The Dow Correction In Perspective

By Colin Twiggs

March 3, 2007 1.00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

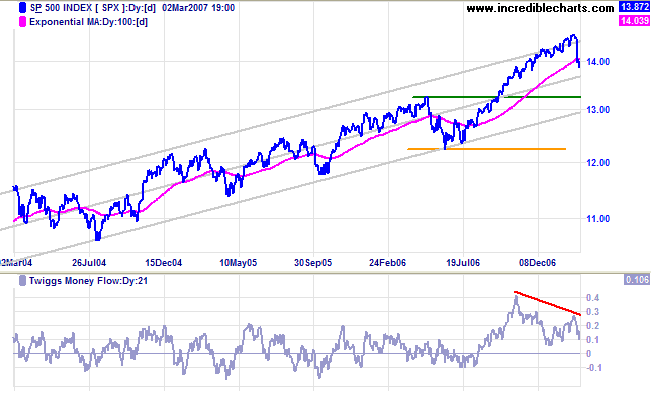

USA: Dow, Nasdaq and S&P500

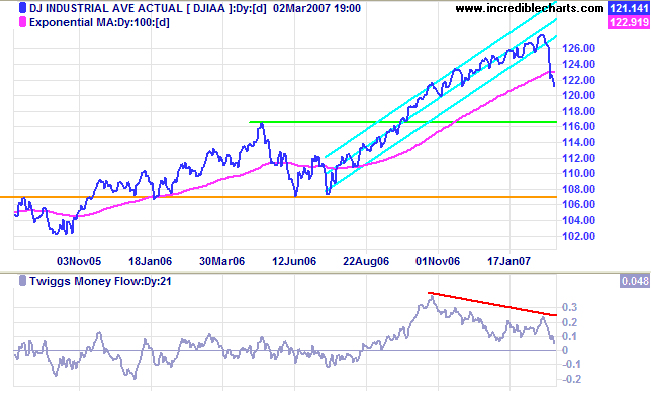

The Dow Jones Industrial Average fall below the recent trend channel and the 100-day moving average warn of a secondary correction. Twiggs Money Flow (21-day) displays a long-term bearish divergence and a fall below zero would add further warning. A healthy secondary correction would test support at the May 2006 high of 11600.

Long Term: The primary trend is up. A fall below the June 2006 low of 10700 would signal a reversal.

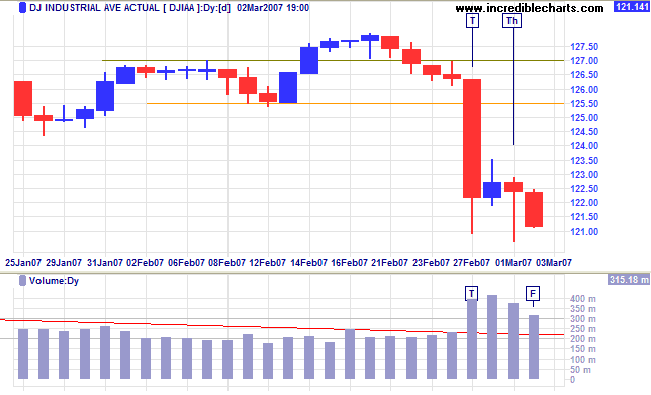

Short Term: The market is consolidating after Tuesday's sharp fall and strong volume. Bargain-buying is evident at the weak closes on [T] and [Th], but investors are nervous and any attempted rally is likely to meet considerable resistance. A fall below Thursday's low is more likely and would be expected to trigger further selling.

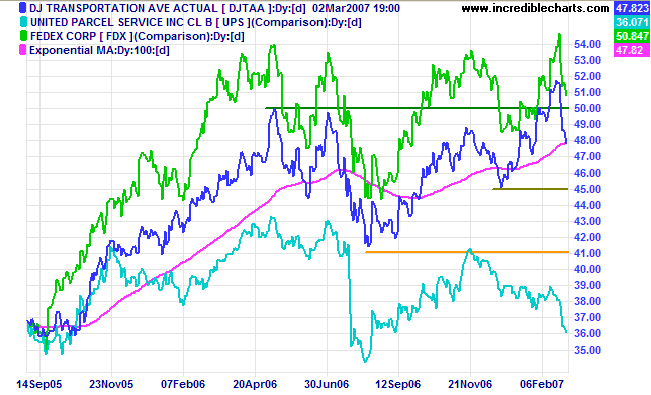

The Dow Jones Transportation Average again reversed below 5000, signaling weakness. A fall below 4500 would be bearish, while below 4100 would signal a primary down-trend. Though unlikely, respect of the 100-day moving average and reversal above 5000 would signal that the up-trend has recovered.

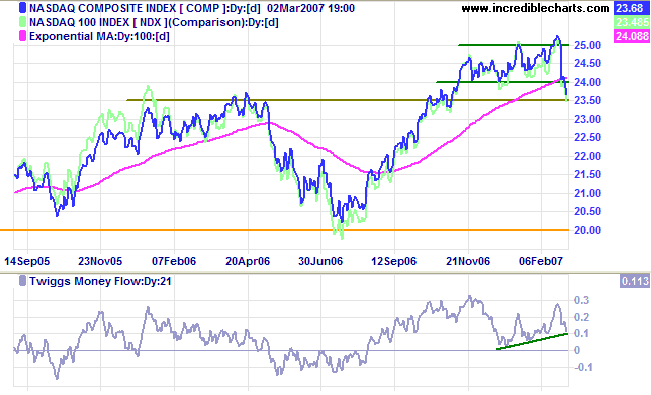

The Nasdaq Composite broke downwards from its recent

consolidation and is testing the first line of primary support

at the April 2006 high of 2350.

Long Term: The primary trend remains up, but a fall

through the July 2007 low of 2000 would signal reversal.

The S&P 500 retraced after the extended rally

approached its all-time high of 1500. After hugging the upper

border of the trend channel, drawn at 2 standard deviations

around a linear regression line, the index now appears set for

a test of the lower channel line.

Twiggs Money Flow (21-day) bearish divergence warns of

distribution; a fall below zero would be a further

warning.

Long Term: The primary trend is up. A healthy correction

would test the first line of support at 1325; a fall below 1220

would signal reversal of the primary trend.

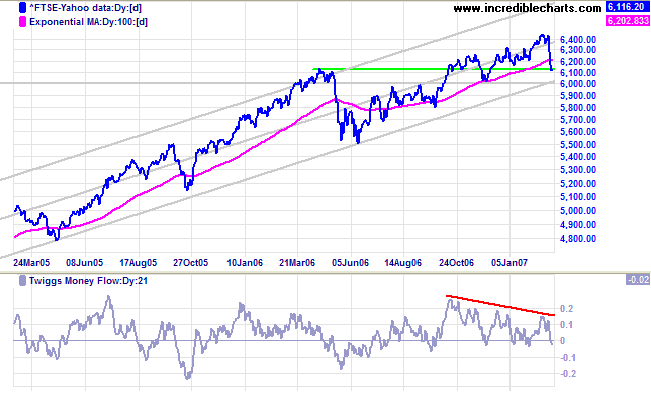

LSE: United Kingdom

The FTSE 100 retraced sharply, along with other markets,

and appears headed for a test of support at 6000, the lower

border of the standard deviation channel.

Twiggs Money Flow (21-day) retreated to below zero, the

long-term bearish divergence warning of further

distribution.

Long Term: The primary trend is up. Respect of support

at 6000 would signal a healthy up-trend, while penetration

would warn of a test of primary support at 5500.

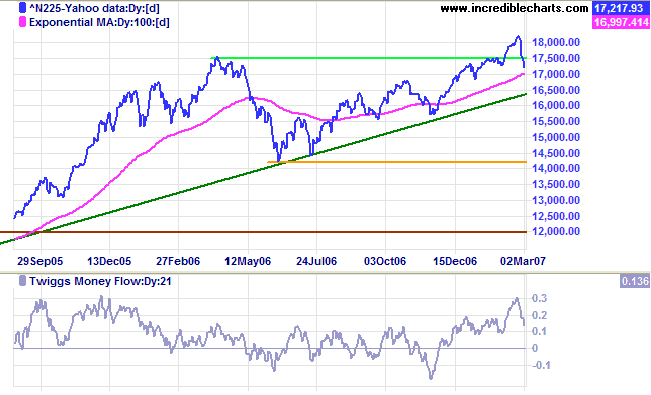

Nikkei: Japan

The Nikkei 225 retreated below the first line of support

at 17600. The up-trend still appears reasonably healthy: above

the 100-day moving

average; above the long-term trendline; and with

Twiggs Money Flow (21-day) well above zero. So let's not

yet write off the target of 21000 [ 17600 + ( 17600 - 14200

)].

Long Term: The primary trend is up, with support at the

June 2006 low of 14200.

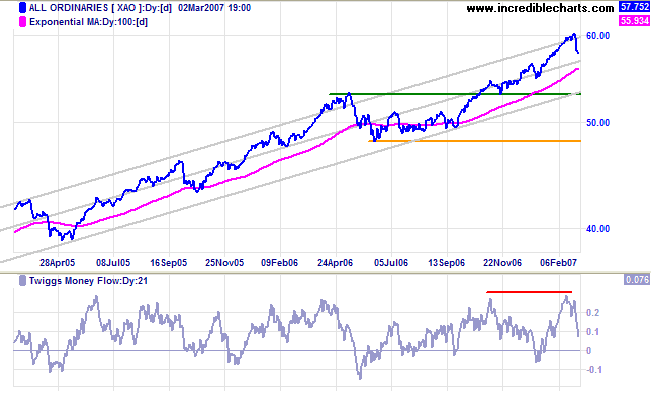

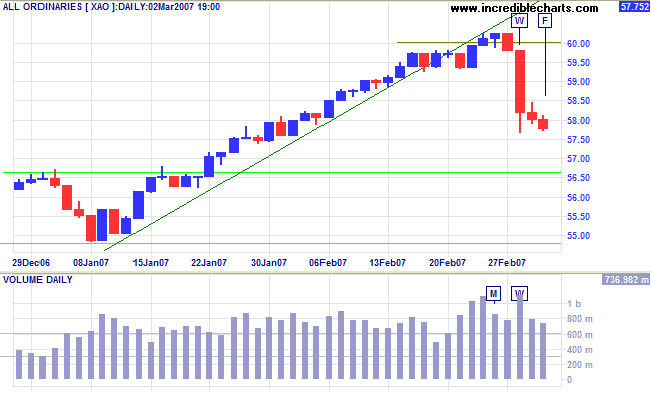

ASX: Australia

The All Ordinaries has retraced from the psychological

barrier of 6000 after an extended rally.

Twiggs Money Flow (21-day) has been warning of

profit-taking over the last 3 months and this correction is

overdue. To put the retracement in perspective, the index is

still in the top half of the trend channel (drawn at 2 standard

deviations around a linear regression line). The time is not

yet right for bargain-hunting: a healthy correction is likely

to test the lower border of the trend channel, which coincides

with the first line of primary support at the May 2006 high of

5300.

Long Term: A fall below 5300 would signal that the

primary trend is losing momentum. However, only a fall below

the June 2006 low of 4800 would signal a reversal.

Short Term: The All Ords consolidated over the last two days after Wednesday's sharp fall and exceptional volume. Investors will be nervous and any attempted rally would encounter considerable resistance as it approached 6000. A fall below Wednesday's low is more likely and would be expected to trigger further selling.

Always drink upstream from the herd.

~ Will Rogers

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.