Dow and S&P500 Reach Targets

By Colin Twiggs

January 20, 2006 1.00 a.m. ET (5:00 p.m. AET)

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA: Dow, Nasdaq and S&P500

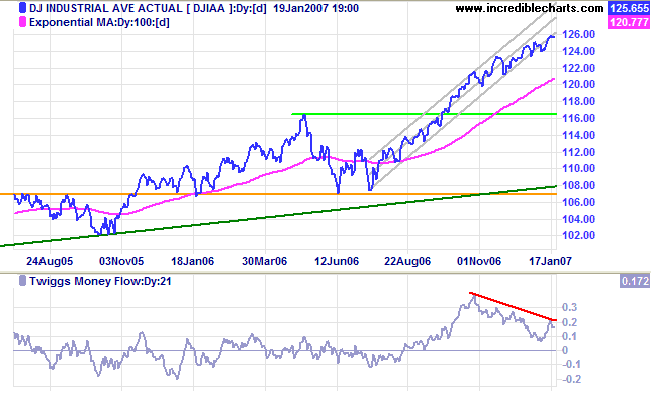

The Dow Jones Industrial Average has exceeded its target

of 12500 (11600+[11600-10700]) and momentum has slowed, with

the index dipping below the lower border of its recent trend

channel (drawn at 2 standard deviations around a linear

regression line). The bearish

divergence on

Twiggs Money Flow (21-day) warns of a secondary

correction.

The primary trend is up with support at 11600/11650 (the

preceding high) and 10700 (the preceding low).

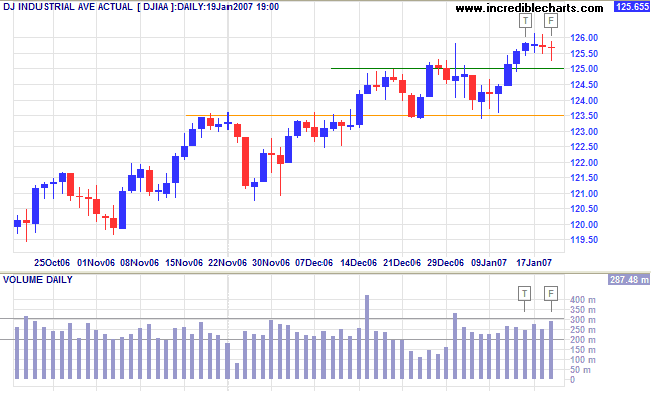

Short Term: The latest rally encountered resistance at 12600, highlighted by tall shadows and increased volume. If the retracement respects support at 12500, that will signal continuation of the strong up-trend. A close below support at 12350, on the other hand, would warn of a secondary correction.

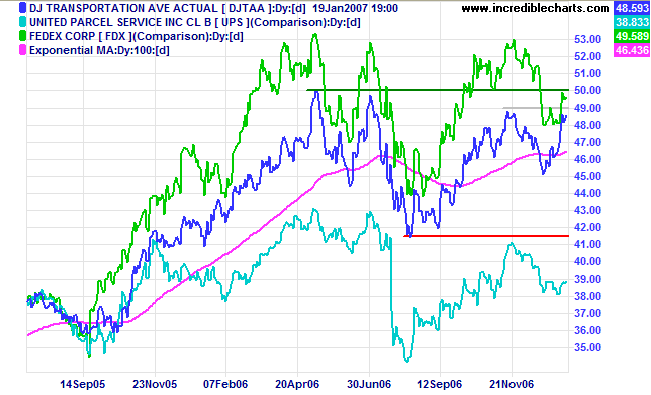

The Dow Jones Transportation Average appears headed for another test of resistance at 5000. The short consolidation below intermediate resistance at 4900 is a bullish sign. Breakout above 5000 would confirm the existence of a bull market.

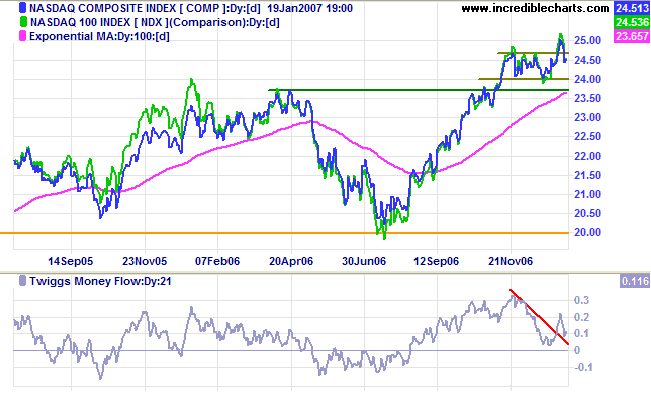

The Nasdaq Composite is testing support at 2450. Respect

of this level would confirm trend strength.

Twiggs Money Flow appears to be recovering and a higher

trough would be a bullish sign.

The index remains in a primary up-trend with support at

2350/2370 (preceding high) and at 2000 (preceding low).

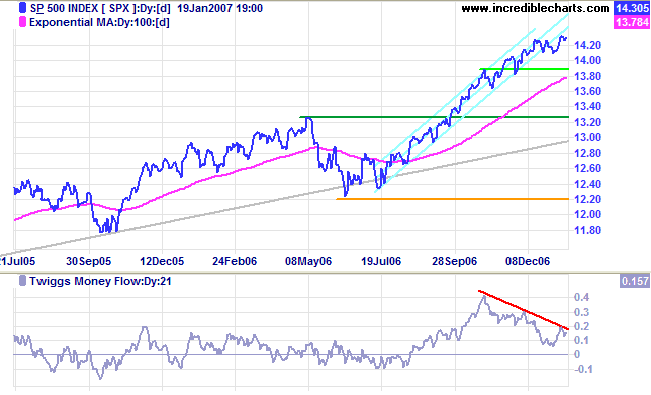

The S&P 500 shows a similar bearish divergence (on Twiggs Money Flow 21-day) to the Dow. Momentum is slowing as the index has reached its target of 1430 (1325+[1325-1220]) and probability of a secondary correction (or large consolidation) is increasing.

LSE: United Kingdom

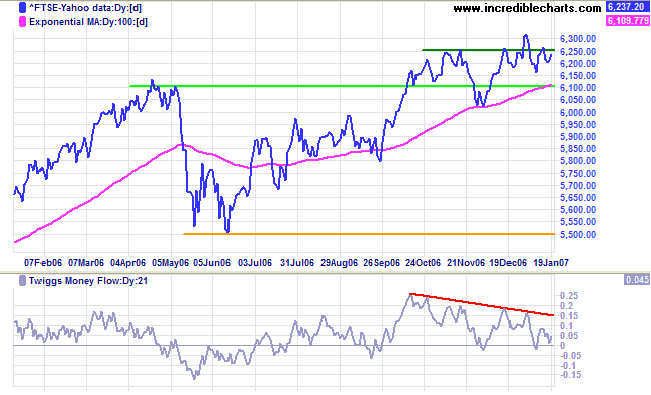

The FTSE 100 consolidation between 6000 and 6250/6300

favors continuation of the up-trend; watch for a breakout above

6300. A fall below 6000, on the other hand, (also breaking the

100-day moving

average) would warn of another correction to test primary

support at 5500 (and a possible stage 3 top). Bearish

divergence on

Twiggs Money Flow (21-day) signals distribution.

Long Term: The primary up-trend continues, with support

at 6000/6100 (preceding high) and at 5500 (preceding low).

Nikkei: Japan

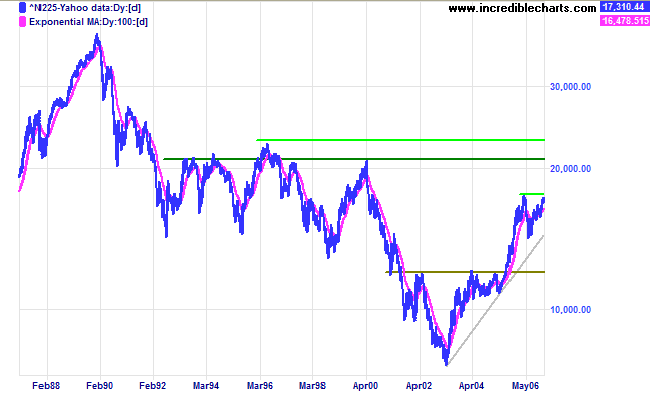

The Nikkei 225 is headed for a test of resistance at the

April high of 17500.

Twiggs Money Flow (21-day) above the zero line signals

accumulation.

Long Term: The primary up-trend continues, with support

at 14200 (preceding low) and resistance at 17500 (preceding

high). Breakout above 17500 would signal continuation of the

primary trend. The target for the breakout is close to the next

major resistance level of 21000: 17500 + (17500 - 14200) =

20600.

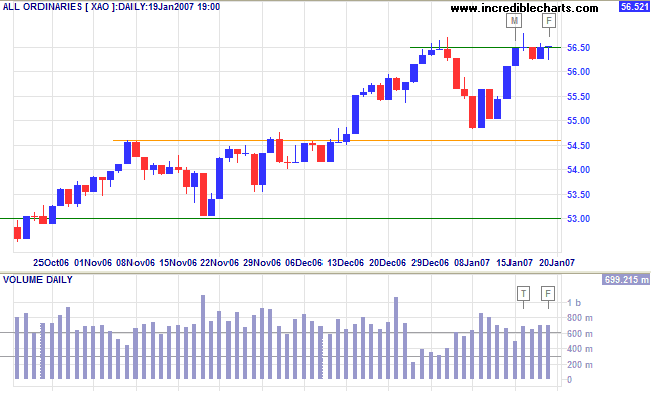

ASX: Australia

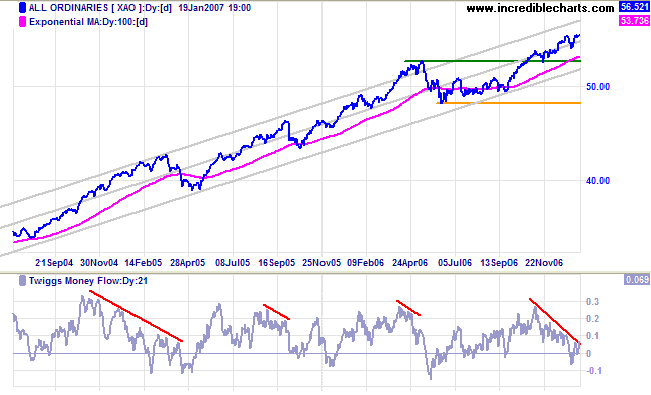

The All Ordinaries continues to display a strong bearish

divergence on

Twiggs Money Flow (21-day) while still some way from its

target of 5800: 5300 + (5300-4800). There may still be another

upward leg to test the upper border of the standard deviation

channel (drawn at 2.0 STD), but there is bound to be an

increase in volatility.

Long Term: The primary trend is upwards, with support at

5300 (the preceding high) and 4800 (preceding low).

Short Term: The narrow consolidation below resistance at 5650 signals an upward breakout and continuation of primary up-trend. Increased volume at the resistance level indicates opposition, but this is likely to be overcome. Target for the breakout coincides with the long-term target of 5800: 5650 + (5650 - 5500). Though unlikely at this stage, a fall below support at 5480 would warn of a secondary correction.

A hero is no braver than an ordinary man,

but he is brave five minutes longer.

~ Ralph Waldo Emmerson (1803 - 1882)

|

Technical Analysis and Predictions I believe that Technical Analysis should not be used to make predictions because we never know the outcome of a particular pattern or series of events with 100 per cent certainty. The best that we can hope to achieve is a probability of around 80 per cent for any particular outcome: something unexpected will occur at least one in five times. My approach is to assign probabilities to each possible outcome. Assigning actual percentages would imply a degree of precision which, most of the time, is unachievable. Terms used are more general: "this is a strong signal"; "this is likely"; "expect this to follow"; "this is less likely to occur"; "this is unlikely"; and so on. Bear in mind that there are times, especially when the market is in equilibrium, when we may face several scenarios with fairly even probabilities. Analysis is also separated into three time frames: short, medium and long-term. While one time frame may be clear, another could be uncertain. Obviously, we have the greatest chance of success when all three time frames are clear. The market is a dynamic system. I often compare trading to a military operation, not because of its' oppositional nature, but because of the complexity, the continual uncertainty created by conflicting intelligence and the element of chance that can disrupt even the best made plans. Prepare thoroughly, but allow for the unexpected. The formula is simple: trade when probabilities are in your favor; apply proper risk (money) management; and you will succeed. For further background, please read About The Trading Diary. |