Gold, Oil, Currencies & Interest Rates

By Colin Twiggs

July 10, 2007 3:00 a.m. EST (5:00 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

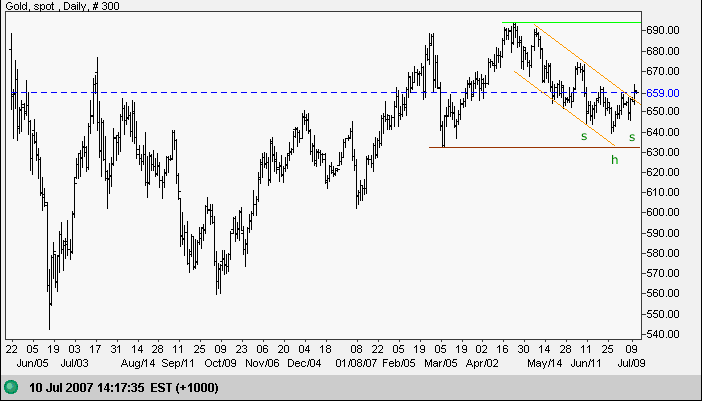

Gold

Spot gold broke through the upper border of the trend channel, completing a small inverted head and shoulders reversal. A rally to test resistance at $695 is now likely, while reversal below $645 would signal a test of primary support above $630. The weak dollar and rising crude prices should boost demand for gold.

Source: Netdania

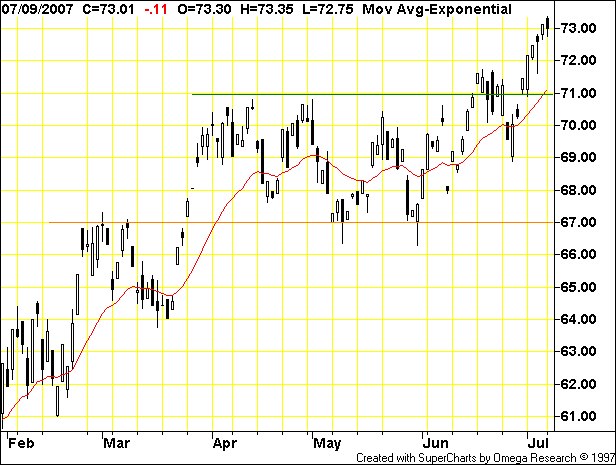

Crude Oil

December Light Crude rallied strongly after breaking through resistance at $71/barrel. I have revised the target downwards to $75 (71+[71-67]). Retracement to test the new support level of $71 remains a possibility.

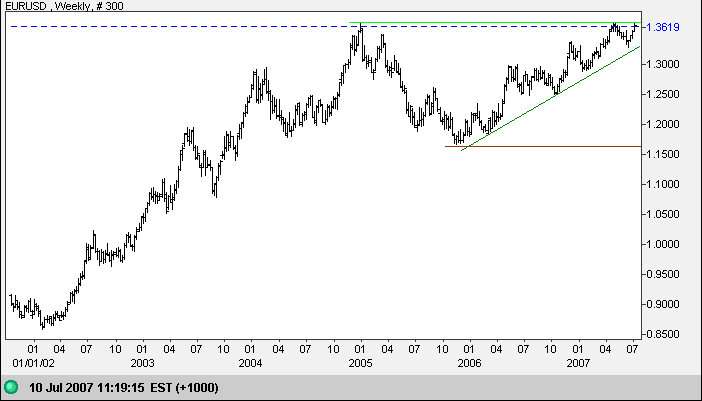

Currencies

The euro is testing major resistance at $1.37. Breakout or a narrow consolidation would be a bullish sign, while a fall below $1.33, though not expected at present, would signal weakness. A rise above $1.37 would give a medium term target of $1.41 (1.37+[1.37-1.33]).

Source: Netdania

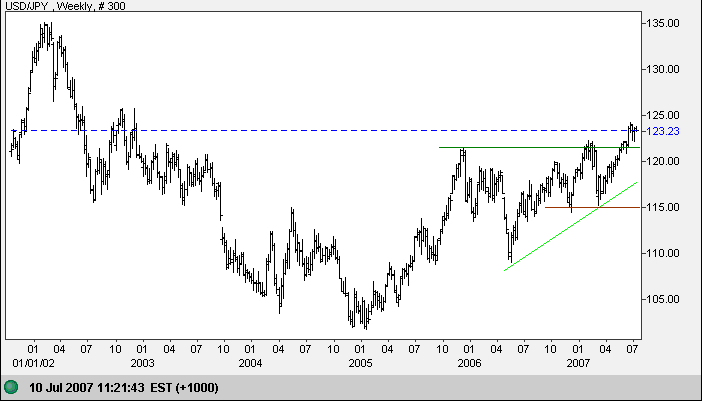

The dollar is consolidating above support at 122 against the

yen. Breakout above 124 would indicate a medium-term

target of 129 (122+[122-115]), while reversal below 122 would

signal weakness.

The primary trend is up and the long-term target is the 2002

high of 135 (122+[122-109]).

Source: Netdania

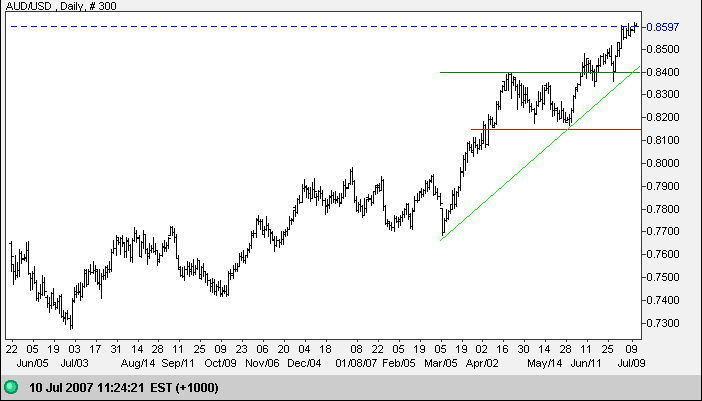

The Australian dollar is approaching its medium term target of 0.8650 (0.8400+[0.8400-0.8150]). The long-term target is 0.92 (0.80+[0.80-0.68]), but we can expect a retracement to establish a new support level before then.

Source: Netdania

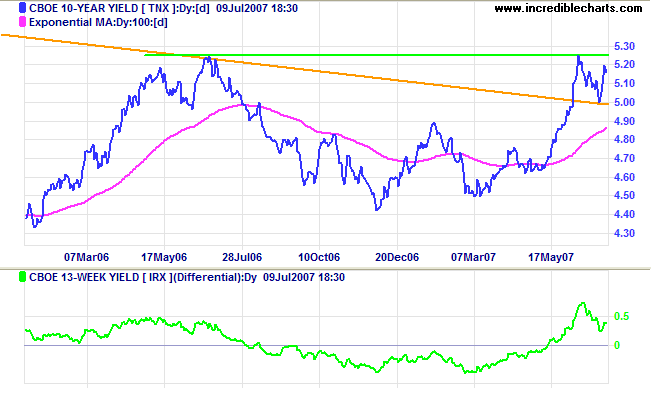

Treasury Yields

The ten-year treasury yield is consolidating between 5.00% and 5.25%. Breakout would indicate future direction. The yield differential (10-year minus 13-week treasury yields) remains positive.

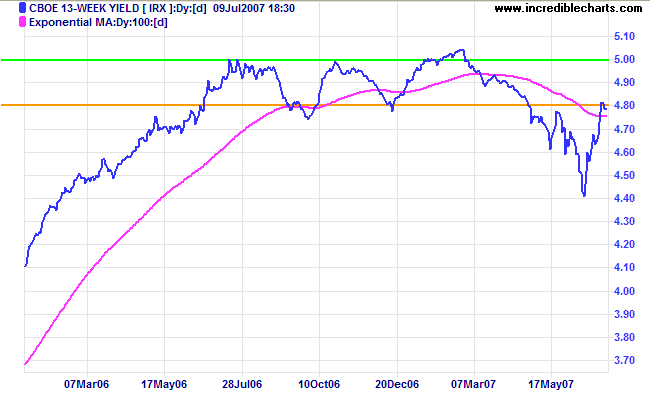

Short-term (13-week) treasury yields are testing resistance at 4.80%. Respect of resistance would warn that the down-trend is intact, while failure would signal that the recent equilibrium is likely to be restored.

Stock Markets

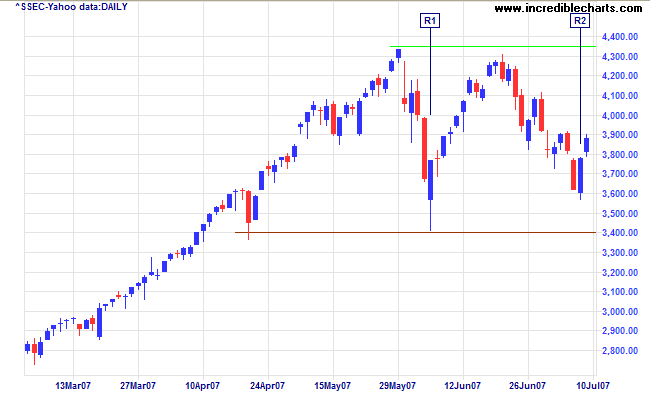

The Shanghai index [^SSEC] displays a bullish key

reversal [R2] above support at 3400, indicating another

test of 4350. The Hang Seng is in a strong up-trend, headed for

a test of 23000, while the Nikkei 225 remains bullish, testing

its 2007 high of 18300.

The FTSE 100 and the DAX appear bullish, while the Dow and

S&P 500 are recovering.

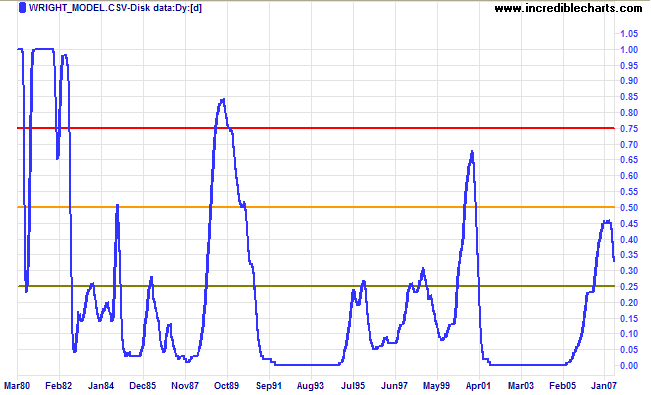

Wright Model

Probability of recession in the next four quarters retreated to 33 per cent according to the Wright Model.

Soon the ice will melt, and the blackbirds sing along the river

which he frequented, as pleasantly as ever. The same

everlasting serenity will appear in this face of God, and we

will not be sorrowful, if he is not.

~ Henry David Thoreau, in a letter to Lucy Brown following the

death of his brother.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.