Bulls Ignore China

By Colin Twiggs

June 2, 2007 2:00 a.m. EST (4:00 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA: Dow, Nasdaq and S&P500

Markets have so far shown little ill-effect from the uncertainty in China, with a number of indices displaying bullish breakouts.

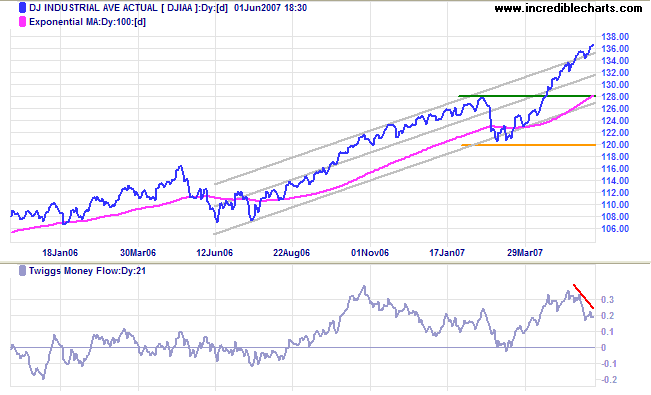

The Dow Jones Industrial Average broke through the upper

border of the trend channel, while

Twiggs Money Flow warns of strong distribution (more than

likely a resulting from volatility in China) over the past

week. The index has also reached its target of 13600

(12800+[12800-12000]) and a secondary correction is expected

soon.

Channel lines on the chart below are not symmetrical: I have

dragged the top channel line closer to the linear regression

line because in this case data is not evenly distributed around

the LR line.

Long Term: The primary up-trend continues, with primary support at 12800 and 12000.

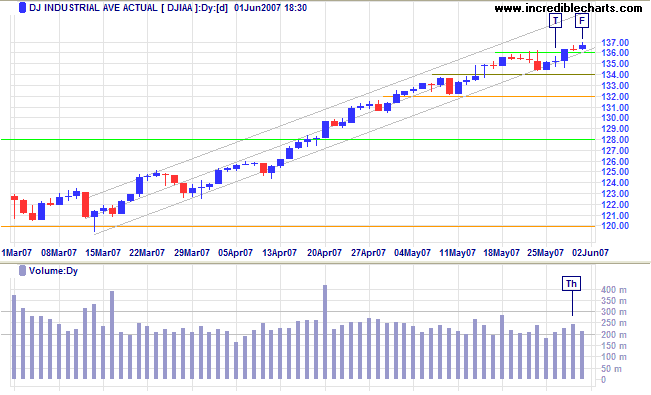

Short Term: Despite some resistance, signaled by higher volume on Thursday, the Dow broke above 13600. Declining activity levels indicate that buyers are increasingly wary.

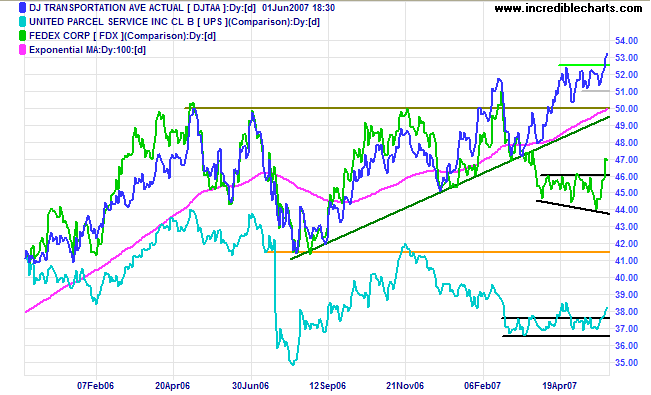

The Dow Jones Transportation Average shows a bullish breakout above 5250 - which should test 5500. Fedex broke out above a right-angled broadening formation and is likely to test its 2006/2007 highs. UPS also shows bullish signs, with a breakout above the recent narrow consolidation.

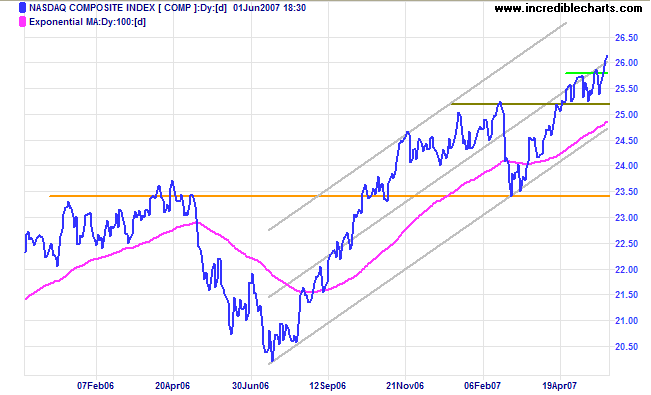

The Nasdaq Composite broke upwards from its recent

narrow consolidation and is likely to test the upper trend

channel. While not at all expected, reversal below 2525 would

warn of another secondary correction.

Twiggs Money Flow (21-day) continues to respect the zero

line, signaling long-term accumulation.

Long Term: The primary trend is up, with support at 2350

and 2000.

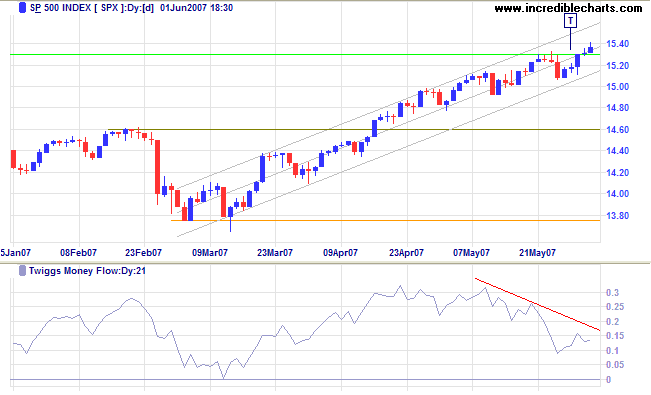

The S&P 500 broke through to a new all-time high

above 1530, but closes are weak and

Twiggs Money Flow (21-day) falling sharply warns of

profit-taking. Reversal below 1530 would indicate weakness,

strengthened if there is a break below the trend channel; while

a fall below 1500 would warn of a secondary correction.

Long Term: The primary trend is up, with support levels

at 1460 and 1375.

LSE: United Kingdom

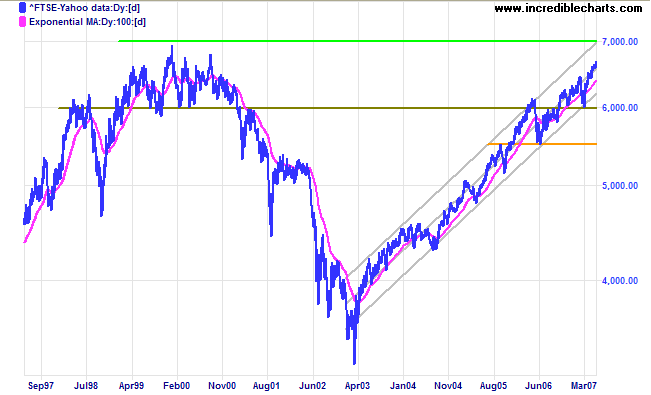

The FTSE 100 recovered above 6650, and appears set for a

test of the upper trend channel and the all-time high of 7000.

Twiggs Money Flow recovered rapidly after a sharp fall. Though

unlikely, reversal below 6550 would warn of a secondary

correction.

Long Term: The primary up-trend continues, with primary

support at 6450 and 6000.

Japan: Nikkei

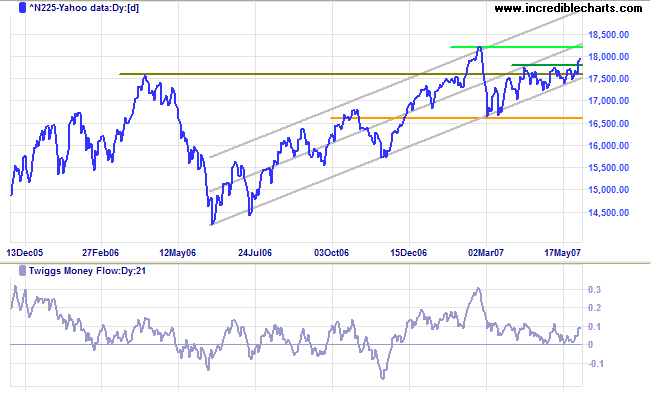

The Nikkei 225 broke above the recent bullish ascending

triangle and is headed for the February high. If that is

overcome expect a test of the upper border of the trend

channel. Though unlikely, a downward breakout below the lower

channel border would warn of a test of primary support at

16600.

Twiggs Money Flow continues to respect the zero line,

signaling accumulation.

Long Term: The primary trend remains up.

China: Hang Seng & Shanghai indexes

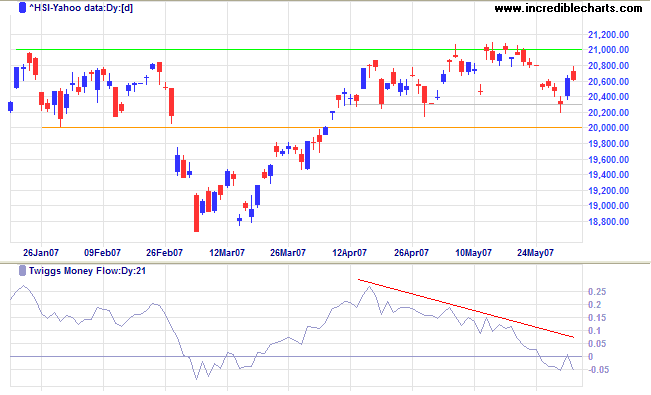

The Hang Seng found support at 20300, with a long tail

on Wednesday.

Twiggs Money Flow is bearish, however, having respected the

zero line from below. A fall below 20000 would warn of a

secondary correction, while a rise above 21000 would signal

resumption of the up-trend.

Long Term: The primary advance continues.

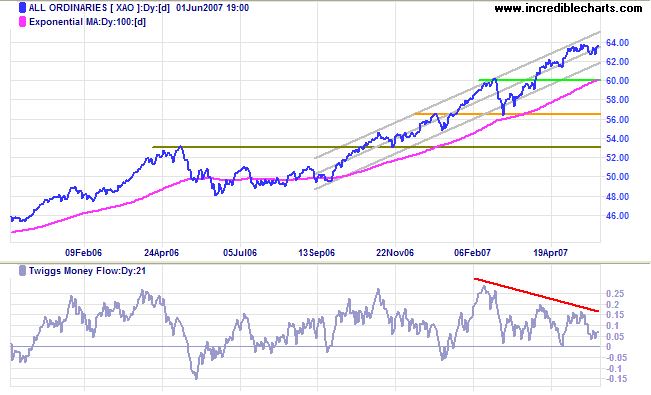

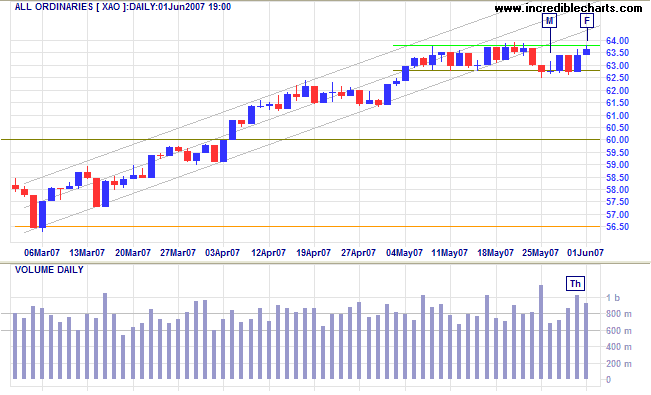

ASX: Australia

Having reached its target of 6350 (6000+[6000-5650]), the

All Ordinaries consolidated in a narrow band for several

weeks. Normally a continuation signal, the current rectangle

has roughly an even chance of breaking out in either direction.

Twiggs Money Flow (21-day) displays a large bearish

divergence, warning of significant profit-taking, with stocks

changing from strong hands to weak hands.

Long Term: The primary up-trend continues, with support

at 6000 and 5650.

Short Term: Fluctuating volumes reveal committed buyers and sellers as the index ranges from one border of the rectangle to the other. Tom Bulkowski has done some excellent research on rectangle patterns and found a low 2% failure rate for upside breakouts and an even lower rate for downward breakouts. Premature breakouts (or false breaks as they are often called), when they do occur, often warn of a genuine breakout in the opposite direction.

It’s the unconquerable soul of man, not the nature of the

weapon he uses, that insures victory.

~ General George S Patton Jr.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.