Gold Consolidates, Stocks Hesitant After Quarter-End

By Colin Twiggs

October 4, 2007 7:00 a.m. ET (9:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Economy

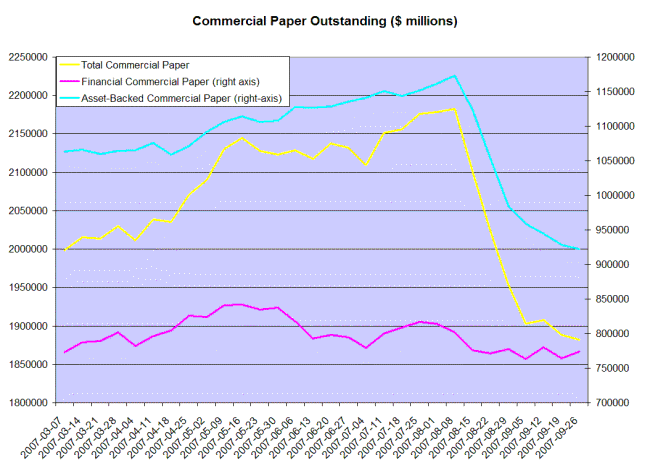

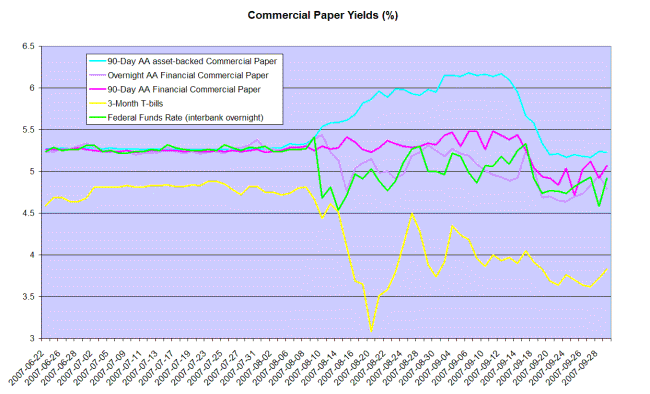

Bank credit remains steady, but there are no signs of recovery in the $2 trillion commercial paper market which has contracted by $300 billion since the start of the subprime crisis.

Declining real estate investment, where housing starts have fallen 38 per cent since August 2005, and tighter credit are likely to have a dampening effect on the economy. Fannie Mae project that the housing slump will continue beyond 2008, according to CEO Daniel Mudd (Bloomberg).

Major stock market indexes should offer some guidance, as they provide a synthesis of all prevailing views, but we will have to wait towards the end of the week for quarter-end distortions to have cleared.

Gold

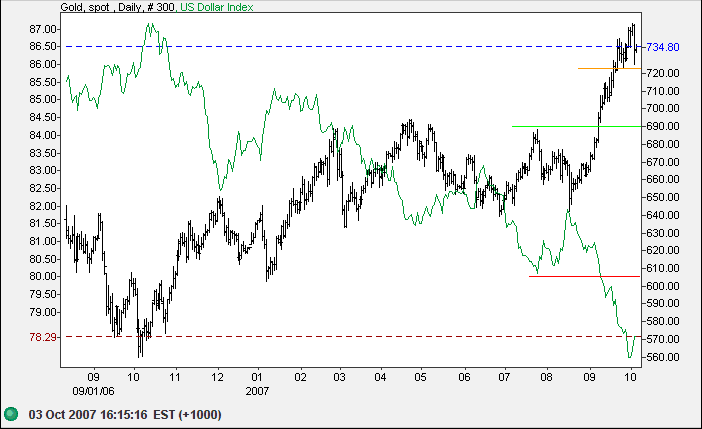

Gold made a short-term retracement to test support at $720, while in a strong primary up-trend. Conversely, the US dollar index shows a short-term retracement while in a strong primary down-trend. Expect gold to appreciate further as the US dollar weakens.

Source: Netdania

Crude Oil

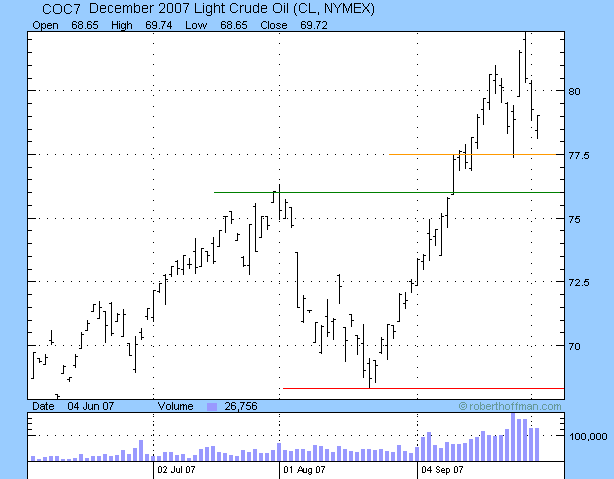

Similar to gold, December Light Crude is testing short-term support at $77.50 barrel while in a primary up-trend. Expect crude to appreciate further as the dollar weakens. Respect of short-term support would confirm this.

Currencies

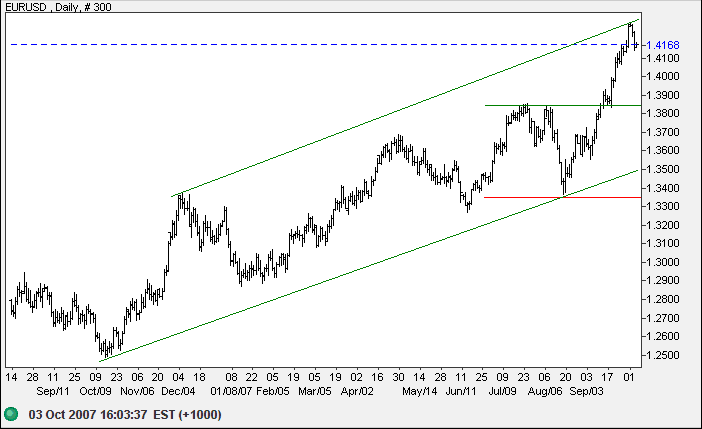

The euro is in a primary up-trend against the dollar. A down-swing to test the lower trend channel is likely as the latest advance has reached the upper trend channel. Breakout above the trend channel would warn of an accelerating up-trend.

Source: Netdania

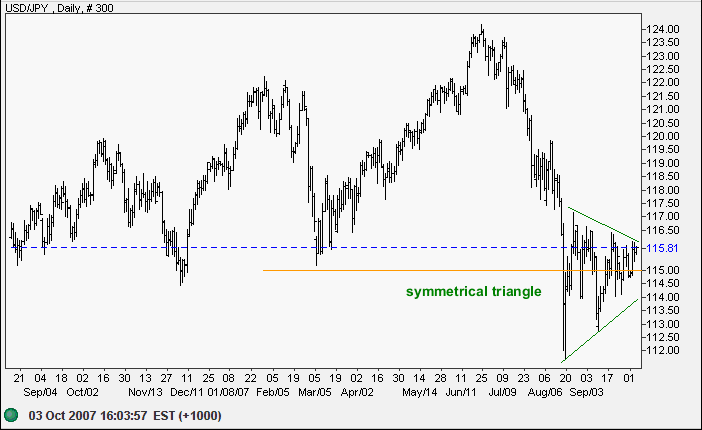

The dollar continues in a symmetrical triangle against the yen. The future trend will be indicated by direction of a breakout.

Source: Netdania

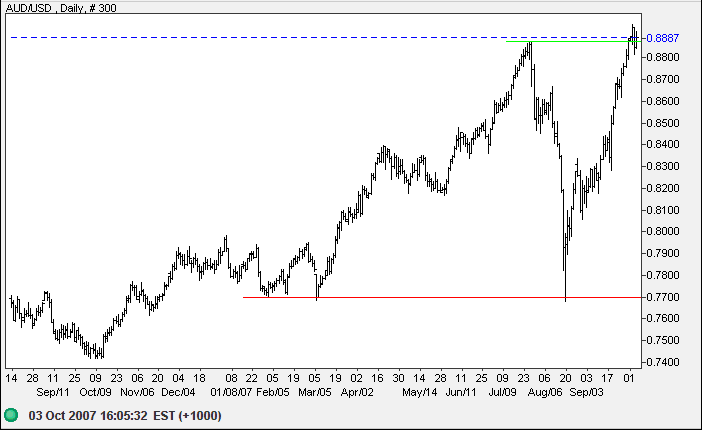

The Australian dollar is consolidating at the former high of $0.8875 against the greenback. The RBA is unlikely to follow the Fed in cutting interest rates, and an upward breakout would signal that parity is achievable in the longer term. Reversal below $0.8800, while not expected, would warn of another correction.

Source: Netdania

Treasury Yields

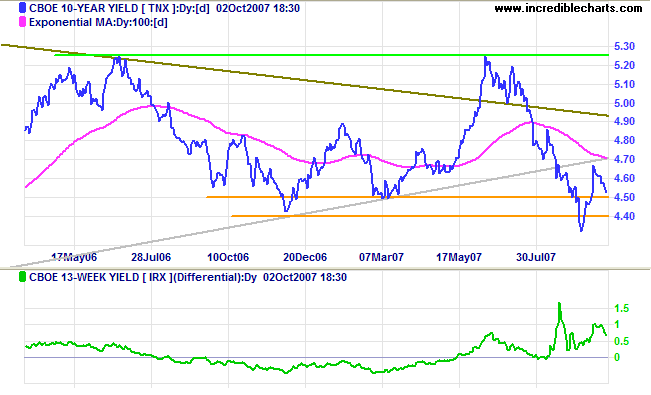

Ten-year treasury yields are falling as the dollar rallies in

the short-term, in a similar fashion to gold and crude oil.

Expect support at 4.40%/4.50% to hold as the US dollar index

remains in a primary down-trend.

The yield differential (10-year minus 13-week treasury yields)

is trending upwards, easing pressure on bank margins, but

concern over the credit squeeze continues.

The risk premium between 3-month treasury yields and 90-day commercial paper remains at 120 to 140 points, compared to the normal 40 to 50 points, reflecting the financial market's aversion to risk.

Stock Markets

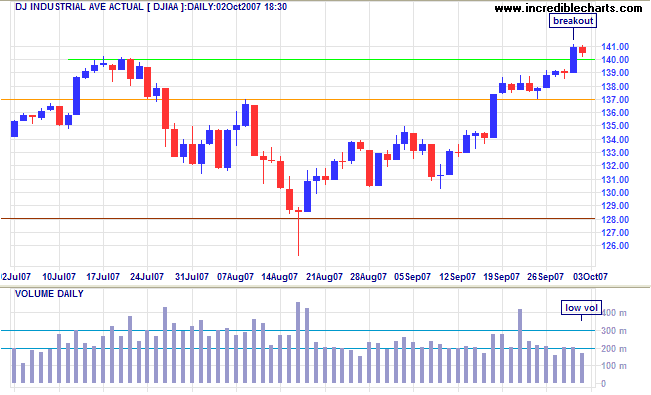

The Dow Jones Industrial Average broke through resistance at 14000, but low volumes signal a lack of commitment and this could easily turn into a failed (or false) breakout. Reversal below 13700 would warn of another correction, while a close above 14100 would signal increased commitment.

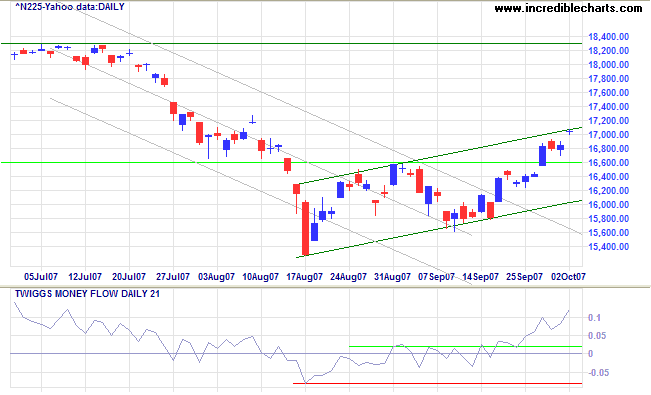

The Nikkei broke through resistance at 16600, indicating weakness in the primary down-trend. Twiggs Money Flow signals strong accumulation. Upward breakout from the current trend channel would signal a test of primary resistance at 18300, while a downward breakout would warn of another primary decline.

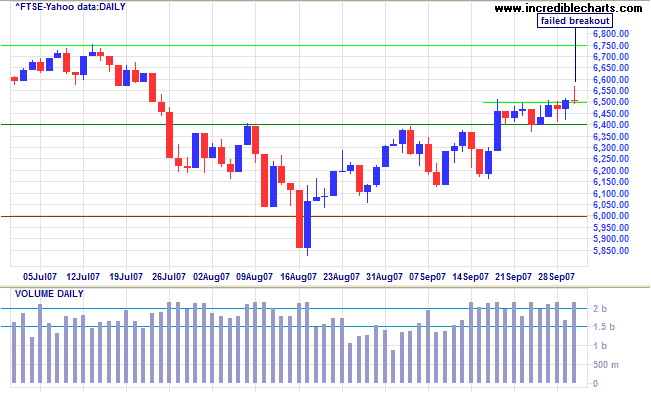

The FTSE 100's failed breakout above 6500, accompanied by strong volume, signals committed sellers. A close above 6500 would signal a test of the earlier high of 6750, but reversal below 6400 would warn of another correction.

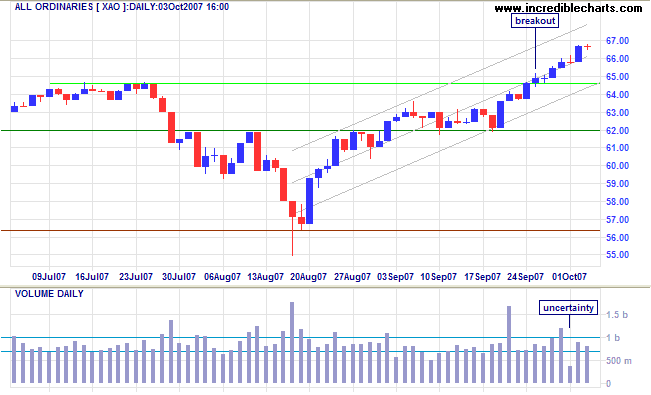

The Australian All Ordinaries remains hesitant, with low volume and a doji candlestick signaling indecision.

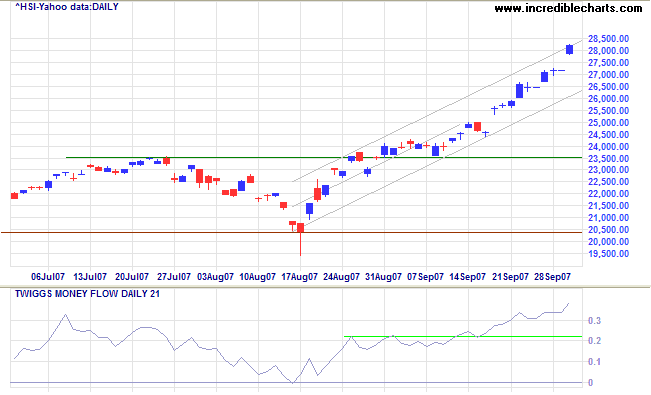

The Hang Seng shows no sign of hesitancy, however, having reached its optimistic target of 28000 [24000+(24000-20000)]. With Twiggs Money Flow rising strongly, the index shows no sign of abating.

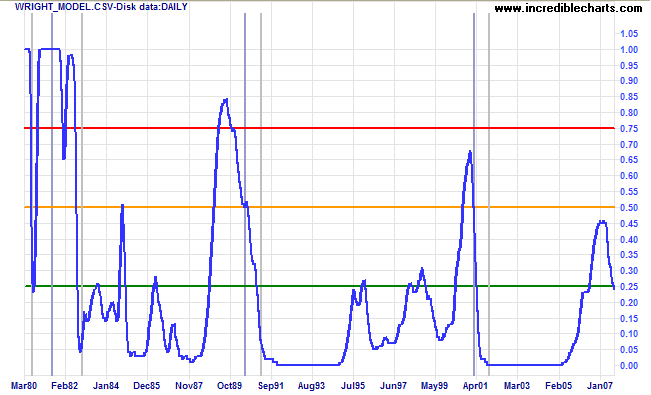

Wright Model

Probability of recession in the next four quarters eased further, to a low 24 per cent, according to the Wright Model. The model fairly accurately predicts recessions caused by contraction of the money supply, but I suspect that it may not be as reliable in identifying mischief caused by artificially low interest rates.

The best way to destroy the capitalist system is to debauch the

currency. By a continuing process of inflation, governments can

confiscate, secretly and unobserved, an important part of the

wealth of their citizens.

~ John Maynard Keynes

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.