Subprime Turmoil Continues

By Colin Twiggs

November 15, 2007 3:00 a.m. ET (7:00 p.m. AET)

In an attempt to make our newsletters more readable we will

trial splitting the weekly coverage in two: gold, oil and forex

on Tuesdays; the economy and interest rates on Thursdays.

Please give us your feedback when we survey readers after a few

weeks.

These extracts from my trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use.

Stock Markets

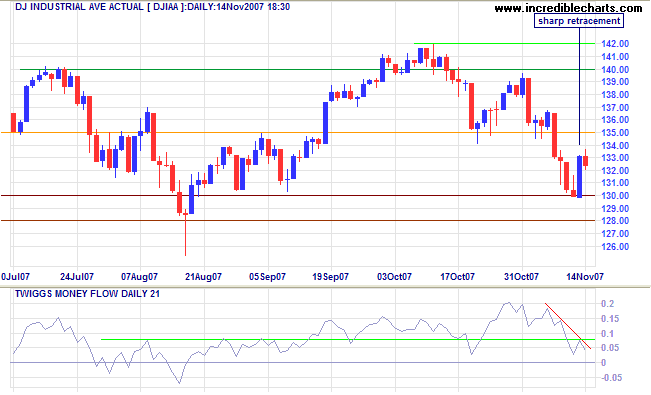

The Dow respected support at 13000, but the sharp retracement, far from being a positive sign, is typical of a reaction in a down-trend. A second successful test of 13000 would be a bullish sign, while a close below 12800 would signal that the primary trend has reversed.

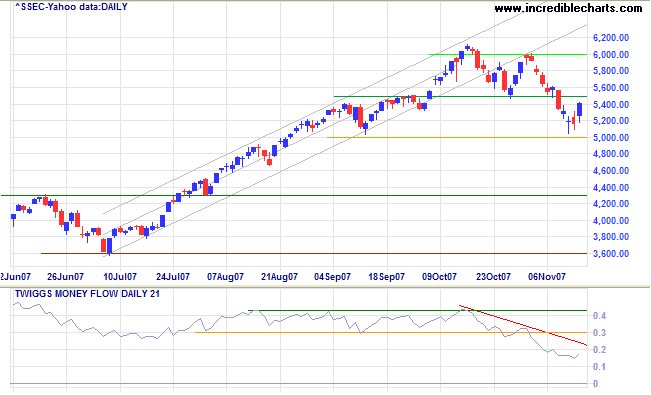

The Shanghai Composite found support at 5000 and is now retracing to test resistance at 5500. Twiggs Money Flow continues to signal distribution, warning that the secondary correction may not yet be over.

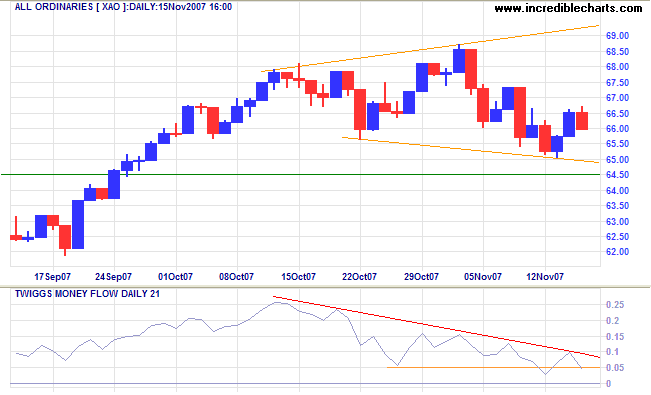

The Australian All Ordinaries has held up better than both China and the US, but is now forming a broadening top pattern. A failed up-swing (partial rise) would warn of a downward breakout and a test of primary support at 5650. The pattern is only valid after two clear peaks and two clear troughs, however, and the second trough needs a few more days to be certain.

Financial Markets

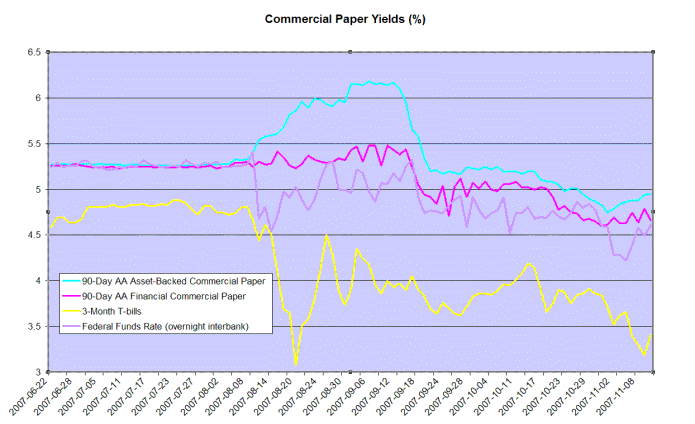

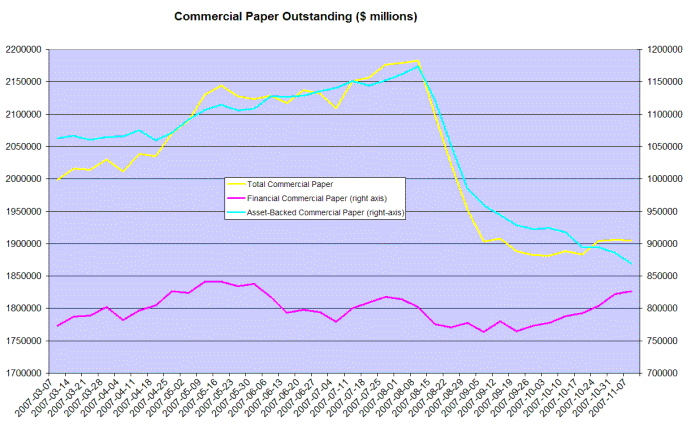

Treasury bill (3-month) yields have so far respected support at 3.00%, but the spread of 100 to 150 points below the federal funds target rate (compared to the 50 point spread in July) reflects ongoing uncertainty in financial markets. We can also see investors' continued aversion to asset-backed securities, with rates again rising.

Banks are being forced to take asset-backed securities back onto their balance sheets and issue their own paper to fund this, thereby reducing the amount of reserves available to back new loans. The spread between financial commercial paper and the targeted federal funds rate (4.50%) indicates the degree of difficulty that banks are experiencing in obtaining sufficient funding. A rise to near 5.00% would pressure the Fed to make further rate cuts.

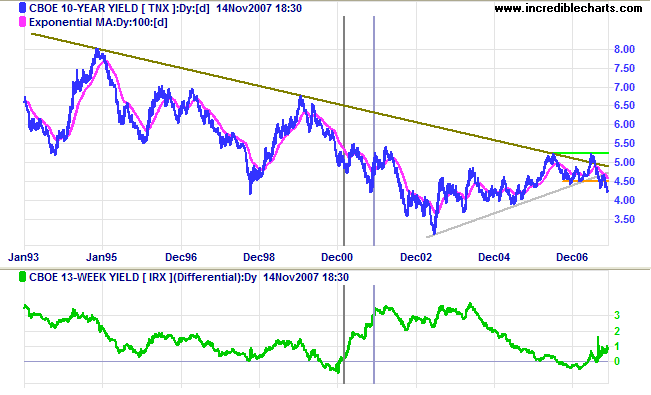

The Yield Curve

Ten year treasury yields are trending downwards, but should

encounter support at 4.00%. The twenty-five year super-cycle

down-trend continues.

The yield differential has risen to near 1.00%, but for the

wrong reasons: low short-term yields caused by the flight from

financial markets.

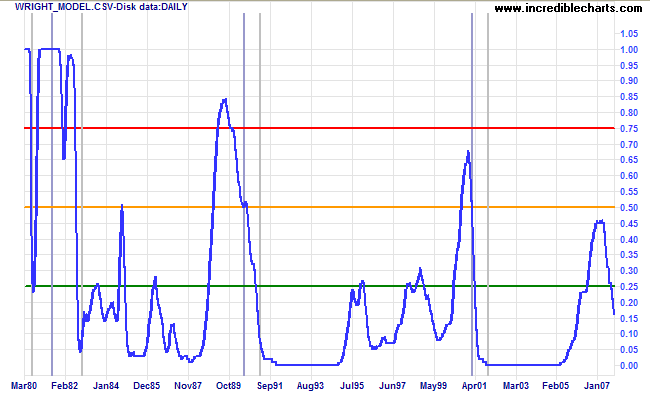

Jonathan Wright's recession prediction model indicates the probability of a recession in the next four quaters has decreased to a low 16 percent.

The model is based on the nominal level of the fed funds rate and the yield differential between 10-year and 3-month treasuries. As such it fairly accurately predicts a decline in the availability of credit caused by a narrowing of bank interest margins. However, it will not reflect a decline in availability of credit caused by other factors, such as a collapse of the commercial paper market. Not all recessions are atypical, as I pointed out earlier. While the model remains a useful tool, I believe that it underestimates the risk of recession in the present environment.

In the beginner's mind there are many possibilities,

in the expert's mind there are few.

~ Shunryu Suzuki

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.