Nikkei Weakens

By Colin Twiggs

November 18, 2006 2:30 p.m. AET (10:30 p.m. ET)

November 18, 2006 2:30 p.m. AET (10:30 p.m. ET)

These extracts from my daily trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use. The next newsletter (an update on Gold, Crude

Oil and the Dollar) will be on Tuesday.

The Big Picture

The Dow broke out from its recent

consolidation and resumed a strong up-trend. The Transport index is testing its previous high of

5000 and breakout above this level would signal the start of a

bull market. The FTSE 100 and Australian

All Ords show reasonable strength, but the

Nikkei is weakening rapidly.

Crude oil is testing major support at $55/barrel. Failure of this level would signal a long-term down-trend. The dollar is at $1.28 against the euro, testing the high of the last 6 month's consolidation. Gold recovered to $621.75 after testing short-term support at $615, continuing the intermediate rally. However, if oil falls and the dollar continues to consolidate against the euro, gold is likely to weaken.

Probability of recession in the next four quarters increased to 42 per cent according to the Wright model. A climb above 50% would be cause for concern.

Crude oil is testing major support at $55/barrel. Failure of this level would signal a long-term down-trend. The dollar is at $1.28 against the euro, testing the high of the last 6 month's consolidation. Gold recovered to $621.75 after testing short-term support at $615, continuing the intermediate rally. However, if oil falls and the dollar continues to consolidate against the euro, gold is likely to weaken.

Probability of recession in the next four quarters increased to 42 per cent according to the Wright model. A climb above 50% would be cause for concern.

USA: Dow, NASDAQ & SP500

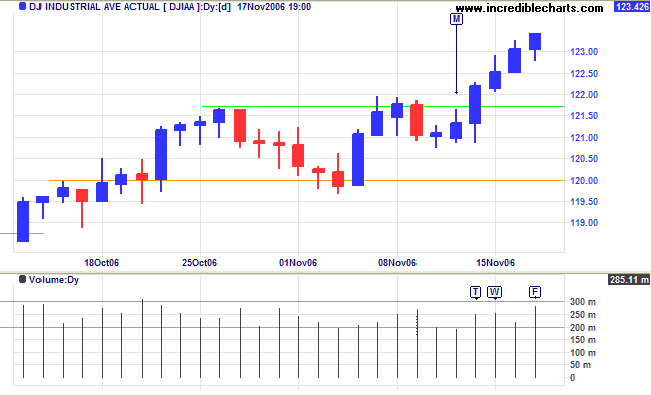

The Dow Industrial Average broke

through resistance, Tuesday, at the October high of 12175; a

bullish sign (especially after the short retracement) signaling

further gains. Increased volume on Friday warns of further

resistance, but buyers appear to have sufficient numbers to

overcome this (as on Wednesday).

Medium Term: The index respected intermediate support at

12000, confirming that the target of 12700 (calculated as 11650

+ {11650 - 10700}) is still achievable.

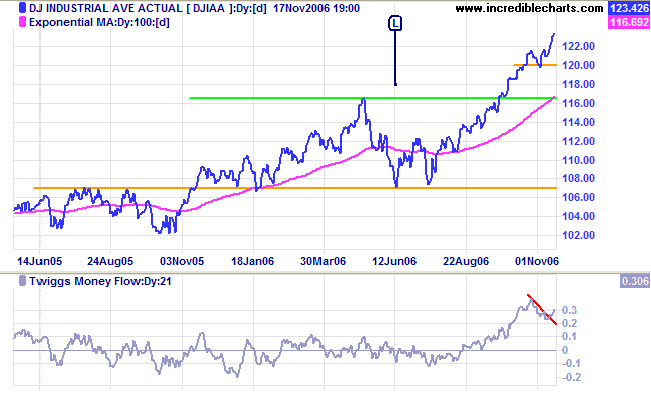

Twiggs Money Flow (21-day) shows a

divergence but appears to be recovering .

Long Term: The Dow is in a primary up-trend with support at 10700 [L].

Long Term: The Dow is in a primary up-trend with support at 10700 [L].

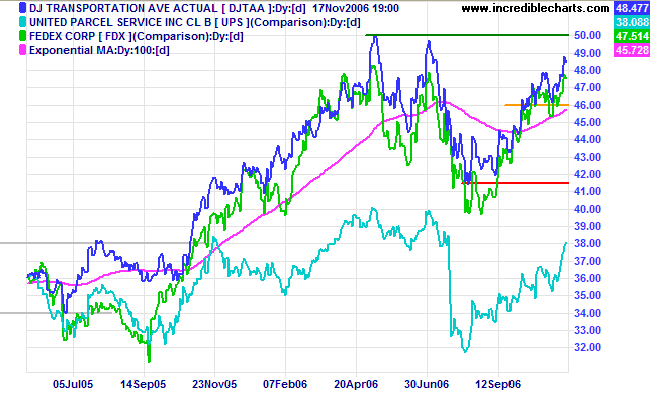

The Dow Jones Transportation Average continues to

closely shadow Fedex, approaching another test of resistance at

the May high of 5000. Breakout would signal reversal to a

primary up-trend and confirm the existence of a

bull market.

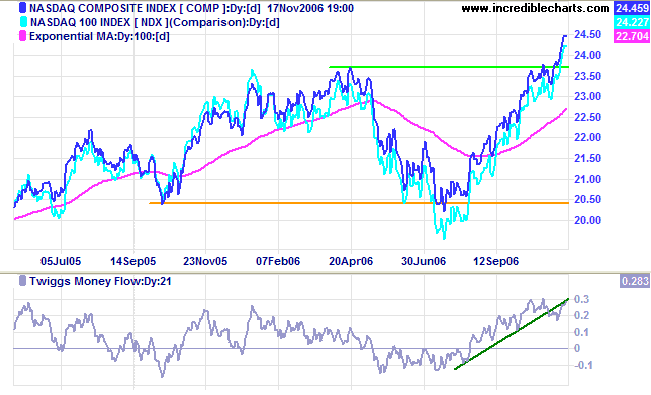

The Nasdaq Composite Index rallied strongly above its

April high of 2370, a positive sign for the broader equity

market, and the Nasdaq 100 has followed suit.

Twiggs Money Flow (21-day) recovered from the recent

divergence, but expect a retracement to test the new support

level of 2370.

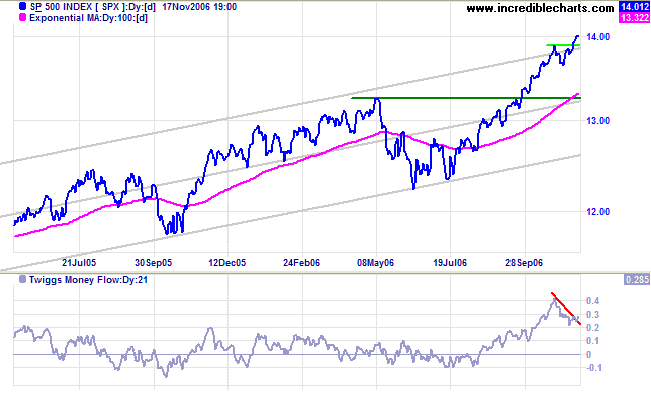

The S&P 500 completed a short retracement and

rallied above the upper trend channel (drawn at 2 standard

deviations around a linear regression line).

Medium Term: Breakout above the upper trend channel

signals that the slow long-term trend may be accelerating, but

divergence on

Twiggs Money Flow (21-day) warns us to be cautious.

Long Term: The S&P 500 continues in a primary up-trend with support at 1220.

Long Term: The S&P 500 continues in a primary up-trend with support at 1220.

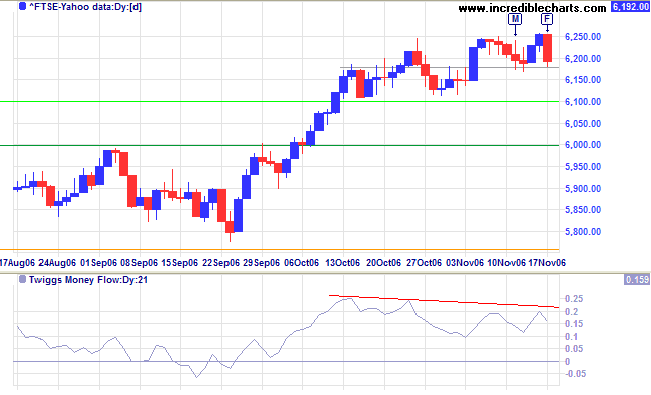

LSE: United Kingdom

The FTSE 100 twice respected resistance at 6250. A fall

below Tuesday's low would signal another test of support at

6100 (from the April high).

Medium Term: Twiggs Money Flow (21-day) bearish triple divergence warns that another test of 6100 is likely. Consolidation in a narrow band above the new support level is a bullish sign: while buyers may not be strong enough to overcome further resistance they have sufficient strength to prevent a correction, maintaining the support level at 6100. Failure of support at 6000/6100, though not expected at this stage, would warn of a correction, possibly testing primary support at 5500.

Long Term: The primary up-trend continues.

Medium Term: Twiggs Money Flow (21-day) bearish triple divergence warns that another test of 6100 is likely. Consolidation in a narrow band above the new support level is a bullish sign: while buyers may not be strong enough to overcome further resistance they have sufficient strength to prevent a correction, maintaining the support level at 6100. Failure of support at 6000/6100, though not expected at this stage, would warn of a correction, possibly testing primary support at 5500.

Long Term: The primary up-trend continues.

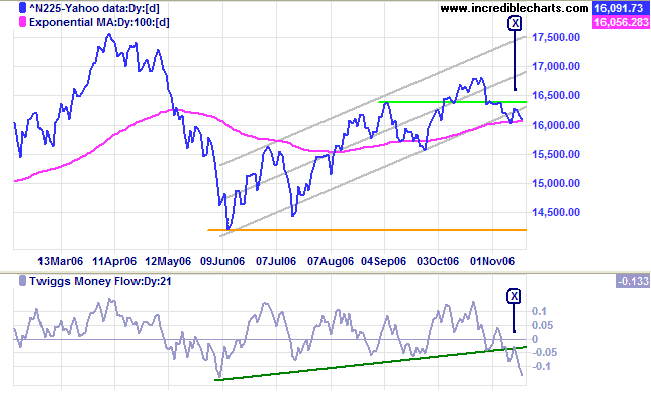

Nikkei: Japan

The Nikkei 225 appears in trouble. The break below the

lower trend channel (drawn at 2 STD around a linear regression

line) warns that the rally is weakening and

Twiggs Money Flow (21-day) displays a bearish peak [X]

respecting the zero line, signaling strong distribution.

Medium Term: A break below the 100-day moving average would be a further bear signal, warning of a test of primary support at 14200. Failure to test the previous high of 17500 would be a further negative, weakening primary support.

Long Term: The index is in a primary up-trend.

Medium Term: A break below the 100-day moving average would be a further bear signal, warning of a test of primary support at 14200. Failure to test the previous high of 17500 would be a further negative, weakening primary support.

Long Term: The index is in a primary up-trend.

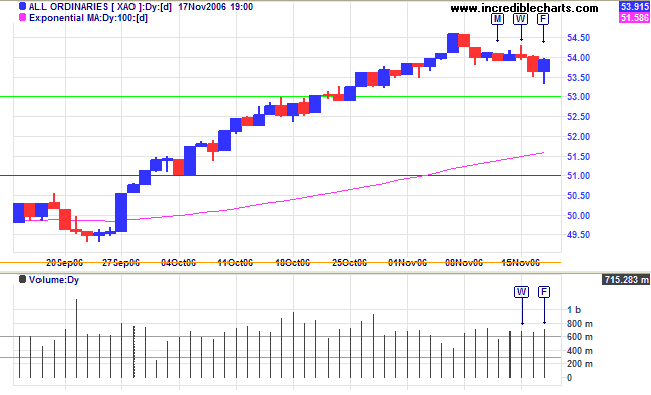

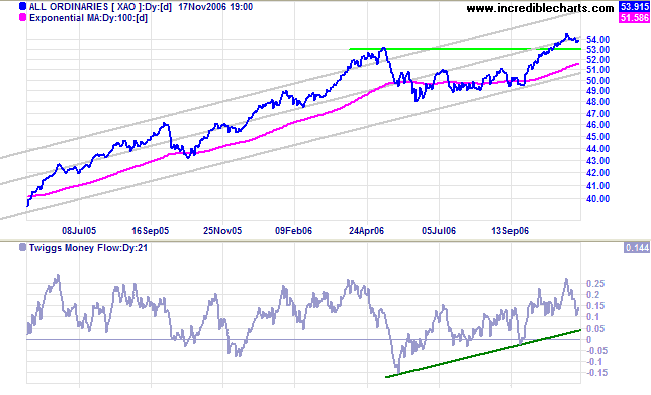

ASX: Australia

The All Ordinaries consolidated for several days before

breaking downwards on Thursday on strong volume. Friday's long

tail and strong volume indicate buying support, however, and a

reversal is likely. A rise above Wednesday's high would confirm

this.

Medium Term: Respect of initial support at 5300 would be

a bullish sign and a test of the upper border of the trend

channel (channel lines drawn at 2 standard deviations around a

linear regression line) is likely to follow.

Twiggs Money Flow (21-day) is above zero and trending

upwards, signaling long-term accumulation.

Long Term: The All Ordinaries continues in a primary up-trend with support at 4800.

Long Term: The All Ordinaries continues in a primary up-trend with support at 4800.

Luck is a matter of preparation meeting

opportunity.

~ Oprah Winfrey

~ Oprah Winfrey

|

Technical Analysis and Predictions I believe that Technical Analysis should not be used to make predictions because we never know the outcome of a particular pattern or series of events with 100 per cent certainty. The best that we can hope to achieve is a probability of around 80 per cent for any particular outcome: something unexpected will occur at least one in five times. My approach is to assign probabilities to each possible outcome. Assigning actual percentages would imply a degree of precision which, most of the time, is unachievable. Terms used are more general: "this is a strong signal"; "this is likely"; "expect this to follow"; "this is less likely to occur"; "this is unlikely"; and so on. Bear in mind that there are times, especially when the market is in equilibrium, when we may face several scenarios with fairly even probabilities. Analysis is also separated into three time frames: short, medium and long-term. While one time frame may be clear, another could be uncertain. Obviously, we have the greatest chance of success when all three time frames are clear. The market is a dynamic system. I often compare trading to a military operation, not because of its' oppositional nature, but because of the complexity, the continual uncertainty created by conflicting intelligence and the element of chance that can disrupt even the best made plans. Prepare thoroughly, but allow for the unexpected. The formula is simple: trade when probabilities are in your favor; apply proper risk (money) management; and you will succeed. For further background, please read About The Trading Diary. |