Markets Face Critical Day On Monday

By Colin Twiggs

October 20, 2007 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

The housing slump and credit squeeze appear to be spilling over into other sectors of the economy, with companies like Caterpillar and Hershey reporting lower sales. The Fed is likely to make further cuts in the federal funds rate if the contagion spreads — weakening the dollar and increasing import prices for commodities such as crude oil.

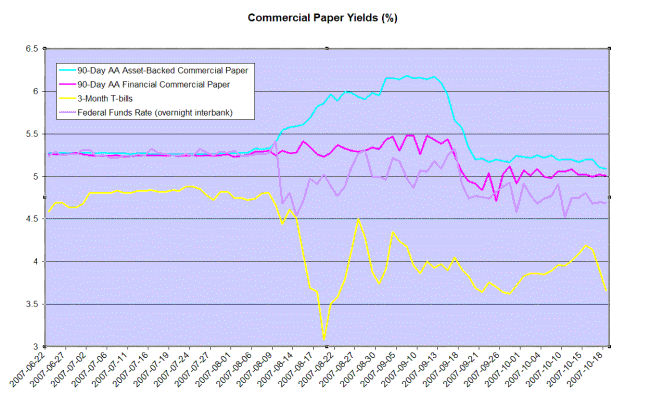

The Fed continues to inject liquidity into the financial markets, with repurchase operations totalling more than $28 billion according to Reuters. Spreads between commercial paper and equivalent Treasury bill yields have again widened, reflecting investors perceptions of market risk. A fall of 3-month T-bill yields below support at 3.50% would be a bear signal for both financial and equity markets.

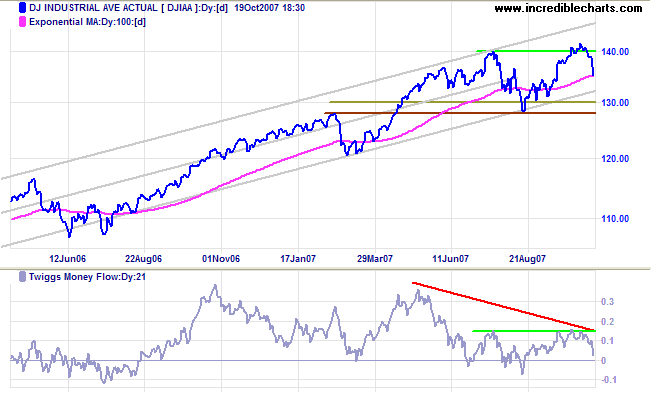

Dow Jones Industrial Average

The Dow Jones Industrial Average turned down sharply after making a new all-time high above 14000, completing a typical bull trap. Expect a test of the lower trend channel and primary support at 12800.

The long-term bearish divergence on Twiggs Money Flow is now backed by short-term distribution.

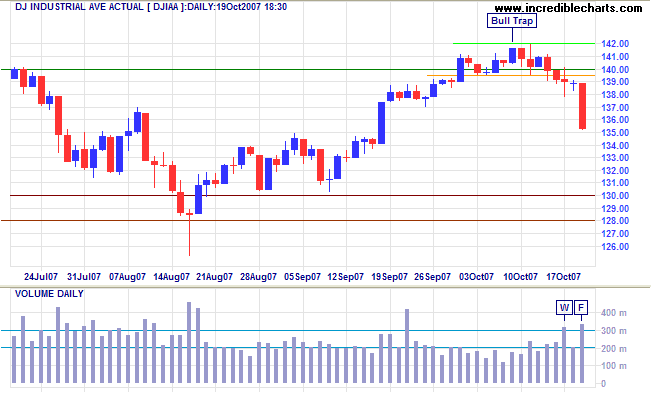

Short Term: High volume on Wednesday signaled buying support, but this soon dissipated and was overcome by strong selling on Friday — the 20th anniversary of Black Monday during the October 1987 crash. Monday will be a critical day for the market: another strong red candle would indicate a serious test of primary support at 12800.

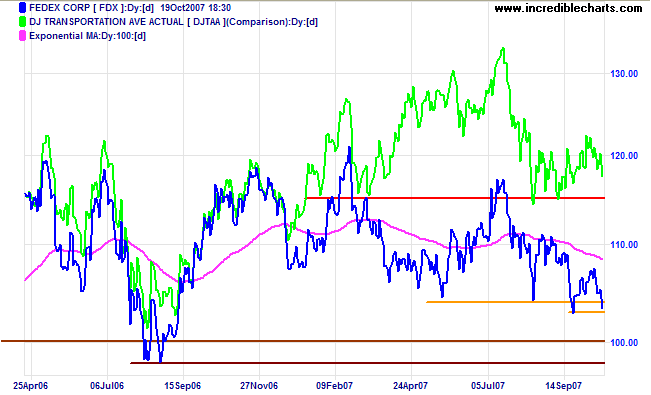

Transport

Fedex is testing support at $103 and the Dow Jones Transportation Average is likely to follow suit, with a test of primary support at 4700. Expect Fedex to test primary support at $100/$98; a fall below this level would be a bear signal for the economy.

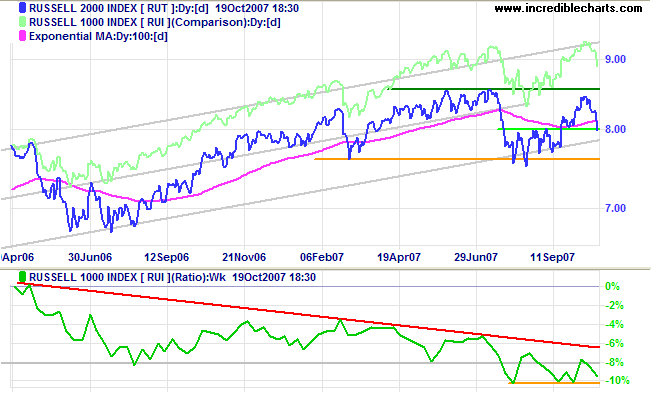

Small Caps & Technology

The Russell 2000 Small Caps Index is leading the market lower, with a close below 800 signaling a test of primary support at 750/760. The shift to safety of large cap stocks is evident from the down-trend in relative strength (compared to the large cap Russell 1000 Index).

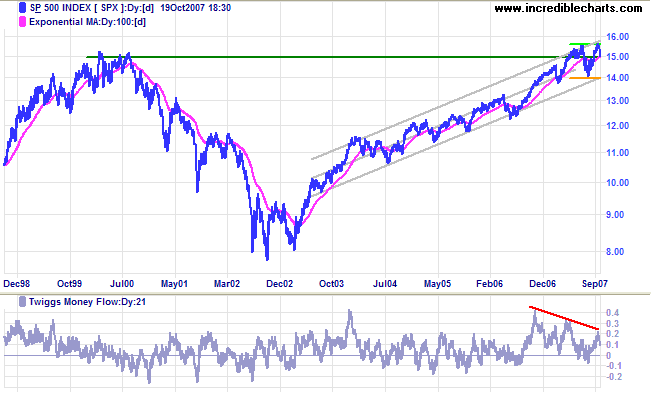

S&P 500

The S&P 500 is at a watershed. The index is testing support at the key support level of 1500, from the high 7 years ago, and a large bearish divergence on Twiggs Money Flow warns of distribution. A break below 1500 appears likely — and would signal a test of primary support at 1400. Not at all promising when we have just had a breakout to a new all-time high above 1500.

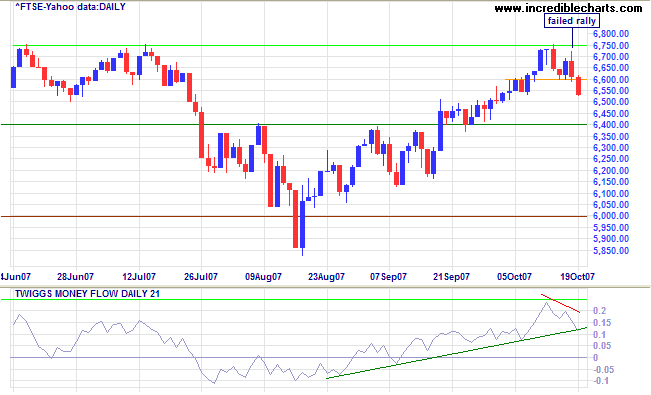

United Kingdom: FTSE

The FTSE 100 closed below support at 6600 after another failed attempt at 6750. Twiggs Money Flow signals short-term distribution and we can expect a secondary correction to test primary support at 6000/5850. Reversal above 6750 now appears unlikely, and would indicate a test of resistance at the all-time high of 6930.

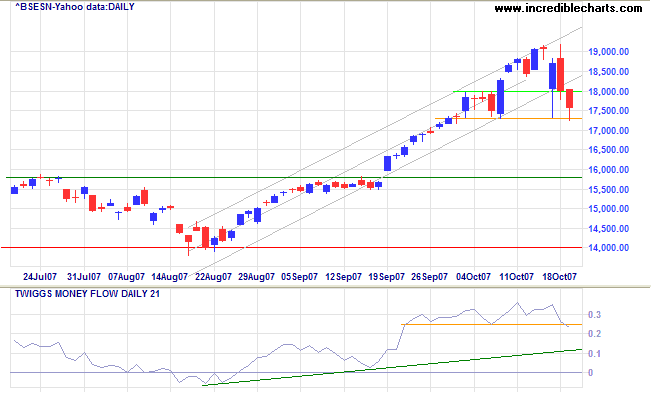

India: Sensex

The Sensex broke below its trend channel, warning of a secondary correction. Long tails on Wednesday and Friday indicate buying support, but a fall below 17300 would confirm the (secondary correction) signal. Twiggs Money Flow fell through support to signal short-term distribution. Primary support remains a long way below at 14000.

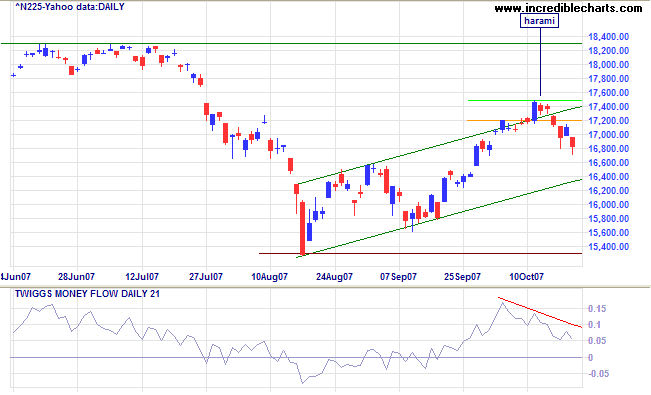

Japan: Nikkei

The Nikkei 225 is headed for a test of the lower trend channel after a harami candlestick reversal. Bearish divergence on Twiggs Money Flow signals strong short-term distribution. A fall below the trend channel would test primary support at 15300.

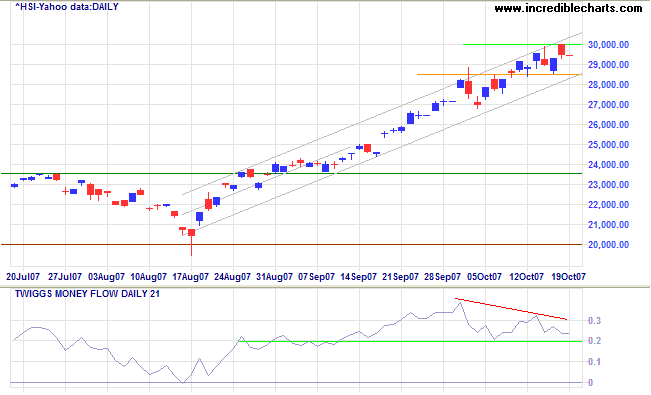

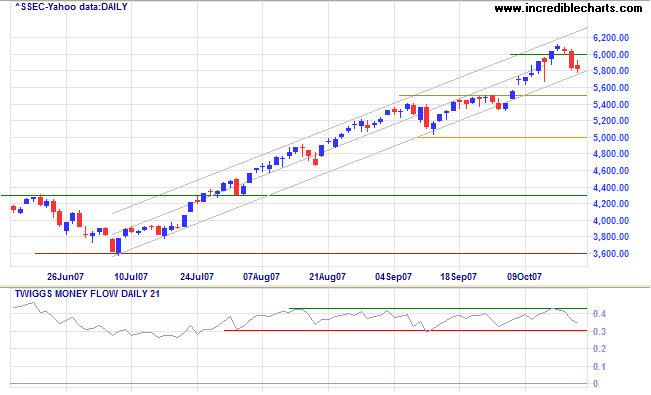

China: Hang Seng & Shanghai

The Hang Seng is testing resistance at 30000. Bearish divergence on Twiggs Money Flow continues to warn of a retracement to the lower channel border. Likelihood of a fall below the trend channel is increased because of bearish sentiment in other equity markets — and would warn of a secondary correction. The index is a long way above primary support at 20000/20500.

The Shanghai Composite Index retreated below 6000 and is testing the lower border of the trend channel. Breakout would warn of a secondary correction. Shanghai is in the final phase of a bull market and vulnerable to reactions in other markets; primary support is a long way below at 3600.

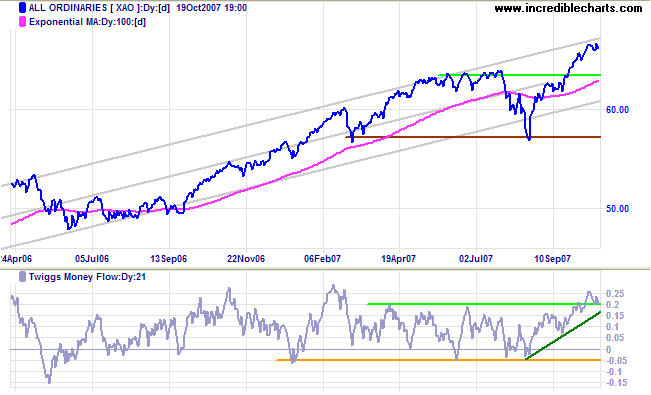

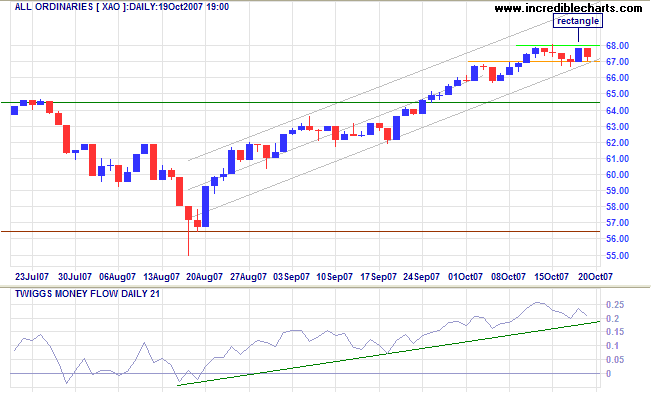

Australia: ASX

The All Ordinaries is more bullish than the Dow and FTSE 100, but remains vulnerable to a trend change in these markets. The index is at the upper channel border, so watch for a down-swing or signs of distribution on Twiggs Money Flow.

Short Term: The All Ords is consolidating in a narrow rectangle, between 6700 and 6800. Volumes are low, as you would expect during a consolidation, and breakout above 6800 would signal another advance. However, I am concerned about the impact of bearish sentiment from US and UK markets. Watch for a breakout below the trend channel, which would warn of a secondary correction.

I believe that banking institutions are more dangerous to our

liberties than standing armies.

~ Thomas Jefferson

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.