Ballooning Spreads Warn Of Trouble Ahead

By Colin Twiggs

December 6, 2007 3:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

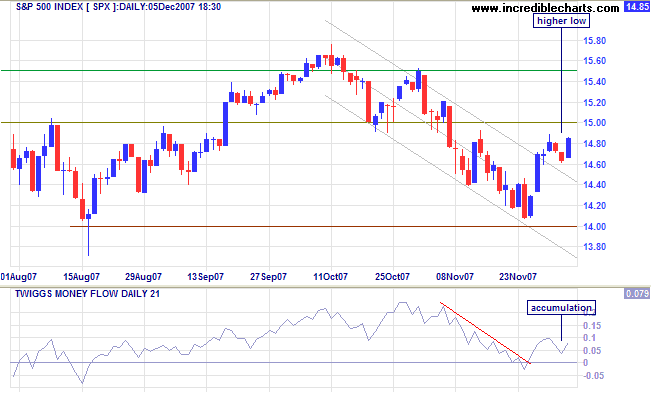

Trend Channel Breakout

The S&P500 and the Dow both broke out above their downward (secondary) trend channels, completing a higher low to signal the end of the secondary correction. Expect them to test their previous highs. The level of resistance will indicate whether the market has impetus for another (primary) advance or whether a stage 3 top is forming.

On the strength of recent accumulation, I would estimate that probability of a bear market has now receded slightly, to about 66 per cent. This remains a time for caution: there may still be a few sharp turns ahead.

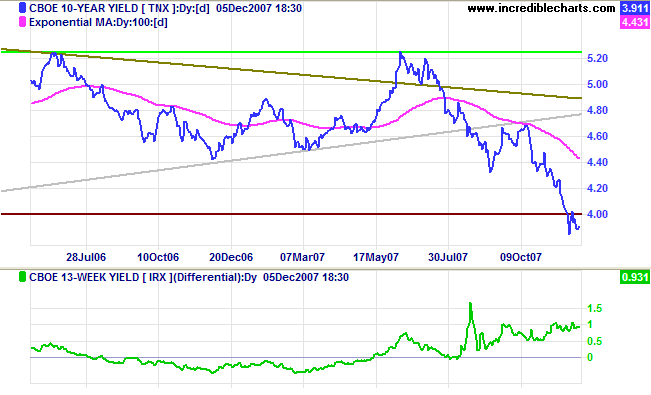

Treasury Yields

Ten-year treasury yields reversed below 4.0% in expectation of further rate cuts by the Fed. The yield differential (10-year minus 3-month treasury yields) remains close to 1 per cent, due to falling short-term rates. It remains to be seen over the next 6 months how much damage was done to the economy by negative spreads in the first half of 2007.

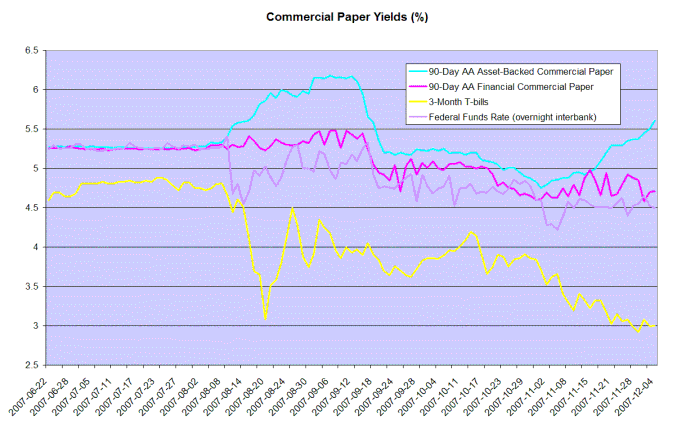

Financial Markets

Treasury bill (3-month) yields are testing support at 3.00%, while rates on asset-backed commercial paper are rising. The spread has ballooned to more than 250 points, the widest since August 2007, at the start of the crisis.

The financial market crisis is far from over and the Fed should have little choice but to make further rate cuts.

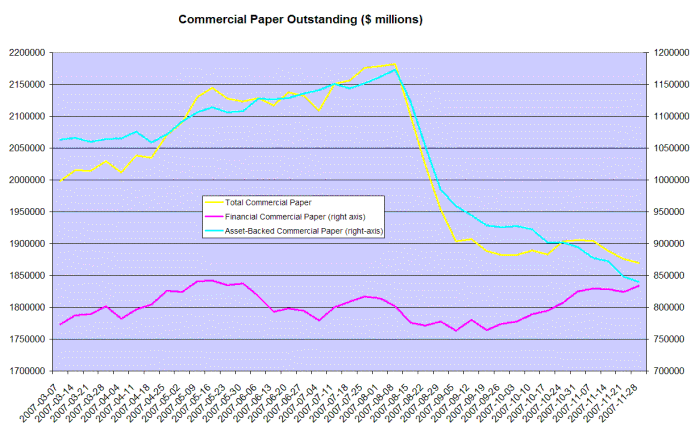

Bank Credit

The commercial paper market reflects large investors reluctance to continue funding banks' off-balance sheet structures. Asset-backed commercial paper is one of the primary sources of short-term funding for SIVs.

The decision of HSBC to unwind existing SIVs and take the assets back onto its balance sheet is commendable. That is the quickest way to restore investor confidence in financial markets. Creation of super-SIVs to replace existing structures lacks transparency and raises questions whether some participants' depleted capital reserves are adequate to confront the problem.

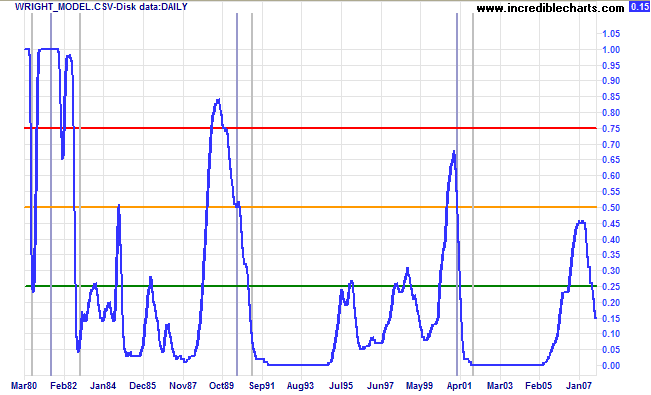

I believe that Jonathan Wright's recession prediction model has failed to adequately address the damage caused by a negative yield curve in a low interest rate environment. The model currently shows probability of a recession in the next four quarters as a low 16 percent.

I was bearish in a bear market. That was wise.

I had sold stocks short. That was proper.

I had sold them too soon. That was costly.

~ Jesse Livermore in Edwin Lefevre's

Reminiscences of a Stock Operator (1923).

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.