Tuesday Update

By Colin Twiggs

September 12, 2006 7:00 p.m. AET

September 12, 2006 7:00 p.m. AET

This mid-week update will only address the short/intermediate

view of the market. Your feedback

is greatly appreciated.

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

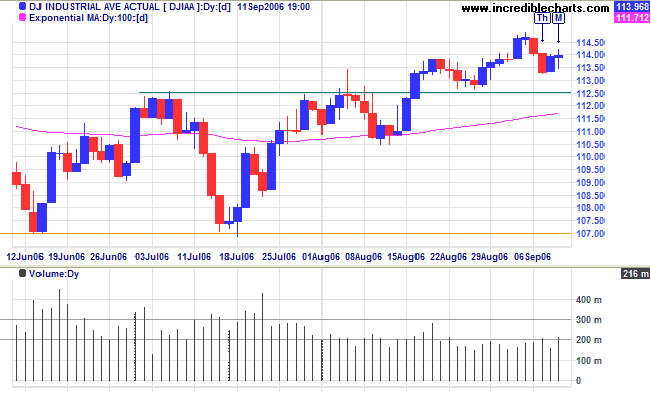

USA

The Dow Jones Industrial Average started the week with further consolidation after a short retracement at the end of last week. A rise above Monday's high would signal another up-swing while a fall below the low would encounter support at 11250. The index appears bullish despite low volumes and Twiggs Money Flow (21-day) is holding above zero, signaling accumulation. Expect a test of the all-time high at 11650, but low volumes place a question-mark over the index's ability to break through this major resistance level.

The Dow Jones Industrial Average started the week with further consolidation after a short retracement at the end of last week. A rise above Monday's high would signal another up-swing while a fall below the low would encounter support at 11250. The index appears bullish despite low volumes and Twiggs Money Flow (21-day) is holding above zero, signaling accumulation. Expect a test of the all-time high at 11650, but low volumes place a question-mark over the index's ability to break through this major resistance level.

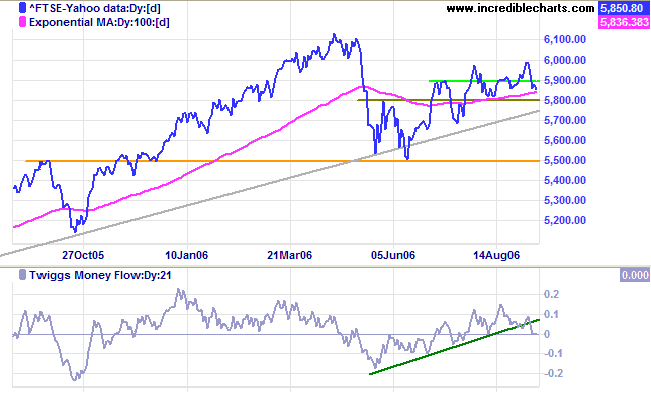

United Kingdom

The FTSE 100 encountered resistance at 6000 and is headed for a test of support at 5800. A fall through this level would be bearish. Twiggs Money Flow (21-day) signals short-term distribution, reversing back to zero.

The FTSE 100 encountered resistance at 6000 and is headed for a test of support at 5800. A fall through this level would be bearish. Twiggs Money Flow (21-day) signals short-term distribution, reversing back to zero.

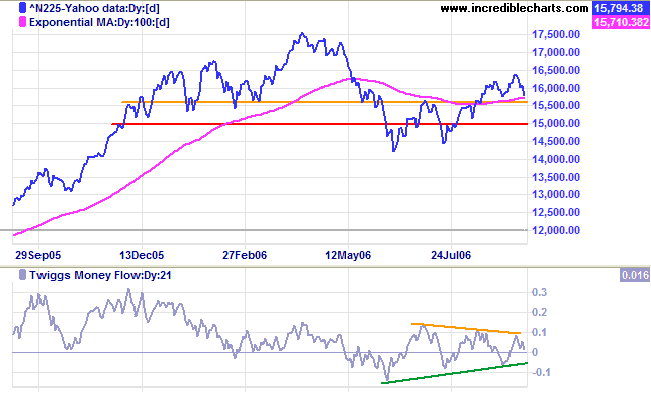

Japan

The Nikkei 225 is again testing support at 15700. If the index respects this first support level, that will confirm a strong up-trend, while a fall below this level will signal weakness. Twiggs Money Flow (21-day) is whipsawing around the zero line, indicating continued uncertainty.

The Nikkei 225 is again testing support at 15700. If the index respects this first support level, that will confirm a strong up-trend, while a fall below this level will signal weakness. Twiggs Money Flow (21-day) is whipsawing around the zero line, indicating continued uncertainty.

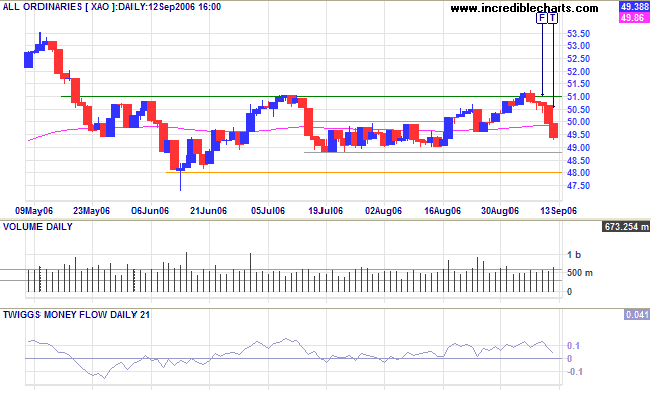

ASX Australia

The All Ordinaries fell sharply since the false break above 5100, overcoming buying support on Thursday/Friday and posting strong red candles at the start of the new week. Some technicians may argue that the secondary correction from May is still underway and that 4800 is therefore not a primary support level, but this ignores the fact that 4800 is the low of the last 3 months and that downward breakout from the subsequent consolidation would be a strong bear signal. Expect support between 4800 and 4900, but if this is overcome, the index may be in for a rough ride. Twiggs Money Flow (21-day) signals short-term distribution at this stage -- not too serious unless there is a fall below zero.

The All Ordinaries fell sharply since the false break above 5100, overcoming buying support on Thursday/Friday and posting strong red candles at the start of the new week. Some technicians may argue that the secondary correction from May is still underway and that 4800 is therefore not a primary support level, but this ignores the fact that 4800 is the low of the last 3 months and that downward breakout from the subsequent consolidation would be a strong bear signal. Expect support between 4800 and 4900, but if this is overcome, the index may be in for a rough ride. Twiggs Money Flow (21-day) signals short-term distribution at this stage -- not too serious unless there is a fall below zero.

Gold

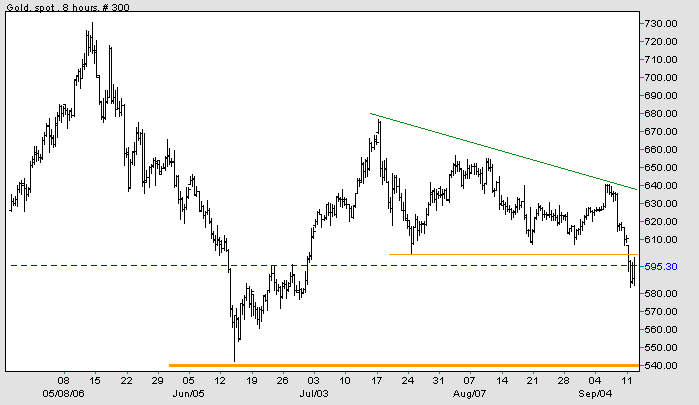

Gold is consolidating below $600 after a downward breakout from a bearish descending triangle. Expect a test of primary support at $540 -- confirmed if price falls below the low of the last two days. Though unlikely, if the new resistance level fails then all bets are off.

Gold is consolidating below $600 after a downward breakout from a bearish descending triangle. Expect a test of primary support at $540 -- confirmed if price falls below the low of the last two days. Though unlikely, if the new resistance level fails then all bets are off.

Source: Netdania

For more background information, read About

the Trading Diary.