Gold , Oil & the Dollar

By Colin Twiggs

September 22, 2006 3:25 a.m. ET (5:25 p.m. AET)

September 22, 2006 3:25 a.m. ET (5:25 p.m. AET)

These extracts from my daily trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use.

Gold

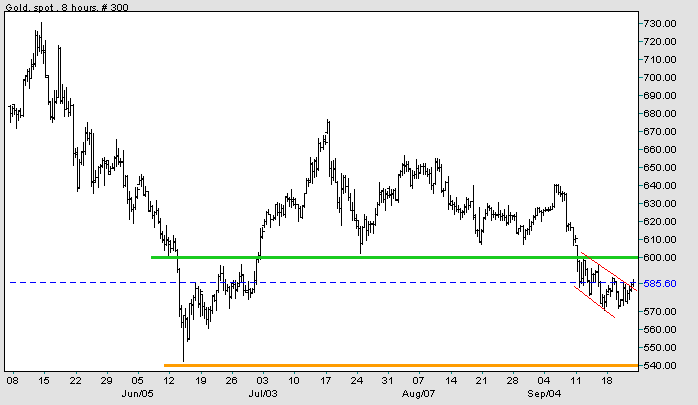

Spot gold broke upwards from the descending flag formed over the last week. Expect another test of resistance at $600.

Medium Term: Falling crude oil prices should weaken gold and strengthen the dollar. Expect gold to test primary support at $540.

Long Term: The dollar is likely to weaken and gold to rise -- unless there is a fall below $540 (signaling a primary down-trend).

Spot gold broke upwards from the descending flag formed over the last week. Expect another test of resistance at $600.

Medium Term: Falling crude oil prices should weaken gold and strengthen the dollar. Expect gold to test primary support at $540.

Long Term: The dollar is likely to weaken and gold to rise -- unless there is a fall below $540 (signaling a primary down-trend).

Source: Netdania

Crude Oil

Light Crude has fallen to $61.59 per barrel. Expect major support between $55 and $60. A fall through this band would signal a sharp down-trend, but we are just as likely to witness a consolidation -- followed by continuation of the long-term up-trend which began in 2002.

Light Crude has fallen to $61.59 per barrel. Expect major support between $55 and $60. A fall through this band would signal a sharp down-trend, but we are just as likely to witness a consolidation -- followed by continuation of the long-term up-trend which began in 2002.

Currencies

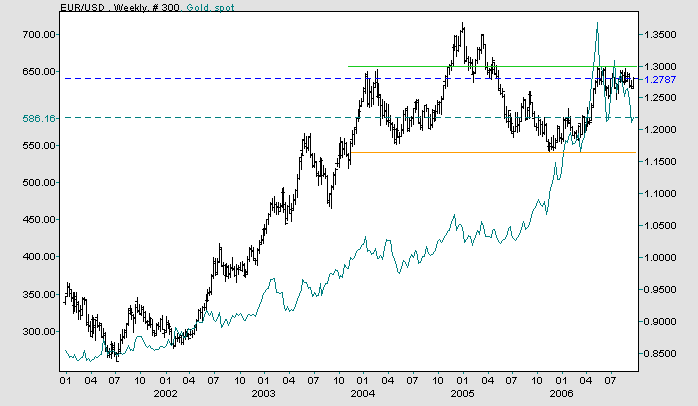

The euro is consolidating below resistance at 1.30/dollar. This is a bullish sign, warning of an upward breakout.

We can see from the weekly chart that the euro/dollar and dollar price of gold tend to rise or fall together -- with the euro leading. If the euro strengthens, expect gold to follow.

Though unlikely at present, a downward breakout (from the consolidation) would test support at 1.16/1.17. A breakout below that would complete a major head and shoulders reversal.

The euro is consolidating below resistance at 1.30/dollar. This is a bullish sign, warning of an upward breakout.

We can see from the weekly chart that the euro/dollar and dollar price of gold tend to rise or fall together -- with the euro leading. If the euro strengthens, expect gold to follow.

Though unlikely at present, a downward breakout (from the consolidation) would test support at 1.16/1.17. A breakout below that would complete a major head and shoulders reversal.

Source: Netdania

Treasury yields

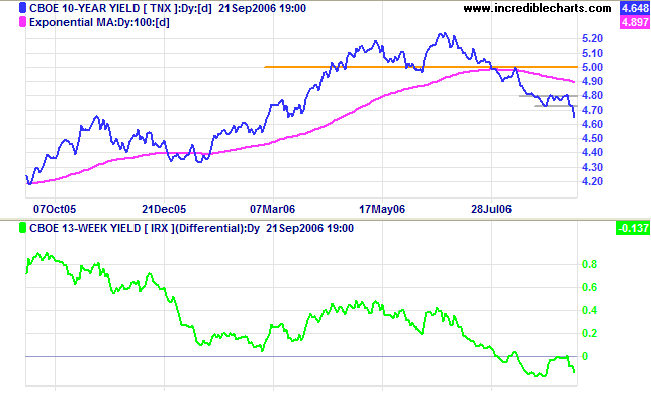

Another major influence on the dollar is interest rates. Falling long-term rates are likely to weaken the dollar.

Ten-year Treasury note yields broke below their recent consolidation, after interest rates were left unchanged at this week's FOMC meeting, and appear headed for 4.55%.

Medium Term: The yield differential (10-year T-notes minus 13-week T-bills) retreated well below zero. However, the primary cause is falling long-term yields rather than rising short-term yields -- reducing the significance.

Another major influence on the dollar is interest rates. Falling long-term rates are likely to weaken the dollar.

Ten-year Treasury note yields broke below their recent consolidation, after interest rates were left unchanged at this week's FOMC meeting, and appear headed for 4.55%.

Medium Term: The yield differential (10-year T-notes minus 13-week T-bills) retreated well below zero. However, the primary cause is falling long-term yields rather than rising short-term yields -- reducing the significance.

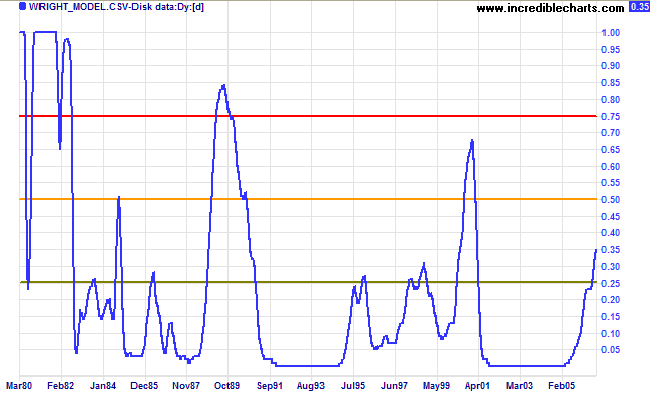

Long Term: Probability of recession in the next

four quarters increased to 35 per cent according to the

Wright

Model. A spike that reaches 50% would warn of a stronger

down-turn than the "soft-landing" the Fed are hoping for.

Where he is the most fearless is that he let

us see who he really was ... and that's being brave in today's

society.

~ Kevin Costner on the death of Steve Irwin

~ Kevin Costner on the death of Steve Irwin

For more background information, read About

the Trading Diary.