Rising Treasury Yields

By Colin Twiggs

June 9, 2007 1:00 a.m. EST (3:00 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA: Dow, Nasdaq and S&P500

Rising 10- and 30-year treasury yields signal a weakening of the long-term bear market and sparked a brief equity sell-off. The next week should tell whether the reaction is quickly mopped up by buyers or evolves into a secondary correction.

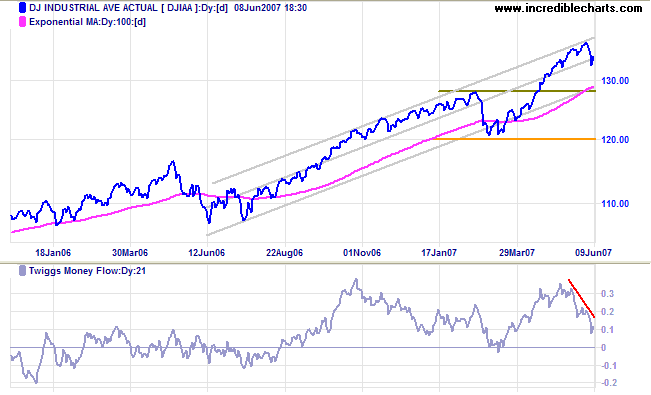

The Dow Jones Industrial Average retreated from the

upper border of the trend channel, warning of a secondary

correction that would test primary support at 12800 and

possibly 12000. A bearish divergence on

Twiggs Money Flow signals distribution.

Channel lines on the chart below are not symmetrical: I have

dragged the top channel line closer to the linear regression

line because in this case data is not evenly distributed around

the LR line.

Long Term: The primary up-trend continues.

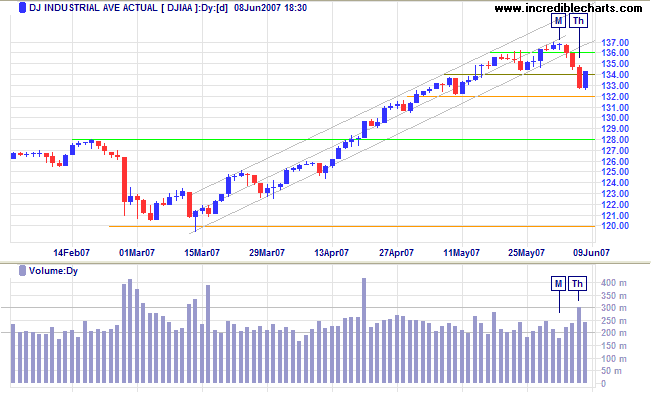

Short Term: Low volume on Monday signaled that the up-trend was losing momentum. A sharp three day fall followed, ending when strong volume [Th] signaled that buyers had re-entered the market. The break below the trend channel indicates that the primary advance is weakening and a rally that fails to test 13700 would warn of a secondary correction - confirmed if the index reverses below Friday's low of 13250.

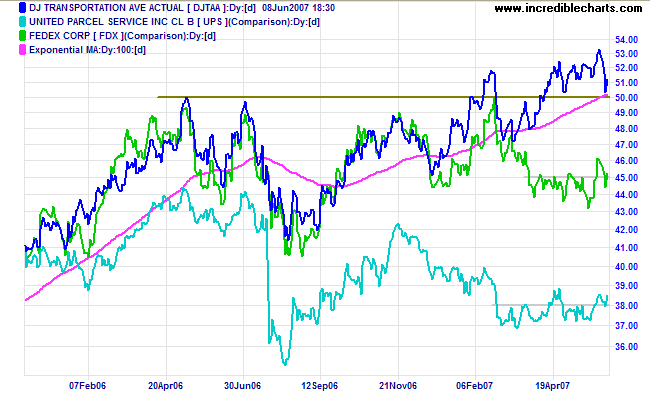

The Dow Jones Transportation Average is testing support at 5000. Respect of support would be a bullish sign, while failure would signal further consolidation (uncertainty). Fedex and UPS both show bullish upward breakouts.

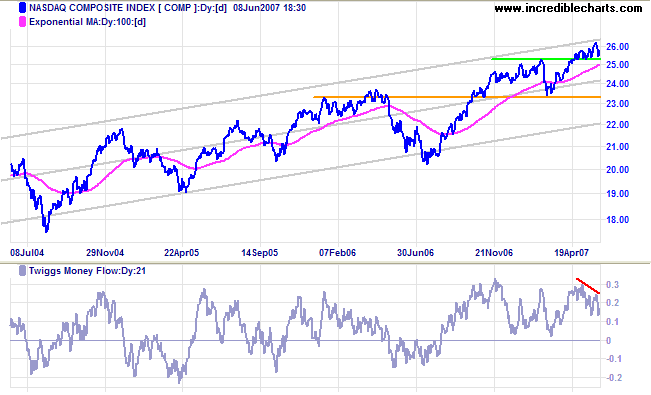

The Nasdaq Composite is consolidating near the upper

trend channel on the 3 year chart and bearish divergence on

Twiggs Money Flow (21-day) warns of distribution. A fall

below 2525 would be bearish.

Long Term: The primary trend remains upwards, with

support at 2525 and 2340.

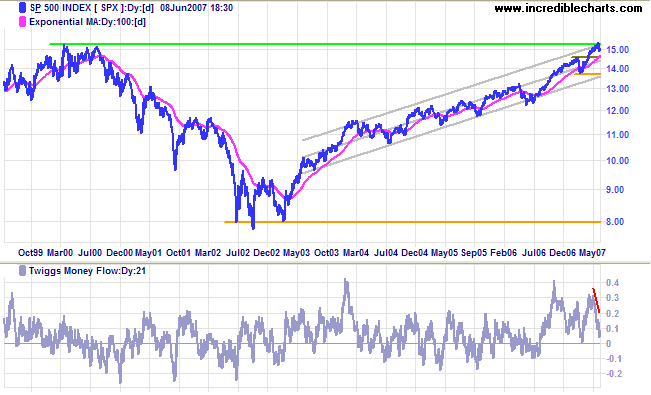

The S&P 500 retreated below the 2000 high of 1530,

while a bearish divergence on

Twiggs Money Flow (21-day) warns of distribution. Reversal

below Friday's low of 1490 would warn of a secondary

correction.

Long Term: The primary trend remains up, with support

levels at 1460 and 1375.

LSE: United Kingdom

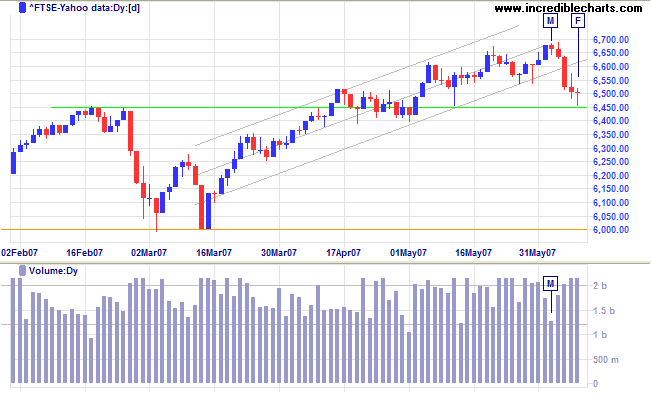

The FTSE 100 broke below the trend channel - signaling

trend weakness - after a failed breakout above resistance at

6650. Strong volume and weak closes in the latter part of the

week indicate that buyers have re-entered the market. A fall

below the first line of primary support at 6450 would warn of a

secondary correction, possibly testing primary support at

6000.

Long Term: The primary up-trend continues.

Japan: Nikkei

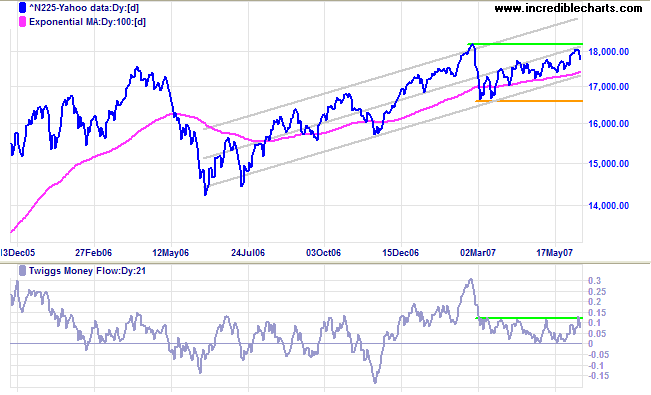

The Nikkei 225 continues to edge upwards towards

resistance at the February 2007 high. A rise above 18215 would

signal a test of the upper border of the trend channel, while

downward breakout from the trend channel would indicate that

the primary trend is weakening.

Twiggs Money Flow continues to respect the zero line,

signaling accumulation.

Long Term: The primary trend remains up, with primary

support at 16600.

China: Hang Seng

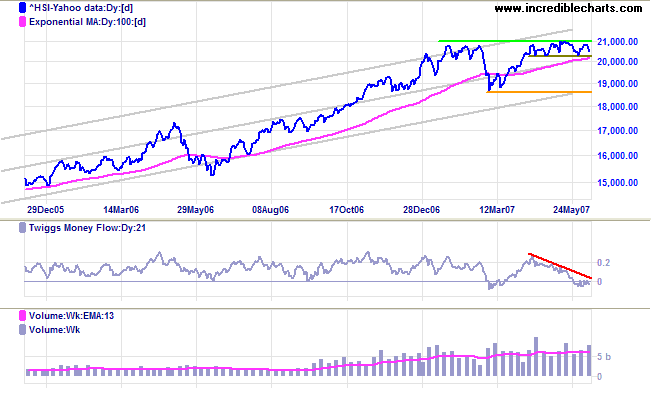

Volumes on the Hang Seng index have trebled over the last 9 months, indicating that the market is overheating. The index continues to consolidate in a narrow band between 21000 and 20300, normally a bullish sign in an up-trend, but Twiggs Money Flow signals strong distribution. The two scenarios appear equally likely: a fall below 20300 would warn of a secondary correction testing primary support at 18700, while a rise above 21000 would signal that the primary advance continues.

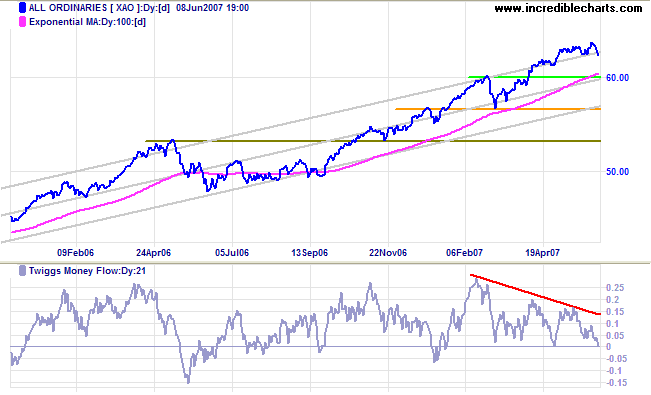

ASX: Australia

The All Ordinaries continues to consolidate at the upper

border of the trend channel. An upward breakout is less likely

- because of the position on the trend channel and

Twiggs Money Flow (21-day) testing zero after a large

bearish divergence - but would warn of an accelerating up-trend

and possible blow-off. Downward breakout would test the first

line of primary support at 6000 and possibly the second at

5650.

Long Term: The primary up-trend continues.

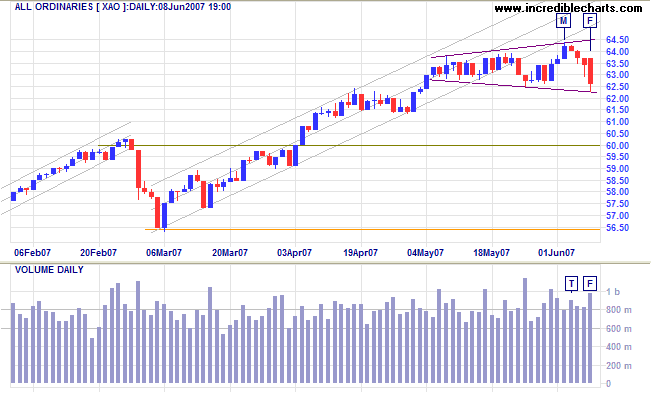

Short Term: Monday's failed breakout encountered resistance above 6400 - signaled by strong volume at [T] - before retracing to test support on Friday. Weak closes and strong volume at [F] reveal that buyers remain committed. The rectangle pattern has morphed into a broadening top formation; future direction will be signaled by a failed swing (partial rise or decline) or an actual breakout.

The financial markets generally are unpredictable. So that one

has to have different scenarios... The idea that you can

actually predict what's going to happen contradicts my way of

looking at the market.

~ George Soros

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.