Sub-Prime Tremors Continue

By Colin Twiggs

September 8, 2007 2:30 a.m. EST (4:30 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

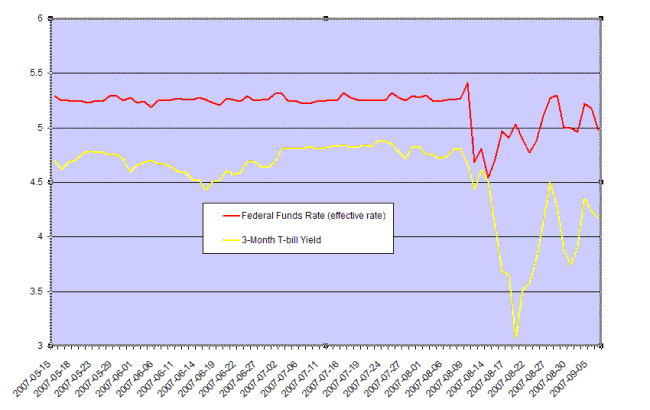

The Fed continues to boost liquidity in financial markets, with the effective federal funds rate easing to 5.00%—below the target rate of 5.25%. Treasury bill yields below 4.5% continue to reflect a substantial safety premium. The full effect of the credit squeeze and re-pricing of illiquid assets will only be revealed over the next few months, with the release of third-quarter earnings.

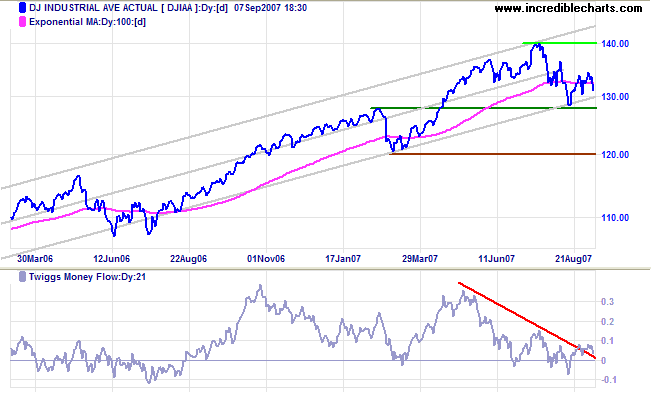

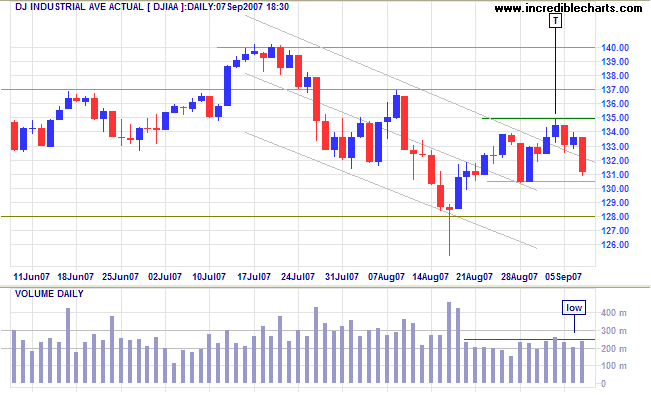

Dow Jones Industrial Average

The Dow Jones Industrial Average is consolidating at the lower border of the trend channel. Breakout below 12800 would warn of another down-swing—and that the primary trend is weakening. Twiggs Money Flow broke through its downward trendline and a rise above 0.08 would signal accumulation.

Long Term: The primary trend remains up, with support at 12000.

Short Term: Volatility remains high and a fall below 13000 would warn that the secondary correction is likely to continue, while a rise above 13500 would confirm that it has ended.

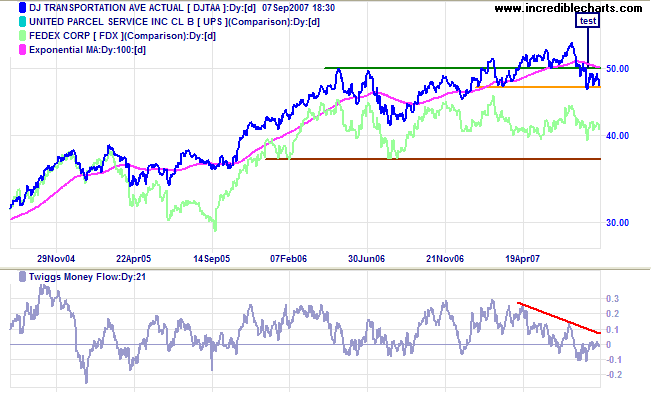

Transport

A Dow Jones Transportation Average fall below support at 4700 would signal the start of a primary down-trend. Fedex continues to range between $100 and $120, indicating uncertainty about the economy.

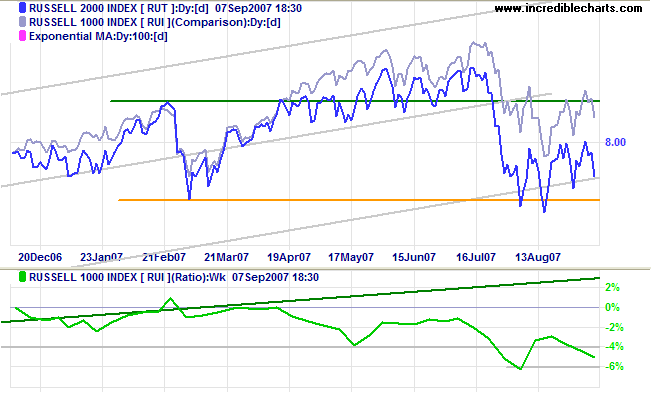

Small Caps

The Russell 2000 declined faster than the large cap Russell 1000 index and a Price Ratio (Russell 2000/1000) fall below the August low (-6%) would confirm a long-term shift to the safety of large cap stocks.

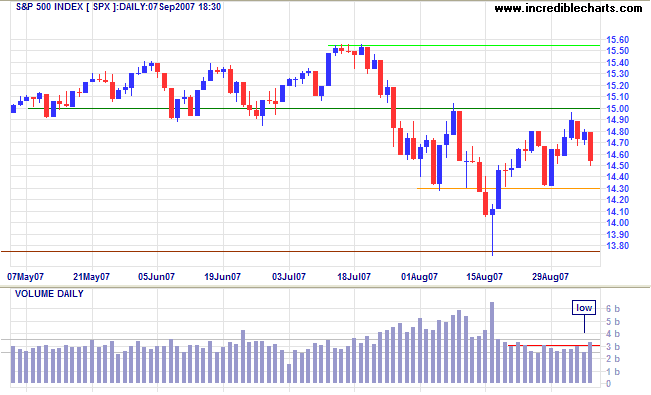

S&P 500

The S&P 500 respected resistance at 1500 before

retreating to test short-term support at 1430. Low volume

indicates that further consolidation between 1500 and 1430 is

likely. Breakout above 1500 would warn of another primary

advance, while a fall below 1430 would threaten primary support

at 1370.

Long Term: The primary trend remains up.

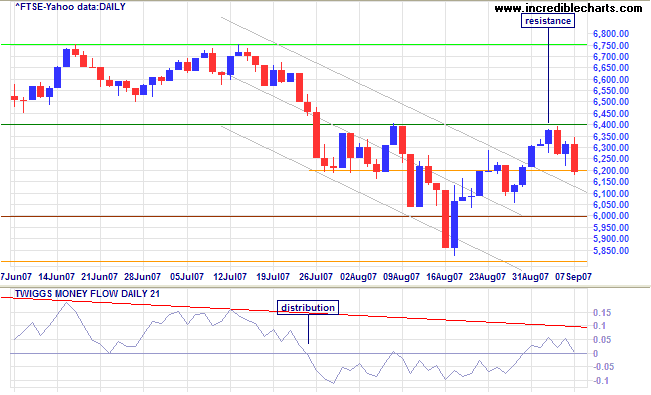

United Kingdom: FTSE

The FTSE 100 respected resistance at 6400 and is now headed for a re-test of primary support at 6000. A close below this level would confirm the reversal to a primary down-trend. Recovery above 6400, however, remains equally likely and would indicate that the fall through primary support was merely a false break.

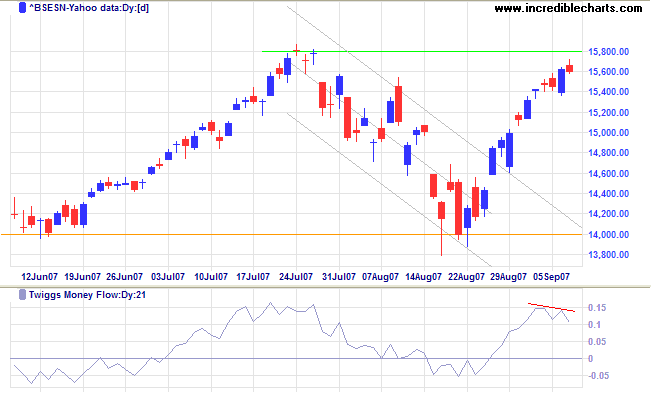

India: Sensex

The Sensex is testing 15800, but divergence on Twiggs Money Flow warns of distribution. Narrow consolidation below resistance would be a bullish sign, while breakout would present a target of 17600 [15800+(15800-14000)]. Reversal below 15400/15350, while not as likely, would warn of another correction.

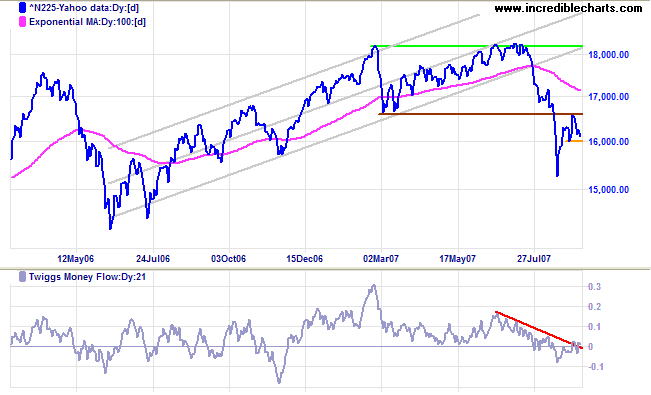

Japan: Nikkei

The Nikkei 225 respected resistance at the former primary support level of 16600 and is now headed for a test of short-term support at 16000; penetration would warn of another down-swing. The primary trend is down, but Twiggs Money Flow whipsawing around zero signals uncertainty.

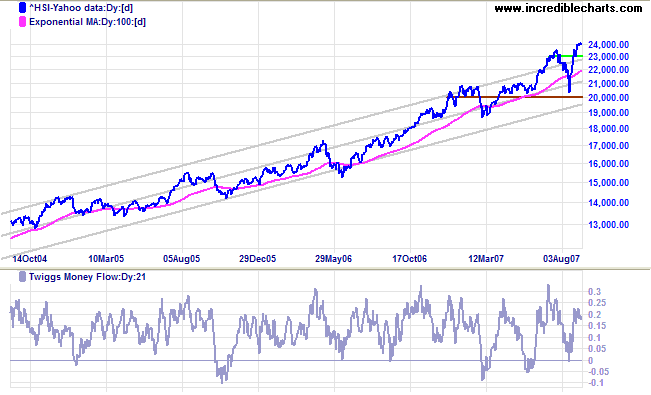

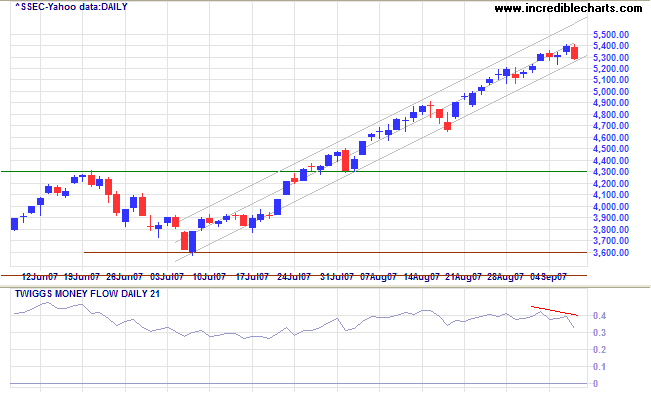

China: Hang Seng & Shanghai

The Hang Seng continues to advance in a strong primary up-trend, with a target of 26700 [23500+(23500-20300)]. Primary support remains at 20400 and Twiggs Money Flow signals strong accumulation.

The Shanghai Composite is testing the lower border of its trend channel; breakout would warn that the up-trend is weakening. Bearish divergence on Twiggs Money Flow indicates short-term distribution. The primary trend is up with the bull market having entered stage 3 (speculation dominates and price advances are based on hopes and expectations rather than actual results).

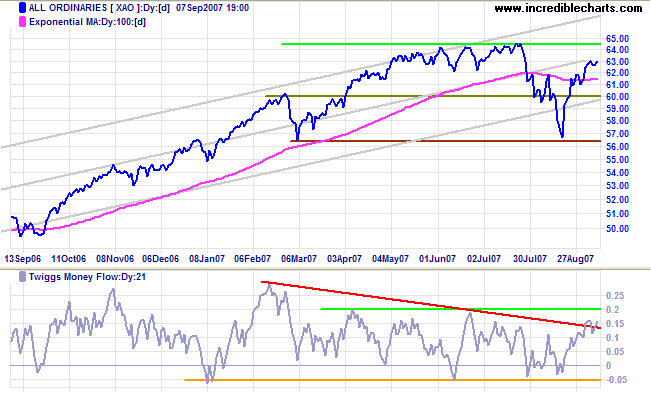

Australia: ASX

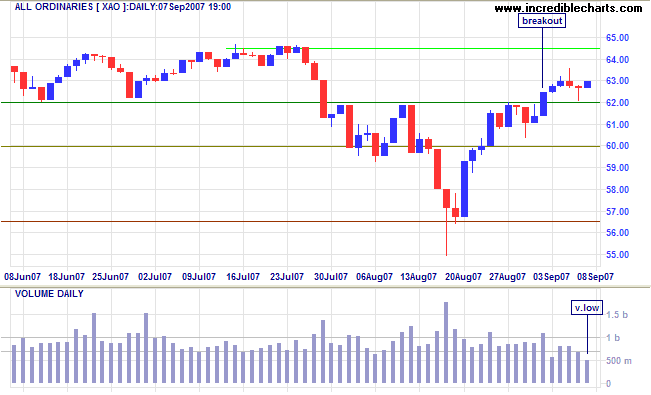

The All Ordinaries is warily headed for a test of the

previous high of 6450, while

Twiggs Money Flow (21-day) signals accumulation after

penetrating its downward trendline. However, do not expect a

breakout above 6450 unless the Dow or S&P 500 has started a

new advance. Reversal below 6000 is unlikely—and would

indicate another test of primary support at 5650.

Long Term: The primary up-trend continues.

Short Term: The market obliged us with a retracement that respected the new support level of 6200, providing further confirmation of the breakout. Reversal below 6200 would normally be considered unlikely, but negative sentiment from the US and UK makes this an even chance—which would signal a test of 6000.

A market can and does often cease to be a bull market long

before prices generally begin to break. My long expected

warning came to me when I noticed that, one after another,

those stocks which had been the leaders of the market reacted

several points from the top and—for the first time in

many months—did not come back. Their race was evidently

run....

~ Jesse Livermore in

Reminiscences of a Stock Operator by Edwin Lefevre.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.