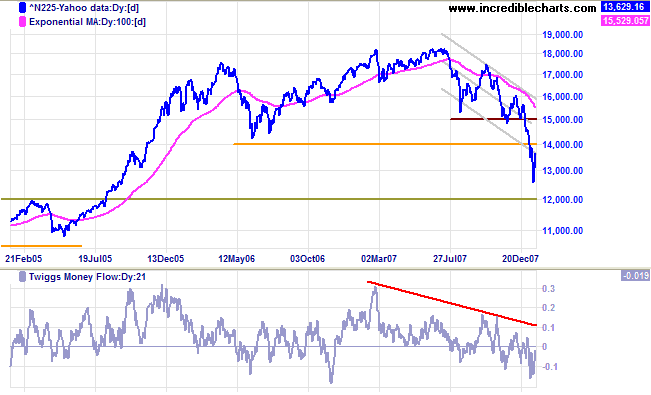

Japan: Nikkei

The Nikkei 225 rallied but is likely to encounter resistance at 14000. Twiggs Money Flow signals distribution.

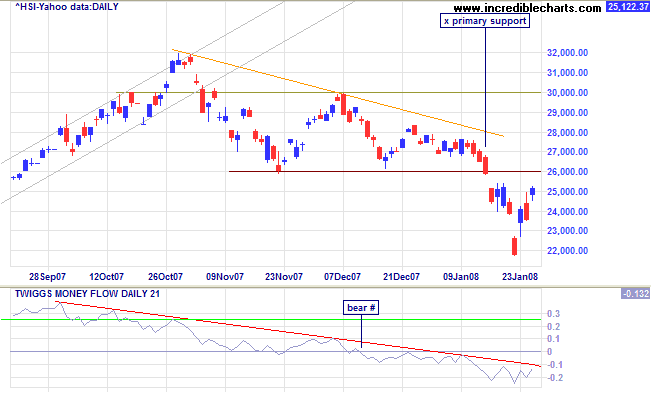

China: Hang Seng & Shanghai

The Hang Seng is testing resistance at 26000, after commencing a primary down-trend. Expect resistance to hold and a test of support at 22000 to follow.

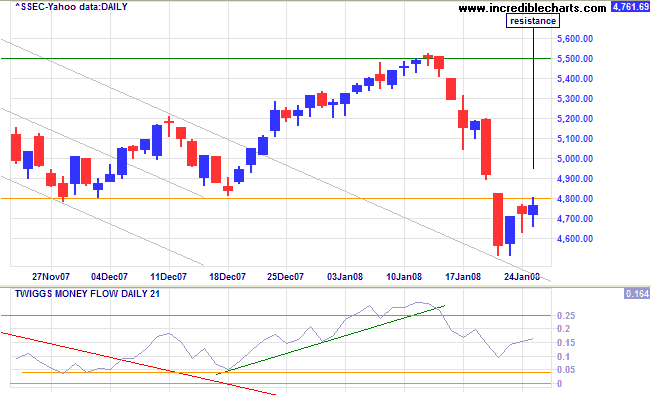

The Shanghai Composite is testing resistance at 4800 after commencing a primary down-trend. A Twiggs Money Flow fall below 0.04 would confirm the primary trend change.

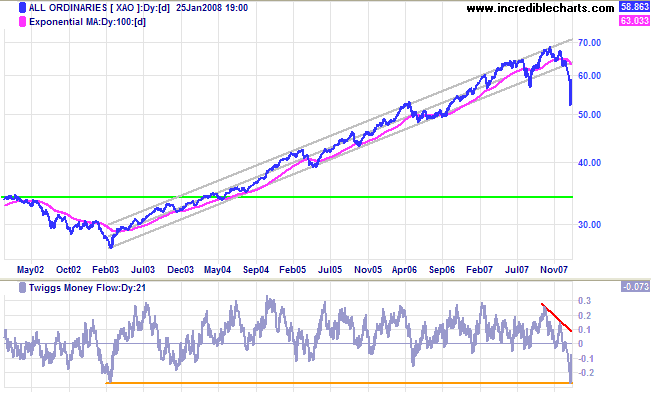

Australia: ASX

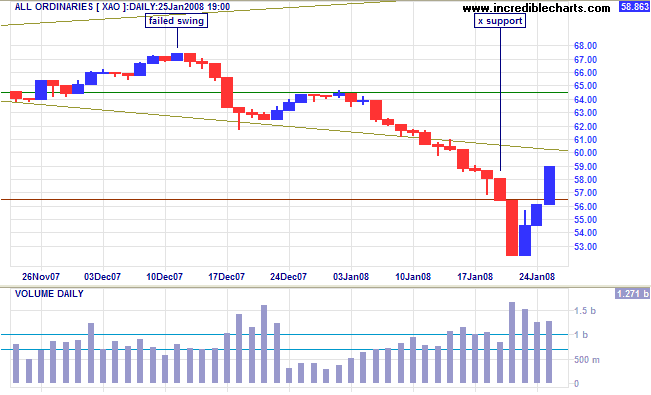

The All Ordinaries rallied steeply in the last 3 days, reversing above 5650. Twiggs Money Flow recovered from its lowest level since 2003. We should however, recognize that we are in the midst of a global bear market and no individual stock market is immune. Talk of low price earnings ratios and stocks being under-valued is irrelevant. The market is ruled by emotion and logic will only feature in the longer term. Expect another down-swing to follow any weakness on the Dow or FTSE 100.

Short Term: Large volumes warn of significant selling into the latest rally. Reversal below 5650 would be bearish and below 5250 would signal another primary down-swing.

Markets can remain irrational far longer than you or I can

remain solvent.

~ John Maynard Keynes

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.