Tuesday Update

By Colin Twiggs

August 15, 2006 5:15 a.m. ET

August 15, 2006 5:15 a.m. ET

Apologies for the erratic delivery over the past few weeks. I

have now returned home and can settle into a normal

routine.

Your feedback is greatly appreciated.

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Your feedback is greatly appreciated.

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

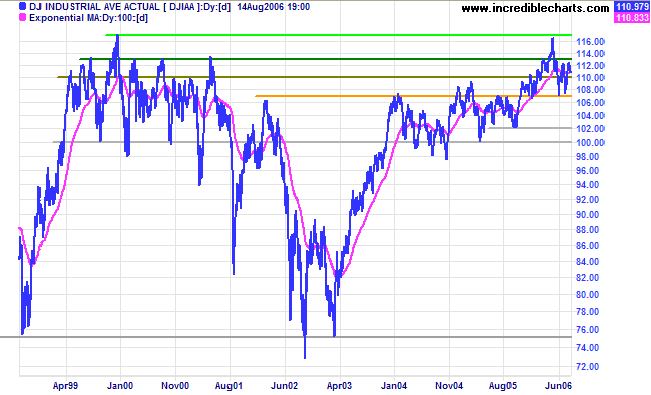

The overall state of the market is best summed up by the

monthly chart of the Dow Industrial Average. After

testing resistance at the previous high of 11600, the average

has pulled back to test support at 10700. A close below this

level would signal a primary down-trend, while a close above

the recent highs of 11250/11300 would signal another test of

11600 and a possible breakout to a new high.

Short-term support sits at 11050 and resistance at 11250/11300.

Twiggs Money Flow (21-day) remains well below zero,

signaling

distribution.

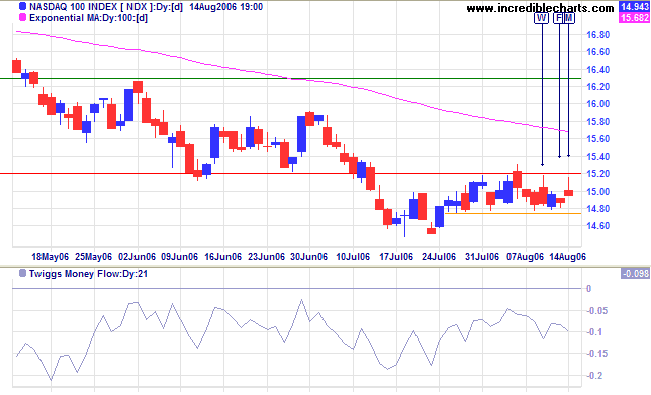

The Nasdaq 100 is consolidating in a narrow range below

1520. A close below 1480 would be bearish, while a close below

1450 would confirm the down-trend. No sharp move has developed

after the downward breakout, so reversal above 1520 would be

just as likely -- if

Twiggs Money Flow (21-day) was not signaling strong

distribution.

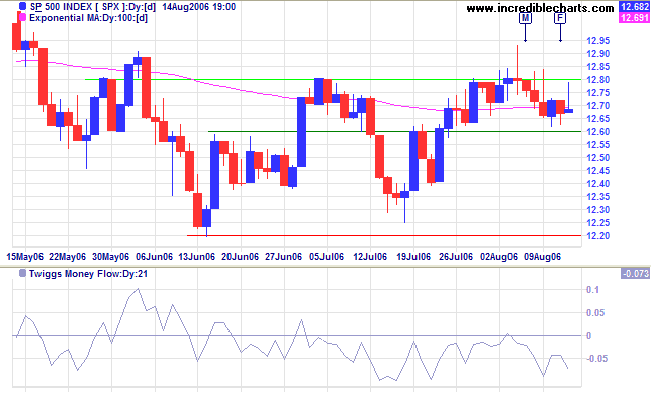

The S&P 500 displays a similar pattern to the Dow,

with short-term resistance at 1280/1290 and support at 1260.

Twiggs Money Flow (21-day) below zero signals

distribution, warning of another test of primary support at

1220.

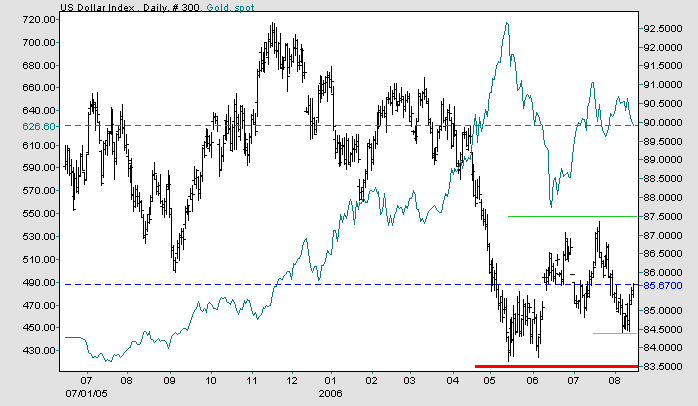

Gold

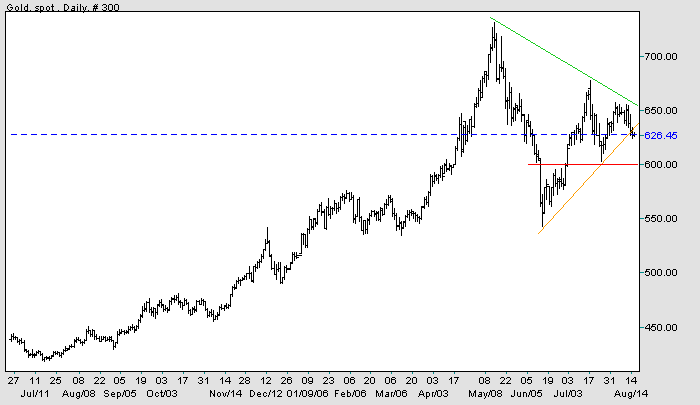

Spot gold made a downward breakout from a large symmetrical triangle, with a target of $450 (630 - (730 - 550)). A close below support at $600 would confirm the signal, but beware of reversal if the dollar weakens.

Spot gold made a downward breakout from a large symmetrical triangle, with a target of $450 (630 - (730 - 550)). A close below support at $600 would confirm the signal, but beware of reversal if the dollar weakens.

Source: Netdania

Currencies

Contrary to expectations, the US Dollar Index has strengthened since the recent pause in rate hikes, but the intermediate trend remains downward. Reversal below recent support at 84.50 would confirm another test of major support at 83.50 -- and gold would be likely to rally.

Contrary to expectations, the US Dollar Index has strengthened since the recent pause in rate hikes, but the intermediate trend remains downward. Reversal below recent support at 84.50 would confirm another test of major support at 83.50 -- and gold would be likely to rally.

Source: Netdania

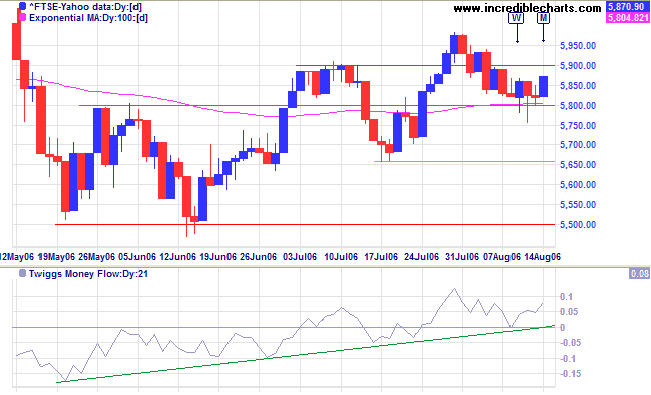

United Kingdom

The FTSE 100 appears to have respected support at 5800 -- confirmed if there is a close above 5900. Twiggs Money Flow (21-day) is trending upwards, signaling accumulation.

The FTSE 100 appears to have respected support at 5800 -- confirmed if there is a close above 5900. Twiggs Money Flow (21-day) is trending upwards, signaling accumulation.

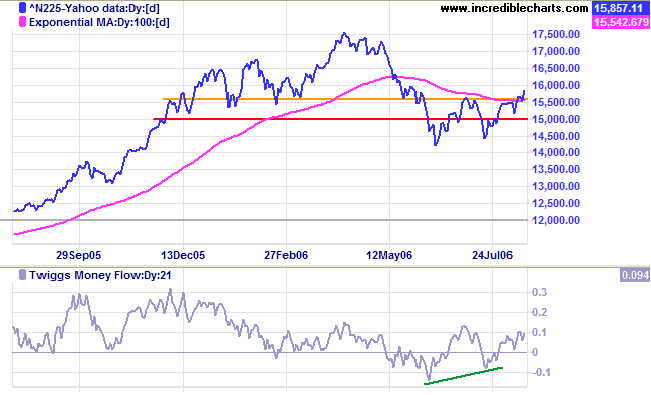

Japan

The Nikkei 225 broke through resistance at 15700, signaling the start of an up-trend that should test the earlier high of 17500. Tuesday has remained flat, but as long as the index remains above the new 15700 support level, the trend looks positive.

The Nikkei 225 broke through resistance at 15700, signaling the start of an up-trend that should test the earlier high of 17500. Tuesday has remained flat, but as long as the index remains above the new 15700 support level, the trend looks positive.

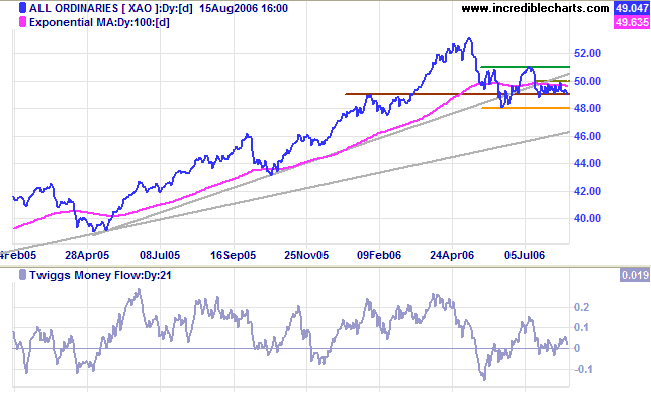

ASX Australia

The All Ordinaries consolidation has shifted slightly, ranging between 4900 and 5000. As duration of the consolidation lengthens, the direction of the breakout increases in significance. A close above 5000 would be bullish, while a close below 4900 would mean a test of primary support at 4800. Twiggs Money Flow (21-day) appears to be edging higher, but remains uncertain.

The All Ordinaries consolidation has shifted slightly, ranging between 4900 and 5000. As duration of the consolidation lengthens, the direction of the breakout increases in significance. A close above 5000 would be bullish, while a close below 4900 would mean a test of primary support at 4800. Twiggs Money Flow (21-day) appears to be edging higher, but remains uncertain.

For more background information, read About

the Trading Diary.