Dow Correction

By Colin Twiggs

February 28, 2007 1:00 a.m. ET (5:00 p.m. AEDT)

Occasionally we will issue a mid-week update when a significant

event occurs on one of the major indexes.

These extracts from my daily trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use.

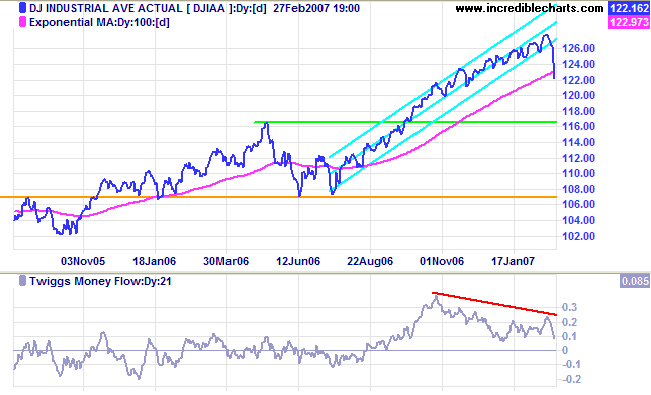

Dow Jones Industrials

The Dow Jones Industrial average recorded a sharp fall, breaking below the recent trend channel and closing below the 100-day moving average. The bearish divergence on Twiggs Money Flow has been warning of profit-taking for some time. A secondary correction will be confirmed if the next rally fails to take out the previous high -- close to a certainty after the extended up-trend. This is not a good time to go bargain-hunting.

The primary trend remains up. The correction is likely to find support at the previous high of 11600, while a fall below 10700 would signal a primary trend reversal.

A correction on the Dow is likely to drag other equity markets down as well, regardless of their fundamentals.