Bush Proposal - Taxpayers To Bail Out The Banks

By Colin Twiggs

September 1, 2007 4:30 a.m. EST (6:30 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

President Bush proposed Friday that federal mortgage insurance be extended to borrowers who fall behind on adjustable rate mortgages. Saving homeowners from losing their homes is a noble cause, but the real beneficiaries are the banks who will be saved from losses on defaulting mortgages —if borrowers later default, the taxpayer will pick up the tab. Some estimates are as high as 2 million homeowners at risk of foreclosure.

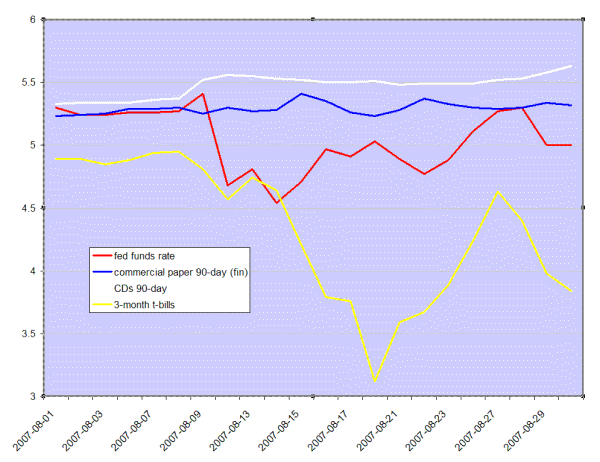

The federal funds rate eased to 5.00%, below the target rate of 5.25%, indicating that the Fed is again boosting liquidity in the market. And 3-month Treasury bills, currently under 4.00%, continue to reflect a substantial safety premium when compared to commercial paper and CDs. The sub-prime crisis is not yet over, with more than $1 triilion of ARMs to be reset (at the end of their honeymoon period) in 2007 and 2008, but the ultimate cost, as with the S&L crisis of the 1990s, could end up being borne by taxpayers and not just investors.

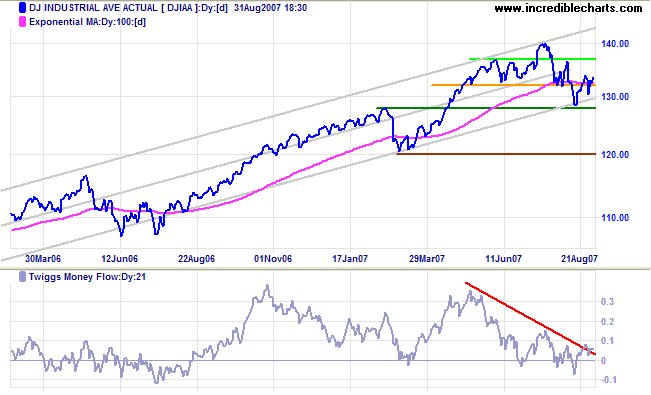

Dow Jones Industrial Average

The Dow Jones Industrial Average is consolidating between 12800 and 13400 —above the lower trend channel. Breakout below 12800/above 13400 would signal continuation/end of the secondary correction respectively. Twiggs Money Flow is testing its downward trendline; a rise above 0.1 would signal accumulation.

Long Term: The primary trend remains up, with support at 12000.

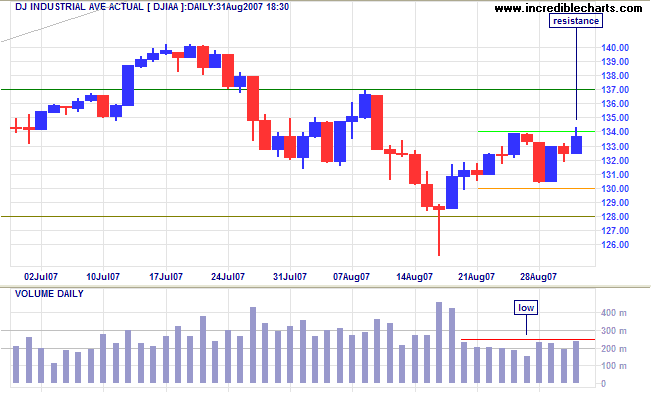

Short Term: Friday's weak close signals resistance at 13400. Volumes remain low and further consolidation between 13000 and 13400 is expected.

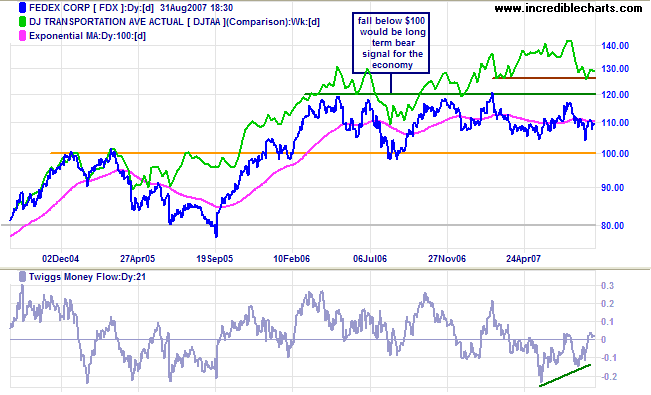

Transport

Fedex continues to range between $100 and $120, signaling uncertainty over the economy. The Dow Jones Transportation Average is testing primary support (at 4700).

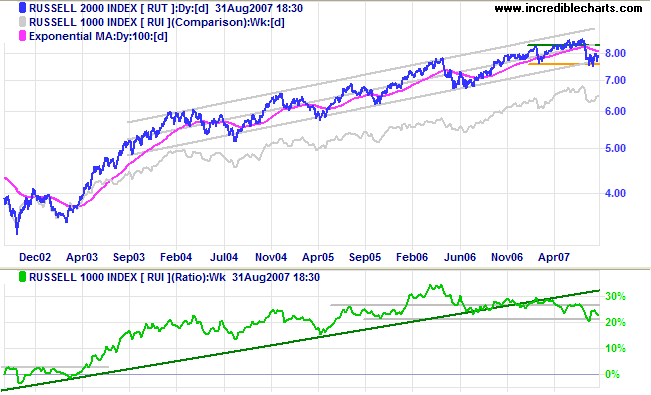

Small Caps

The Russell 2000 is declining at a faster rate than the large cap Russell 1000 index. A Price Ratio (Russell 2000/1000) fall below the August low (20%) would confirm a long-term shift in favor of larger caps and safety.

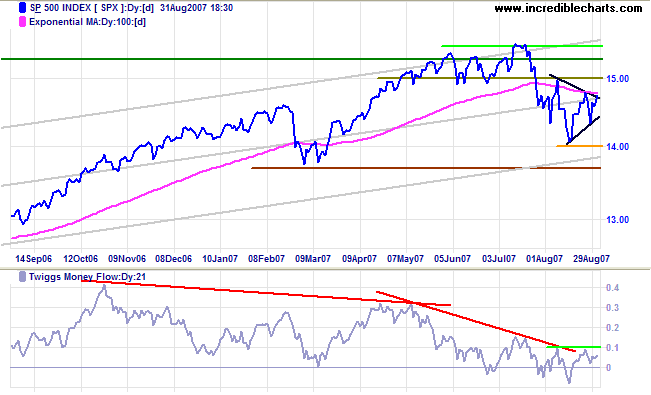

S&P 500

The S&P 500 reflects indecision, with medium-term

consolidation between 1400 and 1500 and a symmetrical triangle.

Twiggs Money Flow rising above 0.1 would signal accumulation,

while a fall below the August low would warn of another

down-swing. The correction has not ended until there is a

breakout above 1500. A downward breakout remains equally likely

and would threaten primary support at 1370.

Long Term: The primary trend remains up.

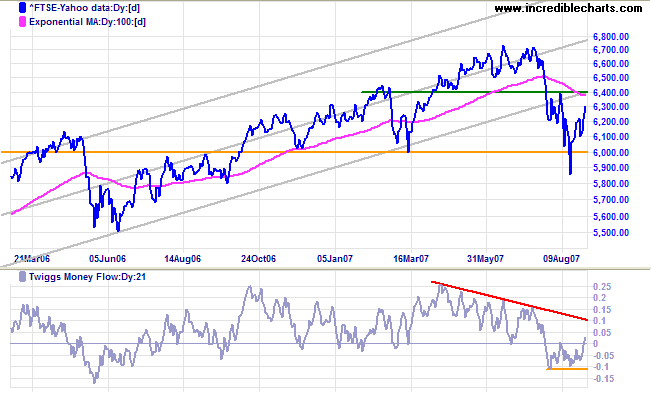

United Kingdom: FTSE

The FTSE 100 is headed for a test of 6400, while Twiggs

Money Flow has recovered above zero. A rise above 6400 would

indicate that the correction is over and the fall through

primary support was merely a false break. Reversal at 6400,

however, remains equally likely.

Long Term: The primary trend remains uncertain and

another close below 6000 would confirm the down-trend.

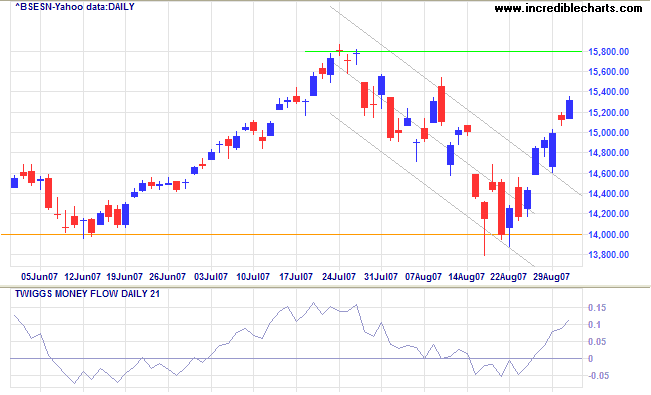

India: Sensex

The Sensex is headed for a test of 15800, with Twiggs Money Flow signaling accumulation. A break through this level would present a target of 17600 [15800+(15800-14000)].

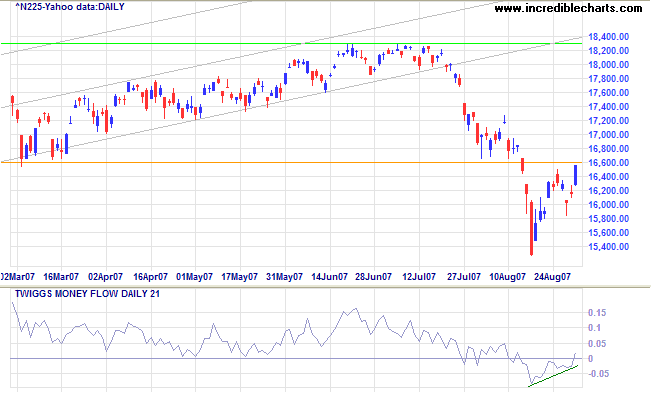

Japan: Nikkei

The Nikkei 225 is testing resistance at the former primary support level of 16600. Respect would confirm the primary down-trend, while a breakout would signal weakness in the primary down-trend. Twiggs Money Flow rose above zero, reflecting short-term accumulation.

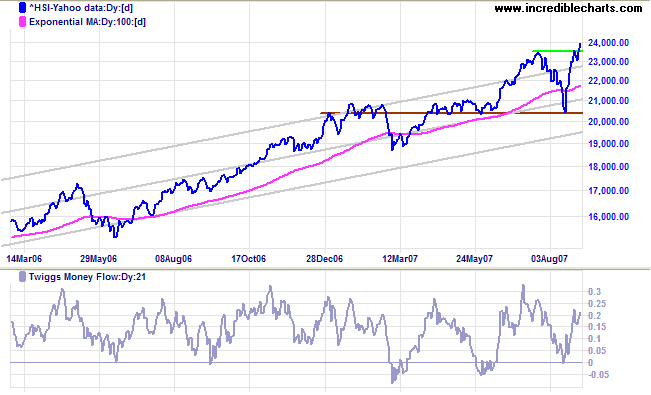

China: Hang Seng & Shanghai

The Hang Seng broke through 23500 to signal another primary advance, with a target of 26700 [23500+(23500-20300)]. Primary support moves up to 20400. Twiggs Money Flow signals strong accumulation.

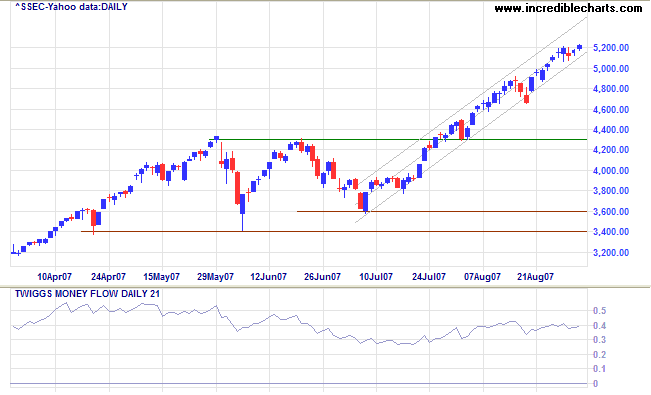

The Shanghai Composite continues to rise within its upward trend channel. Twiggs Money Flow signals strong accumulation. The bull market has entered stage 3, with average PE at 30 according to Forbes scorecard.

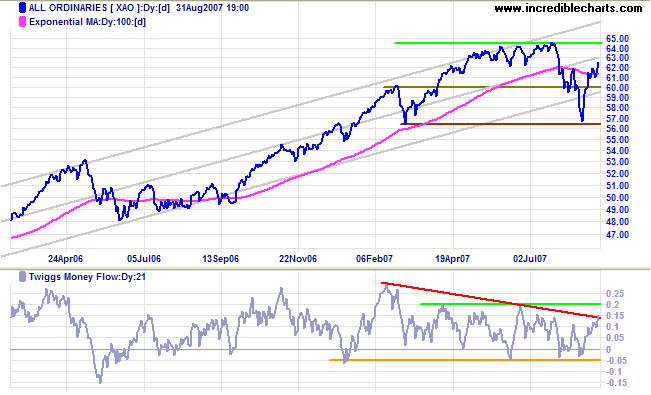

Australia: ASX

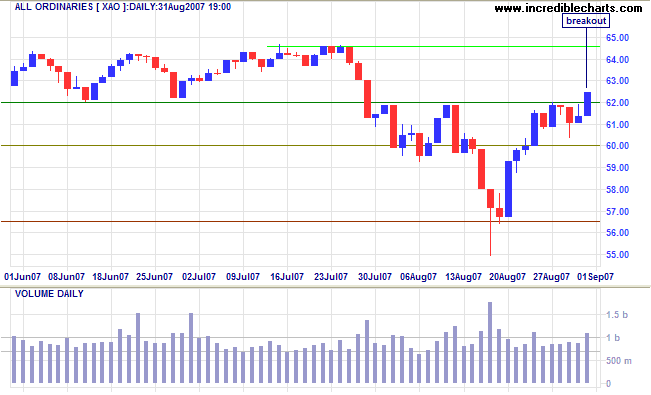

The All Ordinaries broke through resistance, after a

brief consolidation below 6200, to signal the end of the

secondary correction.

Twiggs Money Flow (21-day) also penetrated its downward

trendline to signal accumulation, but I would like to see the

Dow or S&P 500 follow suit before I am comfortable.

Long Term: The primary trend remains up.

Short Term: I would be exceedingly grateful if the market would retrace or consolidate above the new support level at 6200, providing further confirmation of the breakout. Unfortunately markets are not always that obliging. Reversal below 6000 is less likely —and would indicate that the correction is not yet over.

When business in the United States underwent a mild contraction

in 1927, the Federal Reserve created more paper reserves in the

hope of forestalling any possible bank reserve shortage. More

disastrous, however, was the Federal Reserve's attempt to

assist Great Britain who had been losing gold to us... The Fed

succeeded: it stopped the gold loss, but it nearly destroyed

the economies of the world in the process. The excess credit

which the Fed pumped into the economy spilled over into the

stock market —triggering a fantastic speculative boom....

As a result, the American economy collapsed.

~

Alan Greenspan (1966)

Colin's comment: Markets in 1929 and 2007 are not directly

comparable. Currencies are no longer tied to a gold standard;

the current bull market in stocks is mild by comparison to the

speculative boom of 1927 - 1929; and excess credit which the

Fed pumped into the economy has spilled over into the housing

market, not the stock market —with consequences that are

only now beginning to surface. Who was in charge of pumping

liquidity into the economy this time around? ....No prizes for

guessing the correct answer.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.