Gold, Oil, Currencies & Interest Rates

By Colin Twiggs

June 27, 2007 7:00 a.m. EST (9:00 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

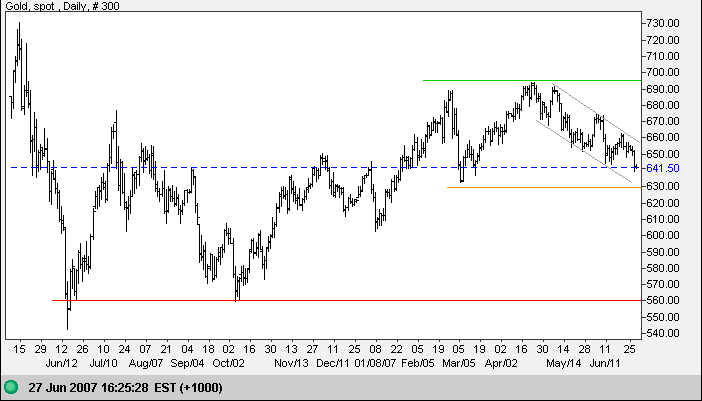

Gold

Spot gold edged toward a test of primary support at $630.

Corrections in a bull-trend are normally a lot sharper, as in

March 2007, and the present gradual decline is a sign of

(primary trend) weakness. Strong crude prices support demand

for gold, but this is being offset by a strong dollar.

In the longer term, the primary trend remains up. A rise above

$695 would indicate that the primary advance will continue,

while a fall below $630 would signal reversal.

Source: Netdania

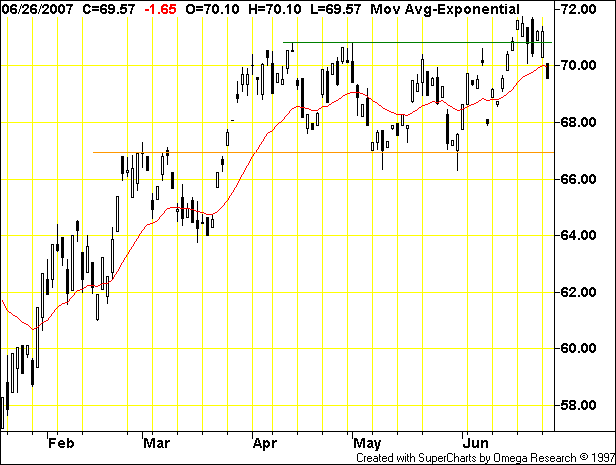

Crude Oil

The December Light Crude failed breakout above $71/barrel may turn into a bull trap. Expect a test of support at $67, failure of which would warn of a correction to test primary support at $55. Reversal above $71, on the other hand, would signal that the up-trend and target of $76 (71+[71-66]) is intact.

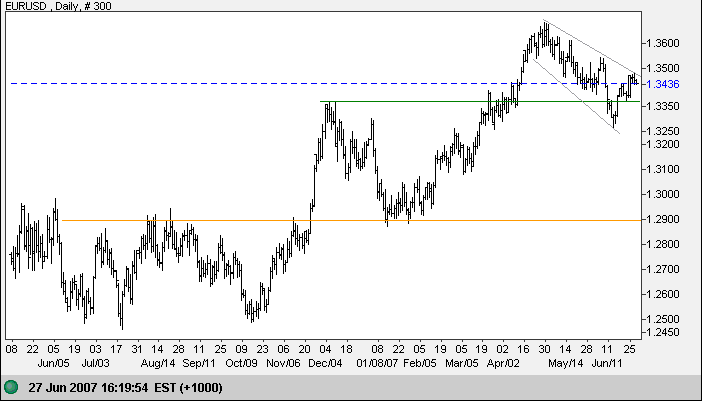

Currencies

The euro recovered above the first line of primary support at $1.3350, with the ECB talking tough on interest rates. Respect of this support level would be a bullish sign, while failure would warn of a test of primary support at $1.29.

Source: Netdania

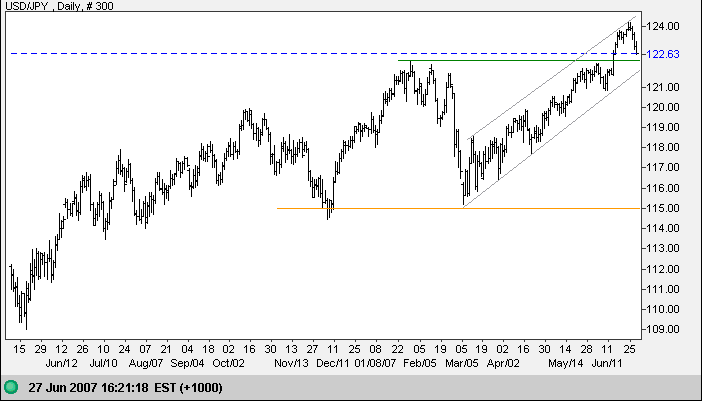

The dollar is headed for a test the new support level at 122 against the yen, with the BOJ also adopting a more hawkish pose on interest rates. Respect of the new support level would be bullish, indicating a medium-term target of 129 (122+[122-115]). A fall through the lower trend channel, though not expected, would signal trend weakness.

Source: Netdania

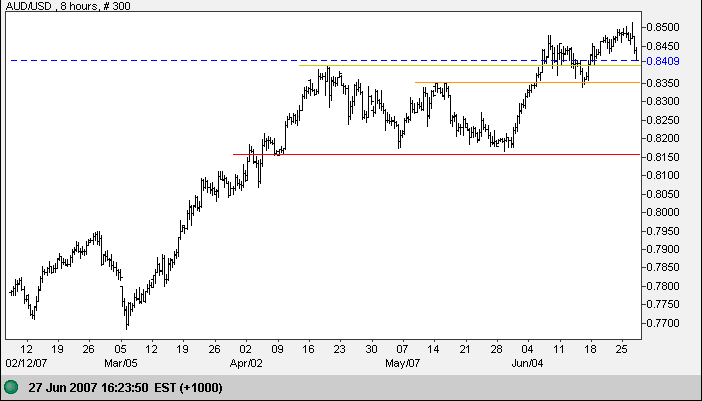

The Australian dollar retraced after testing resistance at 0.85 against the greenback. Respect of support at 0.8350 would be bullish, while failure would signal a test of medium-term support at 0.8150.

Source: Netdania

Treasury Yields

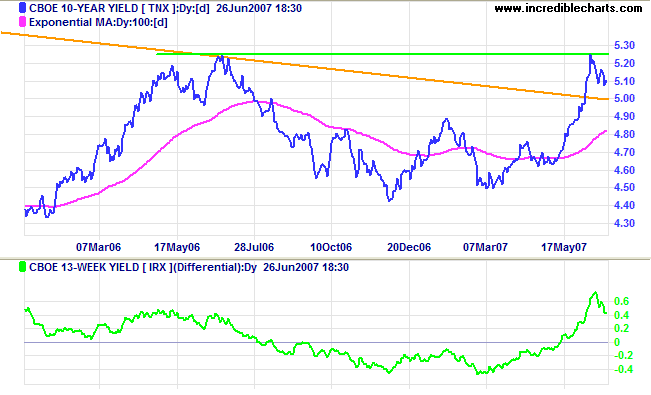

The ten-year treasury yield retraced from resistance at the

2006 high of 5.25%, to close at 5.08%. Consolidation above

5.00% would be a bullish sign for bond yields - bearish for

bond prices.

The yield differential (10-year minus 13-week treasury yields)

fell as short-term rates recovered, but remains positive.

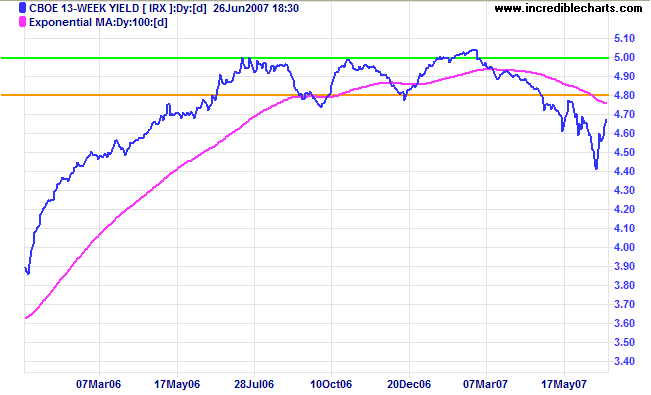

Short-term (13-week) treasury yields recovered sharply, as the flow from long-term to short-term treasuries abated. Respect of resistance at 4.80% would warn that the down-trend is intact, while failure would signal that the recent equilibrium is restored.

Stock Markets

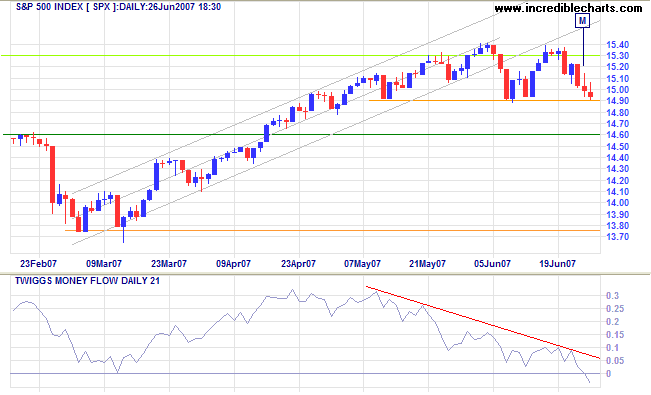

The Hang Seng made sharp gains in the last week and is now consolidating below 22000, while US markets are bearish. The S&P 500 is testing short-term support at 1490, while Monday and Tuesday's tall shadows in a down-trend indicate attempted rallies overwhelmed by sellers. Twiggs Money Flow crossing to below zero signals distribution. Failure of support at 1490 would warn of a secondary correction.

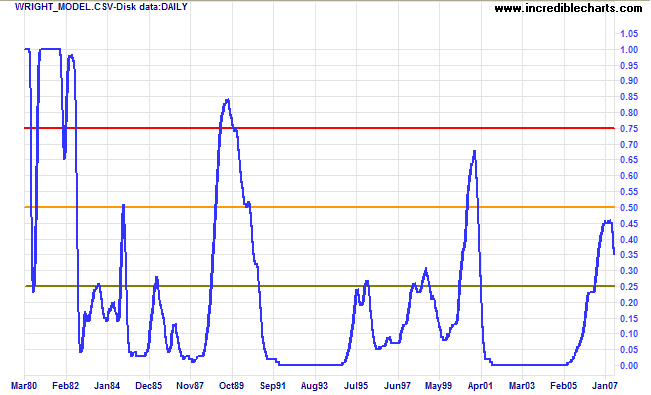

Wright Model

Probability of recession in the next four quarters fell to 35 per cent according to the Wright Model.

Do not seek to have events happen as you want them to, but

instead want them to happen as they do happen, and your life

will go well.

~ Epictetus

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.