The Big Picture

By Colin Twiggs

February 06, 2007 7:00 a.m. ET (11:00 p.m. AEDT)

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

The Big Picture

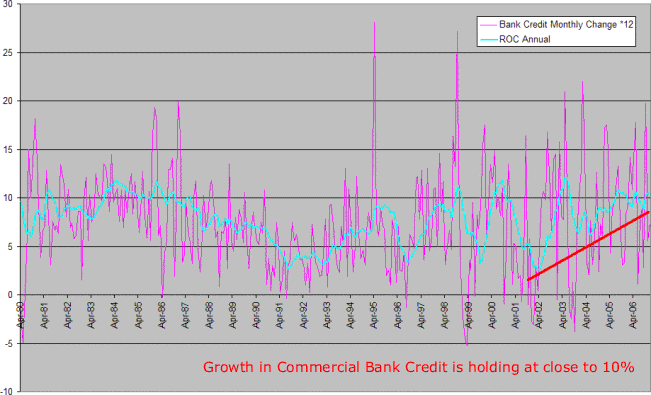

For a bird's eye view of how much money is being pumped into the US economy, take a look at commercial bank credit over the last few years.

Credit growth is maintaining at close to 10 per cent. This is the highest sustained credit expansion since 1984 to 1987. Some readers may still recall how that ended.

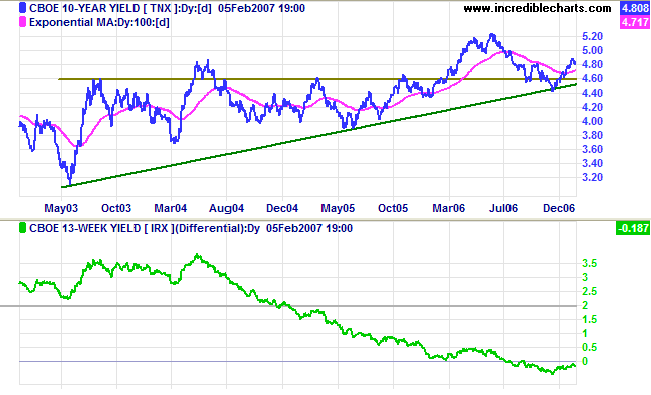

Ten-year treasury yields are in a sluggish up-trend and appear headed for another test of the 3-year trendline. Respect of the trendline would signal a test of resistance at 5.25%.

The yield differential (10-year minus 13-week treasury yields) remains negative, warning of long-term pressure on banking margins and a possible down-turn.

Equity Markets

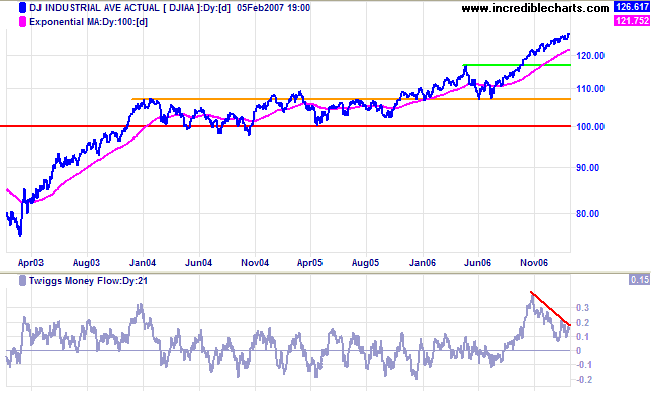

The primary trend on the Dow Jones Industrial average is up, but a bearish divergence on Twiggs Money Flow warns of a secondary correction.

Gold

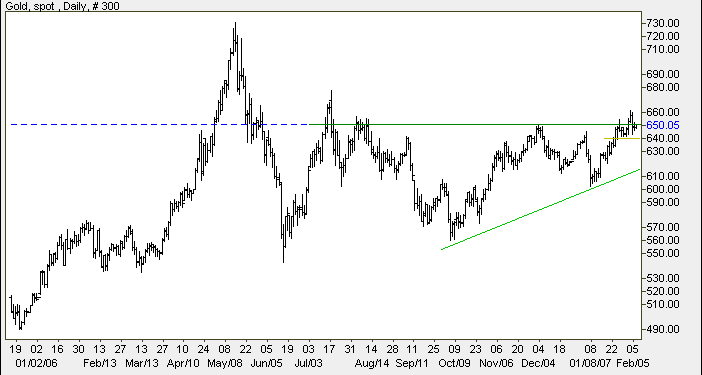

Spot gold is testing resistance at $650. Narrow consolidation

below the resistance level is a bullish sign. A breakout would

signal a test of the May 2006 high; the target is $740 [ 650 +

( 650 - 560) ]. On the other hand, a fall below $600 is

unlikely, but would signal a test of primary support at

$560.

Rising crude oil prices are likely to increase demand for gold.

A weaker dollar would also boost gold prices, but this is not

yet evident.

Source: Netdania

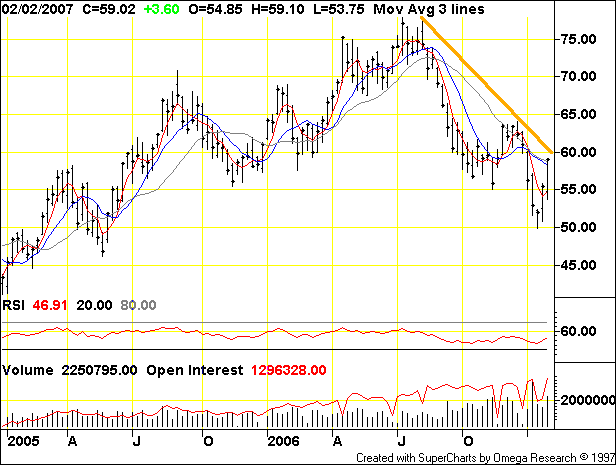

Crude Oil

Crude oil prices have rallied strongly since finding support at $50/barrel. At present this is just a bear market rally and the primary trend remains down. A rise above $65, however, would signal a reversal.

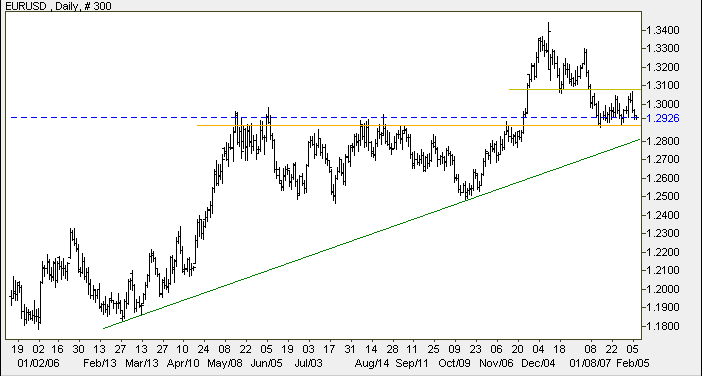

Currencies

The euro continues to test support at $1.29/$1.30. So long as the retracement respects the (green) upward trendline, the up-trend is intact. Narrow consolidation at the support level indicates uncertainty: the breakout could be either way. An upward breakout would be a bull signal, while a downward breakout would signal that the up-trend is slowing. A fall below $1.25, still unlikely, would signal trend reversal.

Source: Netdania

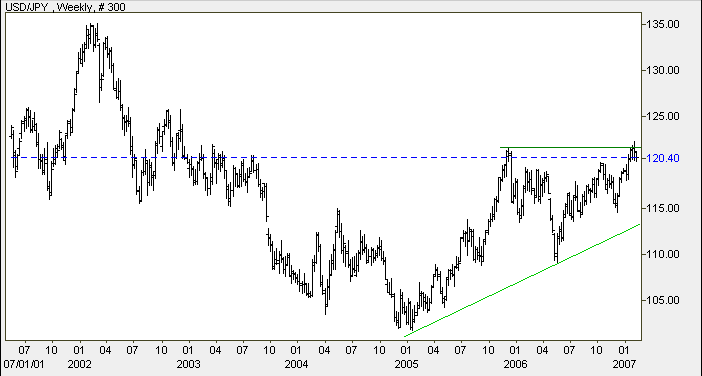

The dollar is testing an important resistance level at 121 against the yen. Breakout above the December 2005 high would be a long-term bull signal; narrow consolidation below 121 would also be bullish; while a fall below 115, unlikely at present, would signal a test of long-term support at 100.

Source: Netdania

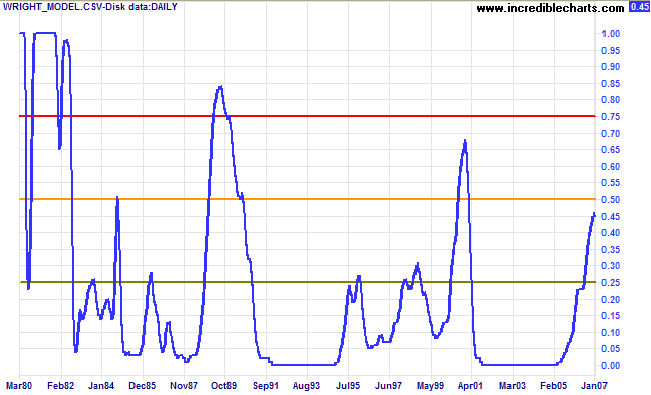

Wright Model

Probability of recession in the next four quarters remains at 45 per cent according to the Wright Model.

There is some evidence that the Wright model may understate the probability of recession in a low interest rate environment (as at present). The model emphasizes the nominal level of short-term interest rates and ignores whether these rates are rising or falling. It also does not adequately explain the behavior of the market during the 1966 and 2001 recessions, when interest rates were low.

You are neither right nor wrong because the crowd disagrees

with you.

You are right because your data and reasoning are right.

~ Warren Buffett

Technical Analysis and PredictionsI believe that Technical Analysis should not be used to make predictions because we never know the outcome of a particular pattern or series of events with 100 per cent certainty. The best that we can hope to achieve is a probability of around 80 per cent for any particular outcome: something unexpected will occur at least one in five times.My approach is to assign probabilities to each possible outcome. Assigning actual percentages would imply a degree of precision which, most of the time, is unachievable. Terms used are more general: "this is a strong signal"; "this is likely"; "expect this to follow"; "this is less likely to occur"; "this is unlikely"; and so on. Bear in mind that there are times, especially when the market is in equilibrium, when we may face several scenarios with fairly even probabilities. Analysis is also separated into three time frames: short, medium and long-term. While one time frame may be clear, another could be uncertain. Obviously, we have the greatest chance of success when all three time frames are clear. The market is a dynamic system. I often compare trading to a military operation, not because of its' oppositional nature, but because of the complexity, the continual uncertainty created by conflicting intelligence and the element of chance that can disrupt even the best made plans. Prepare thoroughly, but allow for the unexpected. The formula is simple: trade when probabilities are in your favor; apply proper risk (money) management; and you will succeed. For further background, please read About The Trading Diary. |